Pakistan Stock Exchange Outage Amidst Market Instability And Rising Tensions

Table of Contents

The PSX Outage: Technical Glitch or Something More Sinister?

The official explanation for the PSX outage pointed towards a technical malfunction, citing unspecified system issues that disrupted trading activities. However, the timing of the outage, coinciding with already heightened market instability, has fueled speculation about deeper, more concerning causes.

- Official PSX statement regarding the outage: While the PSX released a statement acknowledging the outage, specific details regarding the root cause remained limited, leading to increased uncertainty. (Note: Insert actual statement here if available).

- Timeline of events: The outage reportedly began at [Insert Start Time] and lasted for approximately [Insert Duration]. This period of inactivity significantly impacted trading volumes and investor sentiment.

- Impact on trading activity and investor confidence: The sudden halt in trading led to significant losses for some investors and further eroded already fragile confidence in the PSX. Trading volumes plummeted, and many investors remained hesitant to re-engage even after the exchange reopened.

- Speculation regarding the cause of the outage: While a technical glitch is the official narrative, speculation ranges from an overload of trading activity to the possibility of a cyberattack, although there is no evidence to support the latter claim at this time. This uncertainty itself contributes to the overall negative sentiment.

The impact on investor sentiment is undeniably negative. Financial analysts have expressed concerns that this incident could further deter both domestic and foreign investment in the Pakistani stock market, potentially leading to a prolonged period of instability. “[Insert Quote from a Financial Analyst here, if available]”, one expert stated, highlighting the growing unease.

Market Instability in Pakistan: Underlying Economic Factors

The PSX outage is not an isolated event; it reflects a broader picture of market instability rooted in Pakistan's underlying economic challenges.

- Current state of the Pakistani Rupee against major currencies: The Pakistani Rupee has experienced significant devaluation against major currencies like the US dollar, adding to inflationary pressures and impacting import costs.

- Inflation rates and their impact on consumer spending: Soaring inflation rates are eroding consumer purchasing power, dampening economic activity, and reducing demand for goods and services.

- Foreign exchange reserves and their implications for economic stability: Low foreign exchange reserves raise concerns about Pakistan's ability to meet its import obligations and service its external debt, increasing vulnerability to external shocks.

- Government policies and their effect on the stock market: Government policies, particularly those related to fiscal and monetary management, play a significant role in shaping investor confidence and the overall performance of the PSX. Recent policies have, in some analysts' view, exacerbated the existing economic challenges.

The interplay between these economic factors and political tensions creates a volatile environment for the Pakistan Stock Exchange, making it exceedingly difficult to predict the market's trajectory.

Rising Tensions and Their Impact on Investor Confidence

Political and social tensions in Pakistan are significantly impacting investor confidence and contributing to the current market instability.

- Specific political events contributing to uncertainty: [Insert specific political events that have created uncertainty, such as political instability, elections, or policy changes] are cited as major factors eroding investor confidence.

- Impact of social unrest and protests on market sentiment: Social unrest and protests further amplify uncertainty, discouraging both domestic and foreign investment.

- How international relations are influencing investor confidence: Pakistan's relationships with other countries, particularly its geopolitical standing, also affect foreign investor sentiment and the flow of capital.

- Risk assessment for foreign investors in Pakistan’s current climate: The combined effect of economic instability and political uncertainty significantly increases the risk assessment for foreign investors, leading many to adopt a wait-and-see approach.

The flight of capital resulting from these tensions further exacerbates the existing economic challenges, creating a vicious cycle of instability and uncertainty. This outflow of investment can lead to a further economic downturn, impacting the PSX significantly.

The Future of the PSX and Investor Strategies

Predicting the future trajectory of the PSX requires careful consideration of the various factors at play.

- Short-term and long-term forecasts for the Pakistani stock market: Short-term forecasts suggest continued volatility, while long-term prospects depend heavily on addressing the underlying economic and political challenges.

- Recommendations for investors considering Pakistani stocks: Investors considering Pakistani stocks should adopt a cautious approach, diversifying their portfolios and employing robust risk mitigation strategies.

- Government measures needed to restore investor confidence and stabilize the market: The government needs to implement credible economic reforms, address political instability, and ensure transparency to regain investor confidence. International assistance could also play a vital role.

- Potential role of international organizations in providing financial assistance: International financial institutions can potentially provide financial assistance and technical support to help stabilize the Pakistani economy and the PSX.

Despite the current challenges, opportunities may arise for investors with a long-term perspective and a high-risk tolerance who are willing to navigate this complex and unstable market.

Conclusion:

The Pakistan Stock Exchange outage serves as a stark reminder of the vulnerabilities within the Pakistani economy and the significant impact of political and social instability on investor confidence. The underlying economic challenges, coupled with rising tensions, create a volatile environment fraught with risk. The future of the PSX hinges on addressing these fundamental issues and restoring investor confidence.

Understanding the complexities of the Pakistan Stock Exchange and its current instability is crucial for informed investment decisions. Stay informed about future developments in the Pakistan Stock Exchange to make sound financial choices in this dynamic and uncertain market. Continuously monitor news and analysis related to PSX outages and market instability in Pakistan to mitigate risks effectively. Careful analysis of the Pakistan Stock Exchange is vital for all investors.

Featured Posts

-

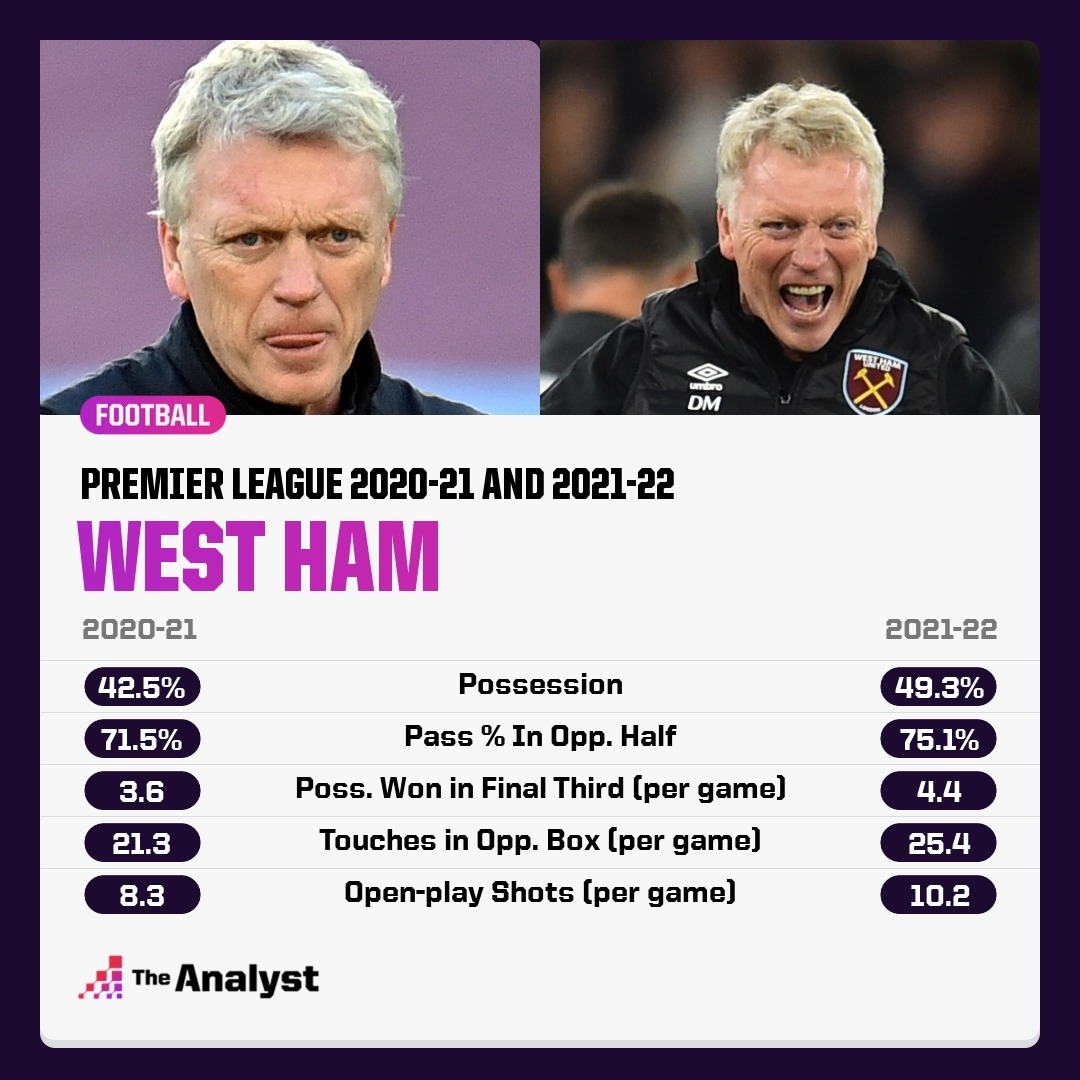

Analyzing West Hams Predicted 25m Financial Shortfall

May 09, 2025

Analyzing West Hams Predicted 25m Financial Shortfall

May 09, 2025 -

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025 -

Bayern Munich Vs Eintracht Frankfurt Who Will Win Prediction And Analysis

May 09, 2025

Bayern Munich Vs Eintracht Frankfurt Who Will Win Prediction And Analysis

May 09, 2025 -

West Hams 25m Financial Gap How Will They Plug It

May 09, 2025

West Hams 25m Financial Gap How Will They Plug It

May 09, 2025 -

Disney Parks And Streaming Fuel Higher Profit Projections

May 09, 2025

Disney Parks And Streaming Fuel Higher Profit Projections

May 09, 2025