Nicolai Tangen And The Impact Of Trump's Tariffs On Global Investment

Table of Contents

Nicolai Tangen's Role and the GPFG's Investment Mandate

Nicolai Tangen, appointed CEO of the Government Pension Fund Global (GPFG) in 2020, heads one of the world's largest sovereign wealth funds. The GPFG, also known as Norway's Oil Fund, manages substantial assets accumulated from Norway's oil and gas revenues. Its investment mandate centers on long-term value creation, aiming to maximize returns for future generations of Norwegians while adhering to strict ethical and sustainability guidelines.

- The GPFG's size and global reach: With trillions of dollars in assets, the GPFG invests globally across a diverse range of asset classes, making it a significant player in international markets.

- Its ethical and sustainability considerations in investments: The GPFG excludes companies involved in controversial weapons, tobacco, and coal, reflecting Norway's commitment to responsible investing. This ethical lens significantly shapes its investment strategy and portfolio composition.

- The fund's diversification strategy to mitigate risk: The GPFG employs a diversified portfolio strategy, spreading investments across various asset classes and geographies to minimize the impact of market fluctuations and geopolitical events, including those stemming from trade wars like the one initiated by the Trump administration.

The Impact of Trump's Tariffs on Global Markets

Trump's tariffs, implemented primarily between 2018 and 2020, targeted numerous sectors, creating significant disruptions in global trade. These trade wars significantly increased uncertainty in global markets.

- Specific examples of industries impacted: Manufacturing, particularly steel and aluminum, faced considerable challenges due to tariffs imposed by the US. The agricultural sector, notably soybeans, also suffered from retaliatory tariffs imposed by other countries.

- The effect on global supply chains and trade relationships: Tariffs disrupted established supply chains, forcing businesses to re-evaluate sourcing strategies and leading to increased costs. Trade relations between the US and several key partners deteriorated significantly.

- Increased costs and reduced competitiveness for businesses: The increased costs associated with tariffs reduced the competitiveness of businesses, impacting profitability and hindering economic growth. This created a climate of heightened uncertainty for investors.

Navigating Uncertainty: The GPFG's Response to Tariff Volatility

The GPFG, with its global reach and long-term investment horizon, had to adapt its strategy in response to the volatility caused by Trump's tariffs. While precise details of their internal adjustments aren't always publicly available due to confidentiality reasons, we can infer likely responses.

- Did the GPFG increase or decrease investments in specific sectors? It's plausible the GPFG may have adjusted its allocation, potentially reducing exposure to sectors most heavily impacted by tariffs or increasing investments in more resilient sectors.

- Were there any divestments from companies heavily impacted by tariffs? Given the GPFG’s ethical and sustainability considerations, divestment from companies demonstrably harming the environment or engaging in unethical practices exacerbated by trade disputes is a possibility.

- How did the GPFG's ethical investment criteria influence its response? The GPFG’s commitment to ethical and sustainable investing likely influenced its response, potentially guiding it towards companies demonstrating resilience and adaptability in the face of trade uncertainties.

Broader Implications for Global Investment

Trump's tariffs had far-reaching consequences for global investment, extending beyond immediate market reactions.

- Increased geopolitical risk and its effect on investment decisions: Trade wars heightened geopolitical risk, making investors more cautious and less inclined to undertake long-term investments. Uncertainty about future trade policies became a major factor in investment decision-making.

- The role of international cooperation in mitigating the negative effects: International cooperation became crucial in mitigating the negative impacts of trade wars. Efforts to establish predictable trade rules and resolve disputes through multilateral mechanisms became increasingly important for investor confidence.

- Opportunities for investors in adapting to changing global dynamics: While trade wars presented challenges, they also created opportunities for investors who could adapt to the changing global dynamics, identify resilient companies, and capitalize on emerging market niches.

Conclusion

Trump's tariffs significantly impacted global investment, creating market volatility and uncertainty. Nicolai Tangen and the GPFG, as a major player in global finance, had to navigate these complexities, likely adjusting their portfolio strategy to mitigate risks and capitalize on opportunities. The broader implications extend to increased geopolitical risk, the importance of international cooperation, and the emergence of new opportunities for adaptable investors. Further research into the impact of trade policies on global investment, particularly focusing on the strategies employed by major players like Nicolai Tangen and the GPFG, is crucial for understanding and navigating future economic uncertainties. Understanding the impact of Nicolai Tangen and the impact of Trump's Tariffs on Global Investment is essential for informed investment strategies.

Featured Posts

-

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Share Her Story

May 05, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Share Her Story

May 05, 2025 -

Sesame Street And Laugh In Veteran Ruth Buzzi Dies At 88

May 05, 2025

Sesame Street And Laugh In Veteran Ruth Buzzi Dies At 88

May 05, 2025 -

Hollywood At A Standstill The Writers And Actors Joint Strike

May 05, 2025

Hollywood At A Standstill The Writers And Actors Joint Strike

May 05, 2025 -

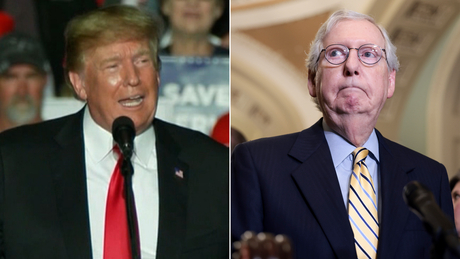

Nhl Standings The Western Conference Wild Card Contenders

May 05, 2025

Nhl Standings The Western Conference Wild Card Contenders

May 05, 2025

Latest Posts

-

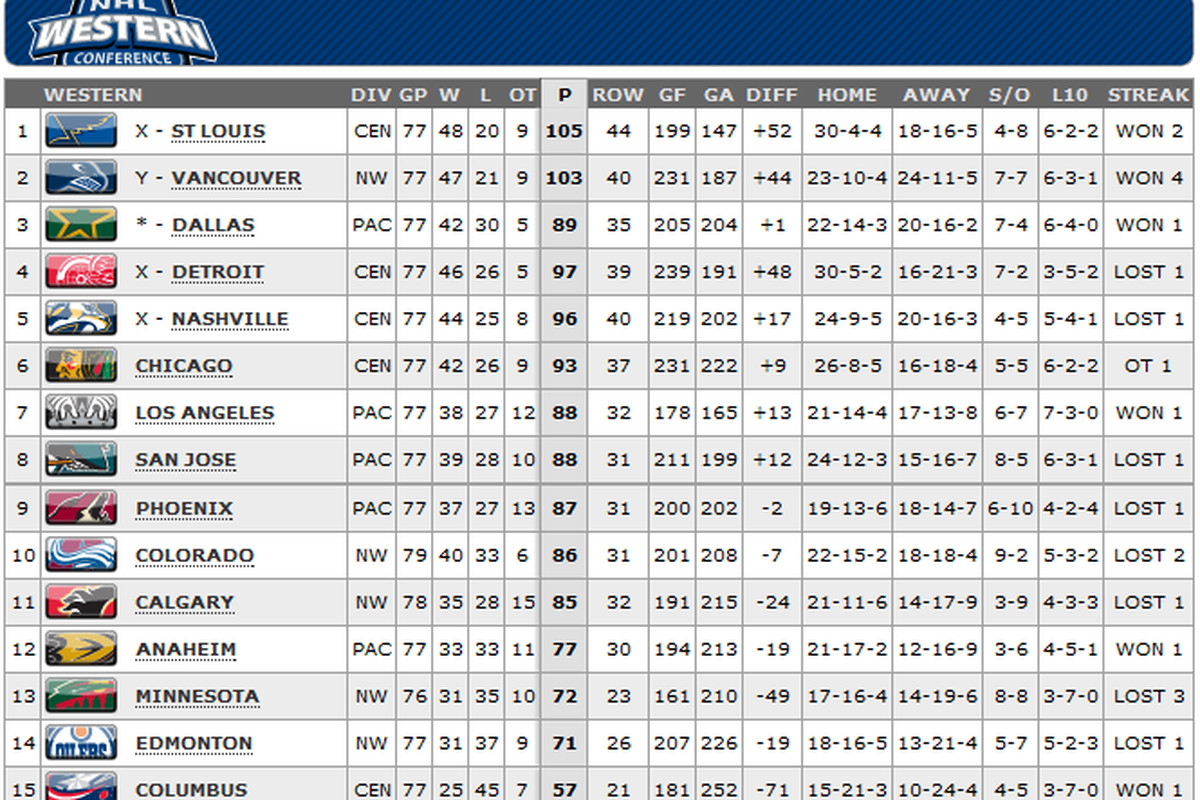

Addressing The Slow Traffic Movement In Darjeeling

May 05, 2025

Addressing The Slow Traffic Movement In Darjeeling

May 05, 2025 -

Darjeelings Traffic Problems A Detailed Analysis

May 05, 2025

Darjeelings Traffic Problems A Detailed Analysis

May 05, 2025 -

When Is The Partial Solar Eclipse In Nyc On Saturday Viewing Tips

May 05, 2025

When Is The Partial Solar Eclipse In Nyc On Saturday Viewing Tips

May 05, 2025 -

Slow Traffic In Darjeeling Understanding The Issues

May 05, 2025

Slow Traffic In Darjeeling Understanding The Issues

May 05, 2025 -

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025