Pakistan Stock Market Crisis: Operation Sindoor Triggers Sharp Decline

Table of Contents

Understanding Operation Sindoor and its Market Implications

Operation Sindoor, while its precise details remain somewhat opaque, is understood to be a government crackdown targeting specific sectors and individuals suspected of various financial irregularities. The operation's goals, ostensibly aimed at curbing corruption and illicit financial activities, employed methods perceived as heavy-handed by many. This approach created significant uncertainty and fueled a climate of fear within the market.

Operation Sindoor's actions directly impacted investor confidence in several ways:

- Increased regulatory scrutiny and its effects: The intensified scrutiny led to a chilling effect, discouraging investment and prompting some businesses to delay expansion plans. This uncertainty impacted the overall market sentiment.

- Uncertainty surrounding future policy decisions: The ambiguity surrounding Operation Sindoor's scope and future actions created considerable uncertainty, making investors hesitant to commit further capital. The lack of transparency fueled speculation and anxiety.

- Impact on foreign investment: The crisis significantly damaged Pakistan's reputation as a stable investment destination, leading to a slowdown in foreign direct investment (FDI). International investors are particularly sensitive to political and regulatory risks.

- Loss of investor trust in the market's stability: The sharp market decline eroded investor trust, triggering a sell-off as many sought to minimize their losses and exit the market. This loss of confidence is a severe blow to market stability.

The Immediate Fallout: Analyzing the Market Crash

The initiation of Operation Sindoor resulted in a dramatic market crash. The KSE-100 index plummeted by [Insert Percentage Drop Here]% within [Timeframe], marking one of the most significant single-day drops in the Pakistan Stock Market's history. Trading volume spiked initially, reflecting panic selling, before subsiding as many investors adopted a wait-and-see approach.

Several sectors were disproportionately affected:

- Specific examples of companies experiencing significant losses: [List specific examples of companies from affected sectors and their percentage losses]. These losses highlight the widespread impact of Operation Sindoor.

- Impact on different investor categories (retail, institutional): Retail investors, often less sophisticated and more susceptible to panic, were particularly hard hit. Institutional investors also suffered losses, though their ability to withstand volatility is generally greater.

- Analysis of trading volume and volatility: The initial surge in trading volume underscored the panic selling. Subsequent trading displayed increased volatility as investors grappled with the uncertain market conditions.

Long-Term Consequences and Economic Ramifications

The Pakistan Stock Market crisis stemming from Operation Sindoor has far-reaching economic implications:

- Potential for capital flight: The uncertainty created by the operation could lead to capital flight as investors seek safer havens for their investments. This would further weaken the Pakistani Rupee and hamper economic growth.

- Impact on economic growth and development: Reduced investor confidence, decreased FDI, and potential capital flight negatively impact economic growth and development, potentially hindering progress on key development goals.

- Government measures to stabilize the market: The government's response to the crisis will be critical. [Mention any government interventions or policy announcements]. The effectiveness of these measures will determine the speed of market recovery.

- Analysis of the credibility of future government policies: The handling of this crisis will significantly impact the credibility of future government policies and the perception of Pakistan as a reliable investment destination. Transparency and consistent policy-making are essential for rebuilding investor trust.

Investor Sentiment and Future Outlook for the Pakistan Stock Market

Investor sentiment remains cautious in the aftermath of the Operation Sindoor-induced Pakistan Stock Market crisis. Many are adopting a wait-and-see approach, awaiting clearer signals regarding the government's future actions and the long-term implications for the market.

- Expert opinions and predictions on market recovery: [Include quotes or summaries of expert opinions on the potential for market recovery and the timeframe].

- Advice for investors regarding risk management: Investors should adopt a cautious approach, diversifying their portfolios and employing risk management strategies. Seeking professional financial advice is crucial during these uncertain times.

- Potential investment opportunities amidst the crisis: While the situation remains volatile, some undervalued assets may emerge as opportunities for long-term investors with a higher risk tolerance. Thorough due diligence is essential.

- Long-term prospects for the Pakistani stock market: The long-term prospects for the Pakistan Stock Market hinge on several factors including government policy, investor confidence, and the overall global economic climate.

Conclusion

The Pakistan Stock Market crisis triggered by Operation Sindoor has revealed significant vulnerabilities in the market and highlighted the importance of investor confidence. The immediate fallout has been severe, impacting various sectors and investor categories. The long-term consequences remain uncertain, but government response and investor sentiment will play crucial roles in shaping the future of the Pakistan Stock Market.

Understanding the complexities of the Pakistan Stock Market crisis and Operation Sindoor is crucial for investors and analysts alike. Stay informed about the evolving situation to make informed decisions and navigate the challenges presented by this significant market downturn. Further research into the implications of Operation Sindoor on the Pakistan Stock Market is essential for future economic stability.

Featured Posts

-

Wynne Evans Illness Update Recovery And Future Performances

May 10, 2025

Wynne Evans Illness Update Recovery And Future Performances

May 10, 2025 -

West Hams 25m Financial Hole Potential Solutions And Consequences

May 10, 2025

West Hams 25m Financial Hole Potential Solutions And Consequences

May 10, 2025 -

Dijon Concarneau 0 1 Resume Du Match De National 2 04 04 2025

May 10, 2025

Dijon Concarneau 0 1 Resume Du Match De National 2 04 04 2025

May 10, 2025 -

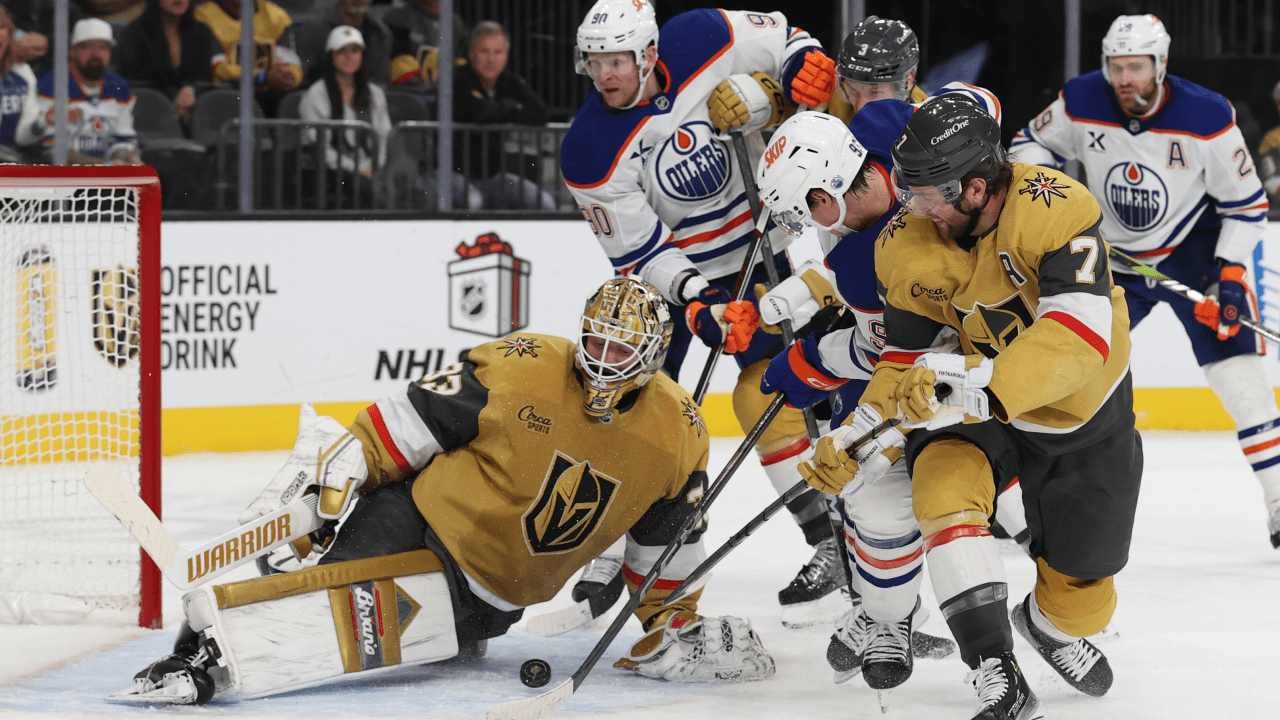

Hills Shutout Performance Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025

Hills Shutout Performance Propels Golden Knights To 4 0 Win Over Blue Jackets

May 10, 2025 -

Dijon Vehicule Percutant Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025

Dijon Vehicule Percutant Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025