Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist: Key Considerations

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for Amundi MSCI World II UCITS ETF Dist?

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, understanding its NAV is key to assessing its performance. This ETF tracks the MSCI World Index, a broad market-capitalization-weighted index representing large and mid-cap equities across developed markets globally.

- Definition of NAV in simple terms: NAV is essentially the net worth of the ETF per share.

- Step-by-step explanation of the calculation process: The calculation involves summing the market value of all the stocks held in the ETF's portfolio. Any accrued income (dividends) is added, and any expenses (management fees, etc.) are subtracted. This total is then divided by the total number of outstanding shares to arrive at the NAV per share.

- Clarification on the frequency of NAV calculation: The Amundi MSCI World II UCITS ETF Dist's NAV is typically calculated daily, reflecting the closing market prices of its underlying assets.

- Mention of any specific factors affecting the Amundi MSCI World II UCITS ETF Dist's NAV: Factors like currency exchange rates (given the ETF's global holdings) and the performance of individual companies within the index significantly influence the daily NAV calculation.

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF Dist

Several internal and external factors can cause fluctuations in the Amundi MSCI World II UCITS ETF Dist's NAV. Understanding these factors is crucial for managing investment expectations.

- Global market trends and their impact: Positive global economic growth typically leads to higher stock prices, increasing the ETF's NAV. Conversely, periods of economic uncertainty or recession often result in lower NAVs.

- Currency exchange rate fluctuations and their effect on international holdings: As the ETF holds assets denominated in various currencies, exchange rate movements can significantly impact the overall NAV, particularly for investors holding the ETF in a different currency.

- Impact of individual company performance within the ETF's portfolio: The performance of individual companies within the MSCI World Index directly affects the ETF's NAV. A strong performance by major holdings will boost the NAV, while underperformance will have the opposite effect.

- Influence of investor sentiment and market volatility: Investor sentiment and market volatility play a critical role. Fear and uncertainty can lead to market downturns, reducing the NAV, while optimism tends to push NAVs higher.

NAV vs. Market Price: Understanding the Difference for Amundi MSCI World II UCITS ETF Dist

While the NAV reflects the intrinsic value of the ETF's assets, the market price is the actual price at which the ETF is traded on the exchange. These two prices may differ, often due to supply and demand dynamics.

- Clear definition of market price and how it's determined: The market price is determined by the forces of supply and demand in the secondary market. It fluctuates throughout the trading day.

- Explanation of the bid-ask spread and its influence on price: The bid-ask spread (the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept) contributes to the difference between NAV and market price.

- Discussion of factors causing discrepancies between NAV and market price: Trading volume, market sentiment, and temporary imbalances between buyers and sellers can cause discrepancies. A high demand might drive the market price above the NAV (premium), while low demand might lead to a discount.

- When a premium or discount might be considered favorable or unfavorable: A persistent premium might suggest overvaluation, while a persistent discount could indicate undervaluation, although these are not guarantees of future price movements.

Using NAV to Make Informed Investment Decisions with Amundi MSCI World II UCITS ETF Dist

The NAV is a powerful tool for making informed investment decisions. However, it shouldn't be considered in isolation.

- Monitoring NAV changes over time to track performance: Regularly monitoring NAV changes provides insights into the ETF's performance relative to its benchmark index.

- Using NAV to assess the value of your investment: The NAV helps you gauge the current value of your investment.

- Incorporating NAV into a broader investment strategy: Consider the NAV alongside your broader investment goals, risk tolerance, and diversification strategy.

- Understanding the implications of NAV fluctuations on long-term returns: While short-term NAV fluctuations are common, focus on long-term performance when evaluating your Amundi MSCI World II UCITS ETF Dist investment.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is essential for investors seeking to make informed decisions. While the market price reflects immediate trading activity, the NAV provides a crucial measure of the underlying asset value. By monitoring NAV changes, considering influencing factors, and understanding the difference between NAV and market price, you can better manage your investment in this globally diversified ETF. Stay informed about your Amundi MSCI World II UCITS ETF Dist NAV and consult with a financial advisor for personalized investment guidance. Regularly check the NAV of your Amundi MSCI World II UCITS ETF Dist investment to ensure it aligns with your financial goals. Learn more about understanding the Net Asset Value for better ETF investment decisions.

Featured Posts

-

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025 -

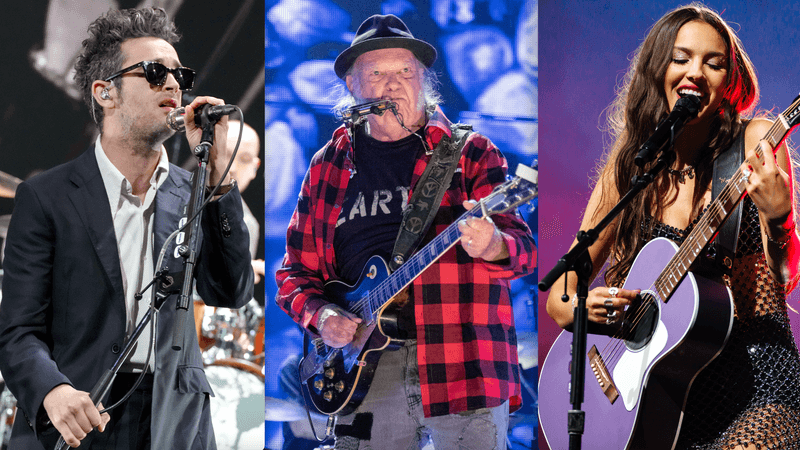

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup Revealed

May 24, 2025

Your Guide To Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup Revealed

May 24, 2025 -

Us Bands Glastonbury Gig Rumours Swirl Despite Official Silence

May 24, 2025

Us Bands Glastonbury Gig Rumours Swirl Despite Official Silence

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025 -

Hospodarsky Pokles V Nemecku Dopady Na Zamestnanost H Nonline Sk

May 24, 2025

Hospodarsky Pokles V Nemecku Dopady Na Zamestnanost H Nonline Sk

May 24, 2025

Latest Posts

-

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025 -

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025 -

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025