Pakistan And The IMF: $1.3 Billion Loan Under Review Amidst Geopolitical Uncertainty

Table of Contents

The IMF Loan's Significance for Pakistan's Economy

The $1.3 billion IMF bailout package is not merely financial assistance; it's crucial for preventing a complete economic collapse in Pakistan. The country desperately needs this injection of funds to address its immediate financial crisis. Without it, the consequences would be dire:

- Impact on foreign exchange reserves: The loan will help replenish Pakistan's rapidly depleting foreign currency reserves, crucial for importing essential goods and servicing its external debt.

- Debt servicing capabilities: Pakistan faces a significant debt burden, and the IMF loan will provide much-needed breathing room to manage its debt obligations and avoid default.

- Import capacity and its effect on essential goods: The shortage of foreign currency has hampered imports, leading to shortages of essential goods. The IMF loan aims to alleviate this pressure and stabilize the supply of crucial items.

- Potential for currency devaluation: Without the IMF loan, the Pakistani Rupee could face further devaluation, fueling inflation and exacerbating the economic crisis. The loan is intended to help stabilize the currency and prevent runaway inflation.

The IMF bailout represents a critical intervention to prevent a further deterioration of Pakistan's already fragile economic situation. Without this financial assistance, the country faces the very real risk of a major economic crisis.

Conditions and Reforms Attached to the IMF Loan

The IMF's financial aid doesn't come without strings attached. Pakistan is expected to implement stringent conditions and reforms as part of the bailout agreement, including:

- Fiscal consolidation measures: This involves implementing significant tax reforms to broaden the tax base and improve tax collection efficiency, coupled with drastic cuts in government expenditure to reduce the fiscal deficit.

- Structural reforms: These reforms aim to improve governance, transparency, and accountability within various sectors. Specific areas include energy sector reforms to enhance efficiency and reduce losses, as well as tackling corruption and improving the business environment to attract foreign investment.

- Monetary policy adjustments: This includes measures to control inflation, such as raising interest rates, which can negatively impact economic growth in the short term but are necessary to stabilize the economy in the long run.

These IMF conditions, while challenging, are designed to create a sustainable economic path for Pakistan by addressing the root causes of its financial instability. The success of the program will depend on Pakistan's ability to implement these reforms effectively.

Geopolitical Factors Influencing the IMF's Decision

The IMF's decision on the loan is not solely based on Pakistan's economic indicators; geopolitical factors play a significant role. The current global landscape presents several challenges:

- Impact of the Russia-Ukraine conflict on global commodity prices: The war has caused a surge in global commodity prices, particularly energy and food, significantly impacting Pakistan's import bill and putting pressure on its already strained resources.

- Regional tensions and their effect on Pakistan's economy: Regional instability and political tensions further complicate Pakistan's economic outlook, impacting investor confidence and hindering economic growth.

- Influence of global inflation on Pakistan's economic prospects: High global inflation rates, driven by various factors including the war in Ukraine, make it more difficult for Pakistan to manage its own inflation and stabilize its economy.

These geopolitical factors significantly influence the IMF's assessment of Pakistan's economic prospects and its ability to repay the loan. The IMF needs to be confident that the loan will be used effectively and that Pakistan can navigate these external headwinds.

Potential Outcomes and Future Implications

The outcome of the IMF loan review holds significant implications for Pakistan's future:

- Scenario 1: Loan approval: Approval would provide much-needed financial relief, enabling Pakistan to address its immediate economic challenges, stabilize its currency, and implement necessary reforms. However, success depends on adherence to the IMF conditions.

- Scenario 2: Loan delay: A delay would prolong Pakistan's economic crisis, further depleting its reserves, deepening the balance of payments crisis, and increasing the risk of default. This could lead to further instability and hardship.

- Scenario 3: Loan rejection: Rejection would trigger a severe economic crisis, potentially leading to default, hyperinflation, and a sharp contraction in the economy. This would have devastating consequences for the Pakistani people.

The path Pakistan chooses—and the IMF's decision—will significantly shape the country's economic future. The success of any recovery will depend on the effective implementation of reforms and a stable geopolitical environment.

Conclusion

The $1.3 billion IMF loan is critical for Pakistan's economic survival. The conditions attached require significant reforms, and the geopolitical context adds another layer of complexity. The potential outcomes range from economic stabilization to a deeper crisis. Staying informed about the latest developments concerning the crucial Pakistan and the IMF loan negotiation is vital for understanding the implications for Pakistan's economic recovery. Follow reputable financial news sources and analyze the implications for Pakistan's future to stay abreast of this critical situation.

Featured Posts

-

Young Thug Addresses Infidelity In New Music Preview

May 09, 2025

Young Thug Addresses Infidelity In New Music Preview

May 09, 2025 -

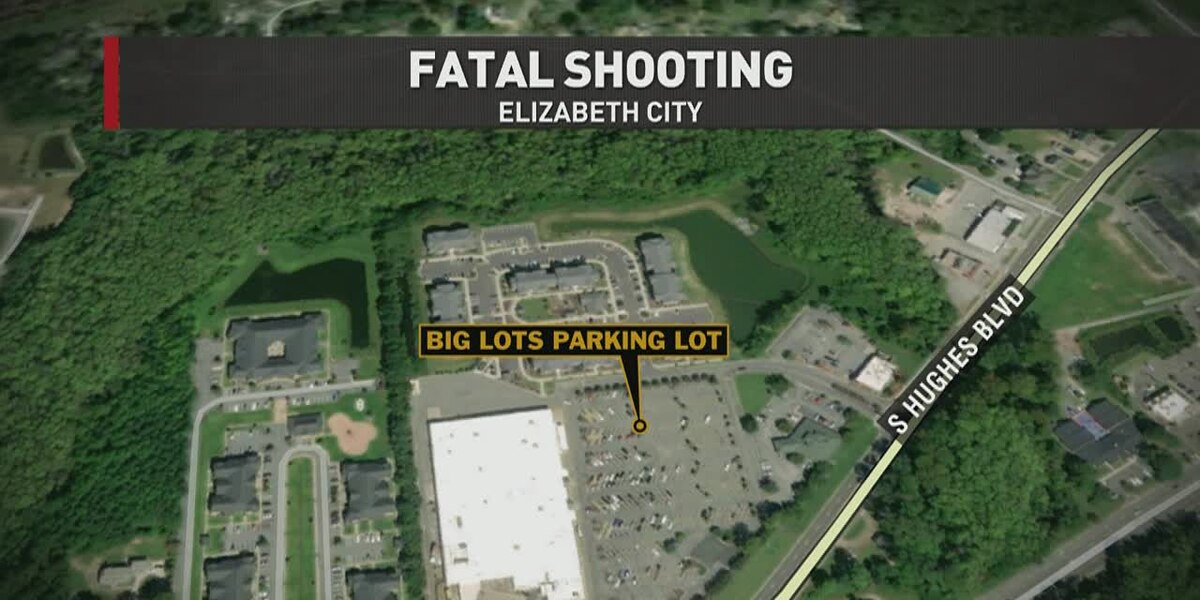

Multiple Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025 -

The Future Of Apple Its Ai Strategy And Market Position

May 09, 2025

The Future Of Apple Its Ai Strategy And Market Position

May 09, 2025 -

Edmonton School Projects 14 Initiatives To Proceed Rapidly

May 09, 2025

Edmonton School Projects 14 Initiatives To Proceed Rapidly

May 09, 2025 -

Uy Scuti Release Date Young Thugs New Album Update

May 09, 2025

Uy Scuti Release Date Young Thugs New Album Update

May 09, 2025