Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Key Considerations

Table of Contents

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist, like any ETF, is subject to various factors. Fluctuations in the NAV directly reflect the performance of the underlying assets and other contributing elements.

The primary driver is the performance of the MSCI World Index, a global equity benchmark that the ETF tracks. Positive performance in the index generally leads to an increase in the ETF's NAV, while negative performance results in a decrease. This is because the ETF holds assets designed to mirror the index's composition.

Crucially, the "USD Hedged" aspect plays a significant role. This means the ETF employs strategies to mitigate the impact of currency fluctuations between the USD and other currencies represented in the MSCI World Index. However, while hedging reduces risk, it doesn't eliminate it entirely. Changes in exchange rates can still subtly affect the NAV, although usually to a lesser extent than an unhedged ETF.

Finally, the ETF's expenses, including management fees, also influence the NAV. These fees are deducted from the fund's assets, impacting the overall value available to investors.

- Market movements of global equities: Global market trends significantly influence the NAV. Bull markets generally lead to NAV increases, while bear markets cause decreases.

- Changes in the USD/other currency exchange rates: Despite the USD hedging, residual currency fluctuations can still slightly impact the NAV.

- Dividend distributions and reinvestment: Dividend payments from underlying companies affect the NAV. The reinvestment of these dividends can contribute to long-term NAV growth.

- ETF management fees: These ongoing fees are deducted from the fund's assets, slightly reducing the NAV over time.

How to Find and Interpret the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Finding the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is relatively straightforward. You can access this crucial information through several reliable sources:

The most accurate source is Amundi's official website. They typically publish the end-of-day NAV. Major financial data providers like Bloomberg and Refinitiv also offer real-time and historical NAV data. Your brokerage account platform will usually display the NAV alongside the current market price of the ETF.

NAV reporting usually presents the NAV per share. It's important to understand the difference between the NAV and the market price. The market price fluctuates throughout the trading day and can differ from the NAV due to supply and demand dynamics. The NAV, however, represents the net asset value of one share at a specific point in time, typically the end of the trading day. Always check the timestamp to ensure you are referencing the most up-to-date NAV information.

- Amundi's official website: The primary source for accurate NAV data.

- Major financial data providers (Bloomberg, Refinitiv): Provide real-time and historical NAV data.

- Your brokerage account platform: A convenient way to track your investment's NAV.

- Understanding the trading day closing NAV: This is the most commonly reported NAV and is generally considered the most accurate representation of the fund's value for a given day.

Using NAV to Make Informed Investment Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist

Understanding the NAV is crucial for making well-informed investment decisions. By tracking the NAV over time, you can effectively monitor your investment's performance. Comparing the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist to other similar ETFs helps assess its relative performance within its asset class.

Regularly monitoring your portfolio's growth through NAV changes allows you to assess the success of your investment strategy. While the market price can fluctuate dramatically in short periods, the NAV provides a more stable measure of the underlying asset value. Consider using the NAV alongside other factors like your risk tolerance and financial goals when determining suitable entry and exit points. Long-term trends in the NAV are significantly more informative than short-term fluctuations.

- Benchmarking against other ETFs: Compare the NAV performance against competitors to assess relative value.

- Monitoring investment returns over time: Track NAV changes to gauge the success of your investment strategy.

- Determining optimal entry and exit points: Use NAV analysis alongside market conditions to make informed buy/sell decisions.

- Risk management through NAV analysis: Understanding NAV fluctuations helps to manage risk and avoid impulsive decisions based on short-term market volatility.

Risks Associated with Investing in Amundi MSCI World II UCITS ETF USD Hedged Dist based on NAV

While the Amundi MSCI World II UCITS ETF USD Hedged Dist offers diversification, it's essential to understand the inherent risks. Investing in global equity markets always involves some degree of risk. Market volatility can cause significant NAV fluctuations, leading to potential losses.

Although the USD hedging strategy minimizes currency risk, it does not eliminate it completely. Unexpected shifts in exchange rates can still impact the NAV, albeit often to a lesser degree than in an unhedged fund. Geopolitical events and macroeconomic factors such as inflation can also impact the performance of the underlying assets, influencing the NAV. Always consider your risk tolerance and diversify your investment portfolio to mitigate potential losses.

- Market volatility: Global equity markets are inherently volatile, leading to NAV fluctuations.

- Currency risk (despite hedging): Residual currency risks can still affect the NAV.

- Geopolitical risks: Global events can negatively impact market performance and the NAV.

- Inflationary pressures: High inflation can erode the purchasing power of your investment, impacting the real NAV.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is paramount for effective investment management. We've explored the key factors influencing its NAV, including the performance of the MSCI World Index, currency fluctuations (despite hedging), expenses, and market conditions. Knowing how to access and interpret NAV data, from sources like Amundi's website or your brokerage platform, is critical for monitoring your portfolio's growth and making informed buy and sell decisions.

Regularly monitoring the Net Asset Value of your Amundi MSCI World II UCITS ETF USD Hedged Dist holdings is vital for maximizing your investment potential. Proactive NAV monitoring, combined with a well-defined investment strategy and appropriate risk management, allows you to optimize your portfolio and achieve your long-term financial goals. Start monitoring your NAV today for a more confident and successful investment journey.

Featured Posts

-

Bbc Radio 1 Big Weekend 2025 How To Buy Tickets Now The Lineup Is Confirmed

May 24, 2025

Bbc Radio 1 Big Weekend 2025 How To Buy Tickets Now The Lineup Is Confirmed

May 24, 2025 -

Glastonbury 2025 Charli Xcx Neil Young And The Artists You Cant Miss

May 24, 2025

Glastonbury 2025 Charli Xcx Neil Young And The Artists You Cant Miss

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc Explained

May 24, 2025 -

Annie Kilners Social Media Activity After Kyle Walkers Night Out Sparks Controversy

May 24, 2025

Annie Kilners Social Media Activity After Kyle Walkers Night Out Sparks Controversy

May 24, 2025 -

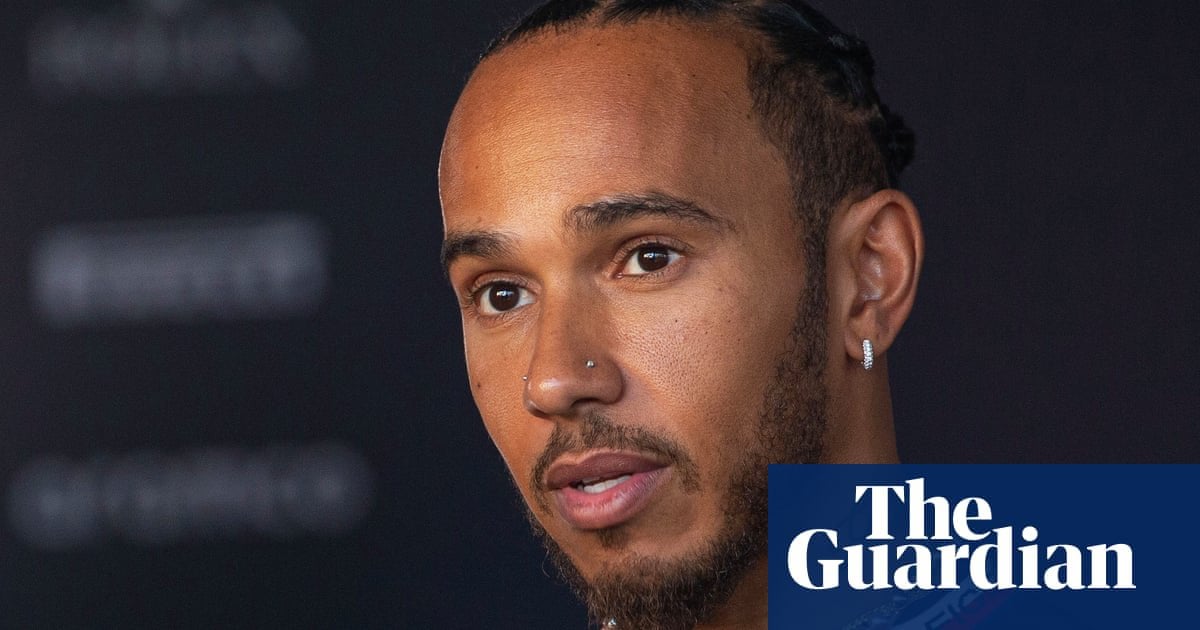

Hamilton Faces Backlash After Unfair Comments

May 24, 2025

Hamilton Faces Backlash After Unfair Comments

May 24, 2025

Latest Posts

-

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025 -

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025 -

Kyle Walker Party Pictures And Annie Kilners Return Home

May 24, 2025

Kyle Walker Party Pictures And Annie Kilners Return Home

May 24, 2025 -

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025 -

The Annie Kilner Kyle Walker Situation A Breakdown Of Recent Events And Allegations

May 24, 2025

The Annie Kilner Kyle Walker Situation A Breakdown Of Recent Events And Allegations

May 24, 2025