Palantir Stock: A 30% Dip - Buy Or Sell?

Table of Contents

Understanding the 30% Dip: Causes and Context

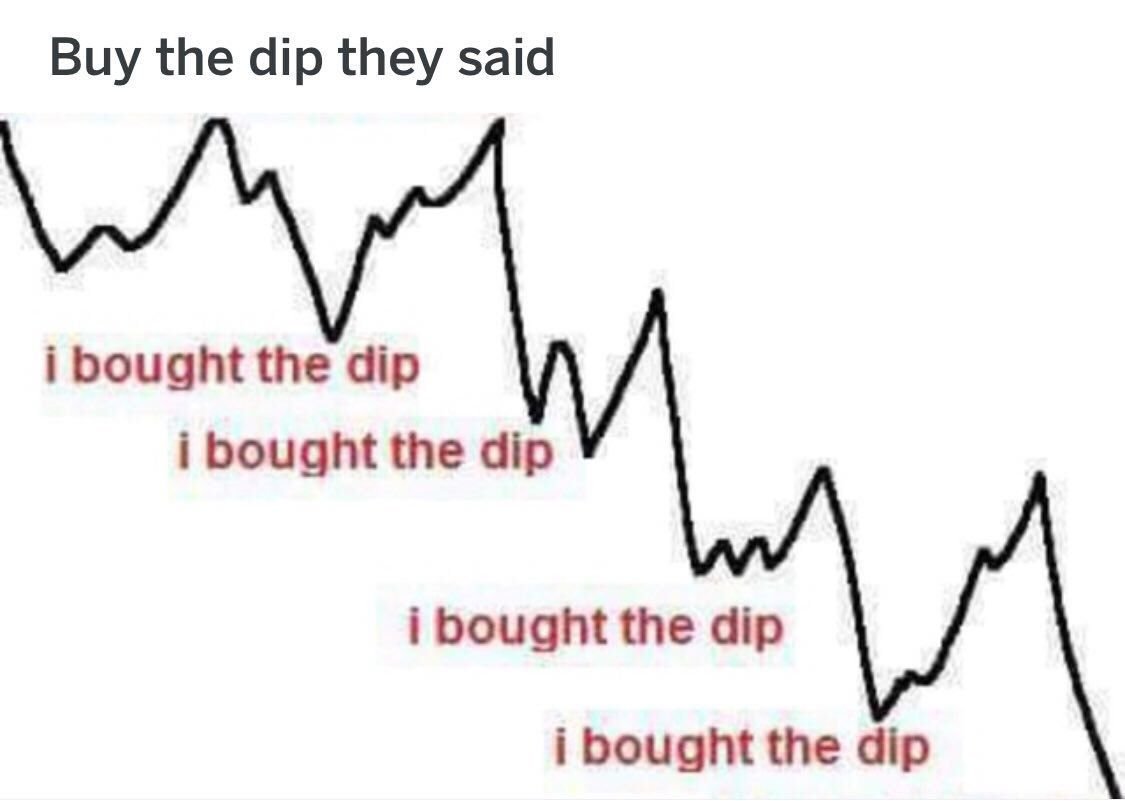

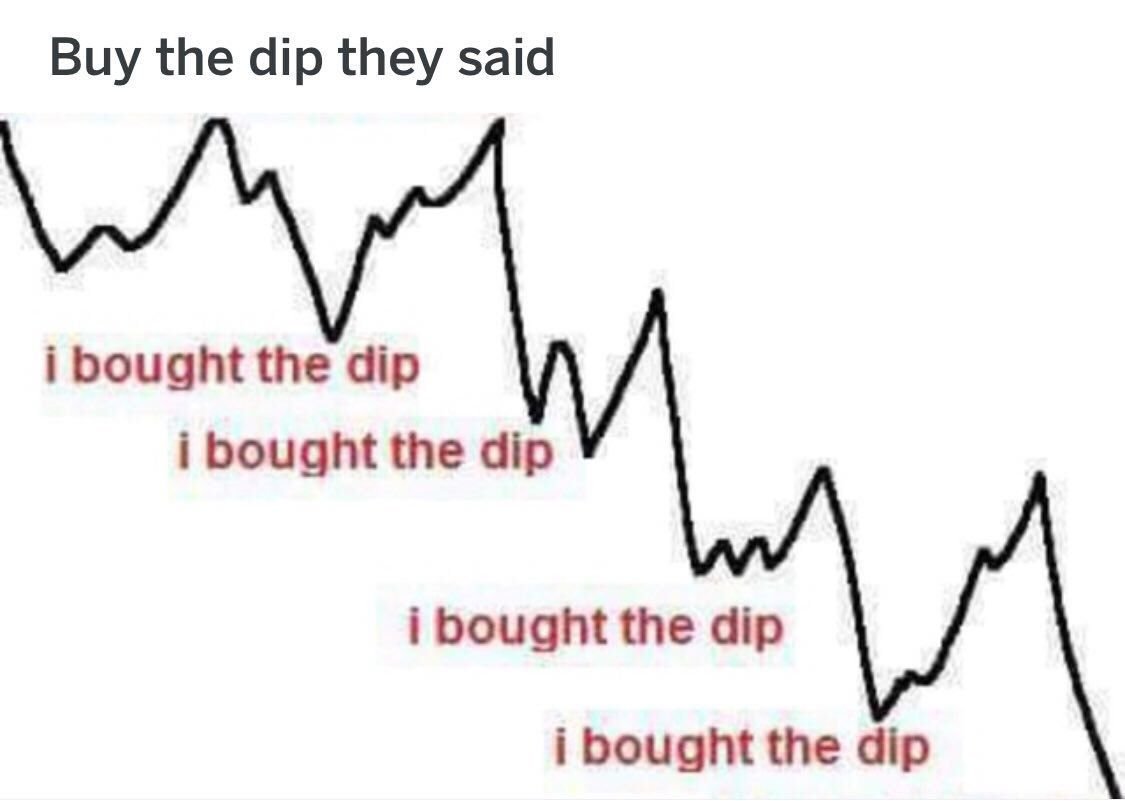

The recent 30% drop in Palantir stock price is a complex issue stemming from a confluence of factors affecting both the broader market and Palantir's specific circumstances.

Market Sentiment and Broader Economic Factors

The current market environment has significantly impacted growth stocks like Palantir. Several key factors contribute to this negative sentiment:

- Impact of rising interest rates: Increased interest rates make borrowing more expensive, impacting companies relying on debt financing for growth, like many tech firms. This negatively affects investor confidence in high-growth, yet often unprofitable, companies.

- General tech sector downturn: The tech sector as a whole has experienced a downturn, with many tech giants seeing their stock valuations decrease. This broader trend often pulls down even relatively strong performers like Palantir.

- Investor sentiment towards growth stocks: Investors are generally shifting away from high-growth, high-risk stocks in favor of more stable, value-oriented investments during periods of economic uncertainty.

Palantir's Recent Financial Performance and News

While market conditions play a role, Palantir's recent performance and news also contribute to the stock price dip. Analyzing these factors is crucial for a comprehensive understanding:

- Revenue growth analysis: While Palantir has shown revenue growth, the rate of growth may have fallen short of investor expectations, leading to selling pressure.

- Profitability trends: Palantir's path to profitability is a key concern for investors. Any setbacks or delays in achieving profitability can negatively impact the stock price.

- New contracts and partnerships: Announcements of significant new contracts, especially with government agencies, can positively impact the PLTR stock price. Conversely, a lack of such announcements could contribute to negative sentiment.

- Any recent negative press or regulatory concerns: Negative news, even if unrelated to the company's core business, can impact investor confidence and lead to selling.

Evaluating Palantir's Long-Term Potential: A Bull Case

Despite the recent downturn, several factors suggest a bullish outlook for Palantir in the long term.

Growth Prospects in Government and Commercial Sectors

Palantir operates in two key sectors with significant growth potential:

- Government contracts and partnerships: Palantir's Gotham platform is a significant player in government data analysis, providing a strong foundation for future growth through continued government contracts and expansions into new agencies.

- Expansion into new commercial sectors: Palantir is actively expanding its commercial offerings, targeting a wider range of industries beyond its initial focus. Success in this area could significantly boost revenue and profitability.

- Technological innovation and product development: Palantir's commitment to innovation and development of new products and features positions the company for future growth and competitive advantage.

- Potential for disruptive technologies (AI, etc.): Palantir's incorporation of AI and other cutting-edge technologies could disrupt the data analytics market, potentially driving significant future growth.

Assessing Palantir's Valuation

Determining whether the current Palantir share price accurately reflects the company's long-term value requires a thorough valuation analysis:

- Comparison to competitors: Comparing Palantir's valuation metrics (like price-to-sales ratio) to competitors in the data analytics market can provide insights into whether the stock is undervalued or overvalued.

- Discounted cash flow analysis (if applicable): A discounted cash flow analysis, which projects future cash flows and discounts them to their present value, can provide an estimate of the intrinsic value of Palantir's stock.

- Potential for future earnings growth: Analysts' projections for future earnings growth are crucial in assessing the potential upside of investing in Palantir stock.

Weighing the Risks: A Bear Case

While the long-term potential for Palantir is promising, several risks warrant consideration:

Concerns About Profitability and Sustainability

Palantir faces challenges in achieving sustained profitability and long-term growth:

- Competition in the data analytics market: The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share.

- Dependence on government contracts: Palantir's significant reliance on government contracts exposes it to potential risks associated with government budget cuts or changes in procurement policies.

- High operating costs: Palantir's high operating costs could hinder its profitability in the short term.

- Potential for future economic downturns: Economic downturns could negatively impact demand for Palantir's services, particularly in the commercial sector.

Risks Associated with Investing in Growth Stocks

Investing in high-growth companies like Palantir inherently involves significant risk:

- Market fluctuations: Growth stocks are often more volatile than established companies, meaning that their prices can fluctuate significantly in response to market conditions.

- Potential for further price drops: There's always a possibility of further price drops, especially given the current market uncertainty.

- Importance of diversification in investment portfolios: It's essential to diversify your investment portfolio to mitigate the risks associated with investing in individual stocks like Palantir.

Conclusion: Should You Buy or Sell Palantir Stock?

The recent 30% dip in Palantir stock presents a complex investment scenario. While the company's long-term potential in the government and commercial sectors is significant, concerns about profitability and market volatility remain. Based on this analysis, investors with a higher risk tolerance and a long-term outlook might consider Palantir stock at these lower prices, but thorough due diligence is crucial. The potential for significant returns needs to be weighed against the considerable risks involved. Before making any decisions regarding your Palantir stock, consult a financial advisor and conduct your own thorough research. Remember that this analysis is not financial advice.

Featured Posts

-

Solve Nyt Strands Tuesday March 4th Game 366 Hints And Answers

May 09, 2025

Solve Nyt Strands Tuesday March 4th Game 366 Hints And Answers

May 09, 2025 -

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025 -

Bed Antqalh Llahly Almsry Madha Qdm Fyraty Me Alerby

May 09, 2025

Bed Antqalh Llahly Almsry Madha Qdm Fyraty Me Alerby

May 09, 2025 -

Daycare And Young Children Weighing The Risks

May 09, 2025

Daycare And Young Children Weighing The Risks

May 09, 2025 -

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025