Palantir Stock Investment: A Pre-May 5th Analysis

Table of Contents

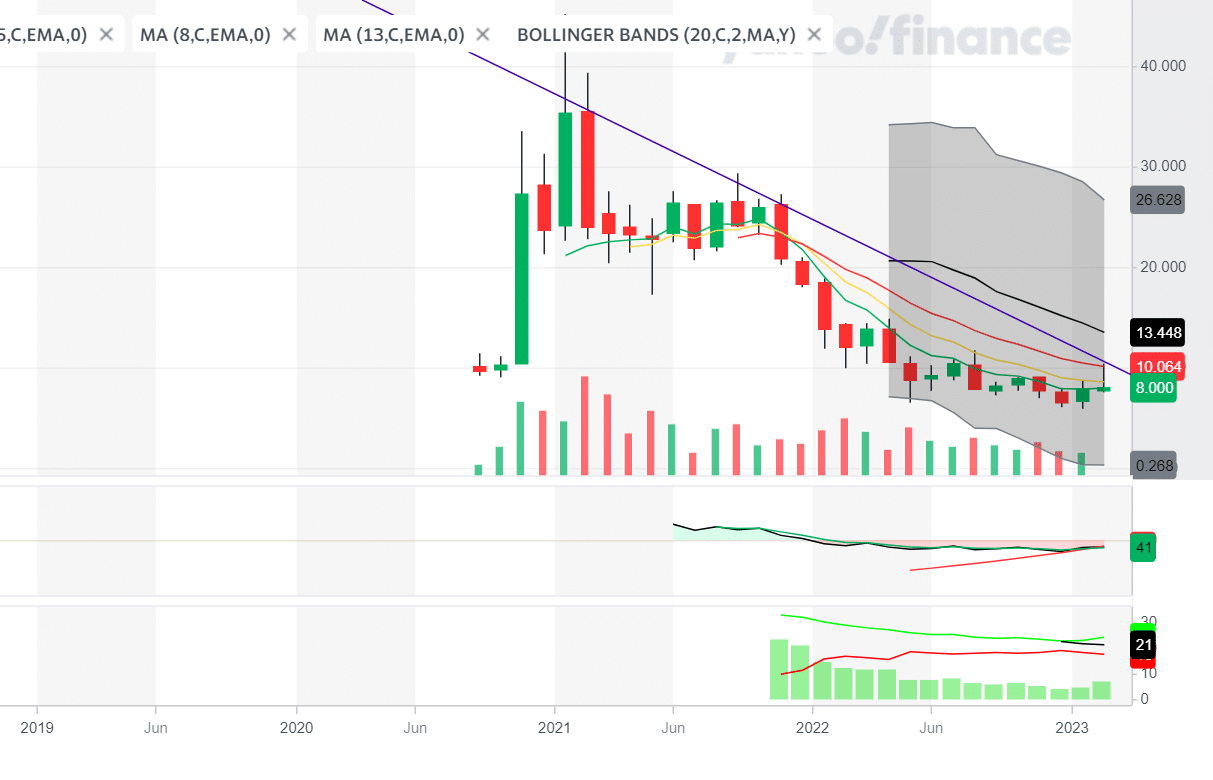

Palantir Technologies (PLTR) has seen a rollercoaster ride recently, with its stock price fluctuating significantly. With a crucial earnings report looming on May 5th and whispers of significant new contracts, many investors are questioning whether now is the time to buy, sell, or hold Palantir stock. This pre-May 5th analysis of Palantir investment opportunities aims to shed light on the potential risks and rewards, helping you make informed decisions regarding PLTR stock. We'll examine Palantir's recent performance, upcoming catalysts, and potential risks, providing a comprehensive overview to help guide your Palantir investment strategy. Keywords: Palantir stock, Palantir investment, PLTR stock, Palantir analysis, May 5th Palantir, big data stock.

Palantir's Recent Performance and Upcoming Catalysts

H3: Q1 2024 Earnings Expectations:

Analysts' predictions for Palantir's Q1 2024 earnings are varied, reflecting the inherent uncertainty in the tech sector. While some anticipate strong revenue growth driven by increasing demand for Palantir's big data analytics platform, others are more cautious, citing potential headwinds from the overall economic climate. Key metrics to watch closely include:

- Revenue Growth: Analysts are keenly focused on the percentage increase in revenue compared to Q1 2023. Sustained high growth would signal continued market adoption.

- Operating Margin: Improving operating margins will demonstrate Palantir's ability to manage costs and increase profitability.

- Customer Acquisition: The number of new customers acquired and their profile (government vs. commercial) will be crucial indicators of future growth potential. Any significant gains in commercial clients would particularly bolster investor confidence.

Any surprises – positive or negative – in these metrics are likely to significantly impact the PLTR stock price in the short term. Keywords: Palantir earnings, PLTR earnings, Q1 2024 earnings, Palantir revenue growth.

H3: New Contracts and Partnerships:

Recent announcements regarding new Palantir contracts and partnerships will play a vital role in shaping investor sentiment. Securing large-scale government contracts, particularly in the defense and intelligence sectors, remains a significant driver of Palantir's revenue. However, expanding its footprint in the commercial sector – through partnerships with major corporations in healthcare, finance, and other industries – is crucial for long-term sustainable growth. The success of Palantir's expansion into these new markets will significantly impact its future valuation. Keywords: Palantir contracts, Palantir partnerships, government contracts, commercial contracts, Palantir growth.

H3: Market Sentiment and Overall Economic Conditions:

The overall market sentiment toward tech stocks and the broader economic climate will influence investor appetite for Palantir. Rising interest rates and persistent inflation create uncertainty, potentially impacting the valuation of high-growth companies like Palantir. Geopolitical factors, especially those affecting government spending on defense and intelligence, can also play a significant role. A downturn in global markets or reduced government investment could negatively affect Palantir's performance. Keywords: Market sentiment, tech stock outlook, economic outlook, interest rates, inflation, geopolitical risks.

Risks Associated with Investing in Palantir Stock

H3: Valuation Concerns:

Palantir's current valuation is a key area of debate among investors. Some argue that its high price-to-sales ratio is justified by its growth potential and unique position in the big data market. Others express concerns that the valuation may be inflated and unsustainable in the face of potential economic headwinds. Understanding these differing viewpoints is essential before making any investment decisions. Keywords: Palantir valuation, PLTR valuation, stock valuation, price-to-sales ratio.

H3: Competition and Market Saturation:

The big data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share. Palantir faces the challenge of maintaining its competitive edge and avoiding market saturation in its key sectors. The emergence of new technologies and the potential for disruptive innovation pose significant long-term risks. Keywords: Palantir competition, big data competition, market saturation.

H3: Dependence on Government Contracts:

Palantir's significant reliance on government contracts exposes it to the risk of reduced government spending or changes in government priorities. This dependence creates volatility and makes Palantir's performance susceptible to shifts in geopolitical dynamics and budgetary decisions. Diversifying its revenue streams by securing more commercial contracts is crucial to mitigating this risk. Keywords: Government contracts, defense contracts, risk analysis.

Investment Strategies Before May 5th

H3: Buy, Hold, or Sell Recommendations (with justifications):

Based on this pre-May 5th analysis, the decision to buy, hold, or sell Palantir stock hinges on individual risk tolerance and investment horizons. Investors with a high-risk tolerance and a long-term perspective might see Palantir as an attractive investment opportunity, given its potential for significant growth in the big data market. However, those with a lower risk tolerance or shorter-term investment horizons may prefer to wait for clearer signals before committing significant capital. The upcoming earnings report will be a critical factor in determining the appropriate course of action. Keywords: Buy Palantir, sell Palantir, hold Palantir, investment strategy, risk tolerance.

H3: Diversification and Portfolio Allocation:

Regardless of your investment decision regarding Palantir, it is crucial to maintain a well-diversified portfolio. Investing a significant portion of your assets in a single stock, particularly one as volatile as Palantir, is inherently risky. Consider allocating a suitable percentage of your portfolio to Palantir, depending on your overall risk tolerance and investment goals. Diversification reduces risk and helps protect your investment from unexpected market fluctuations. Keywords: Portfolio diversification, risk management, asset allocation.

Conclusion: Making Informed Decisions about Your Palantir Stock Investment

This pre-May 5th analysis of Palantir stock highlights both its considerable growth potential and the inherent risks involved. The upcoming earnings report and news regarding new contracts will significantly impact the stock's short-term trajectory. While Palantir operates in a rapidly expanding market and possesses a unique technology, it's essential to acknowledge the valuation concerns, competitive pressures, and dependence on government contracts. Conduct your own thorough research and make informed decisions about your Palantir stock investment before May 5th, carefully considering your risk tolerance and investment objectives. Remember, a successful Palantir investment strategy requires a clear understanding of both the upside and downside risks. Keywords: Palantir stock investment, PLTR investment decision, due diligence, informed investment decisions.

Featured Posts

-

Canadian Homeownership The Burden Of Large Down Payments

May 09, 2025

Canadian Homeownership The Burden Of Large Down Payments

May 09, 2025 -

Singer Wynne Evans Removed From Go Compare Ads Amidst Controversy

May 09, 2025

Singer Wynne Evans Removed From Go Compare Ads Amidst Controversy

May 09, 2025 -

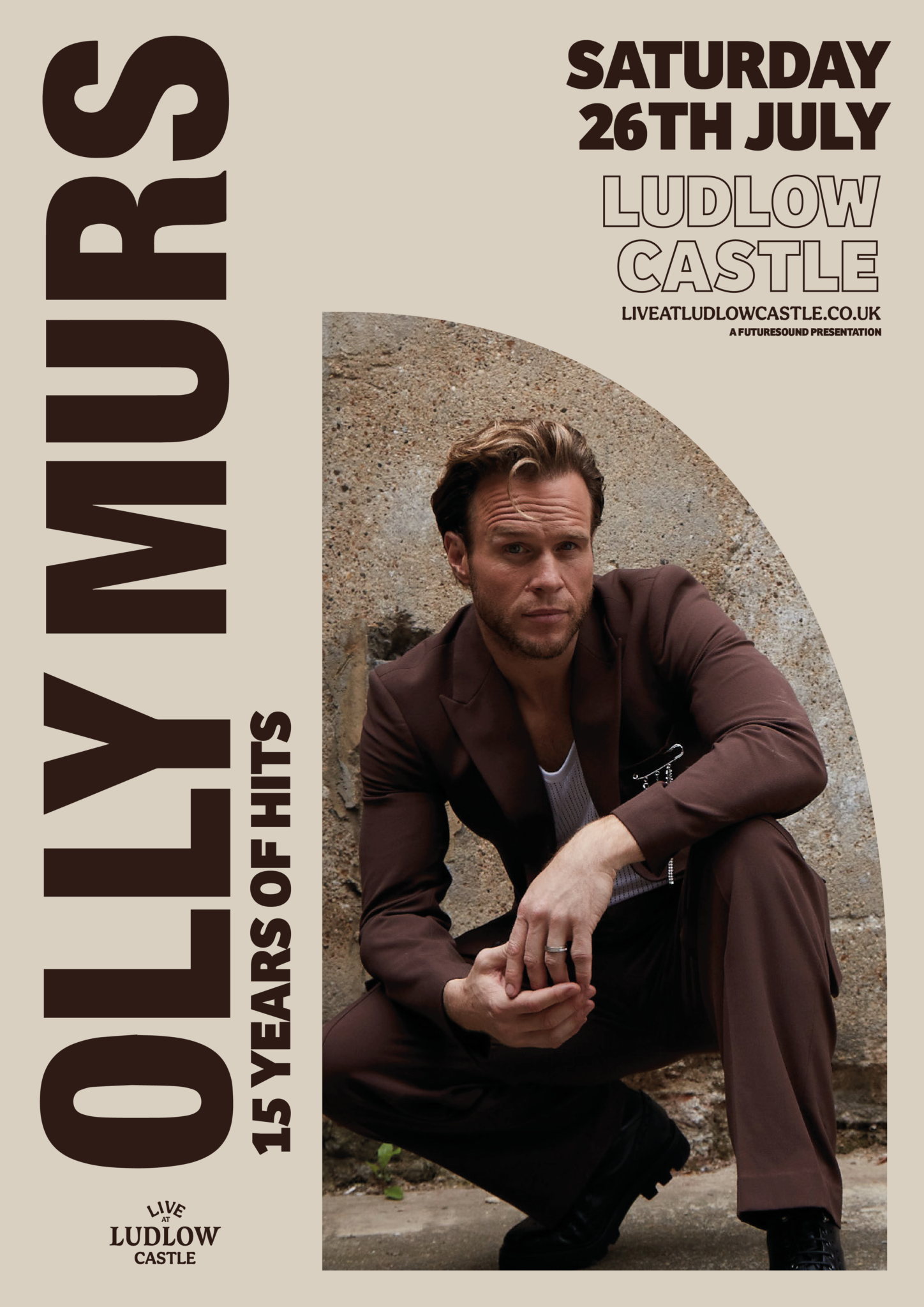

Manchesters Stunning Castle The Venue For Olly Murs Massive Music Festival

May 09, 2025

Manchesters Stunning Castle The Venue For Olly Murs Massive Music Festival

May 09, 2025 -

Harry Styles Sports A Retro Mustache In London

May 09, 2025

Harry Styles Sports A Retro Mustache In London

May 09, 2025 -

Newark Air Traffic Control System Failure Prior Safety Concerns Ignored

May 09, 2025

Newark Air Traffic Control System Failure Prior Safety Concerns Ignored

May 09, 2025