Operation Sindoor Impact: KSE 100 Trading Halted Amidst Sharp Decline

Table of Contents

The Sudden Plunge of the KSE 100

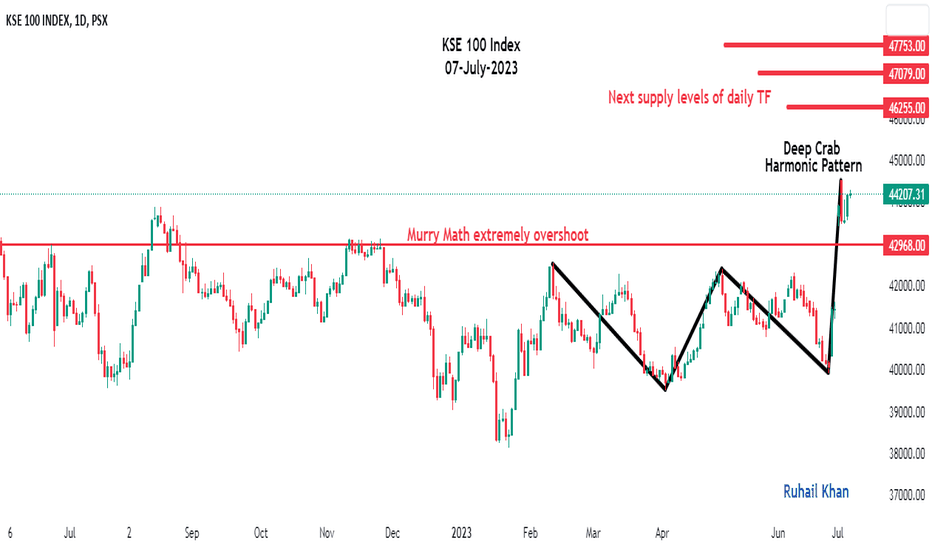

The KSE 100 experienced a precipitous drop following the announcement of "Operation Sindoor." The index plummeted by [Insert Percentage]% within a [Insert Timeframe, e.g., matter of hours], marking one of the sharpest declines in the Karachi Stock Exchange's recent history. This dramatic fall significantly exceeded the average daily volatility typically seen in the KSE 100, underscoring the severity of the event. To put this into perspective, [Insert comparison to a previous significant drop in the KSE 100, e.g., the previous largest single-day percentage drop was only X%].

- Specific index points: Before the halt, the KSE 100 stood at [Insert Index Point]; after the halt, it closed at [Insert Index Point].

- Number of stocks affected: Nearly [Insert Number] stocks were affected, with widespread declines across various sectors.

- Sectors most severely impacted: The [Insert Sectors, e.g., banking, energy, and technology] sectors were particularly hard hit, experiencing disproportionately larger percentage drops than other sectors.

Understanding "Operation Sindoor"

"Operation Sindoor," [Insert Brief Explanation of Operation Sindoor, e.g., a government initiative targeting specific financial irregularities], triggered widespread speculation and concern within the market. News reports and analysts linked the operation to the sudden market crash, suggesting that uncertainty surrounding its implications contributed to the sell-off. [Insert Links to Credible News Sources Reporting on Operation Sindoor]. The perceived negative impact of the operation on investor confidence led to a panic-driven sell-off, further exacerbating the decline.

Reasons Behind the Trading Halt

The sharp decline in the KSE 100 triggered a regulatory response aimed at preventing further losses and maintaining market stability. The Karachi Stock Exchange (KSE) implemented circuit breakers, mechanisms designed to temporarily halt trading when the market experiences significant price swings. These circuit breakers are crucial in preventing a complete market crash during periods of extreme volatility.

- Trigger points: The trading halt was activated when the KSE 100 fell below [Insert Trigger Point Percentage] of its previous closing value.

- Duration of the halt: Trading was suspended for [Insert Duration, e.g., two hours] to allow market participants to assess the situation and prevent further panic selling.

- Regulatory body's statement: [Insert Quote from the KSE or relevant regulatory body's official statement regarding the trading halt].

Impact on Investors and the Economy

The consequences of "Operation Sindoor" and the subsequent KSE 100 crash are far-reaching, impacting investors and the Pakistani economy as a whole.

- Short-term impacts on investors: Many investors experienced significant short-term losses, with the extent of the losses varying depending on their investment strategy and risk appetite. The emotional impact on investors was also considerable, leading to a sense of uncertainty and fear.

- Long-term implications: The long-term consequences will depend largely on the government's response and the market's ability to recover. Sustained market instability could deter foreign investment and hinder economic growth.

- Impact on market capitalization: The overall market capitalization of the KSE 100 decreased significantly, resulting in a reduction in the total value of listed companies.

- Potential government interventions: The government may intervene to stabilize the market through measures such as fiscal or monetary policies designed to boost investor confidence.

Future Outlook and Market Recovery

The recovery of the KSE 100 will depend on several factors, including the government's response to the crisis, investor sentiment, and the overall global economic environment.

- Government policies: The government's role in restoring confidence is crucial. Measures such as increased transparency, regulatory reforms, and targeted economic stimulus packages could help stabilize the market.

- Market performance predictions: The market's future performance is uncertain, with various analysts offering different predictions. A swift and decisive government response could lead to a faster recovery, while continued uncertainty could prolong the downturn.

- Investor recommendations: Investors are advised to adopt a cautious approach, diversifying their portfolios and avoiding impulsive decisions based on short-term market fluctuations. Thorough due diligence and a long-term investment strategy are crucial during periods of market volatility.

Conclusion

The impact of "Operation Sindoor" on the KSE 100 has been significant, resulting in a sharp decline, a trading halt, and considerable uncertainty for investors and the broader Pakistani economy. The reasons behind the market crash stemmed from a combination of factors, including speculation surrounding the operation and the subsequent panic selling. The regulatory response, including the implementation of circuit breakers, was intended to mitigate further losses. The KSE 100's future trajectory remains uncertain, highlighting the importance of informed investment strategies and a close watch on market developments.

The sudden impact of "Operation Sindoor" underscores the inherent volatility in the KSE 100. Stay informed about market developments and consider diversifying your investment portfolio to mitigate risk. For insightful analysis and updates on the KSE 100 and similar events, continue to follow our coverage. Understanding the complexities of the KSE 100 and the impact of events like "Operation Sindoor" is crucial for informed investment decisions.

Featured Posts

-

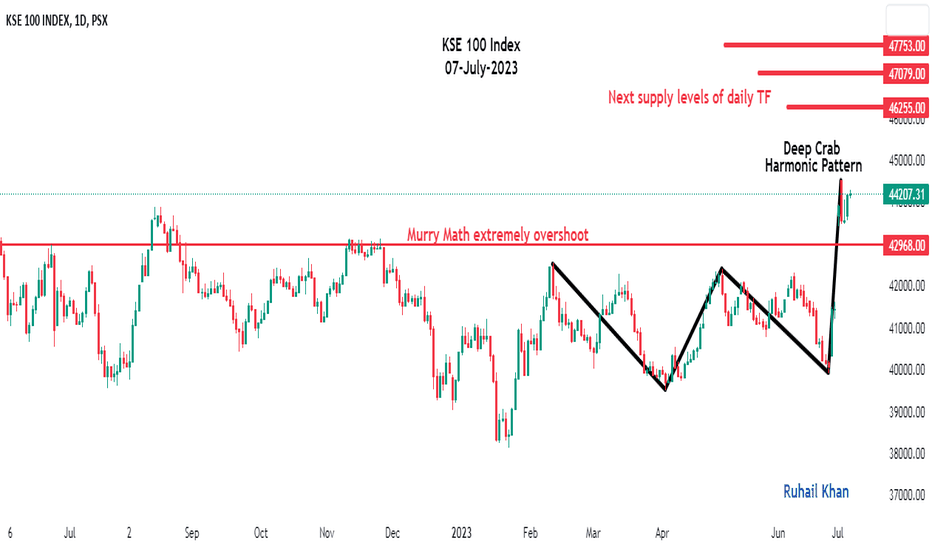

The Harry Styles Influence Benson Boones Response To Critics

May 09, 2025

The Harry Styles Influence Benson Boones Response To Critics

May 09, 2025 -

Arctic Comic Con 2025 A Photo Review Characters Connections And The Ectomobile

May 09, 2025

Arctic Comic Con 2025 A Photo Review Characters Connections And The Ectomobile

May 09, 2025 -

New Uk Immigration Policy Visa Restrictions Explained

May 09, 2025

New Uk Immigration Policy Visa Restrictions Explained

May 09, 2025 -

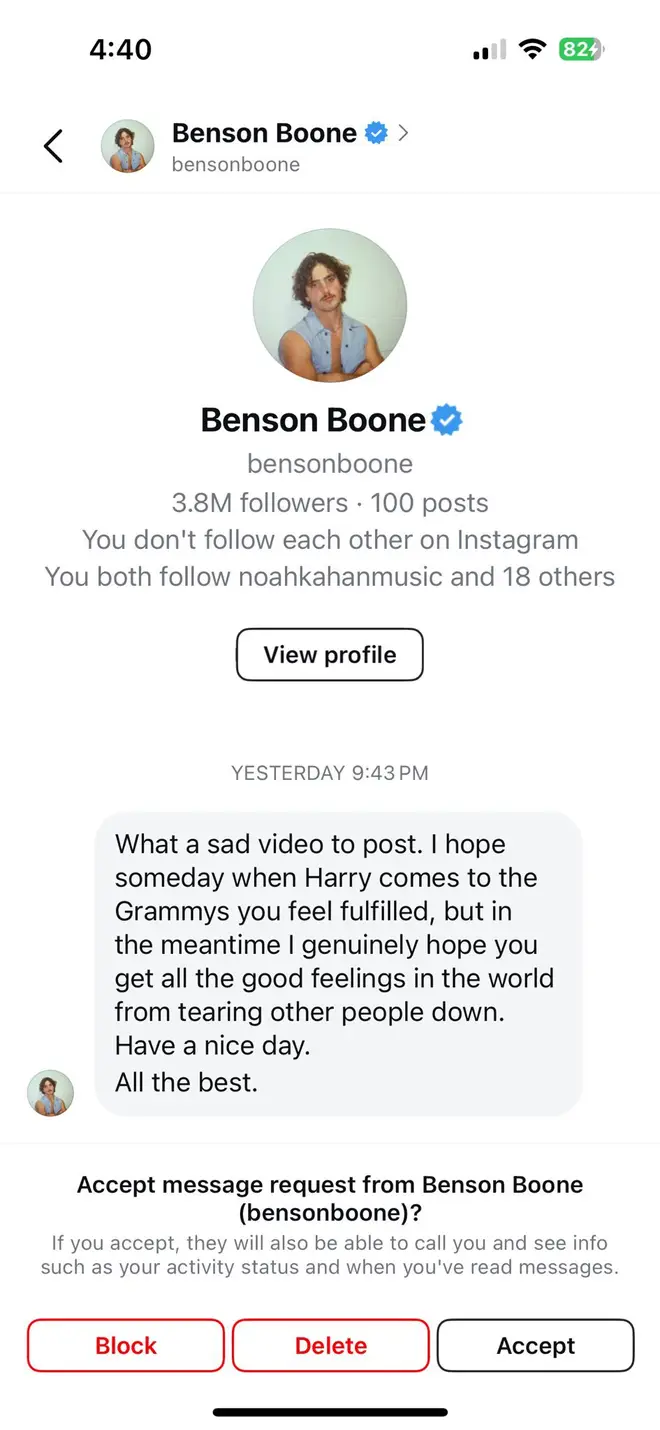

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025 -

Si Psg Dominon 11 Strategjite E Tyre Te Suksesit

May 09, 2025

Si Psg Dominon 11 Strategjite E Tyre Te Suksesit

May 09, 2025