OPEC+ Decision Looms As Big Oil Holds Firm On Production

Table of Contents

Big Oil's Stance: Maintaining Production Levels

Major oil-producing companies are currently signaling a strong inclination to maintain existing oil production levels. This seemingly unwavering stance, despite global economic headwinds, is driven by several key factors.

- High Demand Despite Economic Uncertainties: Even with concerns about a potential global recession, demand for crude oil remains robust, particularly from rapidly developing economies in Asia. This sustained demand provides a strong incentive for oil companies to keep production levels steady.

- Concerns About Future Supply Shortages: The global energy landscape remains precarious. Geopolitical instability and the ongoing transition to renewable energy sources create uncertainty around future supply. Oil companies are hedging against potential future shortages by maintaining current production.

- Profitability at Current Prices: Current crude oil prices, while fluctuating, remain generally profitable for major oil producers. Therefore, there's little incentive to drastically reduce production, risking a loss of market share and profits.

Companies like ExxonMobil, Chevron, and Saudi Aramco are key players in this scenario, with their production figures closely watched by market analysts. Maintaining current oil production levels ensures a steady stream of revenue in an ever-changing market. The volume of crude oil extraction and its impact on global supply chains are critical aspects of this complex situation.

The Upcoming OPEC+ Meeting: Anticipation and Uncertainty

The upcoming OPEC+ meeting (date and location to be inserted here, once confirmed) is the focal point of intense speculation. OPEC+, the alliance of the Organization of the Petroleum Exporting Countries (OPEC) and other major oil-producing nations, holds significant sway over global oil production. Key players such as Saudi Arabia, Russia, and the UAE will be influential in shaping the final decision.

Potential outcomes range widely:

- Maintaining Current Production Levels: This outcome would likely lead to continued price volatility, with prices potentially remaining at current levels or experiencing moderate fluctuations based on other market forces.

- Increasing Production to Meet Demand: Increased production could lead to a decrease in oil prices, benefiting consumers but potentially reducing the profitability of oil producers.

- Decreasing Production to Stabilize Prices: Reducing output could help bolster prices, benefiting oil producers but potentially negatively affecting consumers through higher prices.

The OPEC+ meeting and its subsequent decision on oil prices will have far-reaching consequences for the global energy market. Every decision impacts the stability of global energy supply.

Geopolitical Factors and Their Influence

Geopolitical risks and global instability significantly impact the oil market and OPEC+ decisions. The ongoing war in Ukraine, for example, has created significant uncertainty and volatility. Sanctions against Russia, a major oil producer, have disrupted supply chains and contributed to price increases. Other international conflicts and tensions further exacerbate the instability.

These geopolitical factors often influence OPEC+'s decision-making process. The need to balance economic interests with political considerations adds another layer of complexity to the already intricate dynamics of the global oil market. Understanding these geopolitical risks is crucial to interpreting the final OPEC+ decision and its potential impact.

Impact on Consumers and the Global Economy

The OPEC+ decision will have a direct impact on consumers worldwide, primarily through fluctuating gasoline prices. Higher oil prices translate to higher fuel costs, impacting transportation expenses and potentially increasing the cost of goods and services.

The wider economic consequences are equally significant. High oil prices can contribute to inflation, slowing down economic growth, particularly in economies heavily reliant on oil imports. Different regions and countries will experience varying degrees of impact depending on their economic structures and reliance on oil. This economic ripple effect requires careful consideration, especially in times of global uncertainty.

Conclusion: The OPEC+ Decision and its Ripple Effect

The upcoming OPEC+ decision will undoubtedly shape the global energy market landscape for the foreseeable future. The interplay of big oil's strategies, geopolitical considerations, and the potential outcomes of the OPEC+ meeting creates a scenario brimming with uncertainty. While maintaining production might seem logical for producers, the impact on consumers and the global economy needs careful assessment. The potential for price fluctuations and their cascading effect on inflation and economic growth remain significant concerns.

To navigate this uncertainty, it's crucial to stay informed about the OPEC+ decision and its implications. Follow the OPEC+ decision closely; stay updated on OPEC+ announcements; and learn more about the OPEC+ oil production decisions to understand their potential impact on your world.

Featured Posts

-

Internet Buzz Over Emma Stones Unique Snl Gown The Popcorn Butt Lift Debate

May 04, 2025

Internet Buzz Over Emma Stones Unique Snl Gown The Popcorn Butt Lift Debate

May 04, 2025 -

Emma Stooyn Kai Margkaret Koyalei Sygkroyseis Sta Oskar Analysi Binteo

May 04, 2025

Emma Stooyn Kai Margkaret Koyalei Sygkroyseis Sta Oskar Analysi Binteo

May 04, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

May 04, 2025

Turning Poop Into Podcast Gold An Ai Powered Solution For Repetitive Documents

May 04, 2025 -

Severe Weather Threat In Nyc Monday Timing Impacts And Preparation

May 04, 2025

Severe Weather Threat In Nyc Monday Timing Impacts And Preparation

May 04, 2025 -

A Rock Collaboration We Almost Got Lizzo Sza And More

May 04, 2025

A Rock Collaboration We Almost Got Lizzo Sza And More

May 04, 2025

Latest Posts

-

Chicago Med Season 10 Episode 14 Brian Tees Return

May 04, 2025

Chicago Med Season 10 Episode 14 Brian Tees Return

May 04, 2025 -

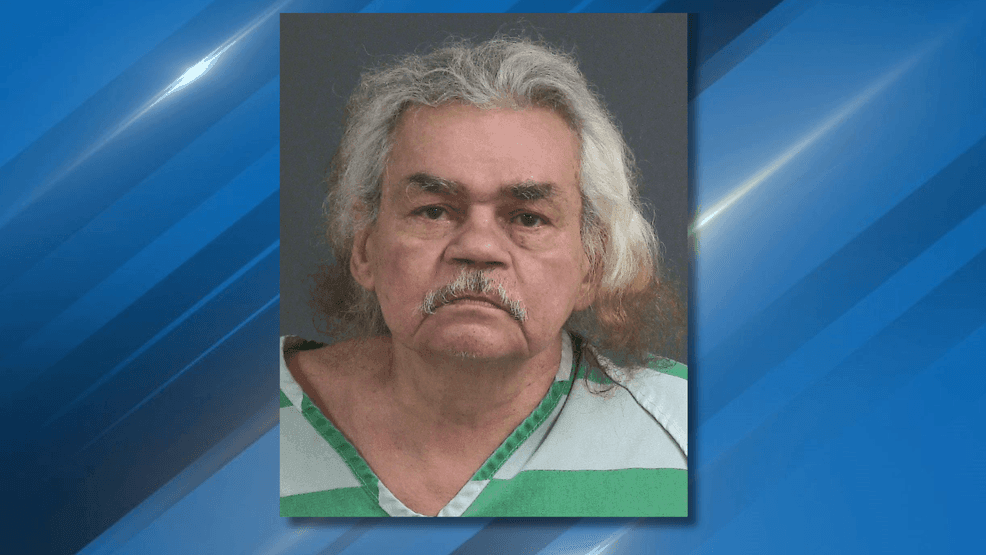

Murder Charge Filed Against Stepfather Alleged Torture And Starvation Of 16 Year Old Stepson Led To Death

May 04, 2025

Murder Charge Filed Against Stepfather Alleged Torture And Starvation Of 16 Year Old Stepson Led To Death

May 04, 2025 -

16 Year Old Stepsons Death Stepfather Arrested Accused Of Murder Torture And Starvation

May 04, 2025

16 Year Old Stepsons Death Stepfather Arrested Accused Of Murder Torture And Starvation

May 04, 2025 -

Stepfather Faces Murder Charge In Stepsons Death Allegations Of Torture Starvation And Assault

May 04, 2025

Stepfather Faces Murder Charge In Stepsons Death Allegations Of Torture Starvation And Assault

May 04, 2025 -

16 Year Olds Torture Death Mother Faces Criminal Neglect Charges

May 04, 2025

16 Year Olds Torture Death Mother Faces Criminal Neglect Charges

May 04, 2025