Oil Market Update April 23: Price Trends And Analysis

Table of Contents

Global Crude Oil Price Trends

Benchmark Prices (Brent & WTI)

As of April 23rd, benchmark crude oil prices showed significant movement. Let's examine the key figures:

- Brent Crude: Closed at $X per barrel, representing a Y% change compared to the previous week and a Z% change compared to the same time last month. This fluctuation can be attributed to [insert specific reason, e.g., increased demand from Asia, concerns about supply disruptions].

- WTI Crude: Closed at $A per barrel, showing a B% change week-over-week and a C% change month-over-month. The price movement in WTI largely mirrors that of Brent, although the spread between the two benchmarks remains [insert spread and reason].

[Insert chart or graph visually representing Brent and WTI price trends over the past month, clearly labeled and with a data source cited.]

Impact of OPEC+ Decisions

OPEC+ recently held a meeting on [date] and decided on [summarize production adjustments]. This decision has had a [positive/negative/neutral] impact on oil prices, primarily because [explain reasoning].

- Production Adjustments: The agreement involves [specific details of production changes by key OPEC+ members].

- Effectiveness of OPEC+ Strategies: The effectiveness of these strategies in managing oil supply remains [debatable/proven/uncertain], as evidenced by [mention specific market reactions and price movements following the decision].

- Geopolitical Factors: [Mention specific geopolitical events influencing OPEC+'s decision, e.g., ongoing conflict in Ukraine, political instability in a key oil-producing region, sanctions against specific countries]. These factors significantly complicate the task of accurately predicting future oil prices.

Geopolitical Factors and Supply Chain Disruptions

Geopolitical Instability

Geopolitical instability continues to be a significant driver of oil price volatility.

- The War in Ukraine: The ongoing conflict in Ukraine has created significant uncertainty in global energy markets, impacting both supply and demand. [Provide specific data or examples illustrating the impact].

- Tensions in the Middle East: [Discuss ongoing tensions and their potential influence on oil production and global prices, citing relevant news sources and analyst opinions].

- Future Geopolitical Risks: Potential future risks include [list potential future conflicts or political events and their potential impact on oil supply].

Supply Chain Bottlenecks

Supply chain disruptions continue to exert upward pressure on oil prices.

- Shipping Constraints: [Discuss the challenges in shipping crude oil and refined products, citing specific examples of port congestion or vessel shortages].

- Refining Capacity Limitations: [Highlight any constraints in refining capacity, and discuss their impact on the availability of refined petroleum products].

- Duration and Severity: The duration and severity of these disruptions remain uncertain, depending on [mention key factors affecting the situation].

Demand Outlook and Economic Indicators

Global Oil Demand Projections

Forecasts for global oil demand in the coming years vary depending on the source, but generally show a [growth/decline/stable] trend.

- IEA Projections: The International Energy Agency (IEA) projects [state IEA's forecast with source citation].

- OPEC Projections: OPEC's forecast indicates [state OPEC's forecast with source citation].

- Driving Factors: Key factors influencing this demand outlook include [list factors such as global economic growth, the adoption of electric vehicles, and government policies].

Economic Indicators and Their Influence

Several macroeconomic indicators play a crucial role in shaping oil prices.

- Inflation: High inflation rates [positively/negatively] impact oil demand due to [explain the correlation].

- Interest Rates: Rising interest rates typically [positively/negatively] influence oil prices by [explain the correlation].

- Economic Growth: Strong economic growth usually leads to [increased/decreased] oil demand. A global economic slowdown could significantly impact future oil prices.

Investment Strategies and Market Sentiment

Investor Sentiment

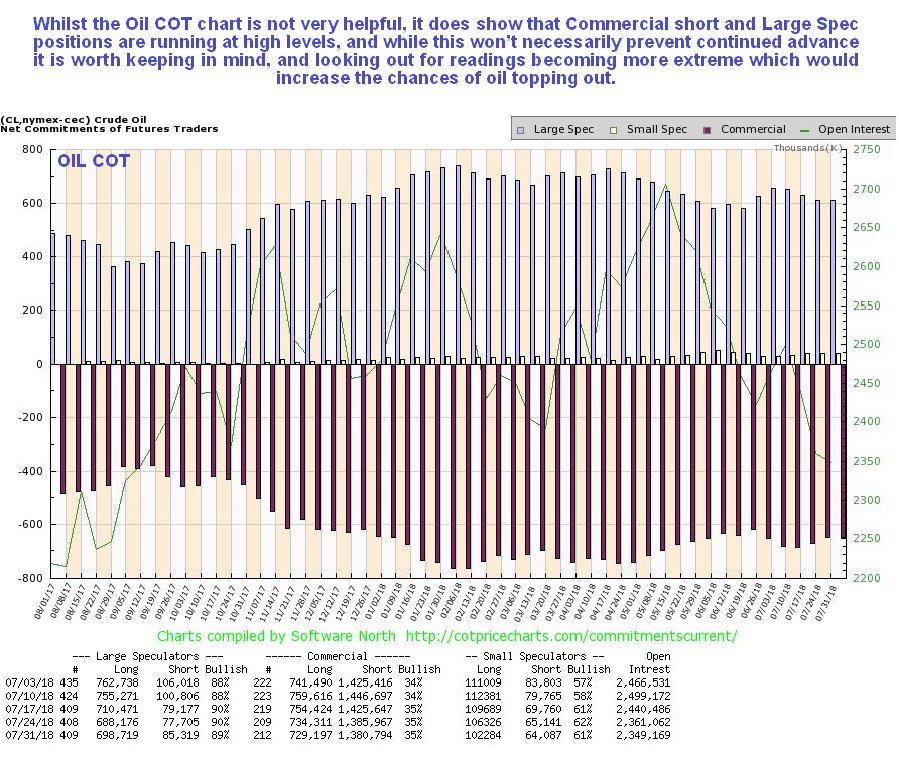

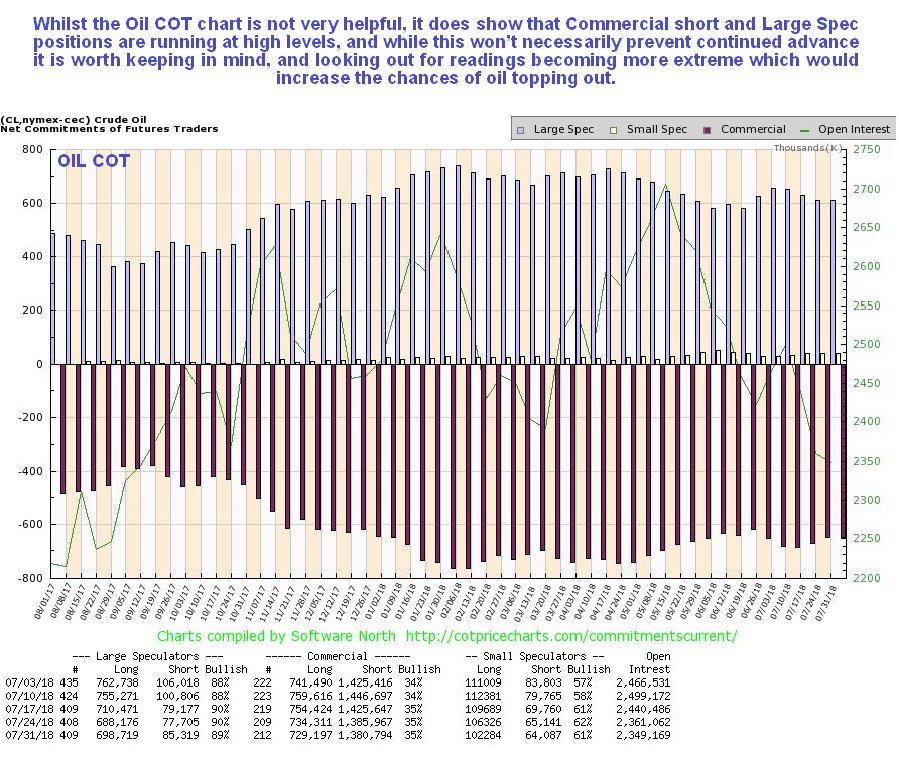

Current investor sentiment towards the oil market is largely [bullish/bearish/neutral], driven by [explain the rationale behind the sentiment, referencing recent market activity such as trading volumes or futures contracts].

- Trading Volumes: [Discuss recent trading volumes in oil futures markets as an indicator of investor sentiment].

- Futures Contracts: Analysis of futures contracts can reveal [describe what futures contracts show about investor expectations].

Potential Investment Opportunities

Given the current market conditions, potential investment opportunities in the oil sector include:

- ETFs: Investing in oil ETFs provides diversified exposure to the sector.

- Individual Stocks: Investing in individual oil company stocks offers the potential for higher returns but also carries greater risk.

Important Considerations: Investing in the oil market involves significant risk due to price volatility. Thorough research and diversification are crucial for managing risk effectively.

Conclusion

This April 23rd oil market update highlights the ongoing volatility in crude oil prices, driven by a complex interplay of geopolitical factors, supply chain issues, and economic indicators. OPEC+ decisions continue to significantly influence the market, while global demand projections remain crucial for shaping the future price trajectory. Understanding these complex dynamics is key to successful navigation of the energy markets.

Call to Action: Stay informed about crucial shifts in the oil market by regularly checking back for our upcoming oil market updates. Understanding these oil market trends is essential for making informed decisions. Subscribe to receive future oil market analyses and insights.

Featured Posts

-

O Tzon Travolta Apoxaireta Ton Tzin Xakman Me Sygkinitiki Anartisi

Apr 24, 2025

O Tzon Travolta Apoxaireta Ton Tzin Xakman Me Sygkinitiki Anartisi

Apr 24, 2025 -

Resistance Mounts Car Dealerships Push Back On Ev Mandates

Apr 24, 2025

Resistance Mounts Car Dealerships Push Back On Ev Mandates

Apr 24, 2025 -

Sharks Missing Swimmer And A Body Found On Israeli Beach

Apr 24, 2025

Sharks Missing Swimmer And A Body Found On Israeli Beach

Apr 24, 2025 -

Ftc To Appeal Microsofts Activision Blizzard Acquisition Faces Setback

Apr 24, 2025

Ftc To Appeal Microsofts Activision Blizzard Acquisition Faces Setback

Apr 24, 2025 -

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025

Understanding The Value Of Middle Managers Benefits For Employees And The Organization

Apr 24, 2025

Latest Posts

-

The Vma Simulcast On Cbs A Turning Point For Music Television

May 12, 2025

The Vma Simulcast On Cbs A Turning Point For Music Television

May 12, 2025 -

Alex Winters Lost Mtv Years The Sketch Comedy That Preceded Freaked

May 12, 2025

Alex Winters Lost Mtv Years The Sketch Comedy That Preceded Freaked

May 12, 2025 -

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Share Happy News

May 12, 2025

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Share Happy News

May 12, 2025 -

Mtv Vs Cbs Analyzing The Impact Of The Vma Simulcast

May 12, 2025

Mtv Vs Cbs Analyzing The Impact Of The Vma Simulcast

May 12, 2025 -

Uncovering Alex Winters Early Comedy Career His Mtv Sketch Shows

May 12, 2025

Uncovering Alex Winters Early Comedy Career His Mtv Sketch Shows

May 12, 2025