Palantir (PLTR) Stock: A Look Ahead To May 5th

Table of Contents

Palantir's Q1 2024 Earnings Report and its Impact on PLTR Stock

The impending Q1 2024 earnings report is a crucial catalyst for Palantir (PLTR) stock price movement. Analyst predictions vary, making the potential for both positive and negative surprises significant for PLTR future performance.

Expected Revenue and Growth Projections

Investors will keenly scrutinize several key financial metrics:

- Revenue Growth: The percentage increase in revenue compared to the same period last year. A significant increase would signal strong growth and potentially boost the stock price.

- Operating Margins: A key indicator of profitability, showing the efficiency of Palantir's operations. Improved margins will generally be viewed favorably by investors.

- Customer Acquisition: The number of new customers acquired during the quarter is a crucial measure of Palantir's market penetration and growth potential.

- Remaining Performance Obligations (RPO): This metric indicates the value of future revenue secured through existing contracts, offering insight into future growth prospects.

Exceeding expectations regarding revenue growth and operating margins could lead to a surge in PLTR stock price, while falling short could trigger a downturn. The market’s reaction will heavily depend on the overall narrative presented by management during the earnings call.

Key Strategic Initiatives and Partnerships

Investors will also be looking for updates on significant strategic initiatives and partnerships. Any announcements concerning:

- New government contracts, especially large-scale deals.

- Progress on key technological advancements, such as improvements to Palantir's AI capabilities.

- New commercial partnerships that expand Palantir's reach into new markets.

Successful collaborations and strategic moves will positively impact investor sentiment and fuel confidence in the long-term growth potential of PLTR, potentially boosting the stock price.

Geopolitical Factors and their Influence on Palantir Stock

Palantir's business is intrinsically linked to geopolitical events and government spending. Understanding these factors is crucial for a comprehensive PLTR investment analysis.

Government Contracts and Spending

A significant portion of Palantir's revenue comes from government contracts, primarily in the US and allied nations.

- Key Government Clients: The US government, along with other intelligence agencies and defense organizations, are major clients.

- Potential Changes in Government Spending: Changes in defense budgets or shifts in geopolitical priorities can directly influence contract awards and revenue streams.

Any indication of reduced government spending or a shift in priorities could negatively impact PLTR stock price, while substantial new contract wins could drive significant growth.

Global Market Conditions and Economic Uncertainty

Macroeconomic factors also play a crucial role.

- Inflation and Interest Rates: Rising interest rates and persistent inflation can impact investor confidence and reduce appetite for riskier investments like PLTR stock.

- Recessionary Fears: Concerns about a potential recession could further dampen investor sentiment and lead to a sell-off.

Economic uncertainty can significantly impact Palantir's valuation, as investors reassess the company's growth potential in a less favorable economic climate.

Technical Analysis of PLTR Stock Before May 5th

Technical analysis can provide valuable insights into potential short-term price movements.

Chart Patterns and Support/Resistance Levels

Analyzing the PLTR stock chart can reveal crucial information:

- Support and Resistance Levels: Identifying key price levels where buying or selling pressure is expected to be strong can help predict potential price reversals.

- Trendlines and Moving Averages: These technical indicators can help determine the overall trend and potential momentum shifts.

(Insert chart/graph here illustrating key technical indicators)

These indicators can provide short-term predictions for PLTR stock. A breakout above resistance could signal a bullish trend, while a break below support could suggest bearish pressure.

Trading Volume and Investor Sentiment

Monitoring trading volume and investor sentiment provides additional context:

- Short Interest: High short interest can suggest potential upward pressure as short-sellers are forced to cover their positions.

- Options Trading Activity: Unusual option activity can indicate significant investor expectations, either bullish or bearish.

- Social Media Sentiment: Analyzing social media conversations about PLTR can offer insights into overall investor sentiment.

These factors can help predict short-term price fluctuations, although they are not reliable indicators of long-term performance.

Conclusion: Palantir (PLTR) Stock: Investing Ahead of May 5th

The upcoming Q1 2024 earnings report and prevailing geopolitical factors are key influencers on Palantir (PLTR) stock price leading up to May 5th. Technical analysis adds another layer of insight, revealing potential short-term price fluctuations based on chart patterns and investor sentiment. The interplay of these factors creates a complex picture, with both upside and downside potential for PLTR stock. While this analysis provides valuable insights into the potential trajectory of Palantir (PLTR) stock before May 5th, remember to conduct your own thorough research and consider your risk tolerance before making any investment decisions. Stay informed about PLTR's performance and upcoming announcements to make well-informed choices regarding your Palantir investments. Understanding these factors is key to making an effective PLTR investment strategy.

Featured Posts

-

Chainalysis And Alterya Merger A New Era In Blockchain Technology

May 10, 2025

Chainalysis And Alterya Merger A New Era In Blockchain Technology

May 10, 2025 -

Focus On De Escalation Key Outcomes Of This Weeks U S China Trade Talks

May 10, 2025

Focus On De Escalation Key Outcomes Of This Weeks U S China Trade Talks

May 10, 2025 -

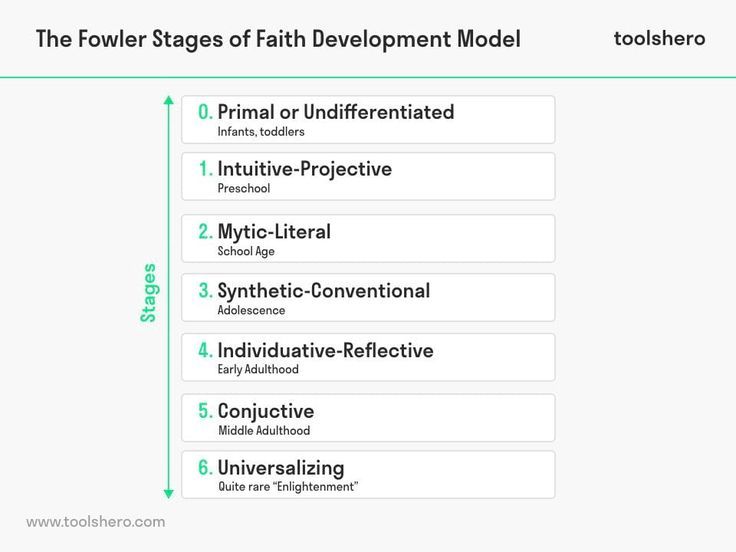

Reflecting On High Potential 11 Years Of Psych Spiritual Development

May 10, 2025

Reflecting On High Potential 11 Years Of Psych Spiritual Development

May 10, 2025 -

Dijon Concarneau 0 1 Resume Du Match De National 2 04 04 2025

May 10, 2025

Dijon Concarneau 0 1 Resume Du Match De National 2 04 04 2025

May 10, 2025 -

Family Demands Justice Following Unprovoked Racist Murder

May 10, 2025

Family Demands Justice Following Unprovoked Racist Murder

May 10, 2025