Oil Prices And OPEC+: Impact Of The Upcoming Production Quota Review

Table of Contents

OPEC+'s Current Situation and Challenges

The current state of the global oil market is a complex interplay of supply, demand, and geopolitical factors. While demand has shown resilience in the face of economic headwinds, the level of supply is heavily influenced by OPEC+'s decisions. Several key factors shape the organization's approach:

-

Geopolitical Instability: The ongoing war in Ukraine, tensions in the Middle East, and other geopolitical events significantly impact oil production and pricing. Sanctions on Russian oil, a major global producer, have further complicated the supply chain.

-

Economic Growth Forecasts: Global economic growth projections heavily influence the demand for oil. A slowing global economy could lead to lower oil demand, while strong growth could drive prices higher.

-

Member Country Interests: OPEC+ comprises a diverse group of nations with varying economic priorities. Saudi Arabia, a key player, often balances its economic interests with its geopolitical influence, while other members like Russia have their own agendas, sometimes leading to internal disagreements within the group.

Recent production cuts and increases by OPEC+ members have shown their ability to significantly impact oil prices. This makes the upcoming quota review a pivotal moment.

-

Global oil demand projections for the next quarter and year: Analysts predict a mixed picture, with some anticipating continued growth in demand, while others foresee a slowdown due to economic uncertainties.

-

Analysis of individual OPEC+ member production levels and their compliance with quotas: Monitoring compliance is crucial. Variations in production from individual members can significantly impact the overall supply and, consequently, prices.

-

Impact of sanctions on Russian oil production: Sanctions have undoubtedly reduced Russian oil exports, creating supply shortages and influencing global oil prices. However, Russia has found alternative markets, mitigating some of the initial impact.

-

Potential for disagreements among OPEC+ members regarding production levels: Internal disagreements within OPEC+ are common, reflecting the varied national interests and economic circumstances of its members. These divisions could lead to unpredictable outcomes in the upcoming review.

Potential Outcomes of the Production Quota Review

The upcoming OPEC+ production quota review presents several potential scenarios:

-

Scenario 1: Maintaining current production quotas: This would likely maintain the existing price equilibrium, though unforeseen events could still cause fluctuations.

-

Scenario 2: Increasing production: An increase in production quotas would likely lead to a decrease in oil prices, potentially benefiting consumers and businesses but potentially impacting the revenues of OPEC+ member countries.

-

Scenario 3: Further reducing production: A further reduction in production would likely drive oil prices higher, leading to concerns about inflation and impacting energy-intensive industries. This scenario also increases the risk of potential shortages.

Factors influencing OPEC+'s decision include concerns about inflation, a potential global economic slowdown, and ongoing geopolitical instability. The balance between maintaining market stability and maximizing member state revenues will be a key consideration.

Impact on Global Economy and Different Sectors

The outcome of the OPEC+ production quota review will ripple through various sectors globally:

-

Impact on gasoline prices for consumers: Fluctuations in oil prices directly affect gasoline prices, impacting household budgets and consumer spending.

-

Effect on airline ticket prices and the travel industry: Higher oil prices can lead to increased airline ticket prices and potentially dampen travel demand.

-

Consequences for businesses with high energy consumption: Industries like manufacturing and transportation are particularly vulnerable to oil price increases, potentially leading to cost pressures and reduced profitability.

-

Influence on global inflation and economic growth forecasts: Sustained high oil prices contribute to inflation, impacting economic growth and central bank monetary policies. Conversely, lower prices could boost economic activity.

Predicting Future Oil Prices: Analysis and Forecasting

Predicting future oil prices is inherently challenging, given the complex interplay of various factors. However, based on the possible outcomes of the OPEC+ review, we can offer a range of potential price forecasts:

-

Price range predictions for different scenarios: Maintaining quotas might keep prices within a certain band, while production increases could see prices decline, and further reductions could drive prices sharply higher.

-

Key factors affecting accuracy of price forecasts (e.g., unforeseen geopolitical events): Unforeseen events – such as new geopolitical crises, unexpected production disruptions, or significant changes in global economic growth – can drastically alter price predictions.

-

Importance of monitoring news and announcements from OPEC+: Closely following OPEC+'s announcements and statements is crucial for informed decision-making.

Conclusion: The Future of Oil Prices and OPEC+

The OPEC+ production quota review will have a significant impact on global oil prices. The potential outcomes – maintaining current quotas, increasing production, or further reducing production – each carry different implications for the global economy and various sectors. Understanding these potential scenarios is vital for navigating the uncertainties in the energy market. To make informed decisions about your investments and business strategies related to Oil Prices and OPEC+, stay informed about market developments and OPEC+'s pronouncements. Consider subscribing to reliable financial news sources for updates and further analysis on this critical factor shaping the global economy.

Featured Posts

-

New Talk To Me Horror Film Trailers Promise Increasingly Disturbing Content

May 29, 2025

New Talk To Me Horror Film Trailers Promise Increasingly Disturbing Content

May 29, 2025 -

16 Year Old Victim Of Gay Bashing Five Teenagers In Custody

May 29, 2025

16 Year Old Victim Of Gay Bashing Five Teenagers In Custody

May 29, 2025 -

Ramalan Cuaca Kalimantan Timur Update Ikn Balikpapan Samarinda

May 29, 2025

Ramalan Cuaca Kalimantan Timur Update Ikn Balikpapan Samarinda

May 29, 2025 -

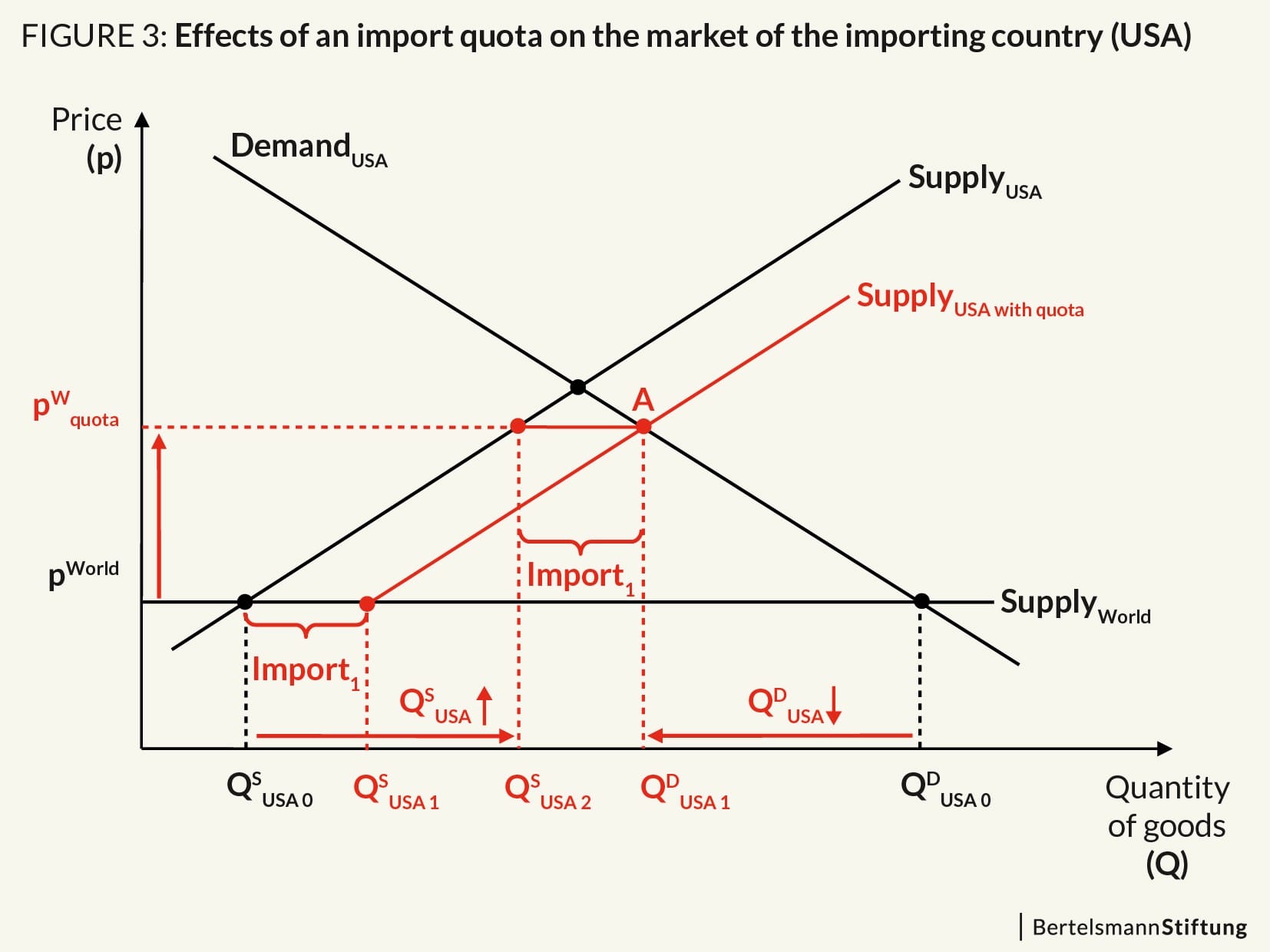

Seventh Graders Two Genders Shirt Supreme Court Denies Review

May 29, 2025

Seventh Graders Two Genders Shirt Supreme Court Denies Review

May 29, 2025 -

Amanda Holdens Dog Grooming The Reaction Thats Got Everyone Talking

May 29, 2025

Amanda Holdens Dog Grooming The Reaction Thats Got Everyone Talking

May 29, 2025

Latest Posts

-

Special Weather Statement High Fire Risk In Cleveland And Akron

May 31, 2025

Special Weather Statement High Fire Risk In Cleveland And Akron

May 31, 2025 -

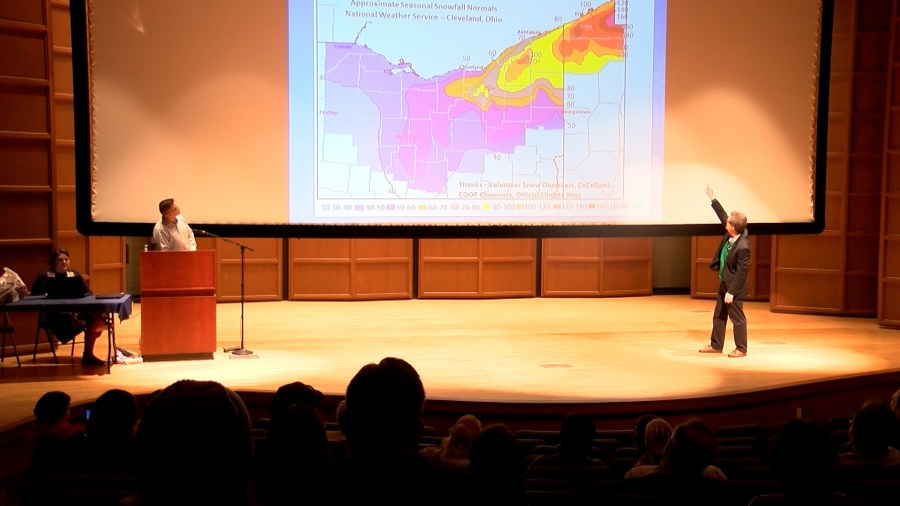

Learn Skywarn Spotter Skills From Meteorologist Tom Atkins

May 31, 2025

Learn Skywarn Spotter Skills From Meteorologist Tom Atkins

May 31, 2025 -

Elevated Fire Risk Special Weather Statement For Cleveland And Akron

May 31, 2025

Elevated Fire Risk Special Weather Statement For Cleveland And Akron

May 31, 2025 -

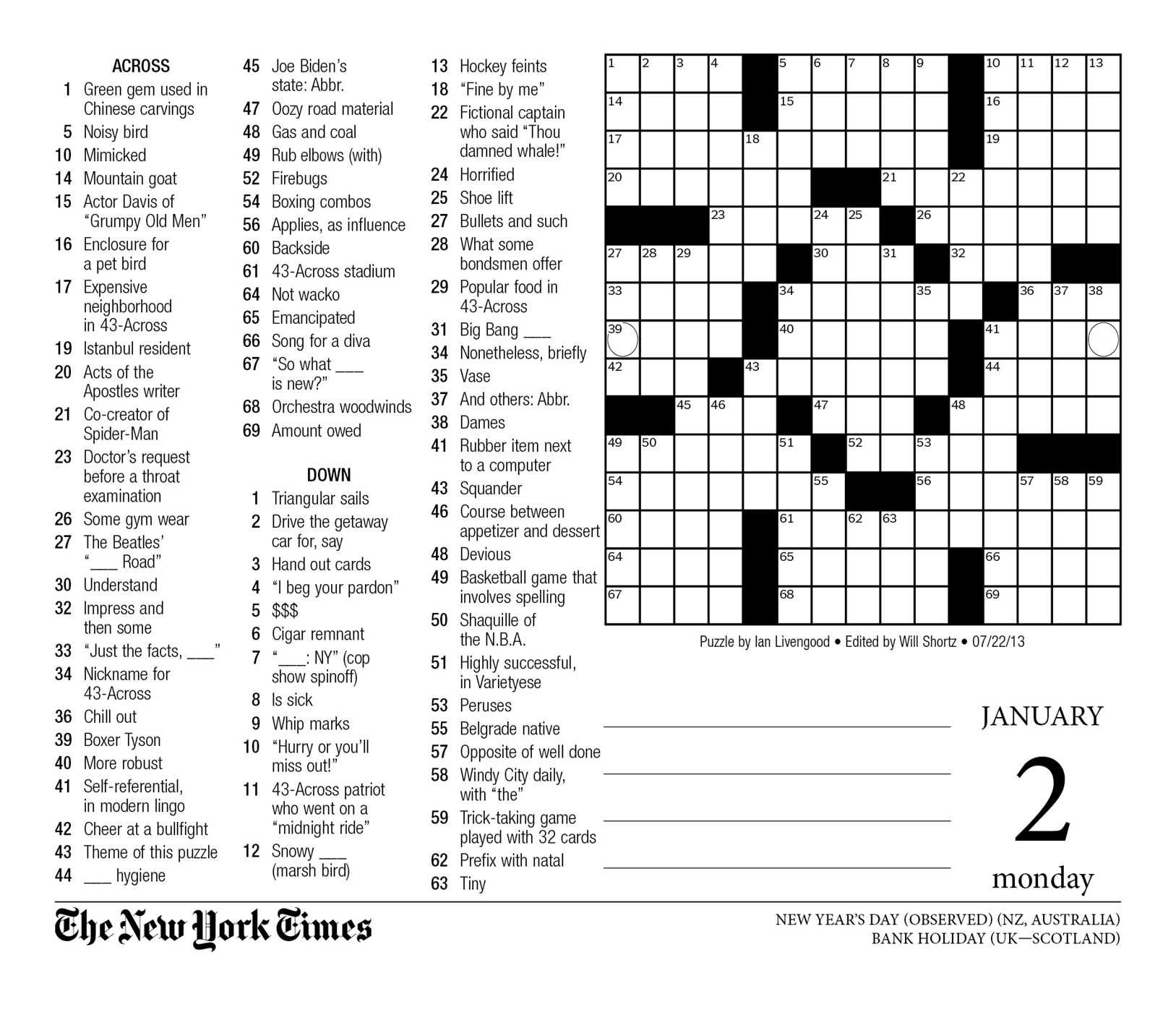

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025 -

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025