Norwegian Cruise Line (NCLH) Stock Jumps On Positive Earnings Report

Table of Contents

Key Highlights from NCLH's Earnings Report

NCLH's recent earnings report showcased impressive growth across several key metrics, providing a solid foundation for the stock price increase. These positive results demonstrate a strong rebound for the company and the broader cruise industry after the challenges posed by the pandemic.

Revenue Growth and Bookings

The company reported a substantial increase in revenue compared to both the previous quarter and the same period last year. This growth was fueled by robust booking numbers, exceeding expectations and indicating a healthy demand for cruises.

- Overall Revenue Increase: [Insert percentage]% increase in overall revenue compared to the previous quarter and [insert percentage]% compared to the same period last year.

- Strong Booking Growth in Premium Categories: A particularly strong increase was seen in bookings for premium cabins and suites, indicating a shift towards higher-spending customers. Onboard spending also experienced significant growth.

- Positive Booking Trends: Forward bookings are significantly ahead of the same period in previous years, suggesting continued strong demand for future cruises.

- Geographic Performance: [Mention specific regions, e.g., North America, Europe, etc., that showed particularly strong booking performance].

Profitability and Margins

NCLH demonstrated significant improvement in its profitability, exceeding analyst expectations. This positive trend reflects effective cost management and increased operational efficiency.

- Net Income: The company reported a net income of [insert amount], a significant improvement compared to [insert previous period's net income].

- Improved Operating Margins: Operating margins increased to [insert percentage]%, showcasing improved efficiency and cost control.

- Factors Contributing to Profitability: Improved occupancy rates, successful cost-cutting measures, and increased onboard revenue contributed to the improved profitability.

Debt Reduction and Financial Health

The earnings report also highlighted progress in reducing NCLH's debt burden, further enhancing investor confidence.

- Debt Reduction: NCLH has successfully reduced its debt by [insert amount or percentage], strengthening its financial position.

- Credit Rating Outlook: [Mention any improvements in credit rating or outlook].

- Positive Investor Sentiment: The improved financial health has boosted investor confidence in the long-term sustainability of the company.

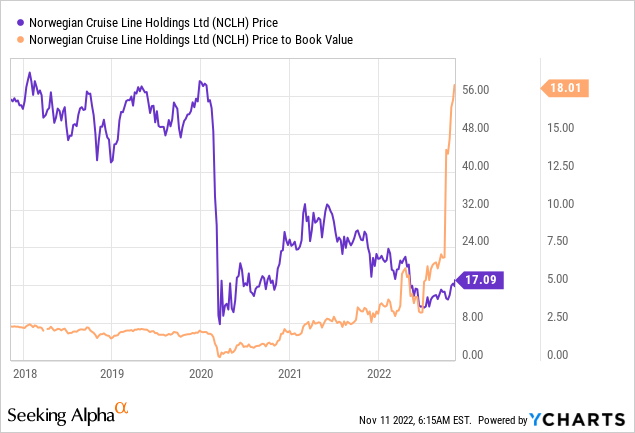

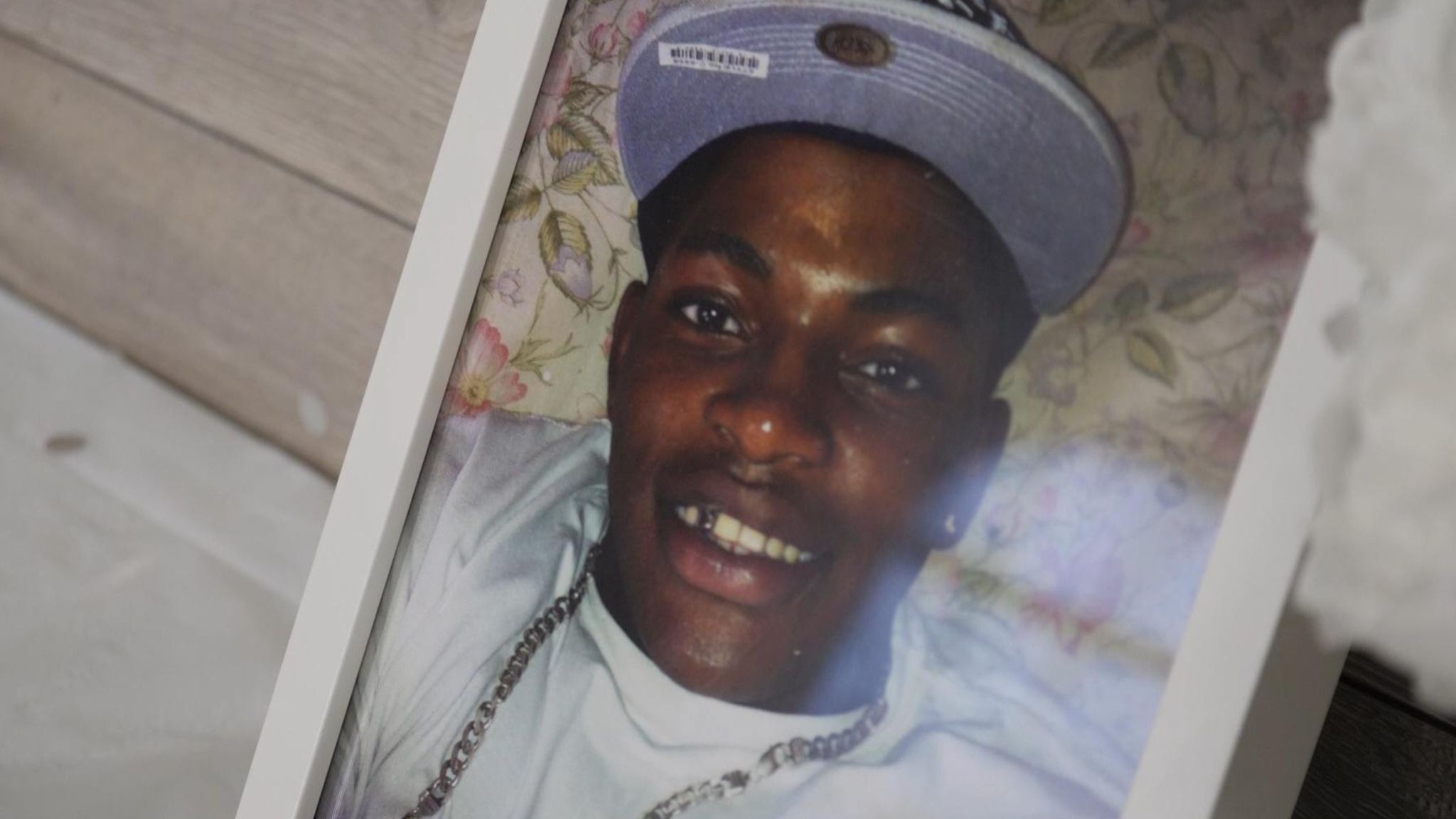

Market Reaction to NCLH Earnings

The market responded enthusiastically to NCLH's strong earnings, resulting in a significant surge in the stock price and increased trading activity.

Immediate Stock Price Surge

The release of the earnings report triggered an immediate and substantial increase in NCLH's stock price.

- Stock Price Increase: The stock price jumped by [insert percentage]% immediately following the report's release.

- Increased Trading Volume: Trading volume also increased significantly, indicating heightened investor interest and activity.

- Comparison to Competitors: NCLH's performance outpaced that of several other cruise line stocks, underscoring the strength of its results.

Analyst Ratings and Price Targets

Following the strong earnings report, several analysts revised their ratings and price targets for NCLH stock.

- Analyst Upgrades: A number of analysts upgraded their rating for NCLH stock, reflecting a more positive outlook.

- Increased Price Targets: Many analysts also increased their price targets for NCLH, suggesting further potential for upside.

- Overall Positive Sentiment: The overall sentiment among analysts is significantly more positive than before the earnings report.

Investor Confidence and Future Outlook

The strong earnings report has significantly boosted investor confidence in NCLH's future prospects.

- Positive Investor Statements: Several investors and company executives have expressed optimism about NCLH's future growth.

- Future Growth Potential: The company's strong booking trends and improved financial health point towards continued growth in the coming quarters.

- New Strategies and Initiatives: [Mention any new strategies or initiatives that are expected to contribute to future growth].

Conclusion: Investing in NCLH Stock After Strong Earnings

NCLH's impressive earnings report, coupled with a robust market reaction, paints a positive picture for the company's future. The significant revenue growth, improved profitability, and debt reduction demonstrate a strong recovery and a healthy outlook for the cruise industry. The immediate stock price surge and positive analyst sentiment further reinforce this positive outlook. The strong earnings report has boosted investor confidence in Norwegian Cruise Line (NCLH) stock. While investing always carries inherent risk, further research into NCLH's prospects is recommended for those interested in this sector. Consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

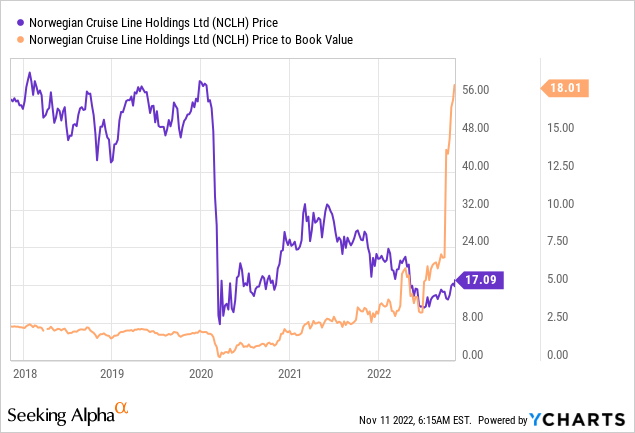

Woman Harassed By Pro Israel Demonstrators Nypd Investigation Underway

Apr 30, 2025

Woman Harassed By Pro Israel Demonstrators Nypd Investigation Underway

Apr 30, 2025 -

Heartbreak On Our Yorkshire Farm Amanda Owens Emotional Statement

Apr 30, 2025

Heartbreak On Our Yorkshire Farm Amanda Owens Emotional Statement

Apr 30, 2025 -

Unlocking The Health Power Of Asparagus Benefits And Uses

Apr 30, 2025

Unlocking The Health Power Of Asparagus Benefits And Uses

Apr 30, 2025 -

Jokic I Jovic Na Evrobasketu Sedlacekeve Prognoze

Apr 30, 2025

Jokic I Jovic Na Evrobasketu Sedlacekeve Prognoze

Apr 30, 2025 -

Chris Kaba Police Watchdogs Dispute With Bbcs Panorama Investigated By Ofcom

Apr 30, 2025

Chris Kaba Police Watchdogs Dispute With Bbcs Panorama Investigated By Ofcom

Apr 30, 2025