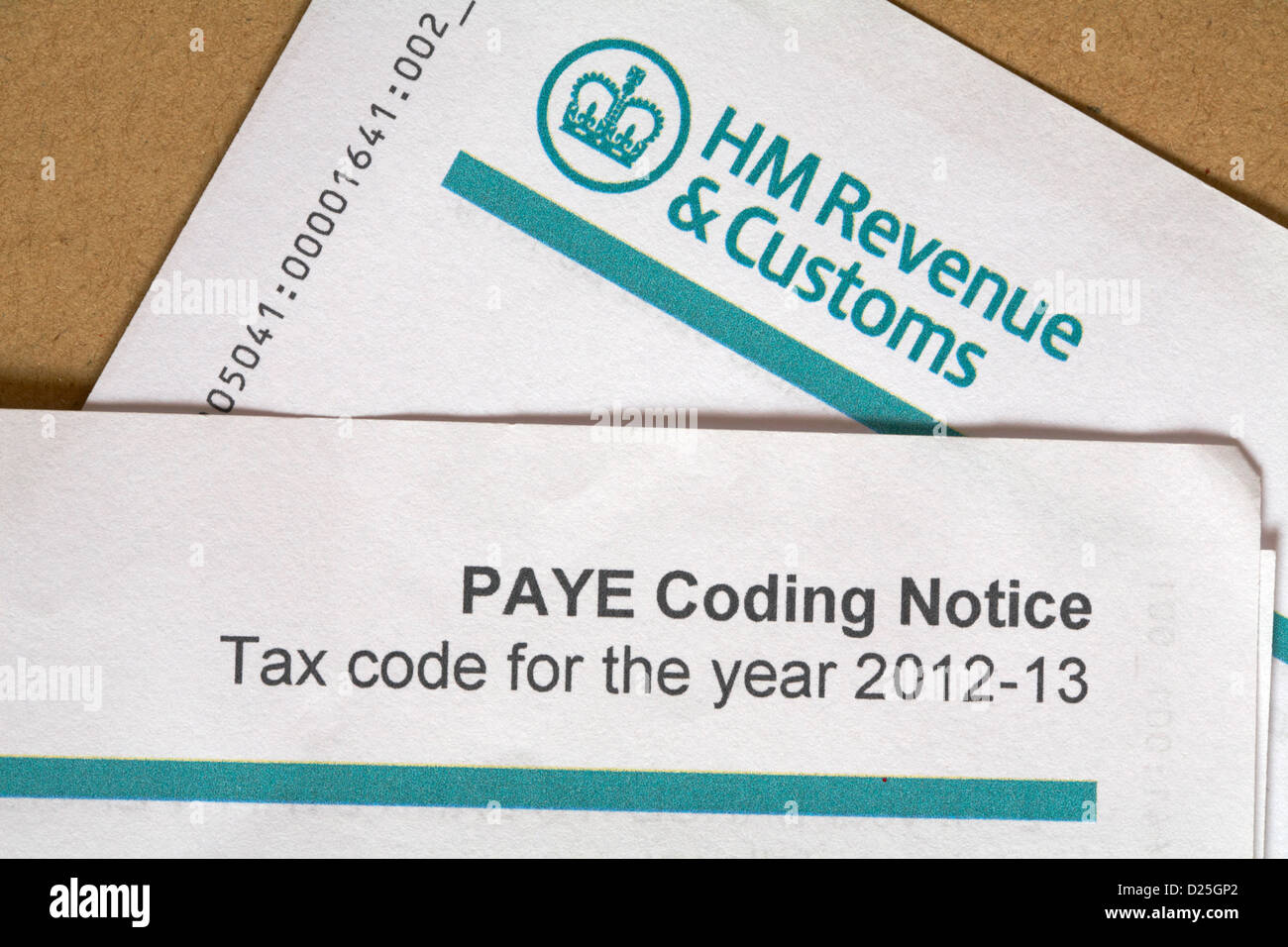

New HMRC Tax Codes For 2024: What Savers Need To Know

Table of Contents

Understanding the Basics of HMRC Tax Codes

Before diving into the changes, let's clarify what HMRC tax codes are and how they work. Your tax code, issued by HMRC (Her Majesty's Revenue and Customs), determines how much income tax is deducted from your earnings through PAYE (Pay As You Earn). This system ensures you pay income tax throughout the year, rather than in one large sum.

- PAYE (Pay As You Earn): This is the system used by employers to deduct income tax from employees' salaries.

- Tax Year: The UK tax year runs from 6th April to 5th April the following year. The changes we're discussing apply to the 2024 tax year, starting April 6th, 2024.

- Tax-Free Allowance (Personal Allowance): This is the amount of income you can earn each year before you start paying income tax. This allowance is adjusted annually and forms a key part of your HMRC tax code.

Key Changes in HMRC Tax Codes for 2024

While the specific numerical changes to HMRC tax codes for 2024 are announced closer to the tax year, it's important to be aware of potential adjustments. HMRC typically reviews allowances and tax bands annually, based on economic factors and government policy. These changes directly impact savers through several avenues:

- Specific Numerical Changes: Keep an eye on official HMRC announcements for precise updates on changes to tax bands and personal allowances. These changes will directly affect the amount of tax deducted from your earnings.

- Impact on Pension Contributions: Changes to tax bands can alter the tax relief you receive on pension contributions. Higher tax relief means more of your contributions are topped up by the government. Be sure to understand how the updated tax bands affect your overall pension contribution strategy.

- Changes Concerning ISAs: While ISAs generally maintain their tax-free status, changes to tax rates and allowances could indirectly influence your overall savings strategy and the benefits of using ISAs.

How the New Tax Codes Affect Different Savings Vehicles

The updated HMRC tax codes for 2024 will have varying effects on different savings vehicles. Let's examine the most common ones:

Impact on Pension Contributions

Pension contributions often qualify for tax relief, meaning the government contributes a percentage towards your pension savings. The amount of relief depends on your tax bracket. New HMRC tax code changes might adjust your tax bracket, potentially altering the level of tax relief you receive. Additionally, be aware of any changes to the annual allowance – the maximum amount you can contribute to your pension each year and still receive tax relief.

Impact on ISAs (Individual Savings Accounts)

ISAs remain a tax-efficient way to save. While the new HMRC tax codes are unlikely to directly affect the tax-free status of ISAs, understanding the overall tax landscape is vital to making informed savings choices. The new tax bands could influence the relative attractiveness of ISAs compared to other savings options. Changes related to ISA contribution limits should also be monitored closely.

Impact on Other Savings and Investments

Changes in HMRC tax codes might indirectly affect other savings vehicles like savings accounts and investments. For example, changes to tax rates could affect the tax you pay on dividends or capital gains from investments. For more complex investment strategies, seeking professional financial advice is strongly recommended.

Avoiding Tax Penalties and Maximizing Savings with the New HMRC Tax Codes

Navigating the new HMRC tax codes effectively requires proactive planning. Here's how to avoid penalties and optimize your savings:

- Accurate Tax Returns: Ensure your tax return accurately reflects your income and expenses. Any discrepancies can lead to penalties.

- Accurate Record Keeping: Keep detailed records of all income and expenses, especially if you're self-employed or receive investment income.

- Resources for Assistance: Utilize resources like the official HMRC website and consult with a financial advisor if you need personalized guidance. Financial advisors are particularly helpful in understanding the impact of these changes on your specific circumstances and creating a tailored savings strategy.

Conclusion: Actionable Steps for Savers Regarding New HMRC Tax Codes for 2024

The new HMRC tax codes for 2024 will introduce changes to tax bands, allowances, and potentially tax relief on savings. Understanding these 2024 HMRC Tax Code changes is key to avoiding tax penalties and maximizing your savings. Review your financial plans to ensure they align with the updated tax landscape. Don't hesitate to seek professional advice on how the 2024 HMRC tax code changes might affect your specific savings strategies and to optimize your savings plans. Taking proactive steps now will set you up for financial success in the coming tax year.

Featured Posts

-

Agatha Christies Endless Night The Bbc Television Adaptation

May 20, 2025

Agatha Christies Endless Night The Bbc Television Adaptation

May 20, 2025 -

Solve The Nyt Mini Crossword May 9th Answers

May 20, 2025

Solve The Nyt Mini Crossword May 9th Answers

May 20, 2025 -

Isabelle Nogueira Apresenta Festival Da Cunha Evento Cultural Em Manaus Com Foco Na Amazonia

May 20, 2025

Isabelle Nogueira Apresenta Festival Da Cunha Evento Cultural Em Manaus Com Foco Na Amazonia

May 20, 2025 -

Schumacher Vuela De Mallorca A Suiza Visita A Su Nieta

May 20, 2025

Schumacher Vuela De Mallorca A Suiza Visita A Su Nieta

May 20, 2025 -

Learn To Write Like Agatha Christie Bbcs New Ai Writing Course

May 20, 2025

Learn To Write Like Agatha Christie Bbcs New Ai Writing Course

May 20, 2025

Latest Posts

-

Croissance Du Trafic Au Port Autonome D Abidjan 2021 2022

May 20, 2025

Croissance Du Trafic Au Port Autonome D Abidjan 2021 2022

May 20, 2025 -

Cote D Ivoire Le Port D Abidjan Et Ses Performances 2022

May 20, 2025

Cote D Ivoire Le Port D Abidjan Et Ses Performances 2022

May 20, 2025 -

Cote D Ivoire Impact Economique De L Arrivee Du Diletta Au Port D Abidjan

May 20, 2025

Cote D Ivoire Impact Economique De L Arrivee Du Diletta Au Port D Abidjan

May 20, 2025 -

Amenagement Urbain En Cote D Ivoire Les Plans De Detail Et Le Role Des Maires

May 20, 2025

Amenagement Urbain En Cote D Ivoire Les Plans De Detail Et Le Role Des Maires

May 20, 2025 -

Paa Analyse Du Trafic Maritime En Cote D Ivoire 2022

May 20, 2025

Paa Analyse Du Trafic Maritime En Cote D Ivoire 2022

May 20, 2025