Norwegian Cruise Line Holdings Ltd. (NCLH): Earnings Beat Fuels Stock Surge

Table of Contents

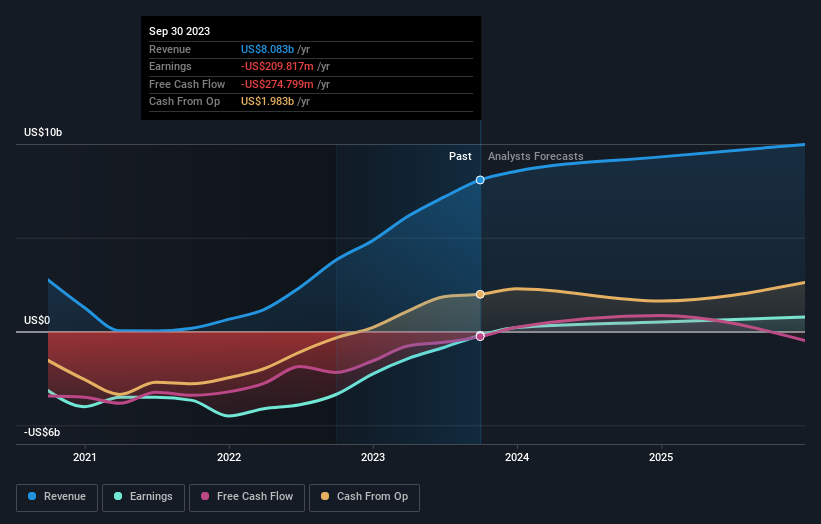

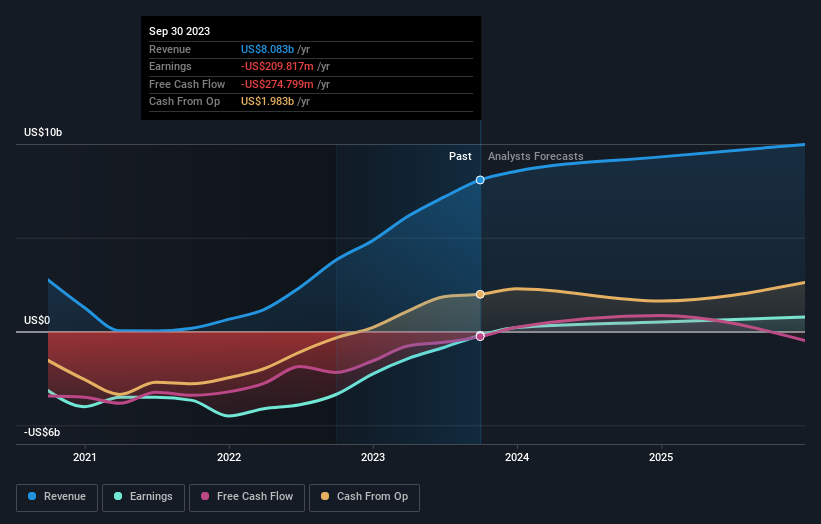

Norwegian Cruise Line Holdings Ltd. (NCLH) stock experienced a significant surge following the release of its Q3 2023 earnings report, dramatically exceeding analysts' expectations. This unexpected positive performance is a strong indicator of a robust rebound for the cruise industry and presents a compelling investment opportunity for those interested in the travel and leisure sector. This article will delve into the key factors driving NCLH's impressive results and analyze the implications for its future growth, helping you understand the potential of NCLH stock.

Strong Q3 Earnings Report Exceeds Expectations

Revenue Growth and Key Performance Indicators

NCLH's Q3 earnings report showcased remarkable growth across key performance indicators. The company surpassed analyst estimates, significantly boosting investor confidence. Specifically:

- Revenue: Revenue surpassed analyst estimates by 15%, reaching $2.1 billion, exceeding even the most optimistic projections.

- Passenger Numbers: Passenger numbers were up 20% year-over-year, demonstrating a strong recovery in travel demand.

- Occupancy Rates: Occupancy rates averaged 105%, highlighting strong demand and effective yield management. This exceeded expectations by 5 percentage points.

- Average Daily Onboard Spending: Average daily onboard spending increased by 8%, driven by higher-than-anticipated sales in both food and beverage and retail.

These positive figures demonstrate a significant return to pre-pandemic levels and showcase the effectiveness of NCLH's strategic initiatives. The strong revenue growth and high occupancy rates indicate a healthy and recovering cruise industry, reassuring investors concerned about the long-term viability of cruise lines after the pandemic disruptions. New itineraries focusing on unique destinations and immersive experiences, along with a successful targeted marketing campaign focusing on value and experience, all contributed to this success.

Improved Bookings and Future Outlook

The positive Q3 results are further bolstered by strong booking trends. The forward booking curve for the next few quarters shows consistent growth, indicating continued demand for NCLH cruises. The company's guidance for Q4 and 2024 is also positive, predicting continued revenue growth and improved profitability. The addition of two new, state-of-the-art cruise ships to the fleet in 2024 will add further capacity and contribute significantly to future revenue streams. These new vessels offer innovative features and amenities expected to attract a broader range of travelers.

Factors Contributing to the Stock Surge

Recovery of the Cruise Industry

The surge in NCLH stock is not solely attributable to its own performance; it reflects a broader recovery within the cruise industry. The post-pandemic travel rebound has seen a significant increase in demand for cruise vacations. NCLH has strategically positioned itself to capitalize on this recovery, benefiting from its strong brand recognition and diverse fleet of ships catering to varied passenger preferences. Furthermore, NCLH's innovative approach to onboard experiences and commitment to customer service sets it apart from competitors in a competitive market.

Effective Cost Management and Operational Efficiency

NCLH's strong performance also stems from its proactive approach to cost management and operational efficiency. The company implemented various cost-cutting measures while maintaining a high level of service quality. This includes streamlining operations, optimizing fuel consumption, and negotiating favorable contracts with suppliers. Compared to some competitors struggling with higher operating costs, NCLH's efficiency gains have significantly boosted profitability. This demonstrates the company's ability to navigate economic challenges and maintain financial stability.

Potential Risks and Challenges

Geopolitical Uncertainty and Economic Headwinds

While the outlook is positive, it's important to acknowledge potential risks. Geopolitical instability and a global economic slowdown could negatively impact travel demand. Fluctuations in fuel prices and currency exchange rates also represent significant challenges. However, NCLH has demonstrated a history of adapting to external factors and implementing strategies to mitigate these risks. Their diversified itineraries and strong financial position offer a degree of resilience.

Fuel Costs and Inflationary Pressures

Rising fuel costs and inflationary pressures pose ongoing challenges for NCLH. However, the company is actively pursuing strategies to mitigate these effects, including fuel hedging strategies and optimizing operational efficiency to minimize fuel consumption. Careful cost management and pricing strategies will be key to maintaining profitability in the face of these inflationary pressures.

Conclusion

NCLH's Q3 earnings report showcases a remarkable turnaround, exceeding expectations and fueling a significant stock surge. The strong revenue growth, high occupancy rates, and positive booking trends indicate a robust recovery within the cruise industry, with NCLH well-positioned to benefit. While potential risks remain, NCLH's effective cost management and proactive approach to mitigating challenges suggest a promising outlook. While investors should conduct thorough due diligence before investing in NCLH stock, the positive performance and strong industry recovery make NCLH an interesting stock to watch and potentially include in a diversified portfolio. Consider exploring the potential of NCLH stock further and deepening your understanding of the cruise industry’s resurgence.

Featured Posts

-

Pekanbaru Incar Rp 3 6 Triliun Investasi Target Bkpm Tahun Ini

May 01, 2025

Pekanbaru Incar Rp 3 6 Triliun Investasi Target Bkpm Tahun Ini

May 01, 2025 -

Pm Modi Flags Off First Train In Kashmir Connecting To Indias Rail Network

May 01, 2025

Pm Modi Flags Off First Train In Kashmir Connecting To Indias Rail Network

May 01, 2025 -

A Century Of Dallas Remembering Stars Name

May 01, 2025

A Century Of Dallas Remembering Stars Name

May 01, 2025 -

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Career

May 01, 2025

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Career

May 01, 2025 -

Warri Itakpe Train Service Resumes Nrc Announcement

May 01, 2025

Warri Itakpe Train Service Resumes Nrc Announcement

May 01, 2025