Palantir Stock Forecast: Examining Government And Commercial Business In Q1 Earnings Report

Table of Contents

Government Contracts: A Cornerstone of Palantir's Revenue

Palantir's government business segment remains a significant contributor to its overall revenue. Analyzing this segment's performance is vital for any Palantir stock forecast.

Analyzing Government Revenue Growth in Q1:

- Specific Numbers: (Insert actual Q1 2024 government revenue figures from the earnings report here, e.g., "$XXX million, representing a YY% increase year-over-year").

- Percentage Changes: (Include comparative data showing percentage changes compared to Q4 2023 and Q1 2023. For example, "This represents a Z% increase compared to Q4 2023 and a YY% increase compared to Q1 2023.")

- Impact of New Contracts: (Discuss the impact of any significant new contracts or contract renewals on Q1 revenue. For example, "The renewal of the contract with [Government Agency] contributed significantly to the growth observed in this quarter.")

- Geographic Growth: (Highlight any specific geographic region showing stronger growth. For example, "Growth was particularly strong in the US defense sector, driven by increased demand for our platform.")

Detail: Palantir's reliance on large government contracts provides a degree of stability and predictability to its revenue stream. However, this also presents risks. Government budget constraints, shifting political priorities, and the competitive bidding process for government contracts can impact future revenue. Analyzing the long-term government contracts pipeline is crucial for accurate Palantir stock forecasting.

Future Outlook for Government Business:

- Growth Projections: (Project future growth based on the Q1 performance and historical trends. For example, "Based on current trends, we project government revenue growth of X% in 2024.")

- Expansion into New Sectors: (Discuss potential expansion into new government sectors, such as [mention specific sectors]. For example, "We anticipate expansion into the cybersecurity and intelligence sectors.")

- International Markets: (Discuss potential expansion into international government markets. For example, "Expansion into European and Asian government markets represents a significant opportunity for growth.")

- Challenges: (Mention potential challenges in securing future contracts. For instance, "Increased competition in the government contracting space could pose a challenge.")

Detail: Palantir's long-term prospects in the government sector depend on its ability to adapt to evolving government needs, maintain strong relationships with key agencies, and successfully compete for new contracts in a dynamic market.

Commercial Business: Driving Growth and Diversification

Palantir's commercial business is a key driver of future growth and diversification, reducing reliance on government contracts alone. A strong commercial sector is essential for a positive Palantir stock forecast.

Assessing Commercial Revenue and Growth:

- Q1 Revenue Figures: (Present the Q1 2024 commercial revenue figures from the earnings report. For example, "$XXX million, representing a YY% increase year-over-year.")

- Year-over-Year Growth: (Compare year-over-year growth. For example, "This represents a YY% increase compared to Q1 2023.")

- Key Contributing Sectors: (Highlight key industry sectors contributing to this growth, such as finance, healthcare, and energy. For example, "The financial services sector showed particularly strong growth, driven by increased adoption of our platform for fraud detection.")

Detail: Analyze the factors driving this commercial growth. Discuss successful platform applications in various commercial sectors. Mention specific customer wins or key partnerships formed during the quarter. For example, "The partnership with [Commercial Partner] is expected to significantly boost our presence in the [Industry] sector."

Expansion Potential in the Commercial Sector:

- Areas of Expansion: (Identify potential future expansion areas within the commercial sector. For example, "We see significant growth potential in the healthcare and supply chain management sectors.")

- Market Penetration Strategies: (Discuss strategies for market penetration and customer acquisition. For example, "We are focusing on strategic partnerships and targeted marketing campaigns to expand our reach in these sectors.")

- Role of Partnerships: (Consider the role of strategic partnerships in achieving commercial growth. For example, "Strategic partnerships with technology providers will be crucial for expanding our platform's capabilities and market reach.")

Detail: Assess the competitiveness of Palantir's commercial offerings. Evaluate the potential for significant market share gains in different commercial industries. This assessment is crucial for any Palantir stock forecast.

Key Financial Metrics and Stock Valuation

A thorough analysis of Palantir's financial health is essential for a reliable Palantir stock forecast.

Profitability and Margins:

Analyze profitability trends from the Q1 earnings report. Discuss gross and operating margins, comparing them to previous quarters and highlighting any significant changes. (Include specific numbers and analysis here.)

Cash Flow and Debt:

Examine Palantir's cash flow situation and debt levels. Assess the company's financial health and its ability to fund future growth initiatives. (Include specific numbers and analysis here.)

Stock Valuation and Price Targets:

Present a stock valuation analysis based on various financial metrics and growth forecasts. Include a range of price targets from different analysts, citing their sources where appropriate. (Include specific numbers and analysis here.)

Conclusion

The Q1 earnings report for Palantir provides valuable insights into the company's performance. While government contracts offer a stable revenue base, the success of Palantir's long-term strategy relies on sustained growth in its commercial segment. A careful assessment of key financial metrics, future growth prospects, and the competitive landscape is crucial for investors considering a position in PLTR. Further analysis of Palantir stock, including monitoring future earnings reports and industry trends, is strongly recommended before making investment decisions. Stay informed on the latest Palantir stock forecast to make well-informed choices regarding your investment portfolio. Remember to conduct thorough due diligence before investing in any stock, including Palantir.

Featured Posts

-

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 09, 2025

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 09, 2025 -

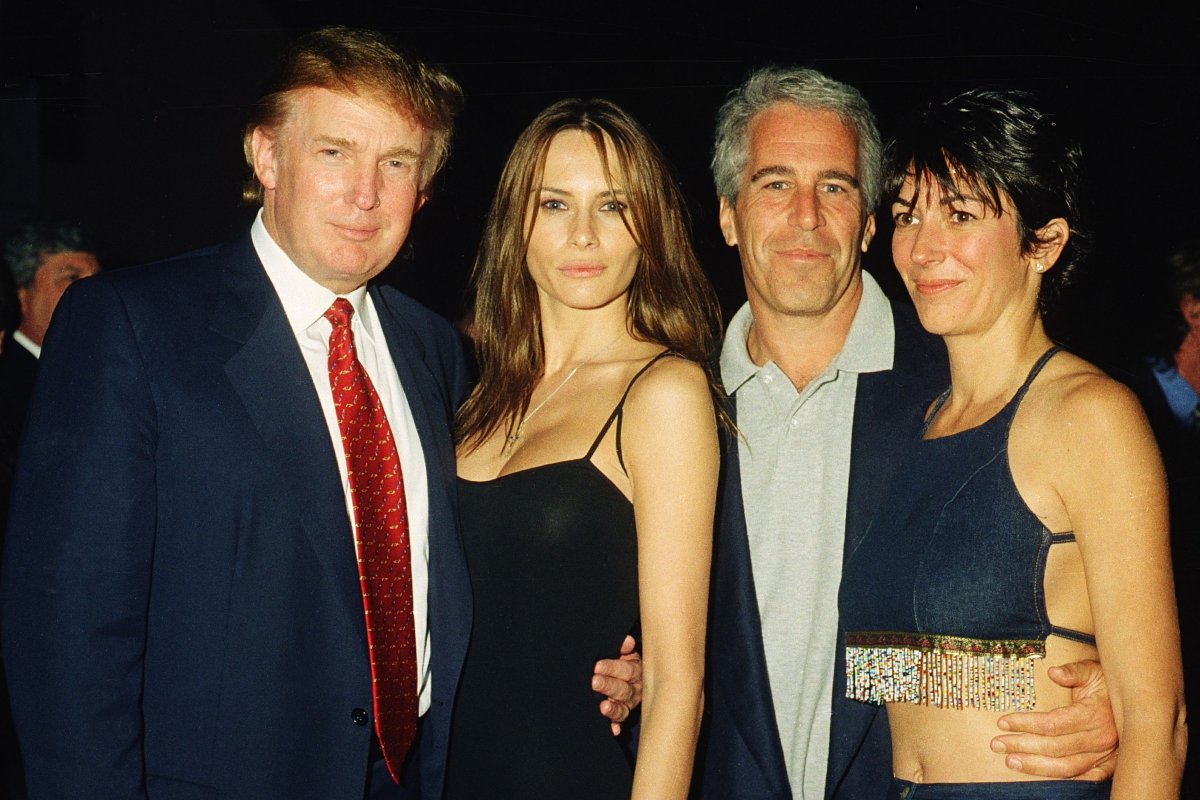

Pam Bondi On Epstein Diddy Jfk And Mlk Files An Update

May 09, 2025

Pam Bondi On Epstein Diddy Jfk And Mlk Files An Update

May 09, 2025 -

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025 -

Arkema Premiere Ligue Paris Sg Stop Dijons Run

May 09, 2025

Arkema Premiere Ligue Paris Sg Stop Dijons Run

May 09, 2025 -

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025

Harry Styles Devastated Reaction To Poor Snl Impression

May 09, 2025