Operation Sindoor Fallout: KSE 100 Trading Halted Amidst Market Panic

Table of Contents

The unexpected halt of KSE 100 trading following the controversial "Operation Sindoor" has sent shockwaves through the Pakistani stock market, triggering widespread panic and uncertainty. This unprecedented event has left investors reeling, prompting questions about the future stability of the Pakistani economy and the role of regulatory bodies in managing such crises. This article delves into the reasons behind the trading suspension, analyzes its impact on investors, and explores potential future repercussions for the Pakistani economy. We'll examine the immediate fallout and discuss the long-term implications of this significant event, providing crucial insights for navigating the turbulent waters of the KSE 100.

The "Operation Sindoor" Crackdown and its Market Impact

"Operation Sindoor," a recent crackdown targeting alleged financial irregularities and market manipulation, significantly impacted the KSE 100. While the operation aimed to cleanse the market of illicit activities and promote transparency, its abrupt execution created unforeseen consequences. The operation's focus on specific sectors and individuals led to a domino effect, triggering widespread fear and uncertainty among investors.

How did "Operation Sindoor" directly affect the stock market? The swift action created a climate of fear, leading to:

- Sudden increase in volatility: The KSE 100 experienced dramatic swings, with sharp price fluctuations making it extremely difficult for investors to make informed decisions.

- Mass sell-offs by investors: Driven by panic and uncertainty, many investors rushed to sell their holdings, leading to a sharp decline in market value.

- Significant drop in KSE 100 index value before the halt: The index plummeted before the trading halt was implemented, reflecting the severity of the market reaction to "Operation Sindoor."

- Increased investor uncertainty and fear: The lack of clarity surrounding the operation's scope and implications fueled widespread anxiety among investors, both domestic and foreign.

Reasons Behind the KSE 100 Trading Halt

The Securities and Exchange Commission of Pakistan (SECP), the country's primary regulatory body for the capital market, responded to the escalating market panic by halting KSE 100 trading. This drastic measure aimed to:

- Prevent further market crashes: The SECP sought to stabilize the market by preventing a potential freefall and further losses for investors.

- Protect investors from potential losses: The trading halt provided a temporary buffer, allowing investors to assess the situation before making further decisions.

- Allow time for assessment of the situation: The pause gave the SECP and other relevant authorities time to analyze the situation and formulate a response.

- Restore investor confidence: The halt was intended to signal a proactive approach to the crisis and to reassure investors that the situation was under control.

Impact on Investors and the Pakistani Economy

The immediate consequences of the KSE 100 trading halt were severe, leading to significant financial losses for both individual and institutional investors. The long-term effects could be equally profound:

- Losses faced by individual and institutional investors: Many investors suffered significant losses due to the sudden market downturn and subsequent trading halt.

- Impact on foreign investment: The crisis could deter foreign investment, negatively impacting economic growth and development.

- Potential implications for economic growth: The market turmoil could hinder economic growth by reducing investor confidence and affecting business activities.

- Erosion of public trust in the market: The events surrounding "Operation Sindoor" and the trading halt have damaged public trust in the KSE 100's integrity and stability.

The Psychological Impact of the Market Halt

The abrupt trading halt had a significant psychological impact on investors, creating a climate of fear and uncertainty:

- Increased anxiety among investors: The unexpected nature of the event and the uncertainty surrounding its consequences triggered widespread anxiety.

- Reduced willingness to invest in the future: The crisis could lead to a decrease in investor confidence, making them hesitant to invest in the Pakistani stock market in the future.

- Potential for long-term market instability: The psychological impact could lead to long-term instability, making the market vulnerable to future shocks.

Government Response and Future Outlook for the KSE 100

The government’s response to the crisis will be crucial in determining the KSE 100's future trajectory. The government's actions, including potential regulatory reforms and strategies to restore investor confidence, will be closely scrutinized. These actions might include:

- Government statements and assurances: Clear communication and reassurance from the government are needed to calm investor fears.

- Potential regulatory reforms: Reforms to improve market transparency and investor protection could enhance confidence.

- Strategies to attract foreign investment: The government may need to implement measures to attract foreign investment back into the market.

- Predictions for future KSE 100 performance: The long-term performance of the KSE 100 will depend on the effectiveness of these measures.

Conclusion

The "Operation Sindoor" fallout and subsequent KSE 100 trading halt represent a significant crisis for the Pakistani stock market and economy. The immediate impact has been substantial, with significant investor losses and eroded confidence. The government's response and future regulatory reforms will play a critical role in restoring stability and attracting future investment. The long-term implications remain uncertain, emphasizing the need for careful monitoring and proactive measures to prevent similar crises in the future.

Call to Action: Stay informed about the ongoing developments regarding the KSE 100 and "Operation Sindoor." Regularly check reputable financial news sources for updates on the market's recovery and the implications for Pakistani investors. Understanding the complexities of the KSE 100 and similar market events is crucial for all investors. Careful analysis and a long-term perspective are essential for navigating the evolving landscape of the Pakistani stock market.

Featured Posts

-

Pochemu Makron Starmer Merts I Tusk Ne Priekhali V Kiev Na 9 Maya

May 10, 2025

Pochemu Makron Starmer Merts I Tusk Ne Priekhali V Kiev Na 9 Maya

May 10, 2025 -

Family Devastated Unprovoked Racist Murder Leaves Loved Ones Broken

May 10, 2025

Family Devastated Unprovoked Racist Murder Leaves Loved Ones Broken

May 10, 2025 -

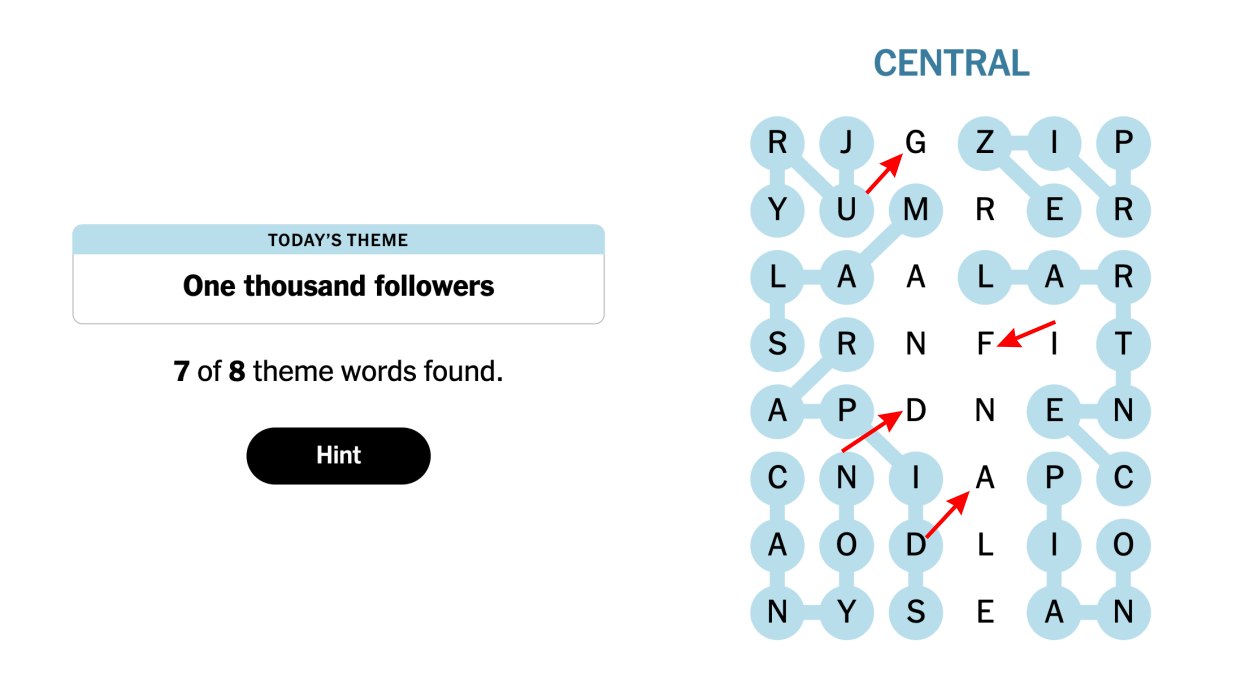

Solving The Nyt Strands A Deep Dive Into The April 6 2025 Puzzle

May 10, 2025

Solving The Nyt Strands A Deep Dive Into The April 6 2025 Puzzle

May 10, 2025 -

High Potential Season 1 When Morgans Intelligence Slipped

May 10, 2025

High Potential Season 1 When Morgans Intelligence Slipped

May 10, 2025 -

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Losses

May 10, 2025

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Losses

May 10, 2025