Palantir Stock: A Pre-May 5th Investment Strategy

Table of Contents

Palantir's Recent Performance and Market Sentiment

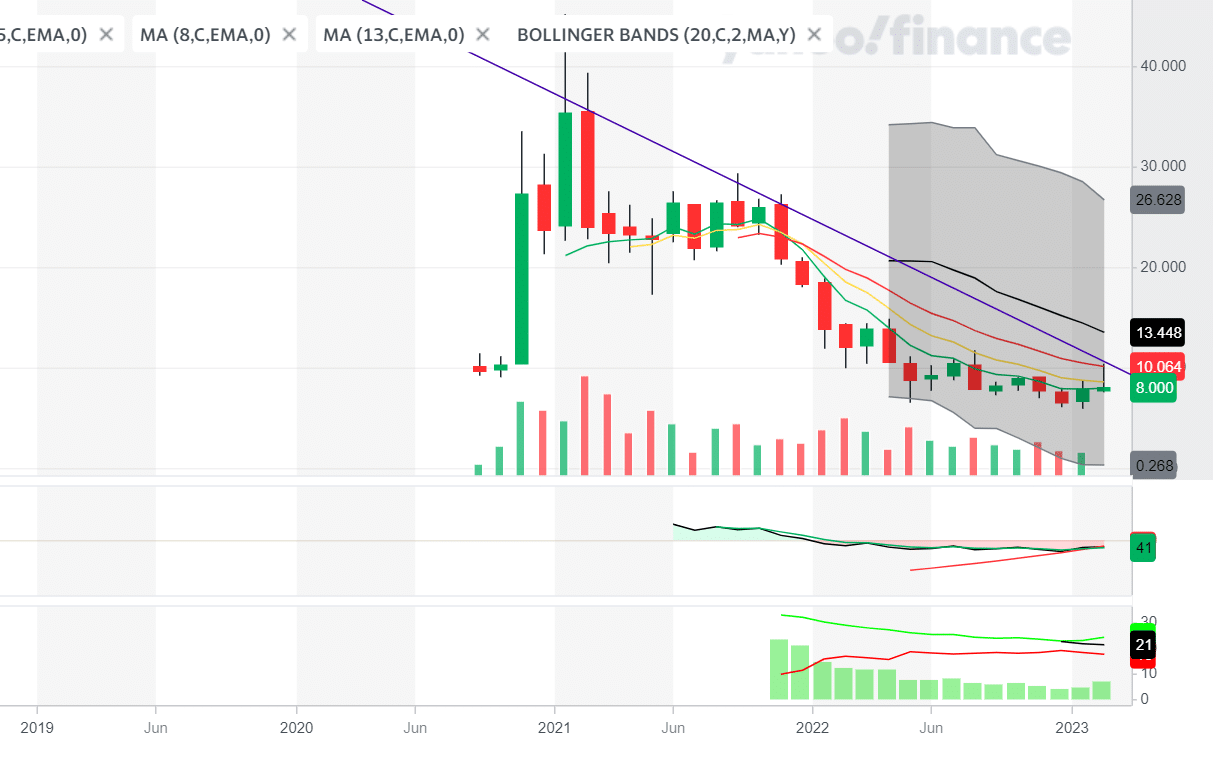

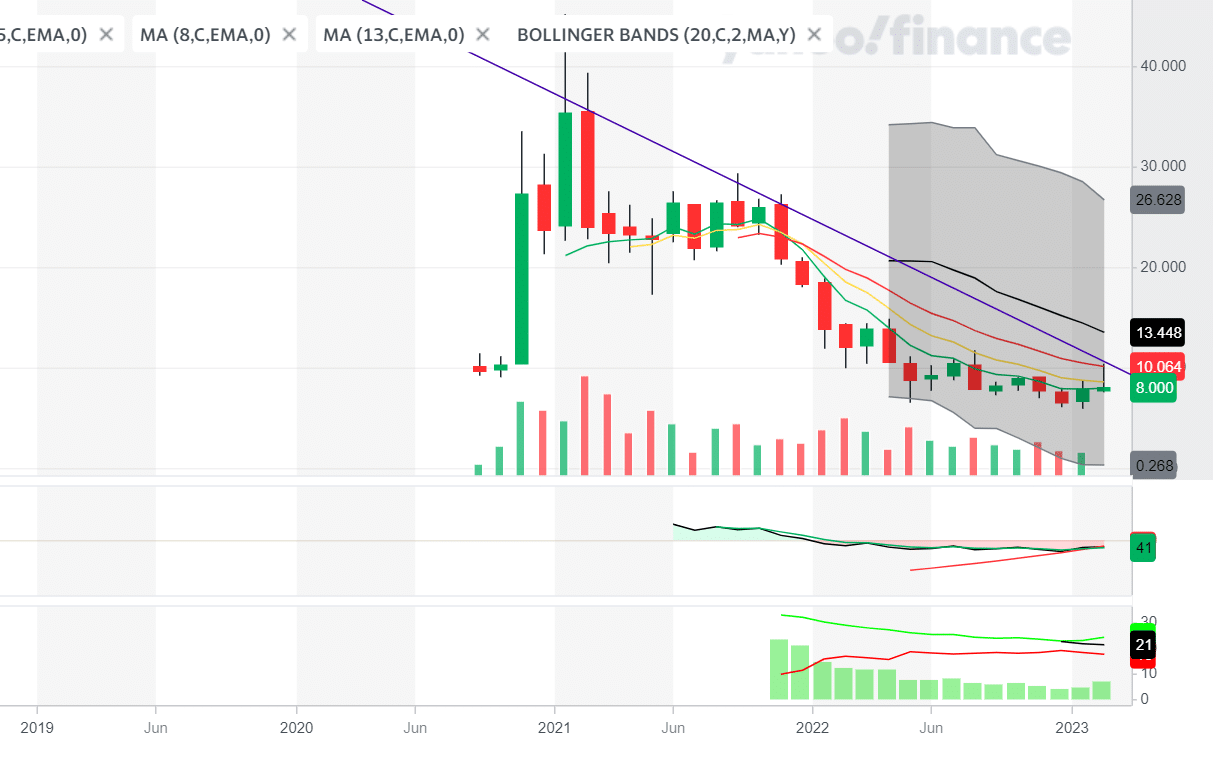

Palantir's stock price has experienced volatility in recent months, reflecting the broader tech market fluctuations and investor sentiment towards the company. Understanding this recent performance is crucial for any pre-May 5th investment strategy. Analyzing market sentiment requires looking at various sources, including news articles, analyst reports, and social media discussions.

- Key Events Impacting PLTR Stock Price: Recent contract wins with government agencies and large enterprises have positively influenced investor confidence. Conversely, concerns about slowing revenue growth in certain sectors have led to periods of price decline.

- Positive News: Successful product launches, strategic partnerships, and expansion into new markets have boosted investor optimism. Strong customer retention rates further reinforce a positive outlook for some analysts.

- Negative News: Concerns about profitability, competition in the big data analytics market, and the overall macroeconomic environment have contributed to periods of negative sentiment. Specific regulatory hurdles in certain regions have also been highlighted by some analysts.

- Relevant Statistics: As of [Insert Date], PLTR's stock price is [Insert Current Price], with a market capitalization of [Insert Market Cap]. Trading volume has [Increased/Decreased] recently, indicating [Increased/Decreased] investor activity. These statistics should be verified from a reputable financial source before making investment decisions.

Analyzing Palantir's Upcoming Earnings Report (if applicable)

The upcoming earnings report (or any relevant financial update around May 5th) will be a pivotal event for Palantir. This report will provide valuable insights into the company's financial health and future prospects, potentially significantly impacting the stock price. Analyst predictions vary, with some expecting strong growth and others forecasting more modest results.

- Key Metrics to Watch: Investors should closely monitor revenue growth, earnings per share (EPS), customer acquisition cost, and operating margins. The success of new product rollouts and contract renewals will also be crucial.

- Impact of Exceeding/Missing Expectations: Exceeding expectations could trigger a significant price surge, while missing targets could lead to a substantial drop. The market's reaction will depend on the magnitude of the surprise and the accompanying management commentary.

- Potential Risks and Uncertainties: Unforeseen challenges, such as supply chain disruptions or unexpected competition, could negatively affect the earnings report. Geopolitical events and shifts in government spending can also influence the results.

Long-Term Growth Potential of Palantir Technologies

Palantir operates in the rapidly expanding big data and government technology sectors, offering significant long-term growth potential. Its advanced data analytics platforms cater to a diverse range of clients, including government agencies, financial institutions, and healthcare organizations.

- Key Strengths and Competitive Advantages: Palantir possesses strong intellectual property, a highly skilled workforce, and a robust technology platform. Its strong relationships with government agencies provide a significant competitive advantage in the government sector.

- Future Market Opportunities and Expansion Plans: Palantir continues to expand its product offerings and target new markets. Growth opportunities exist in both the public and private sectors, with potential for expansion into emerging technologies like artificial intelligence and cloud computing.

- Risks Associated with Long-Term Investments: Investing in Palantir involves inherent risks. Competition from established tech giants, potential regulatory changes, and dependence on large government contracts pose challenges. A thorough understanding of these factors is crucial for making informed investment choices.

Crafting a Pre-May 5th Investment Strategy for Palantir Stock

Developing a pre-May 5th investment strategy requires considering your risk tolerance, investment goals, and understanding of Palantir's business model. There are various approaches, suitable for different investor profiles.

- Strategies for Short-Term Investors: Short-term investors might consider a trading strategy based on the upcoming earnings report, aiming to capitalize on price fluctuations. However, this approach carries higher risk.

- Strategies for Long-Term Investors: Long-term investors might prefer a buy-and-hold strategy, focusing on Palantir's long-term growth potential. This strategy mitigates the impact of short-term volatility.

- Diversification and Risk Management: Diversification is crucial for managing risk. Don't put all your eggs in one basket; spread your investments across different asset classes to reduce potential losses.

- Alternative Investment Options: Consider other companies in the technology sector that align with your investment goals and risk appetite. Thorough research is vital before making any investment decisions.

Conclusion

This pre-May 5th analysis of Palantir stock (PLTR) highlights the importance of considering recent performance, upcoming earnings reports, and long-term growth potential before making any investment decisions. Understanding market sentiment and potential risks is crucial for developing a successful Palantir investment strategy.

Call to Action: Before making any investment in Palantir stock, conduct thorough due diligence and consider consulting a financial advisor. Remember, this is not financial advice; carefully evaluate your risk tolerance before investing in Palantir or any other stock. Make informed decisions regarding your Palantir investment strategy before May 5th.

Featured Posts

-

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Visa Istorija

May 09, 2025

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Visa Istorija

May 09, 2025 -

Uk To Tighten Visa Rules For Pakistan Nigeria And Sri Lanka

May 09, 2025

Uk To Tighten Visa Rules For Pakistan Nigeria And Sri Lanka

May 09, 2025 -

Unprovoked Racist Killing Leaves Family Devastated

May 09, 2025

Unprovoked Racist Killing Leaves Family Devastated

May 09, 2025 -

West Hams Financial Situation A 25 Million Gap And The Path Forward

May 09, 2025

West Hams Financial Situation A 25 Million Gap And The Path Forward

May 09, 2025 -

Bayern Munich Vs Inter Milan Tactical Analysis And Predicted Outcome

May 09, 2025

Bayern Munich Vs Inter Milan Tactical Analysis And Predicted Outcome

May 09, 2025