No New Rules To Oust Mark Carney: Canada's Liberal Party Decision

Table of Contents

The Canadian political landscape has seen significant debate surrounding the Governor of the Bank of Canada, Mark Carney. Recent speculation regarding his potential removal prompted calls for new parliamentary rules to facilitate his dismissal. However, the Liberal Party's recent decision not to enact such rules has sent ripples through the financial and political spheres. This article delves into the details of this crucial decision and its implications for Canada's economy.

The Controversy Surrounding Mark Carney

Mark Carney's tenure as Governor of the Bank of Canada has not been without its critics. His leadership has faced scrutiny from various quarters, sparking considerable debate about his performance and the effectiveness of the Bank's policies. This controversy has fueled calls for greater accountability and even led to proposals for altering the established mechanisms for removing the Governor.

Specific criticisms leveled against Carney include:

- Interest Rate Policies: Some critics argued that his interest rate decisions, particularly during periods of economic uncertainty, were either too cautious or too aggressive, impacting different sectors of the Canadian economy in varying ways.

- Communication Strategies: Concerns were raised about the clarity and transparency of the Bank of Canada's communication regarding its monetary policy decisions. Critics felt that the messaging was sometimes unclear or inconsistent, leading to confusion in the markets.

- Focus on Climate Change: While lauded by some, Carney's emphasis on incorporating climate change considerations into monetary policy was criticized by others as venturing beyond the Bank's traditional mandate.

This controversy garnered significant media attention, with numerous news articles and opinion pieces analyzing Carney's performance and the broader implications for Canadian economic policy. Public opinion polls revealed a divided public, with varying levels of support for Carney's leadership.

Calls for New Rules and Parliamentary Procedures

The controversies surrounding Mark Carney led several factions to advocate for changes to the existing parliamentary procedures for removing the Bank of Canada Governor. The argument centered on the need for greater parliamentary oversight and accountability. Proponents of these changes argued that the current system, which lacks a clearly defined process for removing the Governor, is insufficient to address situations where the Governor's actions are deemed detrimental to the national interest.

Proposed mechanisms for ousting the Governor ranged from requiring a simple majority vote in Parliament to more stringent processes involving supermajorities or specific committees. The parliamentary processes involved would have required significant changes to existing legislation and could have had broader implications for the structure of Canadian governance. Several opposition parties, particularly those representing regions perceived to be disproportionately affected by certain economic policies, voiced their support for these proposed reforms.

The Liberal Party's Decision and its Rationale

The Liberal Party ultimately decided against implementing new rules to facilitate the removal of the Bank of Canada Governor. In an official statement, the party cited the importance of maintaining the Bank of Canada's independence as a crucial factor in its decision. They argued that introducing new rules could undermine the Bank's autonomy and potentially jeopardize its ability to make objective, data-driven decisions regarding monetary policy.

The political motivations behind this decision are complex. The Liberal Party likely weighed the potential political risks associated with appearing to interfere with an institution widely regarded as vital to the Canadian economy. Undermining the Bank's independence could damage investor confidence and negatively impact the Canadian dollar.

Potential Impacts on Canadian Monetary Policy

The Liberal Party's decision to maintain the status quo regarding the removal of the Bank of Canada Governor will likely have significant, long-term effects on Canadian monetary policy. By preserving the Bank's independence, the government aims to ensure its continued ability to make crucial economic decisions free from undue political pressure. This decision could bolster investor confidence and contribute to market stability.

However, some critics argue that this lack of a clear process for removing a Governor, even in extreme cases, is a weakness. This maintains the potential for friction between the government and the Bank, and might impact the long-term effectiveness of monetary policy in responding to significant economic challenges. The impact on the Canadian economic outlook remains to be seen, depending on how the Bank of Canada navigates future economic headwinds.

Alternative Approaches to Addressing Concerns

While the Liberal Party opted against changing the rules for removing the Governor, there are alternative approaches to addressing concerns about the Bank of Canada's performance or leadership. These include:

- Increased Parliamentary Oversight: Strengthening the existing mechanisms for parliamentary scrutiny of the Bank of Canada’s activities, including more frequent appearances by the Governor before parliamentary committees.

- Enhanced Transparency Measures: Implementing measures to increase the transparency of the Bank of Canada’s decision-making processes, including more detailed explanations of its policy choices.

- Public Consultations: Conducting regular public consultations on key monetary policy decisions, allowing for greater public input and feedback.

These alternative strategies could provide a balance between ensuring accountability and preserving the Bank's essential independence.

Conclusion

The controversy surrounding Mark Carney, the calls for new rules to oust him, the Liberal Party's subsequent decision, and the potential impact on Canadian monetary policy have highlighted the delicate balance between political accountability and the independence of the Bank of Canada. The Liberal Party's decision to uphold the existing system underscores their commitment to maintaining the Bank’s autonomy, potentially promoting investor confidence and stability in the Canadian economy. However, the debate underscores the ongoing need for a robust and transparent system that addresses concerns regarding the Bank's operations while preserving its crucial independence.

Key Takeaways: The Liberal Party's decision to not create new rules for removing the Bank of Canada Governor signifies a commitment to maintaining the Bank's independence. This decision has significant implications for the future of Canadian monetary policy, economic management, and the overall relationship between the government and the central bank.

Call to Action: Stay updated on the latest news about the Bank of Canada and the ongoing discussion surrounding Mark Carney and Canadian monetary policy. Understanding these developments is crucial for anyone interested in the Canadian economy and its future.

Featured Posts

-

Nemetskaya Pomosch Ukraine Andrey Sibiga O Gumanitarnoy Situatsii I Spasenii Zhizney

May 27, 2025

Nemetskaya Pomosch Ukraine Andrey Sibiga O Gumanitarnoy Situatsii I Spasenii Zhizney

May 27, 2025 -

Simone Joy Jones Interview Uproxx Music 20 Spotlight

May 27, 2025

Simone Joy Jones Interview Uproxx Music 20 Spotlight

May 27, 2025 -

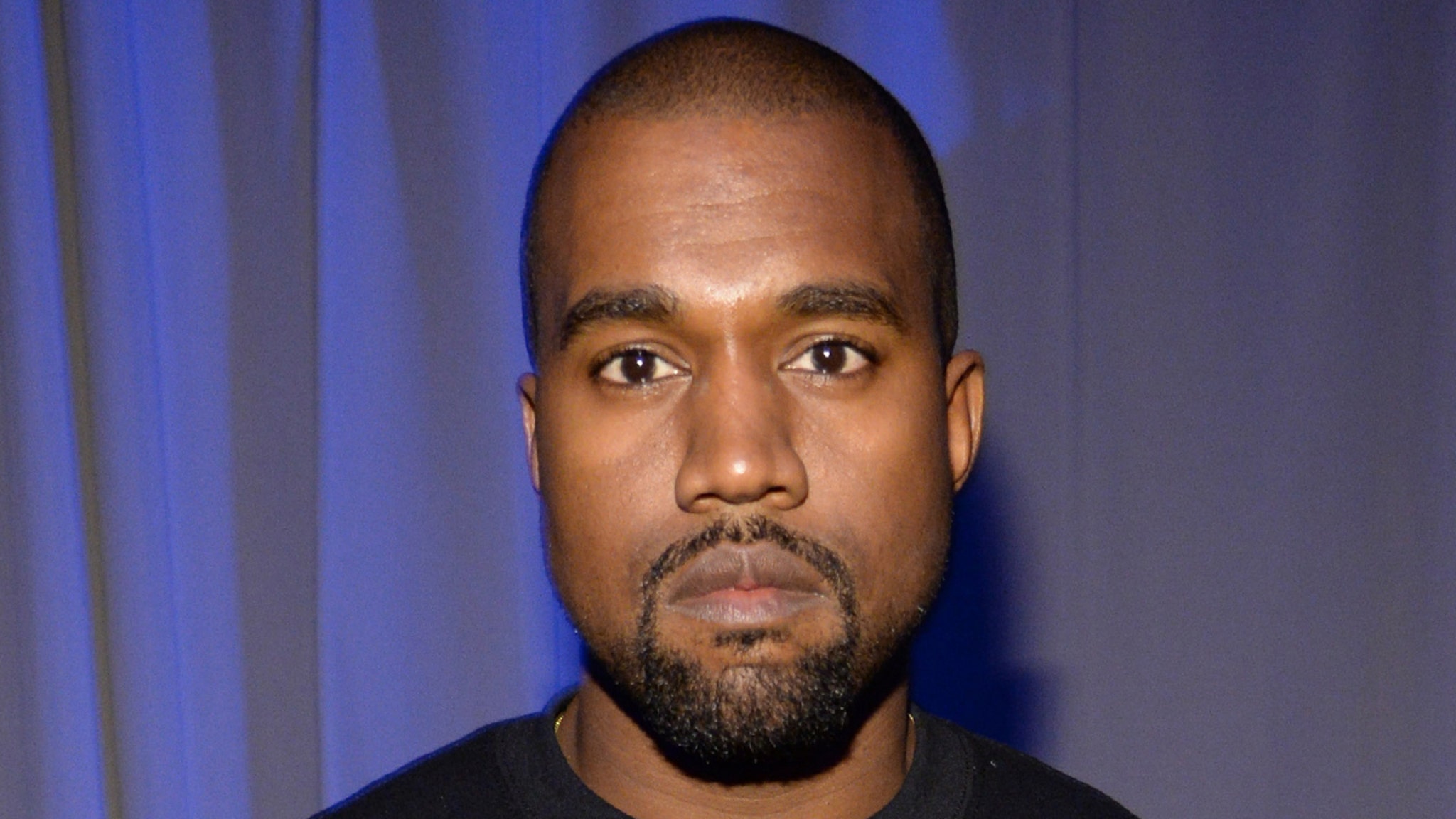

The Truth Behind Kanye Wests Missing Super Bowl Performance

May 27, 2025

The Truth Behind Kanye Wests Missing Super Bowl Performance

May 27, 2025 -

New Elsbeth Episode Family Business Drama In S02 E14

May 27, 2025

New Elsbeth Episode Family Business Drama In S02 E14

May 27, 2025 -

Osimhen Staying Put No Permanent Move To Galatasaray

May 27, 2025

Osimhen Staying Put No Permanent Move To Galatasaray

May 27, 2025

Latest Posts

-

Exclusion De Marine Le Pen En 2027 L Inquietante Declaration De Laurent Jacobelli

May 30, 2025

Exclusion De Marine Le Pen En 2027 L Inquietante Declaration De Laurent Jacobelli

May 30, 2025 -

Arcelor Mittal Et La Russie L Emission Franceinfo Du 9 Mai 2025 Avec Laurent Jacobelli

May 30, 2025

Arcelor Mittal Et La Russie L Emission Franceinfo Du 9 Mai 2025 Avec Laurent Jacobelli

May 30, 2025 -

Proces Rn Une Decision En Appel En 2026

May 30, 2025

Proces Rn Une Decision En Appel En 2026

May 30, 2025 -

2026 Nouvel Appel Dans L Affaire Opposant Cyril Hanouna A Marine Le Pen Le Point Sur La Situation

May 30, 2025

2026 Nouvel Appel Dans L Affaire Opposant Cyril Hanouna A Marine Le Pen Le Point Sur La Situation

May 30, 2025 -

Hanouna Le Pen 2027 Jacobelli S Insurge Contre Une Possible Exclusion De La Candidate

May 30, 2025

Hanouna Le Pen 2027 Jacobelli S Insurge Contre Une Possible Exclusion De La Candidate

May 30, 2025