Palantir Stock: Is It Worth Investing In Right Now? Market Analysis And Predictions

Table of Contents

Palantir's Business Model and Recent Performance

Palantir's success hinges on its unique data analytics platforms, Gotham and Foundry. Understanding its business model and recent performance is crucial for evaluating its investment potential.

Government Contracts and Revenue Streams

Palantir's revenue significantly relies on government contracts, particularly from the US government. This provides a stable, albeit sometimes unpredictable, revenue stream. The stability of these contracts is a significant factor in assessing Palantir's financial strength. However, over-reliance on government contracts presents a risk, prompting Palantir to aggressively pursue diversification into commercial markets. This strategy's success will be a key determinant of future growth.

- Examples of key government clients: CIA, US Army, various other federal agencies.

- Percentage of revenue from government vs. commercial sectors: (Note: This requires up-to-date financial data from Palantir's reports. Insert the most recent percentages here.)

- Recent contract wins and losses: (Note: This section needs to be updated with the most recent information available at the time of publication.)

Financial Performance and Key Metrics

Analyzing Palantir's financial performance requires examining key metrics like revenue growth, profitability, and cash flow. While revenue has shown growth, profitability remains a challenge for the company. Comparing Palantir's performance to competitors like Snowflake and Databricks provides valuable context. Investors need to consider whether Palantir's growth trajectory justifies its current valuation.

- Key financial figures (revenue, EPS, etc.): (Note: Insert the most recent key financial figures from Palantir's financial reports.)

- Debt levels: (Note: Include current debt levels and their implications.)

- Comparisons to competitors (e.g., Snowflake, Databricks): (Note: This section requires a comparative analysis of key metrics across these companies. Include relevant data points.)

Market Analysis and Industry Trends

Understanding the broader market landscape and relevant industry trends is vital for assessing Palantir's future prospects.

The Big Data Analytics Market

The big data analytics market is expanding rapidly, driven by increasing data volumes and the growing adoption of cloud computing, AI, and cybersecurity solutions. Palantir occupies a niche within this market, focusing on complex data integration and analysis for government and commercial clients. Its competitive advantage lies in its sophisticated software and strong relationships with key clients.

- Market size and growth forecasts: (Note: Include market size data and growth projections from reputable market research firms.)

- Key market drivers: Cloud adoption, AI advancements, growing cybersecurity concerns, increasing data volumes.

- Competitive landscape: Snowflake, Databricks, AWS, Google Cloud, Microsoft Azure.

- Palantir's market share and positioning: (Note: Include estimates of Palantir's market share and its competitive positioning within the industry.)

Geopolitical Factors and Their Impact

Global events significantly influence Palantir's business, particularly its government contracts. Increased geopolitical tensions often lead to higher government spending on defense and intelligence technologies, benefiting Palantir. However, political instability or changes in government priorities could negatively impact its revenue streams.

- Examples of geopolitical events affecting Palantir: The war in Ukraine, increasing tensions with China, etc.

- Analysis of their potential impact on revenue and stock price: (Note: Analyze how these events have historically impacted Palantir and predict potential future impacts.)

Future Predictions and Investment Outlook

Predicting the future of Palantir stock involves considering analyst ratings, price targets, and potential risks.

Analyst Ratings and Price Targets

Financial analysts offer varying opinions on Palantir's stock. Some maintain a bullish outlook, citing its growth potential and strong government contracts. Others express caution, highlighting the company's reliance on government contracts and its path to profitability.

- Summary of analyst ratings (buy, hold, sell): (Note: Include a summary of current analyst ratings from reputable sources.)

- Range of price targets: (Note: Include a range of price targets from different analysts.)

- Justification for different ratings: (Note: Summarize the key reasons behind the differing analyst opinions.)

Potential Risks and Challenges

Investing in Palantir involves several risks. Its heavy reliance on government contracts exposes it to potential budget cuts or changes in government priorities. Competition in the big data analytics market is fierce, and regulatory hurdles could also hinder its growth.

- Key risks and challenges: Competition, regulatory changes, dependence on government contracts, profitability challenges.

- Potential mitigation strategies: Diversification into commercial markets, innovation in product offerings, strategic partnerships.

- Impact assessment: (Note: Analyze the potential impact of these risks on Palantir's future performance.)

Conclusion

Determining whether Palantir stock is a worthwhile investment requires careful consideration of its business model, recent performance, market trends, and future outlook. While Palantir shows growth potential in a rapidly expanding market, its heavy reliance on government contracts and its path to sustained profitability present significant challenges. The geopolitical landscape also plays a crucial role in influencing its future prospects. Investors should carefully weigh the pros and cons before making any investment decisions.

Remember to conduct your own thorough research and consult with a financial advisor before investing in Palantir stock (PLTR) or any other security. Understanding the complexities of the Palantir investment opportunity is paramount before committing your capital.

Featured Posts

-

Lisa Rays Air India Complaint Airline Denies Allegations

May 09, 2025

Lisa Rays Air India Complaint Airline Denies Allegations

May 09, 2025 -

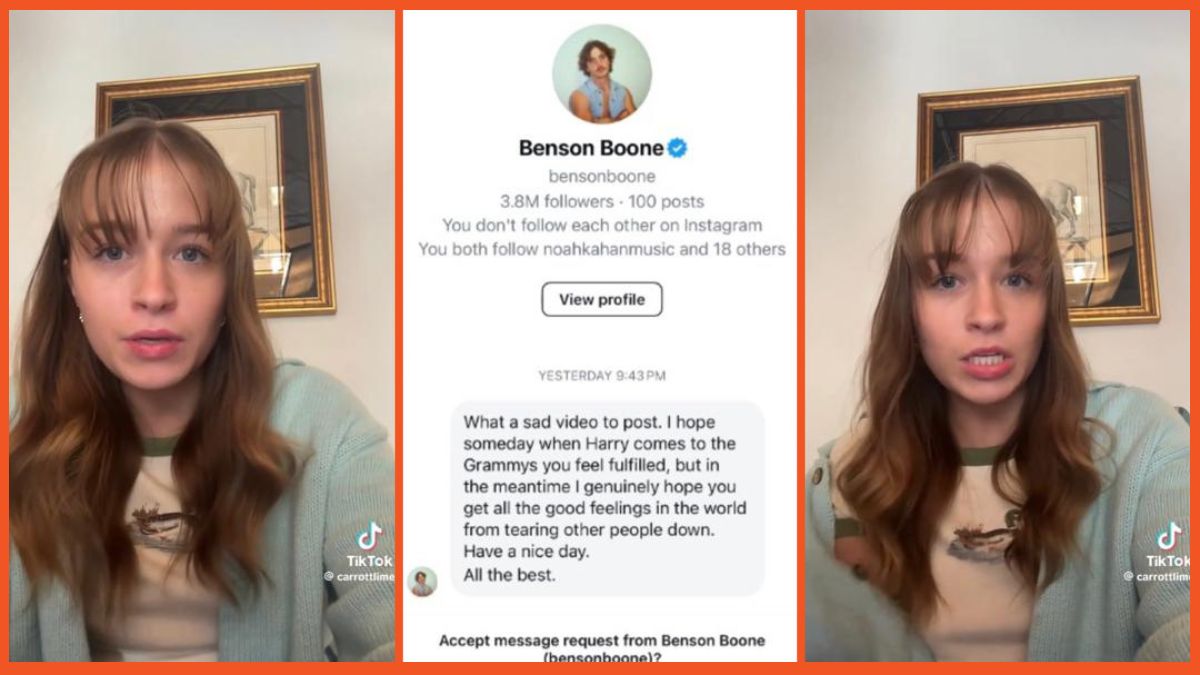

Singer Benson Boone Denies Copying Harry Styles

May 09, 2025

Singer Benson Boone Denies Copying Harry Styles

May 09, 2025 -

The Whats App Spyware Case Metas 168 Million Loss And The Path Forward

May 09, 2025

The Whats App Spyware Case Metas 168 Million Loss And The Path Forward

May 09, 2025 -

Celebrity Antiques Road Trip Expert Tips For Buying And Selling Antiques

May 09, 2025

Celebrity Antiques Road Trip Expert Tips For Buying And Selling Antiques

May 09, 2025 -

Dijon Vs Psg Fin De Serie En Arkema Premiere Ligue

May 09, 2025

Dijon Vs Psg Fin De Serie En Arkema Premiere Ligue

May 09, 2025