Nvidia's Geopolitical Risks: Beyond The China Factor

Table of Contents

H2: The China Factor: Beyond Export Controls

The importance of China to Nvidia's success cannot be overstated. However, the relationship is fraught with peril. The ongoing US-China tech war casts a long shadow, and the implications extend beyond simple export controls.

H3: Supply Chain Disruptions

Nvidia's dependence on Chinese manufacturing presents a significant vulnerability. Potential disruptions could stem from various sources:

- Dependence on Chinese Manufacturing: A substantial portion of Nvidia's chip manufacturing relies on foundries located in China. Any political instability or unexpected regulatory changes could severely impact production.

- Potential for Tariffs or Sanctions: The ongoing trade tensions between the US and China could lead to new tariffs or sanctions targeting Nvidia's products or components, increasing production costs and impacting profitability.

- Alternative Sourcing Strategies: While Nvidia is diversifying its manufacturing base, shifting production away from China requires significant investment and time, leaving the company vulnerable in the short term.

- Impact on Production Costs: Disruptions in the Chinese supply chain inevitably translate to higher production costs, potentially impacting Nvidia's competitiveness in the global market.

H3: Market Access and Demand

The Chinese market is a vital source of revenue for Nvidia. However, political tensions and regulatory changes pose significant risks to its sales and market share.

- Impact of Government Policies on Data Centers: Chinese government policies governing data center infrastructure and data sovereignty could restrict Nvidia's access to this lucrative market.

- AI Development Restrictions: Restrictions on the development and deployment of AI technologies in China could limit the demand for Nvidia's high-performance GPUs, a key driver of its growth.

- Competition from Domestic Chinese Chipmakers: The Chinese government is actively supporting the development of domestic semiconductor companies, increasing competition and potentially reducing Nvidia's market share.

H2: US-China Tech War and its Wider Implications

The escalating US-China tech war is a major geopolitical risk for Nvidia. The company operates in a complex global landscape, and any escalation could have far-reaching consequences.

H3: Escalation of Trade Tensions

Further escalation of the US-China tech war could have several detrimental effects:

- Impact on International Collaborations: Nvidia's ability to collaborate with international partners could be hampered by restrictions and sanctions, hindering innovation and development.

- Potential for Secondary Sanctions: Nvidia could face secondary sanctions for doing business with entities designated as problematic by either the US or China, creating significant financial and reputational risks.

- Navigating Complex Export Control Regulations: Nvidia must navigate increasingly complex and ever-changing export control regulations, adding significant compliance costs and administrative burden.

H3: Alliance Risks

Nvidia's collaborations with various companies and governments introduce further geopolitical complexities:

- Potential Reputational Damage: Collaborations with entities facing sanctions or criticism could damage Nvidia's reputation, affecting consumer trust and investor confidence.

- Risk of Sanctions or Boycotts: Associations with controversial entities could lead to boycotts or sanctions, impacting Nvidia's market access and revenue streams.

- Difficulty Navigating Conflicting Geopolitical Interests: Balancing the interests of different governments and navigating conflicting geopolitical agendas poses a significant challenge for Nvidia's strategic decision-making.

H2: Geopolitical Risks in Other Key Markets

Nvidia's global reach exposes it to geopolitical risks beyond the US-China dynamic.

H3: Europe's Regulatory Landscape

The EU's increasingly stringent regulatory environment for technology companies poses a growing threat:

- GDPR Compliance: Meeting the requirements of the General Data Protection Regulation (GDPR) adds significant compliance costs and complexity.

- Potential for Antitrust Investigations: Nvidia's market dominance could attract antitrust scrutiny from the European Commission, potentially leading to fines and limitations on its business practices.

- Impact of Data Localization Requirements: Data localization requirements could increase operational costs and limit the efficiency of Nvidia's cloud services.

H3: Emerging Market Uncertainties

Expansion into emerging markets presents unique challenges:

- Investment Risks in Unstable Regions: Investing in politically unstable regions exposes Nvidia to risks such as nationalization, expropriation, and currency fluctuations.

- Protection of Intellectual Property: Protecting intellectual property in countries with weak intellectual property rights protection is a significant concern.

- Challenges in Adapting to Local Regulatory Frameworks: Navigating diverse and often complex local regulatory frameworks adds costs and complexity to market entry.

3. Conclusion

Nvidia's success hinges on its global reach, but this very reach exposes it to a complex web of geopolitical risks. The challenges extend far beyond the well-publicized China factor, encompassing supply chain vulnerabilities, trade wars, evolving regulatory landscapes, and the intricacies of operating in diverse and often unstable global markets. Understanding Nvidia's geopolitical risks is crucial for investors, analysts, and policymakers alike. Analyzing Nvidia's exposure to geopolitical factors is vital to assessing the company's long-term prospects and its capacity to navigate the increasingly turbulent global landscape. We encourage further research into assessing the geopolitical landscape for Nvidia and its impact on its future performance.

Featured Posts

-

Guardians Extra Inning Offense Fuels Opening Day Win

Apr 30, 2025

Guardians Extra Inning Offense Fuels Opening Day Win

Apr 30, 2025 -

Unexpected Dragons Den Backlash Peter Jones Response Stuns Fans

Apr 30, 2025

Unexpected Dragons Den Backlash Peter Jones Response Stuns Fans

Apr 30, 2025 -

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Tim Hieu Doi Quan Quan

Apr 30, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Tim Hieu Doi Quan Quan

Apr 30, 2025 -

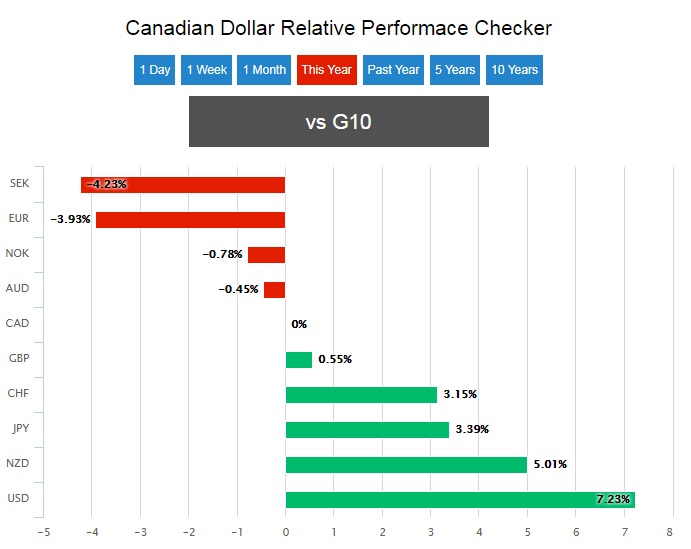

Canadian Dollar At Risk Strategist Warns Of Minority Government Impact

Apr 30, 2025

Canadian Dollar At Risk Strategist Warns Of Minority Government Impact

Apr 30, 2025 -

Poilievre Loses Implications For Canadas Conservative Party

Apr 30, 2025

Poilievre Loses Implications For Canadas Conservative Party

Apr 30, 2025