Palantir Stock Forecast Revised: A Deep Dive Into The Market Upswing

Table of Contents

Analyzing Palantir's Recent Performance and Growth Drivers

Palantir's recent success isn't just luck; it's fueled by several key factors. Understanding these drivers is crucial for any accurate Palantir stock forecast.

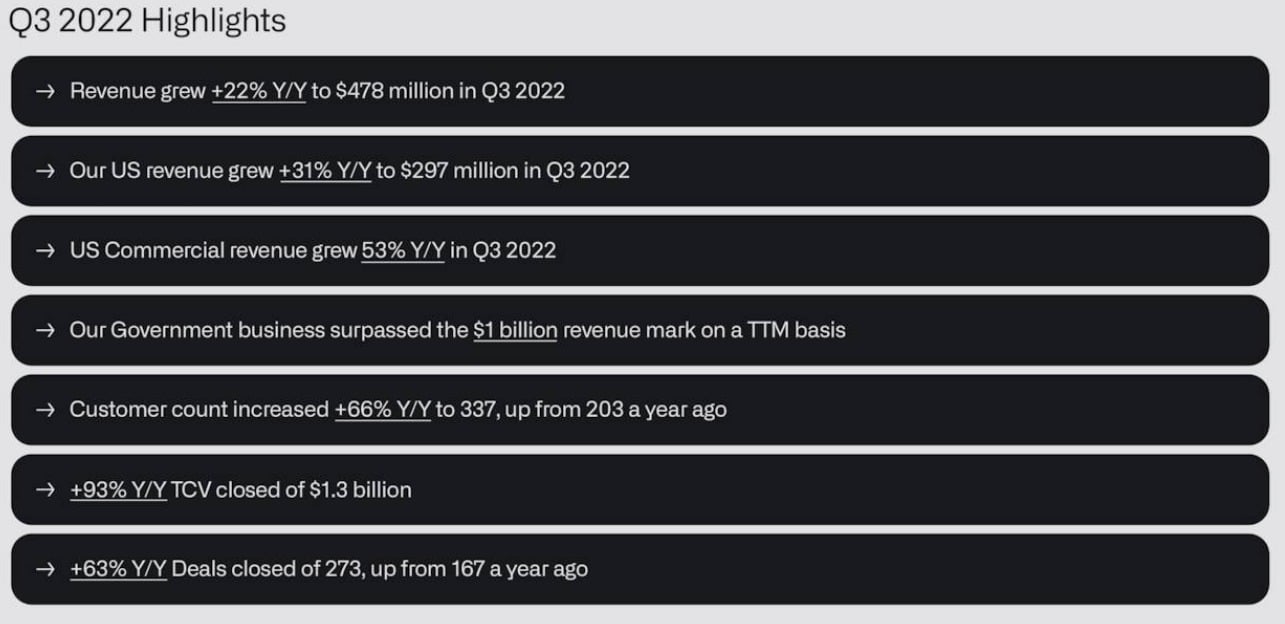

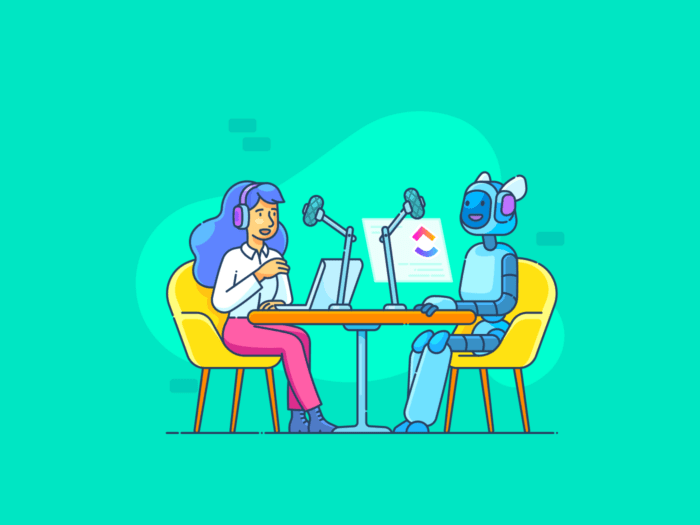

Revenue Growth and Profitability

Palantir's recent financial reports paint a picture of encouraging growth. Let's delve into the key metrics:

- Revenue Growth: [Insert latest reported revenue growth percentage]. This substantial growth signifies increasing demand for Palantir's data analytics and AI solutions.

- Net Income: [Insert latest reported net income figures]. While profitability remains a key focus, the trend indicates positive progress.

- Operating Margins: [Insert latest reported operating margin figures]. Improved margins signal increasing efficiency and cost management.

This positive trajectory is largely attributable to:

- Increased Government Contracts: Palantir continues to secure significant contracts with government agencies worldwide, providing a stable revenue stream.

- Expanding Commercial Partnerships: The company's commercial partnerships are expanding rapidly, indicating success in penetrating the private sector.

- Platform Adoption: The growing adoption of Palantir's Foundry platform underscores the value proposition of its integrated data analytics solutions.

Key Product Developments and Innovation

Palantir's ongoing innovation is a significant contributor to its growth story and any realistic Palantir stock forecast. Key advancements include:

- Foundry Enhancements: Recent updates to Foundry have improved its functionality and scalability, attracting more clients and generating additional revenue streams.

- AI Integration: The integration of advanced AI capabilities into Palantir's platforms enhances its competitive advantage and expands its market reach.

- New Product Releases: [Mention any recent new product releases and their functionalities]. These new products cater to emerging market needs and drive further growth.

Palantir's competitive advantage lies in its ability to seamlessly integrate data from diverse sources, offering powerful analytical capabilities that are crucial in today's data-driven world.

Expanding Market Share and Customer Acquisition

Palantir's strategic focus on securing new clients and expanding its market share is bearing fruit:

- Key Partnerships: [Mention significant partnerships formed recently and their potential impact].

- Large-Scale Contract Wins: [Highlight any major contract wins, specifying the client and contract value].

- Market Penetration: Palantir is steadily increasing its market penetration across various sectors, demonstrating the versatility and adaptability of its solutions.

The potential for future growth is substantial, as Palantir continues to expand its reach into new markets and sectors.

Evaluating External Factors Influencing Palantir Stock

A comprehensive Palantir stock forecast must also account for external factors that can influence its performance.

Macroeconomic Conditions and Market Sentiment

Global economic conditions play a crucial role in influencing investor sentiment and the overall stock market.

- Inflation and Interest Rates: [Discuss the current inflation and interest rate environment and its potential impact on Palantir's valuation]. Higher interest rates can impact investor appetite for growth stocks.

- Tech Market Sentiment: [Analyze the current sentiment towards technology stocks and how it influences Palantir's stock price].

- Geopolitical Events: [Mention any geopolitical events that could potentially impact Palantir's business, such as international relations or sanctions].

Competitive Landscape and Industry Trends

The competitive landscape and emerging industry trends are critical aspects of any accurate Palantir stock forecast.

- Key Competitors: [List Palantir's main competitors and their strategies]. Competition in the data analytics space is intensifying.

- Cloud Computing: The increasing adoption of cloud computing presents both opportunities and challenges for Palantir.

- AI Advancements: Rapid advancements in AI are reshaping the data analytics landscape, presenting both opportunities and challenges for Palantir.

Analyst Ratings and Investor Opinions

Analyst opinions and investor sentiment provide valuable insights for a well-informed Palantir stock forecast.

- Analyst Ratings: [Summarize the consensus among financial analysts regarding Palantir's stock, citing specific price targets and ratings].

- Investor Commentary: [Provide a balanced view of recent investor commentary on Palantir, including both bullish and bearish viewpoints].

Revised Palantir Stock Forecast and Investment Strategies

Based on our analysis, we present a revised Palantir stock forecast.

Short-Term and Long-Term Projections

- Short-Term (Next 12 Months): [Provide a short-term price projection, explaining the rationale behind it and considering different scenarios – bullish, neutral, bearish].

- Long-Term (Next 3-5 Years): [Present a long-term price projection, justifying it with factors such as revenue growth, market penetration, and technological advancements].

Risk Assessment and Mitigation

Investing in Palantir stock carries inherent risks:

- Market Volatility: The tech sector is known for its volatility, and Palantir is no exception.

- Competition: Intense competition could put pressure on Palantir's market share and profitability.

- Regulatory Changes: Changes in government regulations could impact Palantir's business.

To mitigate these risks, consider:

- Diversification: Diversifying your investment portfolio is crucial to manage risk effectively.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly, regardless of price fluctuations.

Investment Recommendations

Based on our revised Palantir stock forecast and risk assessment, [State your clear recommendation: Buy, Hold, or Sell]. [Justify your recommendation with supporting data and analysis from the previous sections].

Conclusion: Final Thoughts on the Palantir Stock Forecast

Our revised Palantir stock forecast indicates [summarize your main conclusion]. Palantir's recent market upswing is driven by strong revenue growth, innovative product development, and expanding market share. However, it's crucial to remember that external factors, such as macroeconomic conditions and competition, can significantly influence the stock's performance. Before making any investment decisions, conduct your own thorough research and consider consulting with a financial advisor. Remember, this Palantir stock forecast is for informational purposes only and should not be considered financial advice. Develop your own informed Palantir stock forecast based on your own research and risk tolerance.

Featured Posts

-

Golden Knights Face Uncertain Future Hertls Absence Looms Large After Lightning Hit

May 10, 2025

Golden Knights Face Uncertain Future Hertls Absence Looms Large After Lightning Hit

May 10, 2025 -

Bangkok Post Highlights Urgent Need For Transgender Equality

May 10, 2025

Bangkok Post Highlights Urgent Need For Transgender Equality

May 10, 2025 -

Ai Transforms Repetitive Scatological Documents Into Insightful Podcasts

May 10, 2025

Ai Transforms Repetitive Scatological Documents Into Insightful Podcasts

May 10, 2025 -

High Potential Season 1 When Morgans Intelligence Slipped

May 10, 2025

High Potential Season 1 When Morgans Intelligence Slipped

May 10, 2025 -

Postponed Bbc Meeting Wynne Evans Enjoys Relaxed Day With Girlfriend

May 10, 2025

Postponed Bbc Meeting Wynne Evans Enjoys Relaxed Day With Girlfriend

May 10, 2025