Palantir Stock Rally Prompts Analyst Forecast Revisions

Table of Contents

Reasons Behind the Palantir Stock Rally

The Palantir stock surge can be attributed to a confluence of positive factors, significantly boosting investor confidence and driving up the Palantir stock price. These key drivers include:

-

Increased Government Contracts: Palantir has experienced a significant uptick in government contracts, contributing substantially to its revenue projections. The awarding of large-scale contracts from agencies like the CIA and the Department of Defense has provided a substantial boost to the company's financial outlook, solidifying its position as a leading provider of data analytics solutions to government entities. This increased government spending on data analytics translates directly into increased revenue and profitability for Palantir.

-

Expanding Commercial Business: Beyond its strong government partnerships, Palantir's commercial business has demonstrated impressive growth. Key partnerships with major corporations across various sectors, coupled with successful implementations of its Foundry platform, have significantly broadened its customer base. This commercial expansion mitigates reliance on government contracts and strengthens the overall long-term sustainability of the Palantir business model. Recent reports indicate double-digit growth in this sector, a major driver of the positive Palantir stock price movement.

-

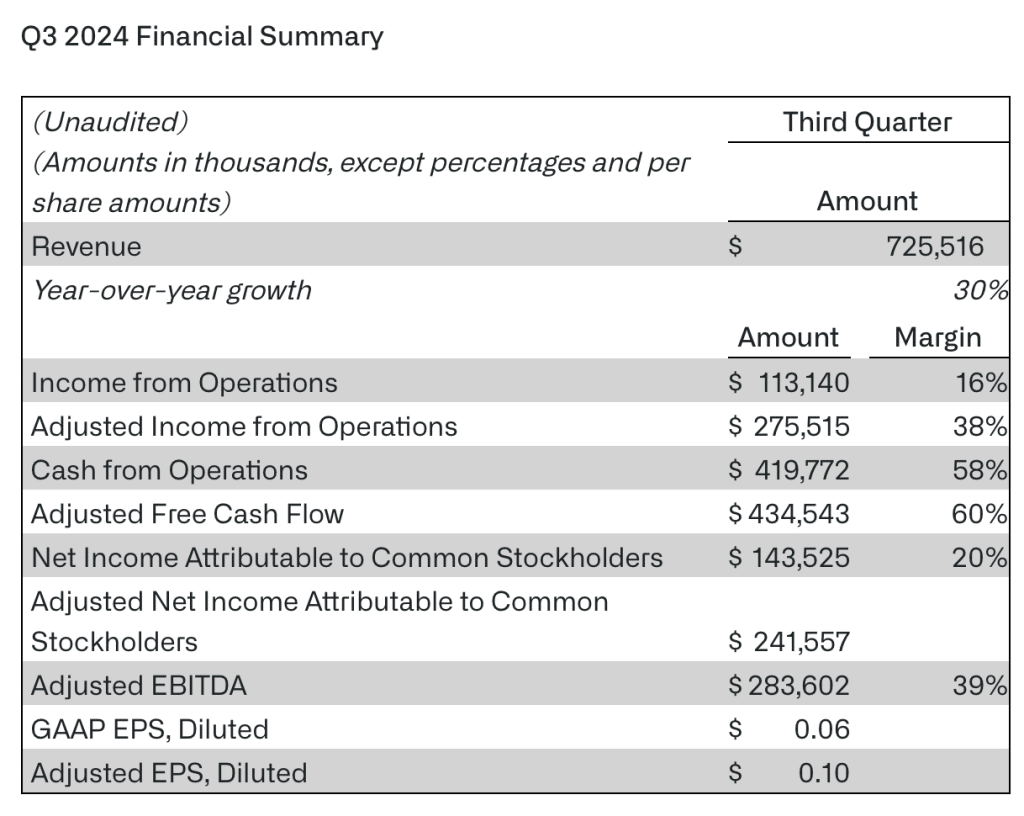

Improved Profitability: Palantir's recent financial reports reveal significant improvements in profitability and margins. This positive shift, indicated by rising earnings per share (EPS) and strong revenue growth, signals a maturing business model and increased operational efficiency. This improved financial performance instills greater confidence in investors, leading to a higher valuation of Palantir stock.

-

AI Advancements: Palantir's strategic investments in artificial intelligence (AI) are generating significant excitement. The company's ongoing development and integration of AI capabilities into its platforms are expected to enhance its offerings and further expand its market share within the rapidly growing data analytics sector. This commitment to AI positions Palantir at the forefront of technological innovation, contributing to the positive Palantir stock predictions.

-

Positive Market Sentiment: The overall positive sentiment towards the data analytics market also plays a role in Palantir's stock performance. The increasing demand for advanced data analytics solutions across various sectors has created a favorable environment for companies like Palantir, contributing to the overall bullish outlook on Palantir stock.

Analyst Forecast Revisions and Implications

The recent Palantir stock rally has prompted significant revisions in analyst forecasts, impacting investment strategies and risk assessments.

-

Summary of Revised Price Targets: Numerous prominent analysts have increased their price targets for Palantir stock, reflecting the heightened optimism surrounding the company's future prospects. These upward revisions are a direct result of the positive factors discussed above, particularly the improved financial performance and the expanding commercial business.

-

Impact on Earnings Estimates: Analyst earnings estimates for Palantir have been revised upwards, aligning with the improved financial performance and growth trajectory. This signifies a more bullish outlook on the company's short-term and long-term earning potential.

-

Changes in Analyst Ratings: Many analysts have upgraded their ratings for Palantir stock, with several shifting from "hold" or "neutral" to "buy" recommendations. This reflects the growing consensus among financial experts that Palantir represents a strong investment opportunity.

-

Investment Implications: The revised forecasts have significant implications for various investment strategies. Long-term investors see the rally as a confirmation of their bullish outlook, while short-term investors may be considering taking profits or adjusting their positions based on the revised price targets.

-

Risk Assessment: Despite the positive outlook, investors should always perform a thorough risk assessment. Factors like market competition, technological disruptions, and macroeconomic conditions could impact Palantir's future performance.

Future Outlook for Palantir Stock

The future outlook for Palantir stock remains promising, although several factors warrant consideration.

-

Continued Growth Potential: Palantir's long-term growth potential remains strong, fueled by the continued expansion of the data analytics market and the company's strategic focus on innovation. Its position in both the government and commercial sectors provides a diversified revenue stream, mitigating risk.

-

Competitive Landscape: While Palantir enjoys a strong market position, it faces competition from established players and emerging startups. The company's ability to maintain its technological edge and adapt to evolving market demands will be crucial for sustained growth.

-

Technological Innovation: Palantir's continued investment in technological innovation, particularly in AI and machine learning, is essential for its continued success. This commitment to technological advancement will be crucial in maintaining a competitive advantage in the dynamic data analytics market.

-

Potential Challenges: Potential challenges include intense competition, economic downturns that could affect government spending, and the successful integration of new technologies. A thorough understanding of these potential headwinds is crucial for informed investment decisions.

-

Long-term Investment Strategy: For investors with a long-term horizon, Palantir stock presents a potentially attractive investment opportunity. However, a diversified investment portfolio and careful consideration of market risks are recommended.

Conclusion

The recent Palantir stock rally, fueled by increased government contracts, robust commercial growth, and improved profitability, has resulted in substantial analyst forecast revisions. This positive momentum reflects a strong underlying business performance and an optimistic outlook for the future. While the potential for further growth is significant, investors should conduct thorough due diligence, carefully weighing the potential rewards against the inherent risks involved.

Call to Action: Stay informed about Palantir's progress and market dynamics. Conduct comprehensive research, consult with a financial advisor, and regularly monitor Palantir stock performance and analyst opinions before making any investment decisions related to Palantir stock or similar data analytics investments. Understanding the nuances of Palantir's performance and its position within the evolving data analytics landscape is key to making sound investment choices.

Featured Posts

-

Ryujinx Emulator Project Halted Official Statement On Nintendos Involvement

May 10, 2025

Ryujinx Emulator Project Halted Official Statement On Nintendos Involvement

May 10, 2025 -

Social Media Censorship X Restricts Access To Jailed Turkish Mayors Page Following Outcry

May 10, 2025

Social Media Censorship X Restricts Access To Jailed Turkish Mayors Page Following Outcry

May 10, 2025 -

Trumps Refusal To Drop Tariffs Warners Perspective

May 10, 2025

Trumps Refusal To Drop Tariffs Warners Perspective

May 10, 2025 -

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

May 10, 2025

Lab Owners Guilty Plea Faking Covid Test Results During Pandemic

May 10, 2025 -

Britannian Kruununperimysjaerjestys Yksityiskohtainen Selvitys

May 10, 2025

Britannian Kruununperimysjaerjestys Yksityiskohtainen Selvitys

May 10, 2025