Palantir Stock: 40% Increase Predicted For 2025 - Time To Invest?

Table of Contents

Analyzing the 40% Palantir Stock Price Prediction for 2025

Factors Contributing to the Positive Forecast

The optimistic Palantir stock price prediction for 2025 is fueled by several key factors. The increasing demand for sophisticated big data analytics solutions is a significant driver. Governments and commercial enterprises alike are increasingly reliant on advanced data processing and AI-powered insights to make critical decisions, creating a booming market for Palantir's specialized platforms.

- Government Contracts: Palantir enjoys significant government contracts, particularly in defense and intelligence, providing a steady revenue stream and demonstrating the robustness of its technology in high-stakes environments.

- Technological Advancements: Palantir continuously invests in research and development, pushing the boundaries of AI, machine learning, and data integration. This commitment to innovation ensures its solutions remain at the forefront of the data analytics market. Recent advancements in their Foundry platform are particularly promising.

- Strategic Partnerships: Strategic partnerships with leading technology companies broaden Palantir's reach and enhance its product offerings, further fueling growth.

These factors, supported by positive analyst reports and recent successful product launches, contribute to the positive forecast for Palantir stock. However, a balanced assessment requires considering potential downsides.

Potential Risks and Challenges to Consider

While the outlook for Palantir appears positive, several potential risks warrant consideration before investing in Palantir stock. The tech sector is inherently volatile, and economic downturns could negatively impact Palantir's growth trajectory.

- Market Volatility: The unpredictable nature of the stock market poses a significant risk. Even with positive predictions, Palantir's stock price can fluctuate dramatically.

- Competition: The data analytics market is increasingly competitive. Established players and new entrants constantly challenge Palantir's market share.

- Regulatory Hurdles: Government regulations and data privacy concerns could pose challenges to Palantir's operations, impacting its growth and profitability.

Palantir's Financial Performance and Growth Trajectory

Revenue Growth and Profitability

Analyzing Palantir's financial performance reveals a company experiencing substantial revenue growth, albeit with some fluctuations. Examining past earnings reports reveals a clear trend, albeit with some quarters showing stronger performance than others. Visualizing this data through charts and graphs allows for a clear understanding of Palantir’s growth trajectory. This financial data should be considered alongside the company's strategic initiatives and market position to arrive at a comprehensive assessment.

Customer Acquisition and Retention

Palantir's success hinges on its ability to acquire and retain high-value clients. Their diverse client base, spanning various industries and government agencies, demonstrates the versatility and effectiveness of their platforms. Successful case studies highlighting the positive impact of Palantir's solutions on client operations further strengthen their position. A strong customer retention rate is a key indicator of long-term success and profitability for Palantir.

Comparing Palantir Stock to Competitors in the Data Analytics Market

Competitive Analysis

To fully assess the investment potential of Palantir stock, a thorough competitive analysis is crucial. Palantir faces competition from established players like [Competitor Name 1], [Competitor Name 2], and [Competitor Name 3]. A comparison of market share, financial performance, and technological capabilities offers a valuable perspective on Palantir's competitive advantage and its potential for future growth. Analyzing their respective strengths and weaknesses provides a context within which to evaluate Palantir’s market position and potential.

Investment Strategies and Considerations for Palantir Stock

Risk Tolerance and Investment Goals

Before investing in Palantir stock, it’s paramount to assess your individual risk tolerance and investment goals. Investing in Palantir, or any technology stock, carries inherent risk. A long-term investment strategy might be more suitable for those comfortable with potential volatility, while a more cautious approach might involve diversification across different asset classes. Day trading Palantir stock, given its volatility, is extremely risky and not recommended for inexperienced investors.

Diversification and Portfolio Management

Diversification is a cornerstone of sound investment practice. Investing solely in Palantir stock could expose your portfolio to significant risk. A well-diversified portfolio, incorporating various asset classes, mitigates risk and enhances overall returns. Before making any significant investment decisions, it’s strongly recommended that you consult with a qualified financial advisor.

Conclusion: Is Palantir Stock a Smart Investment for 2025?

The 40% Palantir stock price prediction for 2025 is based on positive growth indicators such as increasing demand for big data analytics, Palantir's technological advancements, and its strong client base. However, potential risks, including market volatility and competition, must also be carefully considered. The decision of whether or not to invest in Palantir stock depends entirely on your individual risk tolerance, investment goals, and a thorough understanding of the company’s financial performance and market position. Conduct your own due diligence, consult a financial advisor, and consider a diversified investment strategy before making any decisions regarding Palantir stock. Further research into effective Palantir investment strategies is strongly recommended.

Featured Posts

-

Wall Streets Palantir Prediction Before May 5th Should You Invest

May 10, 2025

Wall Streets Palantir Prediction Before May 5th Should You Invest

May 10, 2025 -

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 10, 2025

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 10, 2025 -

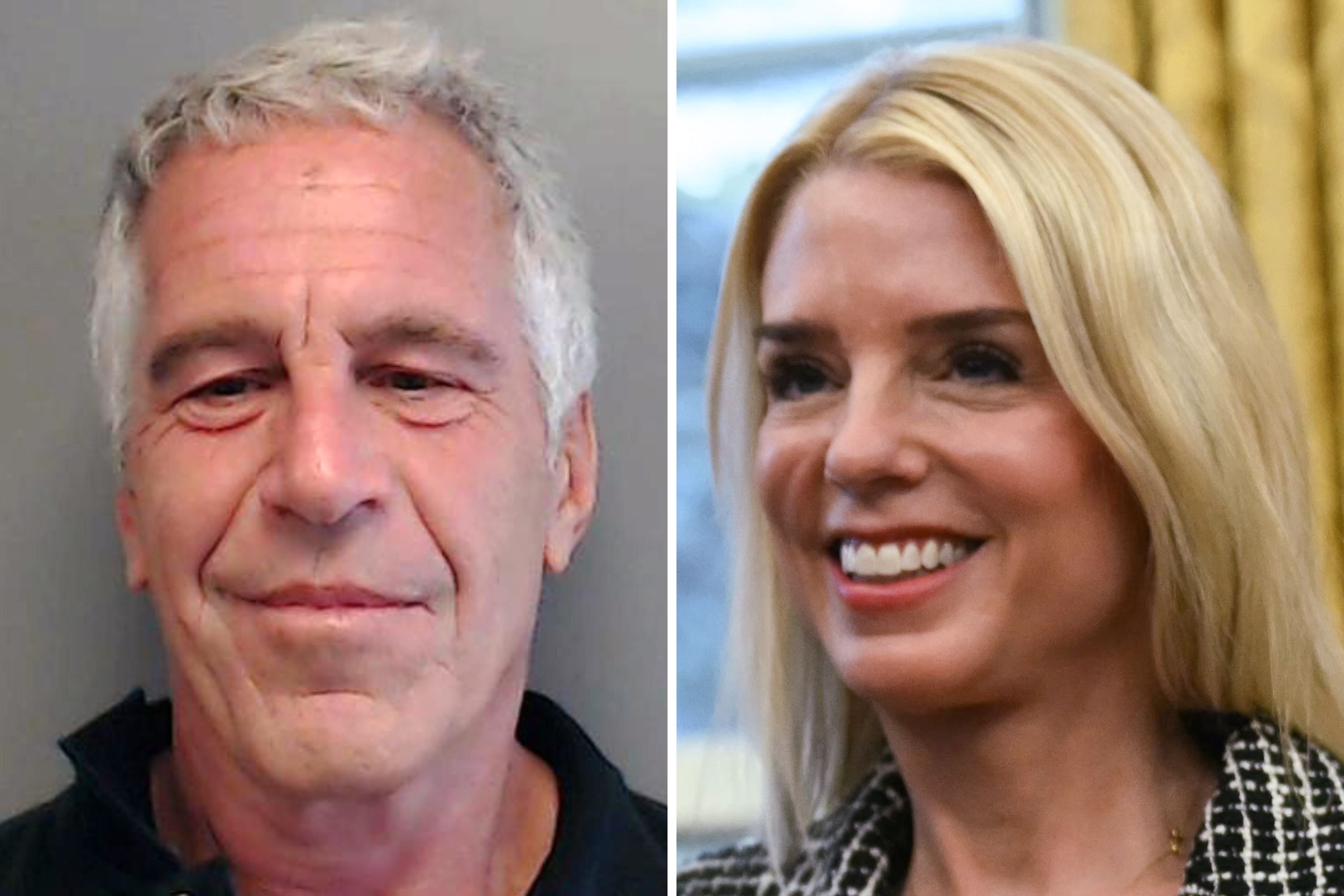

The Epstein Client List Pam Bondis Claims And Their Implications

May 10, 2025

The Epstein Client List Pam Bondis Claims And Their Implications

May 10, 2025 -

Trump Issues 10 Tariff Warning Exceptional Deals Only Exempt

May 10, 2025

Trump Issues 10 Tariff Warning Exceptional Deals Only Exempt

May 10, 2025 -

Itogi Vstrechi Zelenskogo I Trampa V Vatikane Zayavlenie Makrona

May 10, 2025

Itogi Vstrechi Zelenskogo I Trampa V Vatikane Zayavlenie Makrona

May 10, 2025