Nigel Farage's NatWest Debanking Case Resolved

Table of Contents

The Chronology of Events Leading to the Resolution

The Nigel Farage NatWest debanking saga unfolded over several months, culminating in a resolution that has left many questioning the practices of UK banks. Let's trace the key events:

- July 2022: NatWest closed Nigel Farage's personal and business bank accounts.

- July - August 2022: Mr. Farage publicly denounced the closure, claiming it was politically motivated. NatWest initially justified the action based on reputational risk, citing concerns over his association with certain individuals and organizations.

- September 2022 - onwards: Mr. Farage initiated legal action against NatWest, arguing that the account closure violated his rights to freedom of speech and financial access. The case attracted significant media attention and public debate, with many questioning the power of banks to de-bank individuals based on their political views.

- [Insert Date of Resolution]: The case concluded with [details of the resolution, e.g., a settlement, an out-of-court agreement, or a court ruling]. The specifics of the agreement between Mr. Farage and NatWest remain partially undisclosed, but it reportedly involved a significant financial settlement and a public apology from the bank.

- The role of regulatory bodies: The Financial Conduct Authority (FCA) and other relevant regulatory bodies played a role in investigating the circumstances surrounding the account closure. While their investigations' details were not always public, their involvement highlights the importance of regulations in guiding banking practices.

NatWest's Justification and the Debate Around Debanking

NatWest's initial justification for closing Mr. Farage's accounts centered on managing reputational risk. However, this sparked a wider debate about the phenomenon of "debanking" and its implications for UK society.

- NatWest's stated reasons: The bank cited concerns related to Mr. Farage's political activities and associations as posing a potential reputational risk. This explanation fueled accusations of political bias and censorship.

- Counter-arguments and political motivations: Many argued that the decision to close Mr. Farage's accounts was politically motivated, given his prominent role as a controversial figure in British politics. The timing of the closure, coinciding with increasing political scrutiny of Mr. Farage, strengthened these claims.

- Similar cases and international precedents: While the Farage case attracted significant attention, it’s not an isolated incident. Other high-profile individuals and organizations have faced similar challenges with bank account closures, raising concerns about the potential misuse of de-risking policies. International examples further highlight this trend.

- Legal precedents and relevant legislation: The case highlights the lack of clear legal guidance on debanking practices. Existing legislation on financial regulation doesn't explicitly address political motivations behind account closures, creating a legal grey area.

Implications of the Resolution for Financial Freedom and Political Discourse

The resolution of the Nigel Farage NatWest case carries significant weight for individual rights and the political landscape.

- Potential changes in banking policies: The case may prompt reviews of banking policies and procedures related to account closures, especially in situations where political considerations are alleged. Expect a call for greater transparency and accountability from financial institutions.

- Impact on public trust in financial institutions: The controversy eroded public trust in the impartiality of UK banking institutions, raising questions about the potential for political bias to influence financial decisions.

- The role of regulatory oversight: The incident emphasizes the need for stronger regulatory oversight of banking practices to prevent future incidents of politically motivated debanking. Increased scrutiny of de-risking policies is likely.

- Potential legal repercussions for NatWest: While the specifics of the resolution are not entirely public, the case might have long-term implications for NatWest's reputation and potential legal exposure in similar future cases.

The Role of Media and Public Opinion

Media coverage and public opinion significantly influenced the narrative surrounding the Nigel Farage NatWest debanking case.

- Key media outlets and stances: Various media outlets covered the story, each with varying perspectives, influencing public perception. Some emphasized the concerns of financial institutions about reputational risk, while others highlighted concerns about freedom of speech.

- Public reaction and social media: Social media platforms played a crucial role in amplifying the debate, with strong opinions expressed on both sides. Public reaction ranged from support for NatWest's decision to condemnations of what was seen as political censorship.

Conclusion

The resolution of the Nigel Farage NatWest debanking case serves as a landmark event, highlighting the complex interplay between financial freedom, political expression, and banking practices in the UK. The debate surrounding de-risking and its potential to stifle freedom of speech and financial inclusion remains central to this discussion. The outcome, though partially undisclosed, indicates a need for clearer regulations and increased transparency in the banking sector's dealings with high-profile individuals and those with controversial views. This case underscores the importance of ongoing discussions regarding banking regulations and the protection of individual rights. Further research into the implications of this landmark case is essential for protecting individual rights and ensuring a fair and transparent banking system. Staying informed about developments in this area is crucial to understanding the evolving landscape of financial access and political expression in the UK.

Featured Posts

-

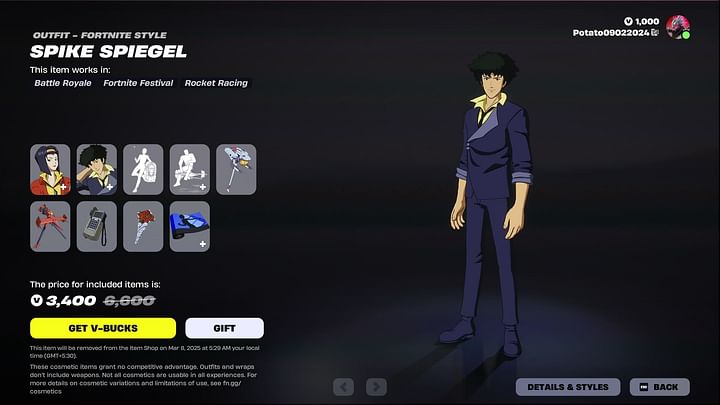

Secure Your Fortnite Cowboy Bebop Rewards Time Is Running Out

May 03, 2025

Secure Your Fortnite Cowboy Bebop Rewards Time Is Running Out

May 03, 2025 -

Tulsas Winter Storm Response A Fleet Of 66 Salt Spreaders

May 03, 2025

Tulsas Winter Storm Response A Fleet Of 66 Salt Spreaders

May 03, 2025 -

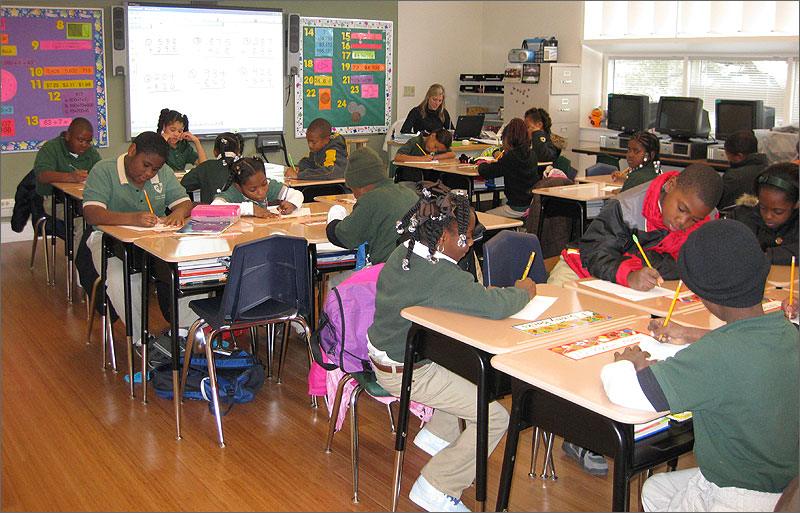

End Of An Era Justice Department Decision On Louisiana School Desegregation

May 03, 2025

End Of An Era Justice Department Decision On Louisiana School Desegregation

May 03, 2025 -

Trump Tariff Impact Auto Industry Navigating Unpredictability

May 03, 2025

Trump Tariff Impact Auto Industry Navigating Unpredictability

May 03, 2025 -

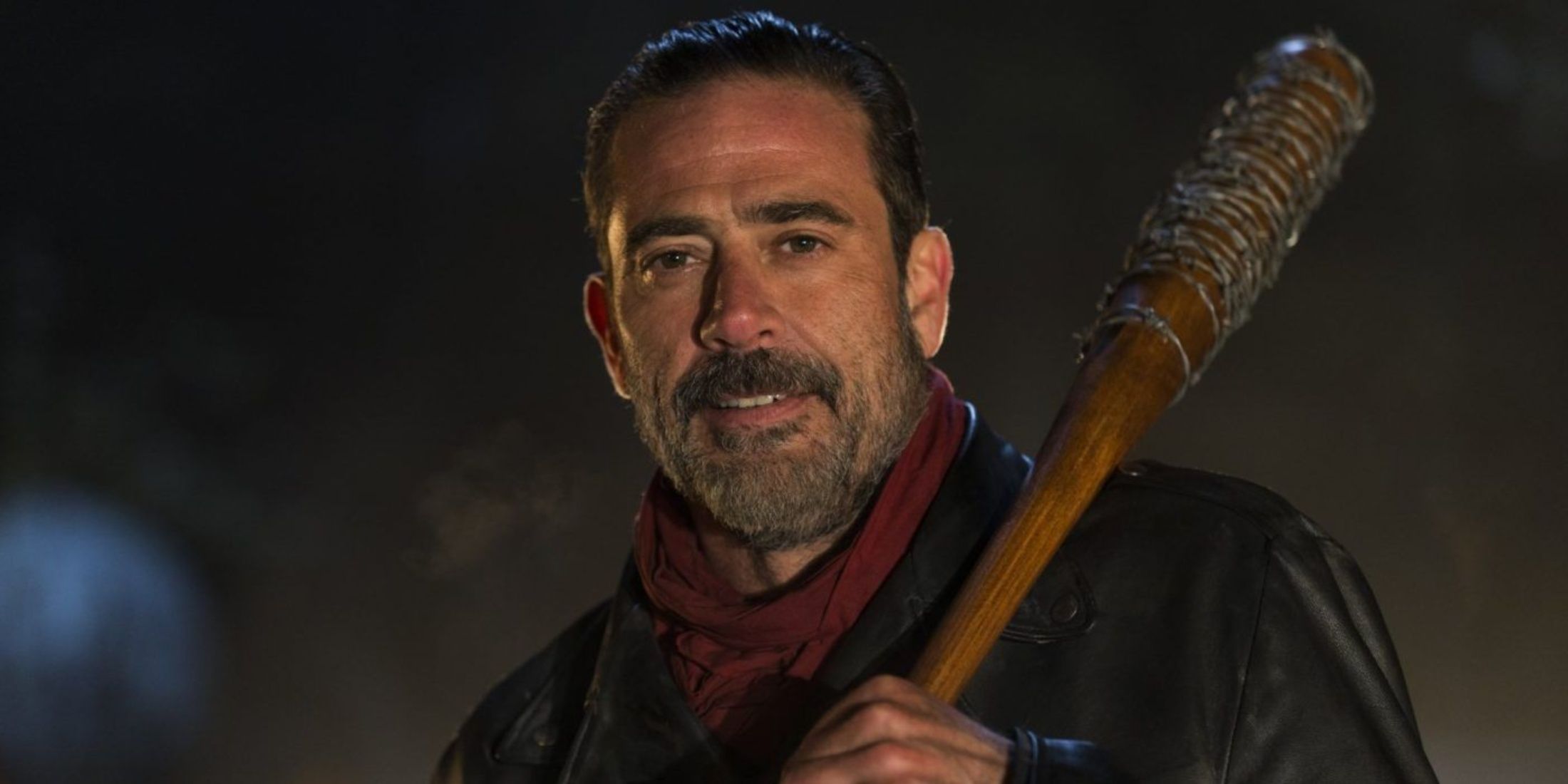

Negan Joins Fortnite Jeffrey Dean Morgans Perspective

May 03, 2025

Negan Joins Fortnite Jeffrey Dean Morgans Perspective

May 03, 2025

Latest Posts

-

Mecsek Baromfi Kft Kme Vedjegy A Kivalo Minoseg Jele A Tanyerodon

May 03, 2025

Mecsek Baromfi Kft Kme Vedjegy A Kivalo Minoseg Jele A Tanyerodon

May 03, 2025 -

Pochemu Moskovskie Eskortnitsy Zhivut V Kladovkakh Rassledovanie

May 03, 2025

Pochemu Moskovskie Eskortnitsy Zhivut V Kladovkakh Rassledovanie

May 03, 2025 -

Izletes Es Minosegi Baromfi Ismerje Meg A Mecsek Baromfi Kft Kme Termekeit

May 03, 2025

Izletes Es Minosegi Baromfi Ismerje Meg A Mecsek Baromfi Kft Kme Termekeit

May 03, 2025 -

Moskva Skrytaya Zhizn Eskortnits I Ikh Vybor Kladovok Kak Zhilya

May 03, 2025

Moskva Skrytaya Zhizn Eskortnits I Ikh Vybor Kladovok Kak Zhilya

May 03, 2025 -

Kivalo Minosegu Baromfihus Valassza A Mecsek Baromfi Kft Kme Vedjegyes Termekeit

May 03, 2025

Kivalo Minosegu Baromfihus Valassza A Mecsek Baromfi Kft Kme Vedjegyes Termekeit

May 03, 2025