News Corp: A Deeper Dive Into Its Undervalued Business Units

Table of Contents

The Strength of News Corp's Diversified Portfolio

News Corp's success stems from its strategic diversification across various media segments. This minimizes the risk associated with relying on a single revenue stream, a crucial factor in the volatile media landscape. Let's examine its key divisions:

-

News & Information: This segment, anchored by Dow Jones (publisher of the Wall Street Journal), provides a reliable stream of subscription revenue and access to a high-net-worth audience. The digital transformation of the Wall Street Journal has been remarkably successful, expanding its reach beyond print and securing a strong position in the online financial news market. Further growth is expected through continued digital innovation and expansion into new international markets. This segment provides a stable foundation for the overall News Corp valuation.

-

Book Publishing: HarperCollins, a major player in the book publishing industry, demonstrates remarkable resilience in the digital age. HarperCollins’ success isn't solely dependent on traditional print sales. They strategically leverage e-books, audiobooks, and other digital formats. Successful titles from renowned authors contribute significantly to consistent revenue streams, demonstrating the enduring appeal of high-quality written content.

-

Digital Real Estate: realtor.com, a key asset within News Corp's portfolio, occupies a prominent position in the booming online real estate market. Its user-friendly interface and extensive listings provide a competitive advantage. Future projections for realtor.com are positive, driven by the continued growth of online real estate transactions and the company's ongoing investments in technology and innovation. This segment represents significant growth potential for the News Corp stock price.

Analyzing News Corp's Undervalued Assets

A key argument for investing in News Corp is its potential for re-rating. Its current market capitalization may not fully reflect the future earning potential of its individual business units. A thorough analysis reveals compelling reasons to believe News Corp is undervalued:

-

Detailed Financial Analysis: A comparison of News Corp's key financial metrics (revenue growth, profit margins, debt-to-equity ratio) against its competitors reveals a potentially undervalued position. While detailed analysis requires accessing financial statements, a comparison shows that News Corp's profitability and revenue streams compare favorably to its peers, suggesting a market underestimation of its intrinsic value.

-

Future Growth Projections: Each business unit exhibits potential for substantial growth. News & Information can leverage its strong brand recognition for further subscription growth and explore new revenue streams through digital content. Book Publishing can continue to adapt to changing consumer preferences by embracing new technologies and formats. Digital Real Estate presents significant growth potential in a rapidly expanding online market. These factors underpin future growth projections for the overall News Corp valuation.

-

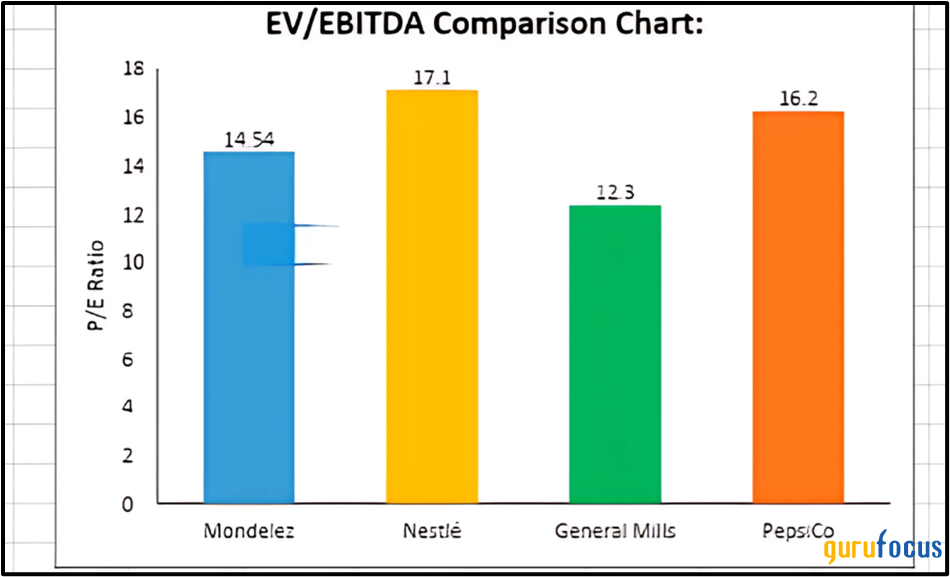

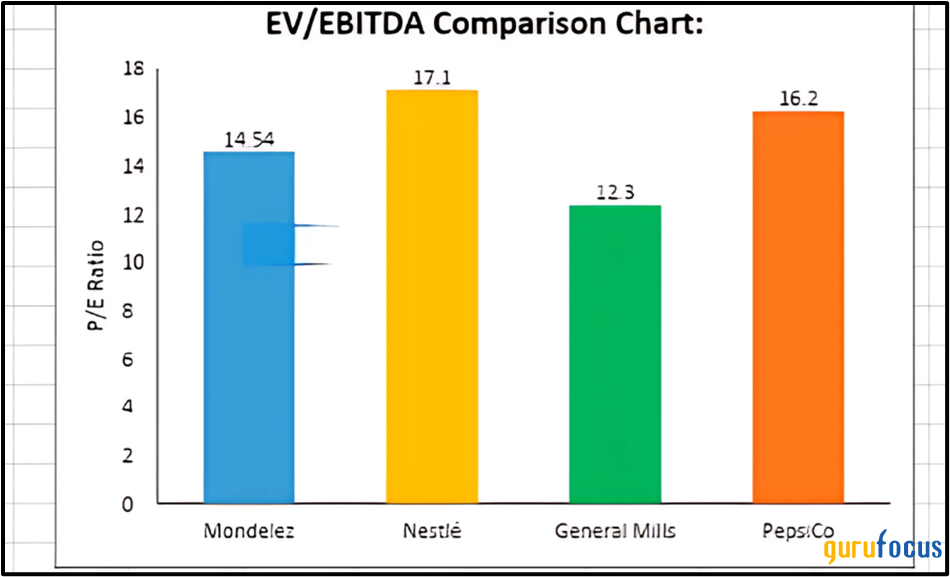

Comparable Company Analysis: Applying valuation multiples (such as Price-to-Earnings ratio and Price-to-Sales ratio) commonly used in the media industry to News Corp, when compared to similar companies, strengthens the undervaluation thesis. This analysis reveals that News Corp's valuation multiples are significantly lower than its peers, suggesting its stock price doesn't fully reflect its underlying asset value.

Addressing Potential Risks and Challenges

While News Corp presents a compelling investment opportunity, it's crucial to acknowledge potential risks:

-

Competition: The media industry is fiercely competitive. News Corp faces challenges from established giants and nimble startups in each of its business segments. Maintaining a competitive edge requires continuous innovation and adaptation.

-

Regulatory Changes: The regulatory environment for media companies is constantly evolving. Changes in regulations, particularly concerning data privacy and antitrust laws, could impact News Corp's operations and profitability.

-

Economic Downturns: Like many businesses, News Corp is sensitive to economic downturns. During recessions, advertising revenue may decline, impacting profitability. However, the diversified nature of News Corp's portfolio provides a level of resilience against such economic shocks.

Conclusion

News Corp, despite its often-overlooked position, showcases a diverse portfolio of strong business units ripe with potential. Its current market valuation may not accurately represent its intrinsic value, making it an intriguing prospect for investors who conduct thorough due diligence. By carefully assessing the strengths, potential growth drivers, and associated risks, investors can determine if News Corp’s undervalued business units fit their investment strategy. Take a deeper dive into News Corp and discover the hidden opportunities within this media conglomerate. Start your research into News Corp stock today.

Featured Posts

-

Analyse Snelle Marktdraai Europese Aandelen Vervolg Of Tijdelijke Verschuiving

May 24, 2025

Analyse Snelle Marktdraai Europese Aandelen Vervolg Of Tijdelijke Verschuiving

May 24, 2025 -

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 24, 2025

Vozrast Geroev Filma O Bednom Gusare Zamolvite Slovo Podrobniy Analiz

May 24, 2025 -

10 Let Posle Pobedy Na Evrovidenii Sudby Pobediteley

May 24, 2025

10 Let Posle Pobedy Na Evrovidenii Sudby Pobediteley

May 24, 2025 -

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Other Music Legends

May 24, 2025

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Other Music Legends

May 24, 2025 -

Ferrari Hot Wheels New Releases Have Us Saying Mamma Mia

May 24, 2025

Ferrari Hot Wheels New Releases Have Us Saying Mamma Mia

May 24, 2025

Latest Posts

-

The Downfall 17 Celebrities Whose Images Were Tarnished

May 24, 2025

The Downfall 17 Celebrities Whose Images Were Tarnished

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

How 17 Celebrities Ruined Their Reputations

May 24, 2025

How 17 Celebrities Ruined Their Reputations

May 24, 2025 -

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 24, 2025

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 24, 2025 -

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025