Nike Q3 Earnings And Foot Locker: A Jefferies Perspective

Table of Contents

Nike Q3 Earnings Report: Key Highlights

Nike's Q3 earnings report offered a mixed bag, prompting close scrutiny from analysts like Jefferies. Several key metrics require careful consideration for a complete understanding of the brand's performance and future prospects.

-

Nike Q3 Revenue Growth: Nike's Q3 revenue growth needs to be analyzed against both internal targets and market expectations. Did the company meet or exceed projected figures? Understanding the reasons behind any variance is key. Factors such as overall consumer spending, macroeconomic conditions, and competitor actions all play a role.

-

Gross Margin Performance: Analyzing Nike's gross margin reveals crucial information about pricing strategies, promotional activities, and supply chain efficiency. Were margins squeezed due to increased production costs or promotional discounting? This insight provides a deeper understanding of Nike's operational health.

-

Inventory Levels: Nike's inventory levels are a critical indicator of future profitability. High inventory suggests potential for markdowns and reduced margins, whereas low inventory could indicate missed sales opportunities. Analyzing the balance is vital for predicting future earnings.

-

Digital Sales Growth: Nike's digital sales growth is a key indicator of its ability to adapt to evolving consumer behavior. Strong growth in this area suggests effective marketing strategies and a successful transition to omnichannel retail.

-

Updated Fiscal Year Guidance: Nike's revised guidance for the remainder of the fiscal year provides crucial insight into the company's expectations. This guidance should be weighed against current market conditions and considered alongside competitor outlooks.

-

Product Category Performance: A detailed breakdown of performance across different product categories (running, basketball, apparel, etc.) offers further valuable insight into consumer preferences and market trends. Identifying strong and weak areas can inform investment strategies.

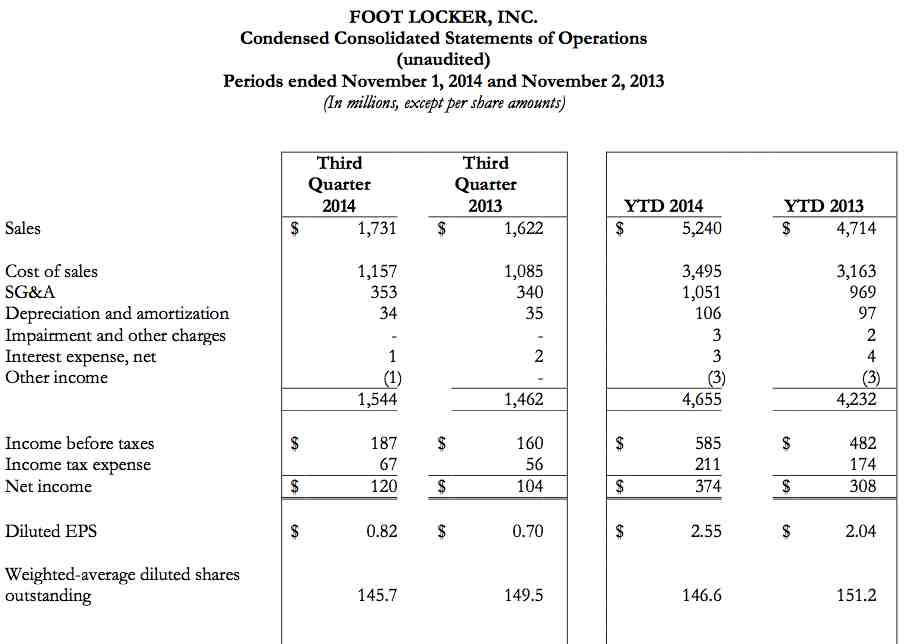

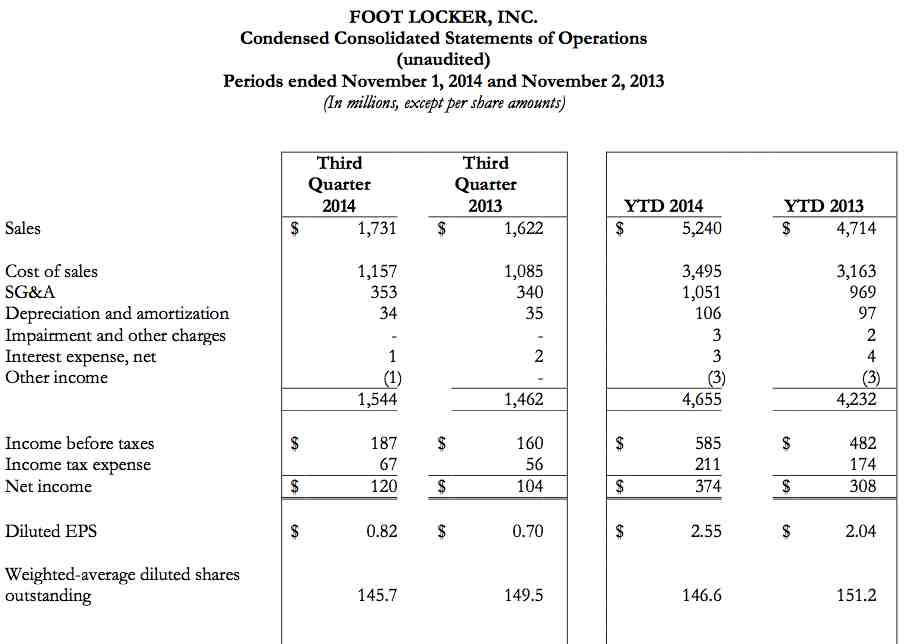

Foot Locker's Dependence on Nike and the Jefferies Perspective

Foot Locker's significant reliance on Nike products for revenue generation presents both opportunities and risks. Jefferies' analysis sheds light on this crucial relationship.

-

Foot Locker Nike Sales: Understanding the proportion of Foot Locker's revenue derived from Nike products is critical. A high dependency creates vulnerability to fluctuations in Nike's performance.

-

Impact of Nike's Performance: Analyzing how Nike's performance directly impacts Foot Locker's financial results is crucial for understanding the interconnectedness of their businesses. A downturn at Nike is likely to negatively impact Foot Locker.

-

Risk of Supplier Concentration: Foot Locker's concentration on a single supplier introduces significant risk. Diversification is key to mitigate the impact of potential supply chain disruptions or changes in Nike's strategy.

-

Foot Locker's Diversification Strategy: Jefferies likely evaluated Foot Locker's efforts to diversify its brand portfolio. Success in this area could significantly reduce the company's dependence on Nike.

-

Inventory Management: Efficient inventory management is crucial for Foot Locker to avoid excess stock of Nike products, especially if demand fluctuates. Jefferies would have examined their inventory strategies.

-

Future of the Nike-Foot Locker Partnership: The long-term relationship between Nike and Foot Locker is a critical factor. Jefferies' perspective on the future of this partnership is crucial for investors.

Jefferies' Overall Assessment and Investment Implications

Jefferies' analysis culminates in an overall assessment of Nike and Foot Locker's prospects, offering investors valuable insights for investment decisions.

-

Stock Ratings: Jefferies likely provided buy, sell, or hold recommendations for both Nike and Foot Locker stocks, based on their analysis.

-

Risk and Opportunity Analysis: Understanding the potential risks and opportunities associated with investing in both companies is critical. Jefferies’ report would have highlighted these aspects.

-

Macroeconomic Factors: The report would have considered the impact of broader macroeconomic factors on the athletic footwear and apparel industry, such as inflation and consumer spending.

-

Key Factors to Watch: Identifying key performance indicators to monitor going forward allows investors to track the companies' progress and adjust their strategies accordingly.

-

Competitor Analysis: A comparison of Nike and Foot Locker's performance against competitors provides context and helps gauge their market position and future growth potential.

Conclusion:

Jefferies' analysis of Nike's Q3 earnings and its impact on Foot Locker provides a crucial perspective for investors. Understanding Nike's performance is paramount for assessing Foot Locker's future, given its significant reliance on the Nike brand. Investors should carefully consider Jefferies' recommendations and conduct their own thorough due diligence before making any investment decisions related to Nike and Foot Locker stock. Stay informed on future earnings reports and market analyses to effectively manage your portfolio in the dynamic athletic footwear and apparel market. Continue to follow updates on Nike Q3 earnings and the Jefferies perspective to make informed investment choices.

Featured Posts

-

Hamer Bruins En Npo Toezichthouder Moeten Over Leeflang Praten

May 15, 2025

Hamer Bruins En Npo Toezichthouder Moeten Over Leeflang Praten

May 15, 2025 -

Brown County Robinson Boil Water Advisory In Effect

May 15, 2025

Brown County Robinson Boil Water Advisory In Effect

May 15, 2025 -

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025

The Warriors Need Jimmy Butler Not Another Kevin Durant

May 15, 2025 -

Free Star Wars Andor Episodes 3 Available On You Tube

May 15, 2025

Free Star Wars Andor Episodes 3 Available On You Tube

May 15, 2025 -

Max Muncys Torpedo Bat Experiment 3 At Bats Then A Game Tying Double

May 15, 2025

Max Muncys Torpedo Bat Experiment 3 At Bats Then A Game Tying Double

May 15, 2025

Latest Posts

-

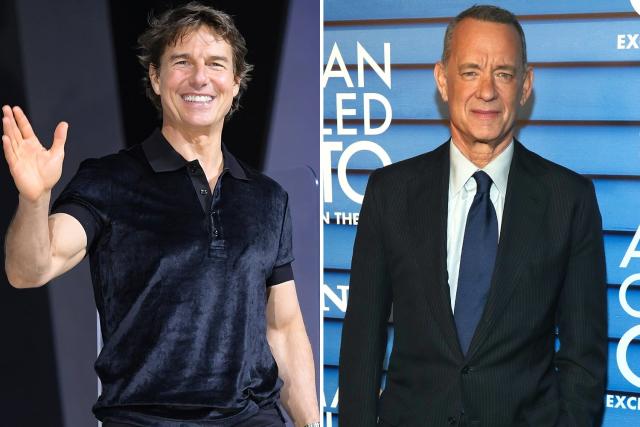

Is Tom Cruise Ever Going To Pay Tom Hanks That Dollar

May 16, 2025

Is Tom Cruise Ever Going To Pay Tom Hanks That Dollar

May 16, 2025 -

12

May 16, 2025

12

May 16, 2025 -

Tom Hanks And Tom Cruises Funny 1 Debt A Hollywood Anecdote

May 16, 2025

Tom Hanks And Tom Cruises Funny 1 Debt A Hollywood Anecdote

May 16, 2025 -

7 12

May 16, 2025

7 12

May 16, 2025 -

The Tom Cruise Tom Hanks 1 Debt Will It Ever Be Repaid

May 16, 2025

The Tom Cruise Tom Hanks 1 Debt Will It Ever Be Repaid

May 16, 2025