Oil Price Update: Market News And Analysis For April 23

Table of Contents

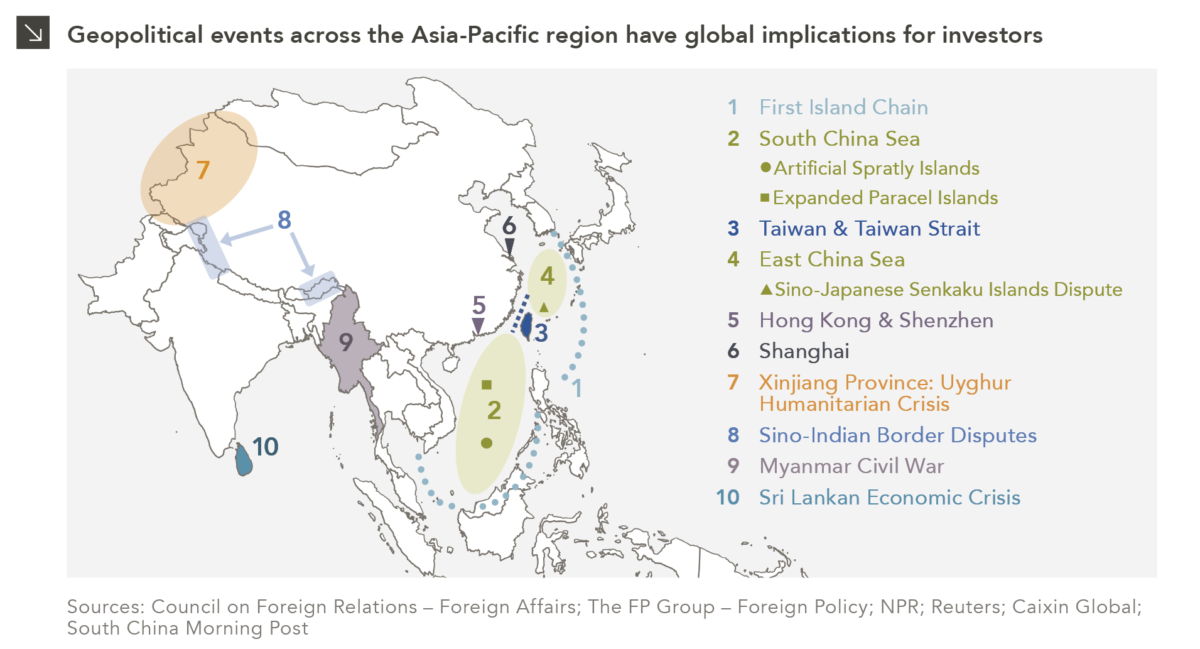

Geopolitical Influences on Oil Prices

Geopolitical events are consistently major drivers of oil price volatility. Understanding these influences is crucial for any investor or business impacted by crude oil price fluctuations.

The Impact of the Russia-Ukraine Conflict

The ongoing Russia-Ukraine conflict continues to be a significant source of uncertainty in the global oil market. The impact extends beyond direct disruptions to Russian oil exports; it creates a ripple effect across the entire energy landscape.

- Specific Sanctions Impacting Russian Oil Exports: Western sanctions targeting Russian oil exports have significantly reduced the country's ability to sell its crude oil on the global market. This reduction in supply has directly contributed to higher prices.

- Redirection of Russian Oil to Alternative Markets: Russia has been attempting to redirect its oil exports to alternative markets, primarily in Asia. While this has somewhat mitigated the impact of sanctions, it hasn't completely offset the supply shortfall in the West.

- Potential for Further Price Spikes Due to Geopolitical Instability: The ongoing conflict carries a significant risk of escalation, which could lead to further disruptions in oil supply and subsequently, even higher prices. Any major shift in the conflict could dramatically impact the oil market. Monitoring geopolitical developments is therefore crucial for predicting oil price movements. Keywords: Russia oil, Ukraine conflict, oil sanctions, geopolitical risk, crude oil price, Brent crude, WTI crude.

OPEC+ Decisions and Their Market Impact

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) play a crucial role in shaping global oil supply and prices. Their decisions regarding production quotas have a direct and often significant influence on the market.

- Recent OPEC+ Meetings and Production Adjustments: Recent OPEC+ meetings have seen discussions regarding production targets. Analyzing these meetings and the subsequent announcements is key to understanding the group's strategy and its influence on oil prices. Any adjustments to production quotas have immediate and substantial repercussions on the oil market.

- Impact on Supply and Demand: OPEC+'s decisions directly impact the balance between global oil supply and demand. Reduced production quotas can lead to tighter supplies and higher prices, while increased quotas can have the opposite effect.

- Role of Individual Member Countries' Compliance with Quotas: The actual compliance of individual OPEC+ member countries with agreed-upon production quotas is also a critical factor. Variations in compliance can significantly impact market dynamics and price volatility. Keywords: OPEC+, oil production, oil supply, OPEC meeting, oil cartel, production quota, oil market share.

Supply Chain Disruptions and Their Effect on Oil Prices

Beyond geopolitical factors, disruptions to the oil supply chain can significantly impact prices. These disruptions can affect both the availability of crude oil and the refining process.

Global Supply Chain Bottlenecks

Ongoing supply chain bottlenecks continue to affect the transportation and refining of oil, creating price volatility. These challenges aren't limited to any one region; they're global in nature.

- Logistical Challenges: Transportation delays, including difficulties in securing tankers and navigating congested ports, contribute to disruptions in the oil supply chain.

- Port Congestion: Increased congestion at major ports worldwide slows the movement of oil and its refined products, affecting availability and leading to price fluctuations.

- Refinery Maintenance Issues: Planned and unplanned maintenance at oil refineries can lead to temporary reductions in refining capacity, impacting the availability of refined products and influencing prices. Keywords: oil supply chain, logistics, refinery, oil transportation, supply chain disruption, oil tanker, port congestion.

Demand Recovery and Its Influence

The global economic recovery from the pandemic has significantly influenced oil demand, impacting prices.

- Post-Pandemic Economic Growth and Its Effect on Oil Consumption: Stronger-than-expected economic growth in various regions has led to increased demand for oil, particularly in transportation and industrial sectors.

- Role of Travel and Industrial Activity in Driving Demand: The resurgence of air travel and increased industrial activity have contributed significantly to the rise in global oil demand. These factors are intrinsically linked to economic growth and have a direct impact on oil prices. Keywords: oil demand, economic growth, global economy, travel, industrial demand, aviation fuel, gasoline prices.

Economic Indicators and Their Correlation with Oil Prices

Macroeconomic indicators have a strong correlation with oil prices. Understanding these relationships is vital for predicting price trends.

Inflation and Interest Rate Hikes

Rising inflation and potential interest rate hikes influence oil prices and investor sentiment.

- Relationship Between Inflation, Interest Rates, and Commodity Prices: Inflation often leads to central banks raising interest rates to control price increases. These rate hikes can impact investor sentiment and influence demand for commodities like oil.

- Impact of Investor Behavior During Periods of Economic Uncertainty: Periods of economic uncertainty often lead to increased volatility in commodity markets, including oil. Investors may react to economic news by adjusting their portfolios, creating price fluctuations. Keywords: inflation, interest rates, investor sentiment, commodity prices, economic uncertainty, monetary policy.

Conclusion

This Oil Price Update for April 23rd highlights the complex interplay of geopolitical factors, supply chain dynamics, and economic indicators influencing the current oil market. Understanding these factors is crucial for navigating the volatility and making informed decisions. Stay tuned for further Oil Price Updates and analysis to stay ahead of the curve in this ever-changing market. Continue to monitor the latest news and analysis to gain a deeper understanding of future oil price movements. Regularly check back for our next Oil Price Update and detailed oil price forecasts.

Featured Posts

-

A Fathers Remembrance John Travolta Shares Photo To Mark Son Jetts Birthday

Apr 24, 2025

A Fathers Remembrance John Travolta Shares Photo To Mark Son Jetts Birthday

Apr 24, 2025 -

The Significance Of Destroying The Papal Signet Ring Upon A Popes Death

Apr 24, 2025

The Significance Of Destroying The Papal Signet Ring Upon A Popes Death

Apr 24, 2025 -

Hudsons Bay Leasehold Interest 65 Properties Attract Attention

Apr 24, 2025

Hudsons Bay Leasehold Interest 65 Properties Attract Attention

Apr 24, 2025 -

Nba Launches Formal Probe Into Ja Morant Incident What We Know

Apr 24, 2025

Nba Launches Formal Probe Into Ja Morant Incident What We Know

Apr 24, 2025 -

The Liberal Government And Fiscal Responsibility A Critical Analysis

Apr 24, 2025

The Liberal Government And Fiscal Responsibility A Critical Analysis

Apr 24, 2025

Latest Posts

-

Trumps Energy Policy Cheap Oil And Its Geopolitical Implications

May 12, 2025

Trumps Energy Policy Cheap Oil And Its Geopolitical Implications

May 12, 2025 -

The Impact Of Trumps Presidency On Cheap Oil And The Energy Industry

May 12, 2025

The Impact Of Trumps Presidency On Cheap Oil And The Energy Industry

May 12, 2025 -

Understanding The Dynamics Between Trumps Policies And Cheap Oil

May 12, 2025

Understanding The Dynamics Between Trumps Policies And Cheap Oil

May 12, 2025 -

Trumps Cheap Oil Policies An Assessment Of Their Success And Failures

May 12, 2025

Trumps Cheap Oil Policies An Assessment Of Their Success And Failures

May 12, 2025 -

Examining Trumps Actions And Their Effect On Cheap Oil Production

May 12, 2025

Examining Trumps Actions And Their Effect On Cheap Oil Production

May 12, 2025