Net Asset Value (NAV) Changes In Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. It's calculated by subtracting liabilities from the total asset value and dividing by the number of outstanding shares. For investors, the NAV provides a snapshot of the ETF's current worth. The Amundi MSCI World Catholic Principles UCITS ETF Acc is an exchange-traded fund that invests in companies aligned with Catholic social teaching principles, offering global market exposure while adhering to ethical investment criteria. This article aims to clarify how various factors influence the NAV changes in this particular ETF.

Market Performance and Global Economic Trends

Broader market movements significantly impact the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV. During bull markets, characterized by rising prices and investor optimism, the ETF's NAV tends to increase. Conversely, bear markets, marked by falling prices and pessimism, usually lead to NAV declines. The ETF's performance is also influenced by specific sectors and geographic regions. Strong performance in technology, for example, might boost the NAV, while weakness in a heavily-weighted sector could negatively affect it.

Key economic indicators such as inflation and interest rates also play a crucial role. High inflation can erode purchasing power and impact company profits, potentially reducing the ETF's NAV. Similarly, rising interest rates can increase borrowing costs for companies, affecting their profitability and, consequently, the ETF's NAV.

- Impact of global economic growth on constituent company performance: Strong global growth generally leads to higher corporate earnings and increased NAV.

- Effect of geopolitical events on market volatility and NAV: Uncertainties caused by geopolitical events can increase market volatility, causing NAV fluctuations.

- Correlation between major market indices (e.g., S&P 500, MSCI World) and the ETF's NAV: The ETF's NAV tends to correlate with broader market indices, reflecting overall market sentiment.

Specific Company Performance within the ETF Portfolio

The performance of individual companies within the Amundi MSCI World Catholic Principles UCITS ETF Acc's portfolio directly contributes to overall NAV changes. Positive company-specific news, such as strong earnings reports or successful product launches, can boost the NAV. Conversely, negative news, like disappointing earnings or regulatory setbacks, might lead to a decline.

The ETF's weighting scheme, which determines the proportion of each company in the portfolio, influences the impact of individual company performance on the overall NAV. A heavily weighted company experiencing significant growth or decline will have a more pronounced effect on the NAV compared to a smaller holding.

- Analysis of top holdings and their contribution to NAV growth/decline: Monitoring the performance of the ETF's largest holdings is crucial for understanding NAV movements.

- Influence of sector-specific events (e.g., technological advancements, regulatory changes): Events affecting specific sectors can significantly impact the NAV, especially if those sectors are heavily represented in the portfolio.

- Impact of mergers, acquisitions, or bankruptcies of portfolio companies: Corporate actions can lead to substantial NAV changes, depending on their nature and impact on the companies involved.

Currency Fluctuations and Exchange Rate Risk

Given its global exposure, the Amundi MSCI World Catholic Principles UCITS ETF Acc is susceptible to currency fluctuations. Changes in exchange rates between the Euro (or other relevant currencies) and other major global currencies can impact the ETF's NAV. For instance, a strengthening Euro against the US dollar could lead to gains for investors holding the ETF, while a weakening Euro could result in losses.

The ETF might employ hedging strategies to mitigate currency risk. However, these strategies aren't always perfect and might not entirely eliminate currency-related fluctuations in the NAV.

- Influence of the Euro (or other relevant currencies) against major global currencies: Fluctuations in exchange rates directly affect the value of the ETF's underlying assets denominated in other currencies.

- Explanation of how currency hedging affects NAV: Hedging strategies aim to reduce the impact of currency fluctuations on the NAV but do not guarantee complete protection.

- Examples of how currency fluctuations can impact returns: Illustrative scenarios showing how different exchange rate movements can positively or negatively affect the NAV.

Expense Ratio and Management Fees

The ETF's expense ratio, which represents the annual cost of managing the fund, gradually affects the NAV over time. Management fees are a key component of the expense ratio. While the expense ratio might seem small on a yearly basis, it cumulatively impacts the long-term return and, therefore, the NAV. Comparing the Amundi MSCI World Catholic Principles UCITS ETF Acc's expense ratio to similar ETFs in the market helps determine its competitiveness.

- Breakdown of the expense ratio's components: Understanding the individual components of the expense ratio helps investors assess the value for their investment.

- Long-term impact of accumulating expense ratios on NAV: While small annually, expense ratios compound over time, subtly affecting long-term NAV growth.

- Comparison with competitor ETFs' expense ratios: Comparing expense ratios allows for better assessment of the cost-effectiveness of the investment.

Conclusion: Monitoring NAV Changes in the Amundi MSCI World Catholic Principles UCITS ETF Acc

Understanding NAV changes in the Amundi MSCI World Catholic Principles UCITS ETF Acc requires considering market performance, individual company performance, currency fluctuations, and expense ratios. All these factors interact to influence the ETF's overall value and returns. Monitoring the ETF's performance and market conditions is crucial for making informed investment decisions.

Stay informed about the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV and its underlying factors to make well-informed investment decisions based on a comprehensive understanding of its performance drivers. Regularly review market trends and the ETF's holdings to maximize your investment potential while upholding your ethical investing goals.

Featured Posts

-

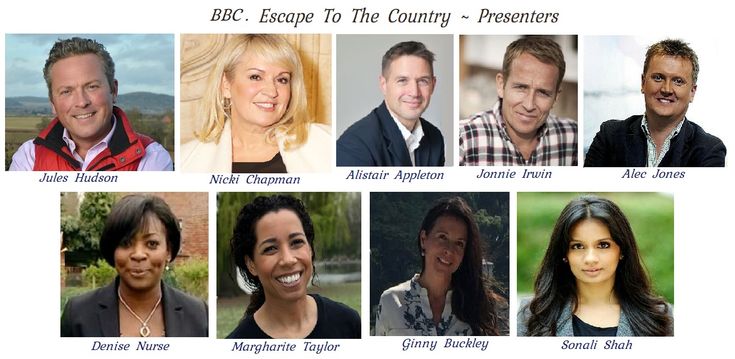

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025 -

Your Escape To The Country Making The Move A Success

May 24, 2025

Your Escape To The Country Making The Move A Success

May 24, 2025 -

West Ham United Submits Bid For Kyle Walker Peters

May 24, 2025

West Ham United Submits Bid For Kyle Walker Peters

May 24, 2025 -

Conchita Wursts Esc 2025 Concert A Eurovision Village Highlight With Jj

May 24, 2025

Conchita Wursts Esc 2025 Concert A Eurovision Village Highlight With Jj

May 24, 2025 -

Ferrari Challenge Racing Days A South Florida Spectacle

May 24, 2025

Ferrari Challenge Racing Days A South Florida Spectacle

May 24, 2025

Latest Posts

-

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025 -

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation Dog Walker Dispute

May 24, 2025 -

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025 -

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025 -

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025