Palantir Stock Forecast 2025: Is A 40% Rise Realistic?

Table of Contents

Palantir Technologies (PLTR) is a data analytics powerhouse, currently navigating a complex market landscape brimming with potential. Some analysts predict a significant 40% rise in Palantir stock by 2025, a proposition that warrants careful examination. This article aims to analyze the feasibility of this ambitious prediction, considering Palantir's current financial performance, market dynamics, and inherent risks. We will explore key factors influencing the Palantir stock price prediction, including government contracts, commercial sector growth, and the competitive landscape, ultimately providing a balanced perspective on the potential for PLTR stock investment. Keywords: Palantir stock, Palantir stock price prediction, Palantir forecast 2025, Palantir investment, PLTR stock.

2. Main Points:

2.1. Analyzing Palantir's Current Financial Performance and Growth Trajectory:

H3: Revenue Growth and Profitability: Palantir's recent financial reports reveal a mixed bag. While the company has demonstrated consistent year-over-year revenue growth, profitability margins remain a key area of focus. Analyzing key financial metrics like revenue, net income, and earnings per share (EPS) is crucial to assessing the sustainability of this growth.

- Key financial metrics: Investors should carefully review Palantir's quarterly and annual reports for detailed financial data. Comparing these figures to previous years allows for the assessment of growth rate trends.

- Growth rate sustainability: Analyzing the drivers of revenue growth (government contracts, commercial sales) is essential to determining whether the current growth trajectory is sustainable in the long term. Sustained profitability will be a key indicator of future success.

- Keyword integration: Palantir financials, Palantir revenue growth, PLTR earnings.

H3: Government vs. Commercial Contracts: Palantir's revenue streams are currently divided between government and commercial contracts. The balance between these two sectors significantly impacts future growth prospects.

- Revenue split: A detailed analysis of the percentage of revenue derived from each sector is crucial. Over-reliance on government contracts can expose the company to budgetary fluctuations and political uncertainties.

- Growth potential: The commercial sector holds significant growth potential but requires substantial investment in sales and marketing. Success in this sector is vital for long-term stability.

- Risk associated with government contract reliance: Heavy dependence on government contracts increases vulnerability to changes in government spending priorities. Diversifying revenue streams is critical to mitigating this risk.

- Keyword integration: Palantir government contracts, Palantir commercial clients, PLTR revenue diversification.

H3: Key Partnerships and Strategic Alliances: Palantir's strategic partnerships play a significant role in expanding its market reach and technological capabilities.

- Significant partnerships: Collaborations with major technology players and industry leaders can unlock new opportunities and accelerate growth. Analyzing these partnerships reveals the potential for future collaborations and expansion.

- Impact on market reach: Strategic alliances help Palantir access new markets and customer segments, boosting overall growth.

- Potential for future collaborations: The company's ongoing pursuit of strategic partnerships indicates a commitment to expanding its reach and influence within the data analytics market.

- Keyword integration: Palantir partnerships, Palantir collaborations, strategic alliances.

2.2. Evaluating Market Factors and Potential Risks:

H3: Competitive Landscape: The data analytics market is highly competitive, with major players like AWS, Google Cloud, and Microsoft vying for market share.

- Key competitors: Understanding the competitive advantages and disadvantages of Palantir relative to its competitors is crucial.

- Competitive advantages: Palantir's specialized software and expertise in data integration give it a unique position in the market. However, maintaining this edge requires continuous innovation.

- Potential market share erosion: The threat of market share erosion from larger, more established competitors is a significant risk.

- Keyword integration: Palantir competitors, data analytics market competition, PLTR competitive advantage.

H3: Macroeconomic Factors: Macroeconomic conditions significantly influence investor sentiment and stock prices.

- Impact of inflation, interest rate hikes, and economic downturns: Economic uncertainty can negatively impact investor confidence, leading to decreased demand for Palantir's services.

- Investor sentiment: Fluctuations in the broader market and economic outlook directly affect the valuation of Palantir stock.

- Keyword integration: Palantir stock and the economy, macroeconomic factors affecting PLTR, market sentiment.

H3: Technological Advancements and Innovation: The rapid pace of technological advancements in the data analytics field necessitates continuous innovation.

- New technologies impacting the data analytics market: Emerging technologies like artificial intelligence (AI) and machine learning (ML) are transforming the data analytics landscape.

- Palantir’s R&D efforts: Palantir's commitment to research and development is vital for maintaining its competitive edge.

- Potential for disruptive innovation: The potential for disruptive innovations to emerge and challenge Palantir's position is a key risk.

- Keyword integration: Palantir technology, AI in data analytics, PLTR innovation.

2.3. Technical Analysis and Valuation:

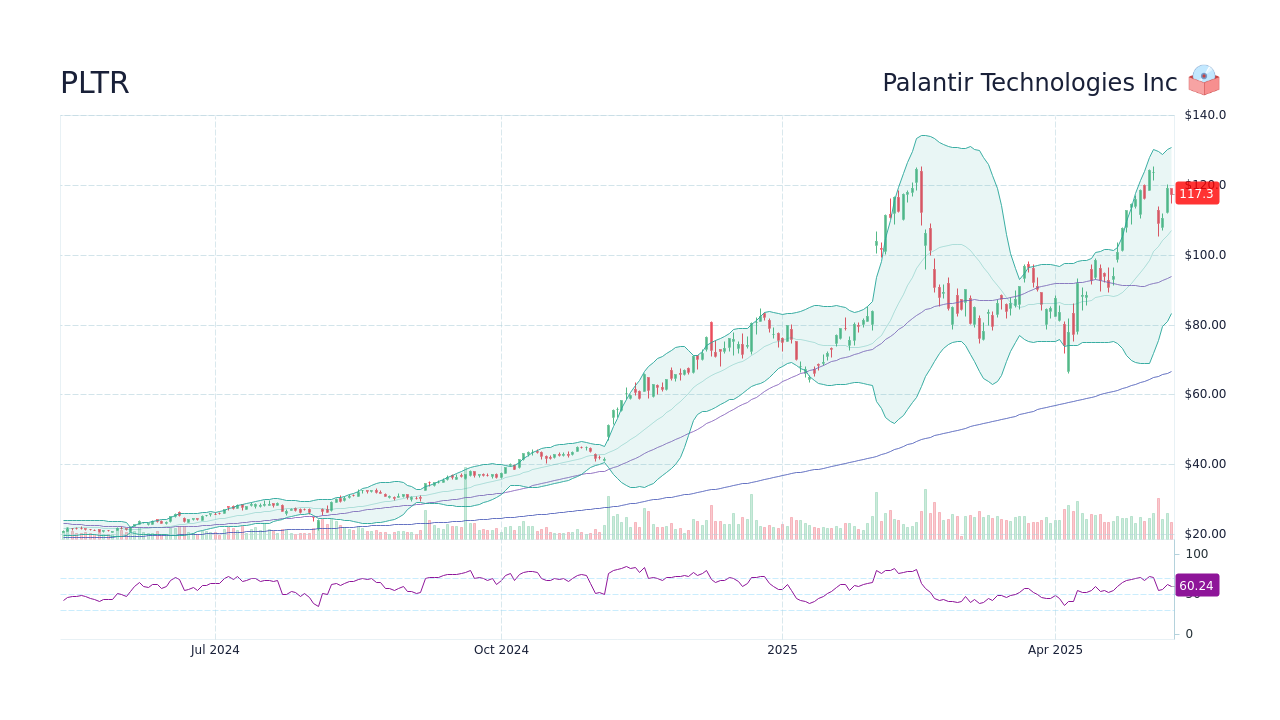

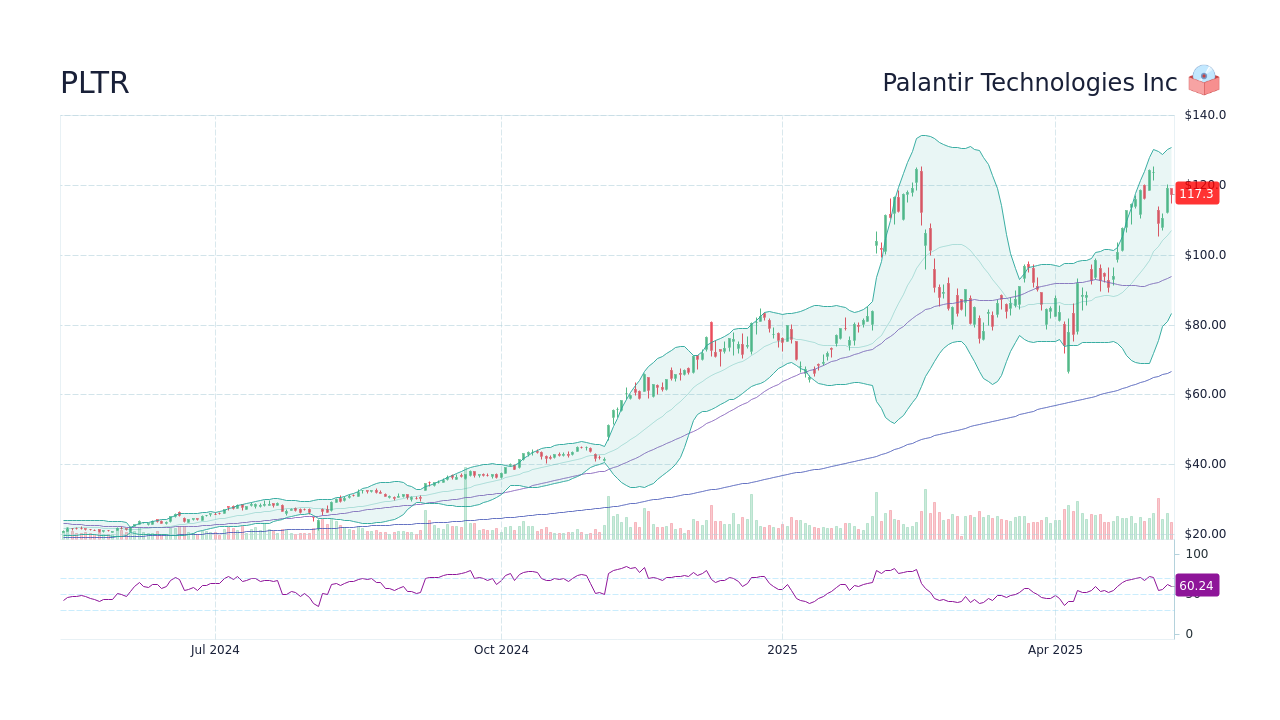

H3: Stock Price Chart Analysis: While this article doesn't include charts, technical analysis using indicators like moving averages and support/resistance levels can provide insights into potential price movements. (Note: This section could be expanded with charts and a more in-depth technical analysis if desired).

- Relevant technical indicators: Technical analysis should be used cautiously and in conjunction with fundamental analysis.

- Keyword integration: Palantir stock chart, PLTR technical analysis.

H3: Valuation Metrics: Assessing Palantir's valuation through metrics like the Price-to-Earnings (P/E) ratio, Price/Earnings to Growth (PEG) ratio, and other relevant metrics is crucial.

- Comparison to competitors and industry benchmarks: Comparing Palantir's valuation to its competitors helps determine whether its stock is overvalued or undervalued.

- Support for a 40% rise: A thorough valuation analysis is needed to determine whether the current valuation supports a potential 40% increase in the stock price.

- Keyword integration: Palantir valuation, PLTR stock price target, stock valuation metrics.

3. Conclusion: Palantir Stock Forecast 2025 – A Realistic 40% Increase?

Analyzing Palantir's financial performance, market position, and valuation reveals a complex picture. While the company shows potential for growth, particularly in the commercial sector, several risks remain. The 40% rise prediction by 2025 is ambitious and hinges on several factors, including sustained revenue growth, successful expansion into the commercial market, and navigating the competitive landscape effectively. A successful execution of its strategy and favorable macroeconomic conditions are crucial for this prediction to materialize. However, investors should be aware of the inherent uncertainties and potential downside risks.

To make informed investment decisions, thorough due diligence is essential. Learn more about Palantir stock projections and stay informed on the latest Palantir stock predictions to assess the potential of PLTR stock for your investment portfolio. Remember to conduct your own research before investing.

Featured Posts

-

Dakota Johnson Family Support At Materialist Premiere

May 10, 2025

Dakota Johnson Family Support At Materialist Premiere

May 10, 2025 -

High Potential Replacement Show For Roman Fate A Season 2 Spoiler And Streaming Guide

May 10, 2025

High Potential Replacement Show For Roman Fate A Season 2 Spoiler And Streaming Guide

May 10, 2025 -

Pley Off Vegas Golden Nayts Obygryvaet Minnesotu V Overtayme

May 10, 2025

Pley Off Vegas Golden Nayts Obygryvaet Minnesotu V Overtayme

May 10, 2025 -

Uk Tightens Visa Rules Implications For Pakistani Students And Asylum Applications

May 10, 2025

Uk Tightens Visa Rules Implications For Pakistani Students And Asylum Applications

May 10, 2025 -

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Politique

May 10, 2025

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Politique

May 10, 2025