Omada Health's US IPO: Details On The Andreessen Horowitz-Backed Company

Table of Contents

Omada Health's Business Model and Target Market

Omada Health focuses on delivering virtual care for chronic disease management. Their programs primarily target individuals with conditions like type 2 diabetes and hypertension. They offer personalized coaching and behavior change programs delivered through a user-friendly mobile app, utilizing digital therapeutics to improve patient outcomes. This approach is particularly appealing to a diverse target market:

- Individuals: Omada provides convenient, accessible, and affordable chronic disease management options for individuals seeking better health outcomes.

- Employers: Companies use Omada's programs to improve employee health and reduce healthcare costs associated with chronic conditions. They benefit from improved employee productivity and reduced absenteeism.

- Health Plans: Health plans partner with Omada to expand their telehealth offerings, improve patient engagement, and potentially reduce overall healthcare spending. Their integration with existing healthcare systems ensures seamless data transfer and facilitates better care coordination.

Omada leverages several key elements in its approach:

- Virtual care delivery: Omada’s mobile app provides remote patient monitoring, telehealth consultations, and educational resources.

- Personalized coaching: Individualized coaching programs support patients in adopting healthier lifestyles and managing their conditions effectively.

- Behavior change programs: Omada employs evidence-based behavioral interventions to encourage lasting lifestyle modifications.

- Integration with healthcare systems: Seamless data transfer between Omada's platform and existing healthcare systems ensures comprehensive care coordination.

- Cost-effectiveness: The virtual care model often proves more cost-effective than traditional care approaches for managing chronic diseases. The use of digital therapeutics, telehealth, and virtual care contributes significantly to this cost-effectiveness.

Financial Performance Leading up to the Omada Health IPO

Omada Health's strong financial performance leading up to its IPO attracted significant investor interest. While precise figures may vary depending on the reporting period, the company demonstrated consistent year-over-year revenue growth. Key factors contributing to this success include strategic partnerships, successful program implementation, and an expanding client base. Backed by prominent investors like Andreessen Horowitz, the company secured substantial funding rounds. These investments fueled their growth and expansion.

- Year-over-year revenue growth percentages: Significant growth was reported, showcasing the increasing demand for their digital chronic disease management solutions.

- Key partnerships and contracts: Omada forged crucial partnerships with major health systems and employers, expanding their reach and solidifying their market position.

- Funding rounds and total capital raised: Multiple funding rounds resulted in substantial capital infusion, allowing for continued expansion and improvement of their platform and programs.

- Profitability or losses: Details regarding profitability may be available through SEC filings. While early-stage companies often operate at a loss during growth phases, a clear path to profitability is typically essential for a successful IPO. Look at metrics like revenue growth and customer acquisition costs.

The Omada Health IPO: Pricing, Valuation, and Market Reaction

The Omada Health IPO pricing and valuation reflect investor confidence in the company's potential. The IPO price per share, along with the total funds raised, provides insights into the market's valuation of the company. Post-IPO market capitalization represents the total value of the company. The initial market reaction, reflected in the stock's performance immediately after the IPO, often signifies investor sentiment.

- IPO price per share: The price per share indicates the initial valuation placed on the company by investors.

- Total funds raised through the IPO: The amount raised provides insight into the company's funding needs and expansion plans.

- Market capitalization post-IPO: The post-IPO market cap reflects investor assessment of Omada's value following the IPO.

- Initial investor response and stock performance: Early trading patterns and analyst reviews provide clues about the success of the IPO.

Risks and Challenges Facing Omada Health Post-IPO

Despite its promising prospects, Omada Health faces several challenges. Competition within the burgeoning telehealth market is intensifying, requiring Omada to continuously innovate and maintain its competitive edge. Regulatory hurdles and reimbursement challenges may also impact its growth.

- Competition from other telehealth companies: Omada faces competition from established players and emerging startups in the telehealth space.

- Reimbursement challenges and insurance coverage: Securing adequate reimbursement from insurance providers is crucial for long-term sustainability.

- Data security and privacy concerns: Protecting sensitive patient data is paramount, particularly in the digital health space. Compliance with relevant regulations is critical.

- Scalability and expansion into new markets: Scaling operations to meet growing demand and expanding into new geographic markets presents significant logistical and operational challenges.

Conclusion

The Omada Health IPO represents a significant milestone for the company and the digital health sector. Its success hinges on its ability to manage chronic disease effectively using innovative virtual care and telehealth solutions. While promising, the company faces competitive pressures, regulatory challenges, and the need to maintain data security. By understanding its business model, financial performance, and potential risks, investors can better assess its long-term prospects. The Omada Health IPO is a noteworthy development in the evolution of telehealth, and keeping abreast of its performance will be crucial in understanding the future of this rapidly growing industry. Stay informed about the evolving landscape of telehealth and the performance of Omada Health by following our updates on [link to relevant page/section]. Learn more about the Omada Health IPO and its impact on the future of healthcare.

Featured Posts

-

Dakota Dzhonson Sredi Nominantov Zolotoy Maliny Khudshie Filmy Goda

May 10, 2025

Dakota Dzhonson Sredi Nominantov Zolotoy Maliny Khudshie Filmy Goda

May 10, 2025 -

Trump Administration Considers Tariffs On Commercial Aircraft And Engines

May 10, 2025

Trump Administration Considers Tariffs On Commercial Aircraft And Engines

May 10, 2025 -

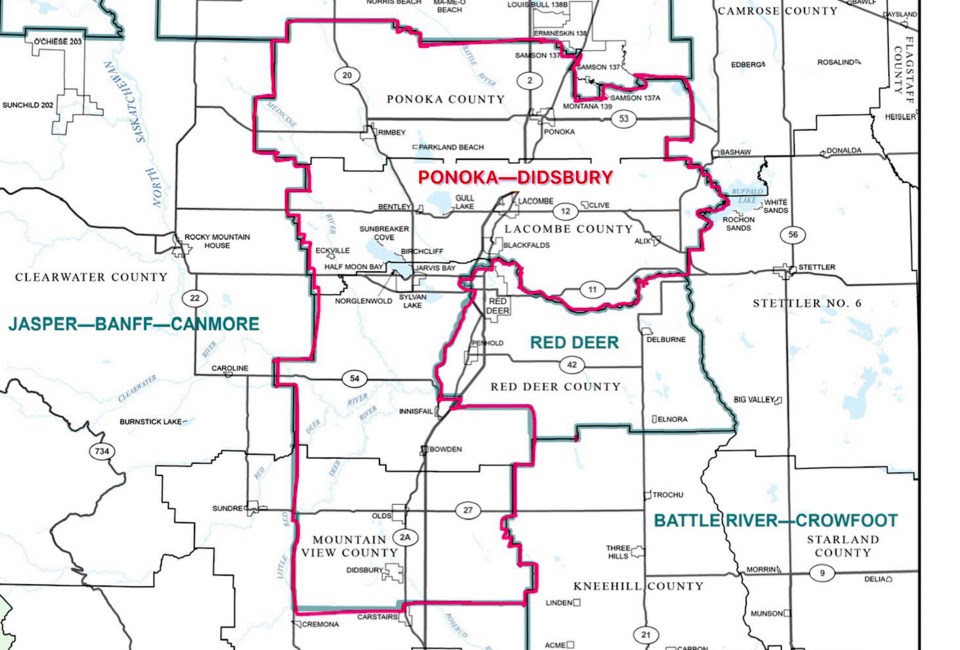

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 10, 2025

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 10, 2025 -

Attorney Generals Fentanyl Prop Understanding The Implications

May 10, 2025

Attorney Generals Fentanyl Prop Understanding The Implications

May 10, 2025 -

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Decline Hurun Global Rich List 2025

May 10, 2025

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Decline Hurun Global Rich List 2025

May 10, 2025