Oil Market Overview And Forecast: May 16, 2024

Table of Contents

Current Global Oil Supply and Demand Dynamics

Understanding the current balance between global oil supply and demand is crucial for predicting future price movements. Analyzing both sides of the equation reveals key factors influencing the market.

Supply Side Analysis

OPEC+ production levels remain a critical factor shaping global crude oil supply. Recent decisions by the cartel to adjust output quotas have directly impacted Brent crude and WTI prices. The responsiveness of US shale oil production to price changes is another key element; higher prices tend to incentivize increased drilling activity, while lower prices can lead to production cutbacks. Geopolitical factors also significantly affect supply. Sanctions against certain oil-producing nations, political instability in key regions, and unforeseen events like pipeline disruptions can all create significant supply shocks.

- OPEC+ Production: Current output is estimated at [Insert current OPEC+ production figures]. Further adjustments are anticipated in [Insert month/date of next OPEC+ meeting].

- US Shale Oil Production: Current production stands at [Insert current US shale oil production figures], with projections for [Insert projected growth/decline].

- Geopolitical Risks: The ongoing situation in [Mention relevant geopolitical hotspots] poses a significant risk to global oil supply, potentially leading to price spikes.

Demand Side Analysis

Global oil consumption patterns are influenced by various factors. Robust economic growth in key regions typically translates into increased oil demand, particularly in transportation and industrial sectors. Conversely, economic slowdowns or recessions can significantly reduce consumption. Seasonal factors also play a role; demand tends to be higher during peak travel seasons.

- Global Oil Consumption: Current estimates indicate global oil demand at [Insert current global oil consumption figures].

- Economic Growth Impact: The projected [Insert projected global GDP growth rate] is expected to [Impact on oil demand - increase/decrease].

- Seasonal Factors: Summer months typically see a surge in oil demand due to increased travel.

Price Volatility and Market Sentiment

Recent weeks have witnessed considerable price volatility in the oil market. Understanding the drivers of these fluctuations and the prevailing market sentiment is crucial for informed decision-making.

Recent Price Fluctuations

Oil prices have experienced [Describe recent price movements - e.g., a sharp increase followed by a slight correction]. These fluctuations are largely attributable to [Explain the primary reasons - e.g., supply disruptions caused by X, geopolitical uncertainty in Y, and increased speculative trading].

[Insert chart or graph illustrating recent price movements of Brent crude and WTI.]

Investor and Trader Sentiment

Futures contracts and options trading provide valuable insights into investor and trader sentiment. Currently, [Describe the prevailing sentiment - e.g., a cautiously optimistic outlook prevails, with some hedging against potential geopolitical risks]. Recent news articles suggest [Mention key news impacting sentiment - e.g., concerns over X have led to a slight decrease in confidence].

Geopolitical Factors Impacting the Oil Market

Geopolitical events exert a powerful influence on the oil market. Conflicts, political tensions, and sanctions can disrupt supply chains, impacting oil prices significantly.

- [Discuss specific geopolitical events and their impact on the oil market - e.g., The ongoing conflict in [Region] is causing disruptions to oil pipelines, leading to supply concerns and higher prices.]

- [Analyze sanctions - e.g., Sanctions imposed on [Country] have reduced its oil exports, tightening global supply.]

- [Examine international agreements - e.g., The recent agreement between [Countries] to cooperate on energy security could lead to greater price stability].

Oil Market Forecast for the Coming Months

Based on the current supply and demand dynamics, geopolitical situation, and market sentiment, we forecast the following for the next few months:

- Brent Crude: We anticipate a price range of [Price range] per barrel.

- WTI Crude: We expect a price range of [Price range] per barrel.

These forecasts are based on the assumptions of [List key assumptions – e.g., stable OPEC+ production, moderate economic growth, and no major geopolitical shocks]. However, there are potential upside risks, such as [Mention upside risks - e.g., further escalation of geopolitical tensions], and downside risks, such as [Mention downside risks - e.g., a sharper-than-expected economic slowdown].

[Insert table summarizing the forecast including price ranges and timeframe].

Oil Market Overview and Forecast: Key Takeaways and Future Outlook

In summary, the oil market remains highly dynamic, influenced by a complex interplay of supply and demand factors, geopolitical risks, and investor sentiment. Our forecast suggests [Reiterate the price forecast]. However, it's crucial to closely monitor developments in key regions and any significant shifts in market sentiment.

Stay informed about the dynamic oil market by subscribing to our regular Oil Market Overview and Forecasts. Understanding these market forces is vital for making informed investment and trading decisions in the energy sector. Continuously monitoring the oil market, and utilizing the information provided here, will allow for better navigation of this complex and volatile commodity.

Featured Posts

-

Understanding Trumps Proposed F 55 Warplane And F 22 Upgrade

May 17, 2025

Understanding Trumps Proposed F 55 Warplane And F 22 Upgrade

May 17, 2025 -

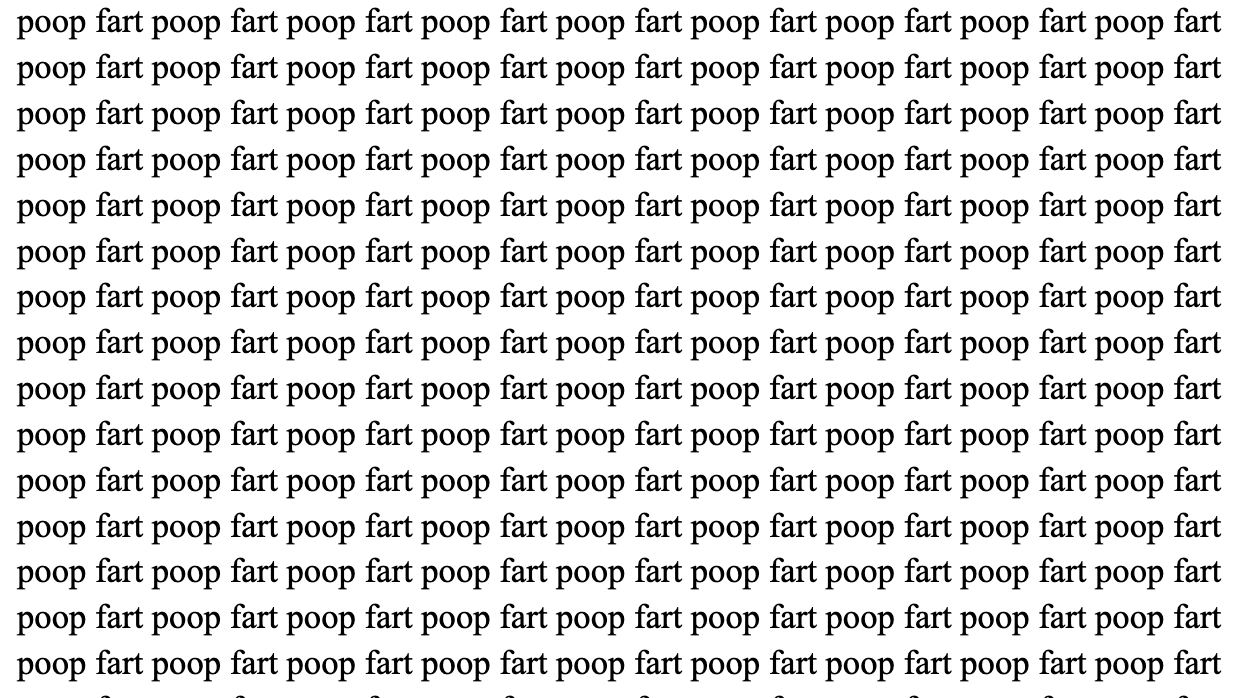

Podcast Production Revolutionized Ais Role In Processing Repetitive Scatological Content

May 17, 2025

Podcast Production Revolutionized Ais Role In Processing Repetitive Scatological Content

May 17, 2025 -

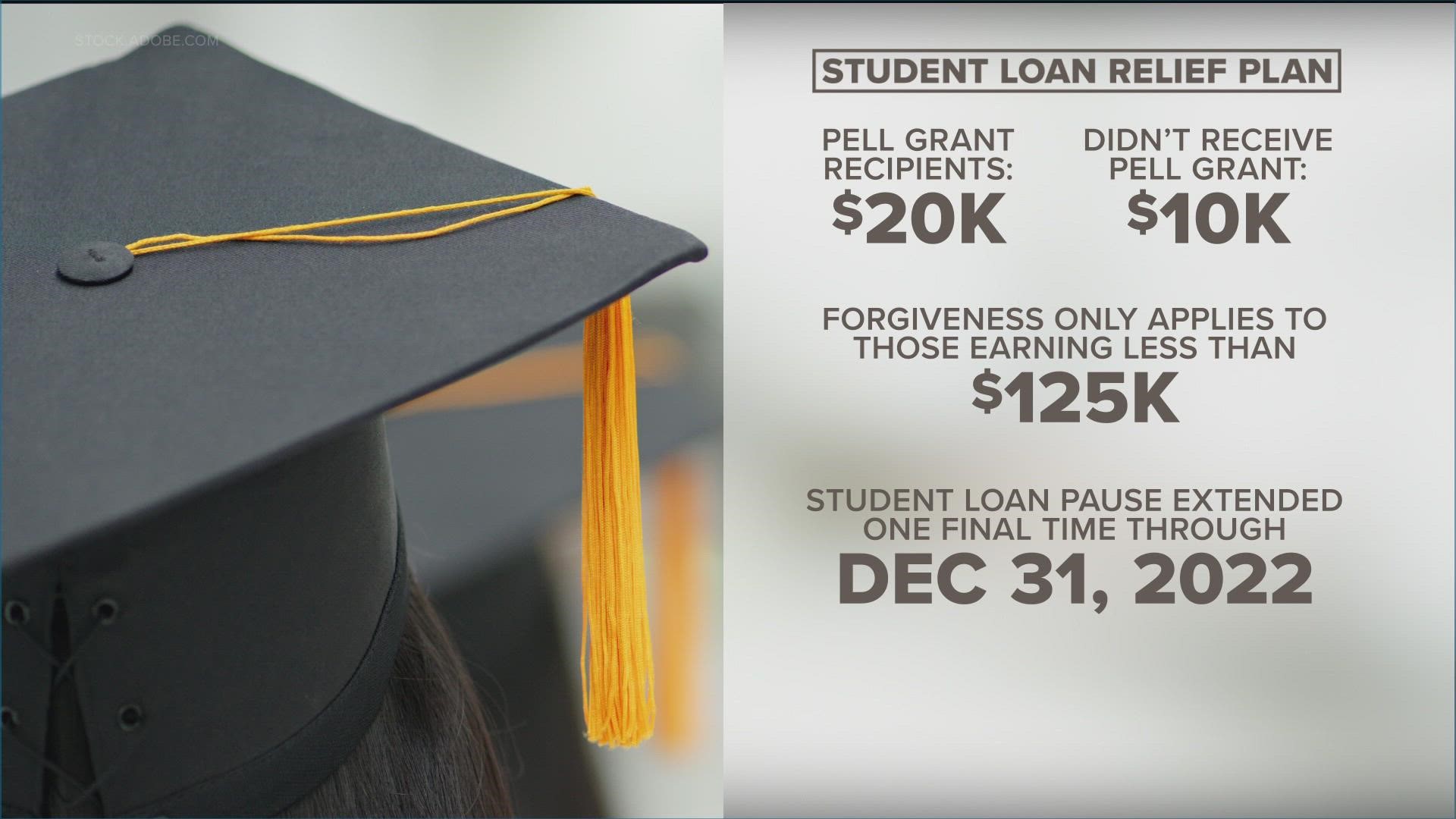

Gops Student Loan Plan What You Need To Know About Pell Grants And Repayment

May 17, 2025

Gops Student Loan Plan What You Need To Know About Pell Grants And Repayment

May 17, 2025 -

Watch Severance Online Free Full Episodes On Demand

May 17, 2025

Watch Severance Online Free Full Episodes On Demand

May 17, 2025 -

Gold Price Rises On Weakening Us Data Xauusd Outlook

May 17, 2025

Gold Price Rises On Weakening Us Data Xauusd Outlook

May 17, 2025

Latest Posts

-

Uspekh V Perepolnennykh Industrialnykh Parkakh Klyuchevye Faktory

May 17, 2025

Uspekh V Perepolnennykh Industrialnykh Parkakh Klyuchevye Faktory

May 17, 2025 -

Industrialnye Parki Analiz Plotnosti Predpriyatiy I Strategii Razvitiya

May 17, 2025

Industrialnye Parki Analiz Plotnosti Predpriyatiy I Strategii Razvitiya

May 17, 2025 -

Network18 Media And Investments Stock Price Live Nse Bse Data April 21 2025

May 17, 2025

Network18 Media And Investments Stock Price Live Nse Bse Data April 21 2025

May 17, 2025 -

V Industrialnykh Parkakh Vysokaya Konkurentsiya I Kak V Ney Preuspet

May 17, 2025

V Industrialnykh Parkakh Vysokaya Konkurentsiya I Kak V Ney Preuspet

May 17, 2025 -

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025