New ECB Task Force Aims To Simplify Banking Supervision

Table of Contents

The Mandate of the New ECB Task Force

The European Central Bank (ECB) established this task force with a clear mandate: to simplify banking supervision within the Eurozone. The objectives are multifaceted and aim to create a more efficient and less burdensome regulatory environment. The task force's key areas of focus include:

- Streamlining regulatory reporting requirements: Reducing the volume and complexity of reporting demands placed upon banks, particularly smaller institutions. This involves identifying redundancies and inconsistencies in existing reporting standards.

- Improving communication and transparency between the ECB and supervised banks: Enhancing dialogue and information sharing to ensure a clearer understanding of supervisory expectations and foster a more collaborative relationship. This includes improving the accessibility and clarity of regulatory guidance.

- Reducing the burden of compliance for smaller banks: Tailoring supervisory requirements to the specific size and complexity of different banks to avoid disproportionate burdens on smaller institutions. This could involve differentiated reporting thresholds and simpler compliance processes.

- Harmonizing supervisory practices across different Eurozone countries: Creating a more consistent approach to banking supervision across the diverse national contexts within the Eurozone. This promotes fairness and reduces regulatory arbitrage.

The ECB has not yet publicly announced specific timelines for the completion of the task force's work, but progress updates are expected periodically.

Expected Benefits of Simplified Banking Supervision

Simplified banking supervision promises substantial benefits for both individual banks and the broader Eurozone financial system.

Positive Impacts on Banks:

- Reduced administrative costs: Streamlined reporting and compliance processes will directly lower administrative expenses for banks, freeing up resources for core business activities. Estimates suggest potential savings of millions of euros annually for individual institutions.

- Increased efficiency in internal processes: Reduced regulatory burden translates into increased efficiency within banks’ internal operations. This allows for better resource allocation and improved operational effectiveness.

- Improved access to capital: A more predictable and less complex regulatory environment can enhance banks’ attractiveness to investors, facilitating easier access to capital for expansion and investment.

- Enhanced competitiveness: Reduced compliance costs and improved efficiency improve a bank's overall competitiveness, both domestically and within the wider European banking market.

Positive Impacts on the Financial System:

- Greater stability within the Eurozone: A simplified and more efficient supervisory framework strengthens the overall stability of the Eurozone's financial system by reducing risks and fostering greater resilience.

- Reduced systemic risk: Harmonized supervisory practices and reduced regulatory complexity contribute to a lower risk of systemic failures within the banking sector.

- Improved resilience to economic shocks: A more robust and resilient banking sector, better equipped to navigate challenges, improves the overall economic resilience of the Eurozone.

Challenges and Potential Obstacles

While the initiative holds significant promise, several challenges could hinder the task force's progress.

- Resistance from national regulators or individual banks: Changes to established practices can meet with resistance from national authorities or banks accustomed to existing systems.

- Complexity of existing regulations: Untangling decades of accumulated regulations and harmonizing them across different jurisdictions presents a significant logistical challenge.

- Need for significant technological upgrades within the supervisory framework: Modernizing supervisory processes requires substantial investment in technology and data infrastructure.

- Ensuring consistent application of simplified rules across diverse banking sectors: Maintaining a consistent application of simplified rules across diverse banking sectors (retail, investment, etc.) will require careful calibration and monitoring.

Addressing these challenges will require proactive engagement with stakeholders, innovative solutions, and a commitment to collaboration across different jurisdictions.

The Role of Technology in Simplifying Supervision

Technology plays a pivotal role in achieving the task force's goals. The adoption of RegTech (regulatory technology) and SupTech (supervisory technology) solutions can automate many manual processes, improve data analysis, and facilitate better communication. This might include:

- Artificial intelligence (AI) for automated reporting and compliance checks: AI can significantly reduce the time and resources needed for regulatory reporting.

- Data analytics for improved risk assessment: Sophisticated data analytics tools can enhance the ECB’s ability to identify and assess risks within the banking system.

- Secure communication platforms for enhanced collaboration: Secure digital platforms can facilitate faster and more efficient communication between the ECB and supervised banks.

By leveraging technology, the task force can streamline its operations and ensure a more effective and efficient supervisory process.

Simplifying Banking Supervision: A Step Towards a Stronger Eurozone

The new ECB task force's initiative to simplify banking supervision offers substantial benefits. Streamlined processes, reduced costs, improved efficiency, and enhanced stability will contribute to a stronger and more resilient Eurozone financial system. Simplified banking supervision is not merely a technical exercise; it is a crucial step towards building a more robust and competitive European banking sector. Stay informed about the latest developments in simplifying banking supervision by following the ECB's website and publications. The future of efficient and effective banking supervision within the Eurozone depends on this crucial initiative.

Featured Posts

-

Celebrity Style Ariana Grandes Hair And Tattoo Transformation And The Professionals Involved

Apr 27, 2025

Celebrity Style Ariana Grandes Hair And Tattoo Transformation And The Professionals Involved

Apr 27, 2025 -

Mubadala Abu Dhabi Open Rybakina Wins Tense Three Set Match Against Jabeur

Apr 27, 2025

Mubadala Abu Dhabi Open Rybakina Wins Tense Three Set Match Against Jabeur

Apr 27, 2025 -

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025 -

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025 -

The Professionals Behind Ariana Grandes New Hair And Tattoo Style

Apr 27, 2025

The Professionals Behind Ariana Grandes New Hair And Tattoo Style

Apr 27, 2025

Latest Posts

-

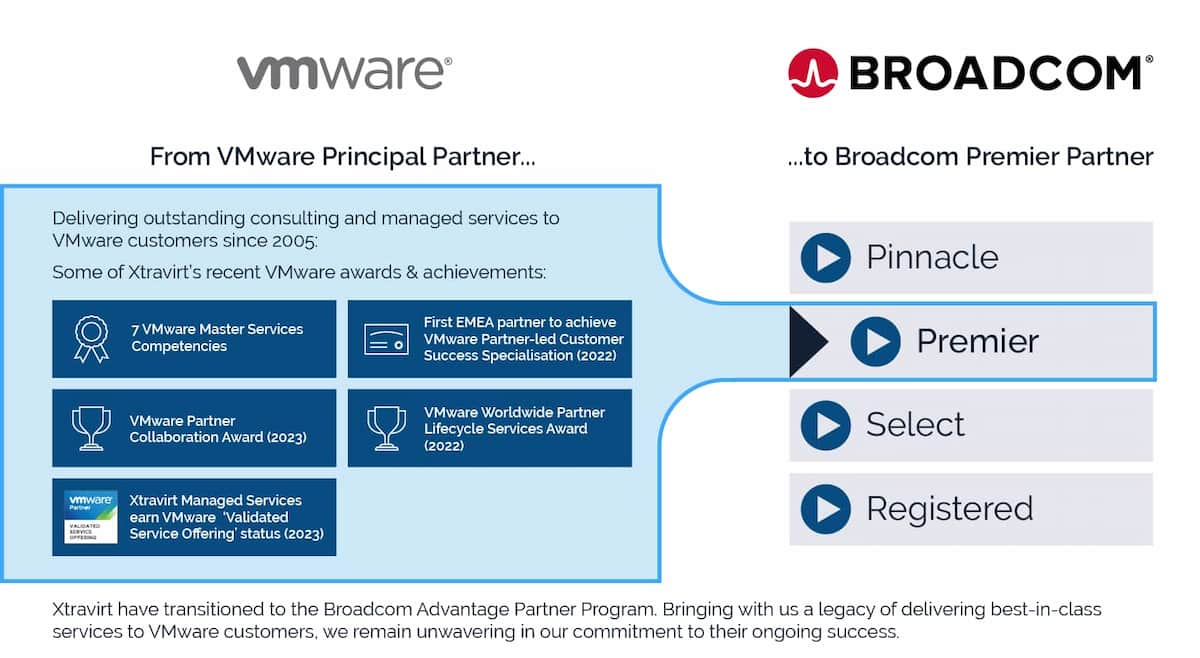

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025