New Deutsche Bank Team Focuses On Defense Finance Opportunities

Table of Contents

Understanding the Unique Needs of the Defense Finance Sector

The defense finance sector differs significantly from other industries due to its unique regulatory landscape, long-term project timelines, and inherent risks. Successfully navigating this space requires specialized knowledge and expertise.

Regulatory Compliance and Due Diligence

Defense finance demands strict adherence to a complex web of regulations. Failure to comply can result in severe penalties and reputational damage. Understanding and adhering to regulations like ITAR (International Traffic in Arms Regulations), EAR (Export Administration Regulations), and other government contract stipulations is paramount.

- Navigating complex procurement processes: Defense procurement often involves intricate bidding processes, stringent requirements, and multiple layers of approval.

- Understanding OFAC sanctions: Compliance with the Office of Foreign Assets Control (OFAC) sanctions is crucial to avoid penalties and legal repercussions.

- Ensuring compliance with data privacy regulations: Protecting sensitive data related to defense projects is critical and requires adherence to specific data privacy regulations.

Long-Term Projects and Funding Structures

Defense projects are often characterized by their long durations and substantial capital requirements. This necessitates specialized financing structures that can accommodate the unique challenges of these long-term engagements.

- Project financing solutions: Deutsche Bank offers tailored project finance solutions to support the development and execution of large-scale defense projects.

- Bridging finance for large-scale projects: The bank provides bridging finance to cover costs during the initial phases of projects before longer-term funding is secured.

- Long-term debt solutions tailored to defense contracts: Deutsche Bank offers long-term debt solutions specifically structured to align with the payment schedules and risk profiles of defense contracts.

Managing Risk in the Defense Industry

The defense industry is inherently subject to various risks, including geopolitical instability, supply chain disruptions, and technological obsolescence. Effective risk mitigation strategies are critical for success.

- Assessing geopolitical risks: Deutsche Bank's team meticulously assesses geopolitical risks and their potential impact on defense projects.

- Managing supply chain disruptions: The bank helps clients develop robust supply chain management strategies to minimize disruptions.

- Developing robust risk management frameworks: Deutsche Bank collaborates with clients to develop and implement comprehensive risk management frameworks tailored to their specific needs.

Deutsche Bank's Specialized Team and Expertise

Deutsche Bank's success in the defense finance sector is underpinned by its dedicated team of experts with unparalleled experience and industry knowledge.

Industry-Specific Knowledge

The team comprises professionals with deep experience in defense contracting, government regulations, and financial structuring within the defense sector.

- Former military personnel with financial backgrounds: This unique combination provides valuable insights into the operational realities and financial needs of the defense industry.

- Experienced professionals with deep knowledge of government contracting: The team possesses in-depth understanding of the complexities of government contracting processes and regulations.

- Strong relationships with key players in the defense industry: The team's extensive network facilitates efficient project execution and access to critical information.

Tailored Financial Solutions

Deutsche Bank offers a customized approach to providing financial solutions, ensuring that each client receives support perfectly aligned with their specific needs and circumstances.

- Bespoke financing solutions: The bank crafts unique financing solutions tailored to the individual requirements of each defense project.

- Advisory services for mergers and acquisitions: The team provides expert advice and support for mergers and acquisitions within the defense industry.

- Risk management and mitigation strategies: Deutsche Bank develops and implements comprehensive risk management strategies to safeguard client investments.

Global Reach and Network

Deutsche Bank's global presence and extensive network provide clients with unparalleled access to resources and expertise worldwide.

- International reach to support global defense projects: The bank's global network allows it to support clients undertaking projects across multiple countries and jurisdictions.

- Established network of contacts within government agencies and defense contractors: This network facilitates efficient communication and collaboration with key stakeholders.

- Access to diverse funding sources: Deutsche Bank leverages its global network to access a wide range of funding sources to meet client needs.

Opportunities in the Growing Defense Finance Market

The global defense finance market is experiencing significant growth, driven by several key factors.

Increased Global Defense Spending

Geopolitical instability, technological advancements, and rising threat perceptions are driving increased global defense spending, creating a wealth of Defense Finance Opportunities.

- Geopolitical instability: Global tensions and conflicts are prompting nations to increase their defense budgets significantly.

- Technological advancements in defense technologies: The development and adoption of advanced defense technologies demand substantial investment.

- Rising threat perceptions: Growing concerns about cyber warfare, terrorism, and other threats are fueling defense spending growth.

Modernization and Technological Upgrades

The need for modernization and technological upgrades within the defense sector presents significant financing opportunities.

- Financing for new weapon systems: The acquisition of new weapon systems and platforms requires substantial financial investment.

- Investments in cybersecurity infrastructure: Strengthening cybersecurity defenses is a top priority for many defense organizations, driving investment in this area.

- Funding for research and development: Continued research and development in defense technologies are essential for maintaining a technological edge, leading to significant funding opportunities.

Conclusion

Deutsche Bank's new focus on Defense Finance Opportunities signifies a significant step into a rapidly expanding market segment. By leveraging its specialized team’s expertise, global network, and tailored solutions, the bank is well-positioned to become a key player in this strategically important sector. The unique challenges and complex regulatory environment of defense finance require a specialized approach. Deutsche Bank's dedication to understanding these intricacies positions them to deliver effective and compliant financial solutions for their defense industry clients. If you're seeking robust and tailored financing options for your defense-related projects or require expert guidance in navigating the complexities of this sector, explore the Defense Finance Opportunities available through Deutsche Bank today.

Featured Posts

-

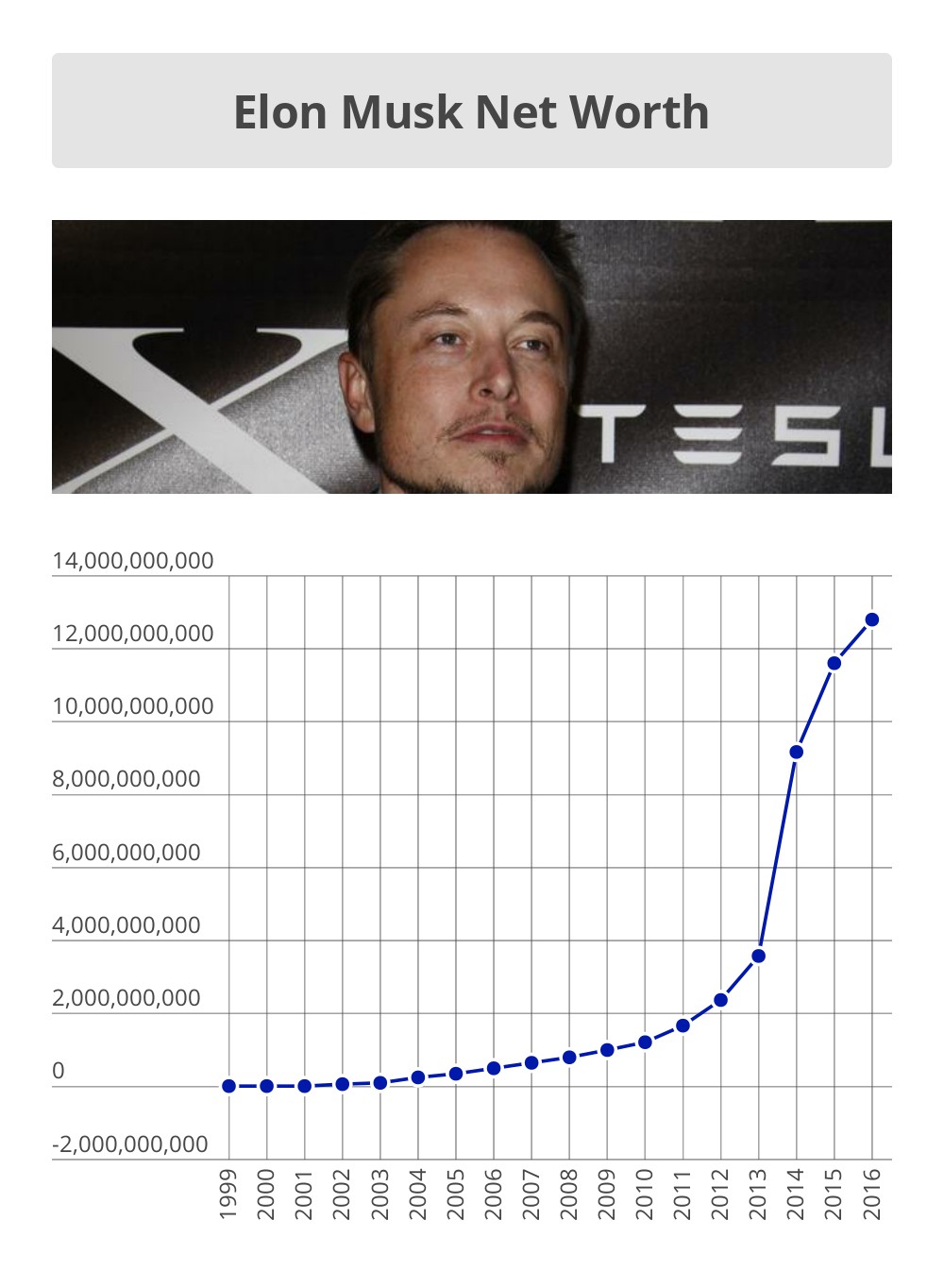

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But He Remains Richest

May 10, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Drops Over 100 Billion But He Remains Richest

May 10, 2025 -

King Nazivaye Maska Ta Trampa Zradnikami Scho Pidtrimuyut Putina

May 10, 2025

King Nazivaye Maska Ta Trampa Zradnikami Scho Pidtrimuyut Putina

May 10, 2025 -

The Dangote Factor A Thisdaylive Perspective On Petrol Prices In Nigeria

May 10, 2025

The Dangote Factor A Thisdaylive Perspective On Petrol Prices In Nigeria

May 10, 2025 -

Chainalysis Expands With Ai Agent Startup Alterya Acquisition

May 10, 2025

Chainalysis Expands With Ai Agent Startup Alterya Acquisition

May 10, 2025 -

Nouveau Vignoble A Dijon 2500 M Plantes Aux Valendons

May 10, 2025

Nouveau Vignoble A Dijon 2500 M Plantes Aux Valendons

May 10, 2025