Palantir Stock Valuation: A Deep Dive Into Its History Of Financial Performance

Table of Contents

Palantir's IPO and Initial Market Reaction

Palantir's initial public offering (IPO) occurred on September 30, 2020, with an IPO price of $10 per share. The initial market reaction was mixed. While the stock price saw some early gains, fueled by anticipation surrounding the company's innovative data analytics platform and its established presence in government and commercial sectors, it didn't immediately skyrocket. Several factors contributed to this relatively muted initial response.

- IPO Price and Date: September 30, 2020, at $10 per share.

- Initial Market Capitalization: Around $22 billion.

- Key Factors Driving Early Price Fluctuations: Investor uncertainty about Palantir's long-term profitability, concerns about its reliance on government contracts, and the overall market conditions at the time (during the COVID-19 pandemic).

- Comparison to Initial Projections and Analyst Estimates: Initial analyst estimates varied widely, reflecting the uncertainty surrounding Palantir's future growth trajectory and the difficulty in valuing a company with a unique business model.

The initial days and weeks following the IPO saw significant price volatility, highlighting the inherent risk associated with investing in a company with a less-established track record in the public markets. Analyzing this initial period provides valuable insights into investor sentiment and the market's perception of Palantir's potential.

Key Financial Performance Indicators Over Time

Analyzing Palantir's financial performance reveals a mixed bag. While the company has demonstrated consistent revenue growth, profitability has been elusive, and operating expenses remain significant.

- Year-over-Year Revenue Growth Analysis: Palantir has consistently shown year-over-year revenue growth, albeit at varying rates. Understanding the drivers of this growth, such as new contracts and expansion into new market segments, is crucial for assessing its future valuation.

- Gross and Operating Margins Trends: Palantir's gross margins have generally been healthy, reflecting the high value of its software solutions. However, its operating margins have been significantly impacted by substantial research and development expenses, along with sales and marketing costs.

- Profitability Metrics (EPS, Net Income): Palantir has not yet consistently achieved positive net income, a key factor influencing its valuation. The company's focus on long-term growth and significant investments in its platform and sales infrastructure have contributed to these losses.

- Significant Financial Events (Acquisitions, Divestitures): Key acquisitions and divestitures, if any, should be analyzed for their impact on the company's financial performance and overall stock valuation.

- Comparison to Industry Benchmarks: Comparing Palantir's financial performance to competitors in the data analytics and software sectors is crucial for gaining a more comprehensive understanding of its position within the market and its relative valuation.

Government Contracts and their Impact on Valuation

Government contracts form a substantial portion of Palantir's revenue stream, significantly influencing its stock valuation. This dependence presents both opportunities and risks.

- Percentage of Revenue from Government Contracts: A significant portion of Palantir's revenue historically comes from government contracts, particularly in the defense and intelligence sectors.

- Impact of Government Budget Changes on Palantir's Performance: Changes in government spending and budget priorities can directly impact Palantir's revenue and, consequently, its stock valuation.

- Risks Associated with Contract Renewals and Competition: The renewal of government contracts isn't guaranteed, creating uncertainty and potential revenue fluctuations. Competition from other technology firms also poses a risk.

- Geographic Diversification of Government Contracts: The geographic diversification of these contracts, spread across various governmental agencies and countries, mitigates some of the risk associated with a concentration in a single region or client.

Analyzing Palantir's Valuation Metrics

Several valuation methods can be applied to assess Palantir's stock.

- Key Valuation Metrics and their Trends Over Time: Key metrics such as the Price-to-Sales (P/S) ratio, Price-to-Earnings (P/E) ratio (if applicable), and Discounted Cash Flow (DCF) analysis provide different perspectives on Palantir's valuation. Analyzing the trends in these metrics over time is crucial.

- Comparison to Competitor Valuations (e.g., Datadog, Snowflake): Comparing Palantir's valuation metrics to those of similar companies in the data analytics and cloud software space, such as Datadog and Snowflake, provides valuable context and helps to determine if it's overvalued or undervalued relative to its peers.

- Discussion of Growth vs. Value Investing Approaches for Palantir: Palantir's valuation can be approached from both growth and value investing perspectives. Growth investors focus on future potential, while value investors concentrate on current fundamentals.

- Analysis of Market Sentiment and Investor Confidence: Market sentiment and investor confidence significantly influence Palantir's stock price. News, announcements, and overall market conditions heavily impact these sentiments.

Future Outlook and Predictions for Palantir Stock Valuation

Predicting Palantir's future stock valuation is inherently challenging, yet several factors could play a pivotal role.

- Potential for Growth in New Market Segments: Expansion into new commercial sectors and international markets holds significant growth potential.

- Risks Posed by Emerging Competitors and Technological Disruption: The data analytics market is dynamic, with new players constantly emerging. Technological advancements could also disrupt Palantir's position.

- Impact of Macroeconomic Factors on Palantir's Business: Broader economic conditions, including recessionary periods or interest rate hikes, can significantly impact Palantir's performance and valuation.

- Analyst Predictions and Consensus Estimates for Future Performance: While analyst predictions should be considered cautiously, they provide a helpful gauge of market expectations and consensus sentiment regarding Palantir's future.

Conclusion

Understanding the complexities of Palantir stock valuation requires diligent research and consideration of the factors discussed above. The company's history reveals a pattern of revenue growth, albeit with persistent challenges in achieving profitability. Its reliance on government contracts introduces both significant opportunities and substantial risks. By carefully analyzing Palantir's financial history, current valuation metrics, and future prospects, you can make a more informed investment decision regarding this potentially transformative company. Further research into individual financial reports and market analyses will solidify your understanding of Palantir's stock valuation and help you determine if it aligns with your investment strategy.

Featured Posts

-

Jenna Ortegas Verdict No Return To Minor Mcu Character

May 07, 2025

Jenna Ortegas Verdict No Return To Minor Mcu Character

May 07, 2025 -

Conclave Explained The Process Of Choosing The Pope

May 07, 2025

Conclave Explained The Process Of Choosing The Pope

May 07, 2025 -

Lotto 6aus49 Ergebnisse Der Ziehung Am 12 April 2025

May 07, 2025

Lotto 6aus49 Ergebnisse Der Ziehung Am 12 April 2025

May 07, 2025 -

Strengthened Partnership Royal Air Maroc And Mauritania Airlines Announce New Agreement

May 07, 2025

Strengthened Partnership Royal Air Maroc And Mauritania Airlines Announce New Agreement

May 07, 2025 -

The White Lotus Season 2 Ke Huy Quans Unexpected Voice Appearance

May 07, 2025

The White Lotus Season 2 Ke Huy Quans Unexpected Voice Appearance

May 07, 2025

Latest Posts

-

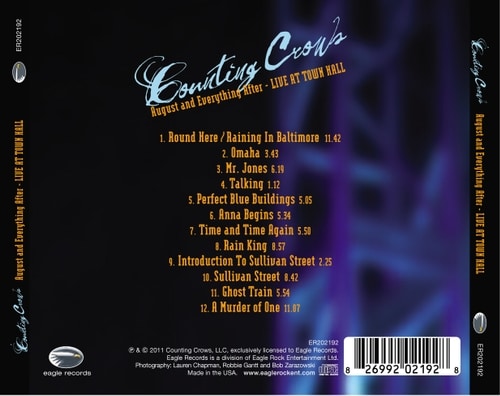

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025 -

The Night That Changed Everything Counting Crows And Saturday Night Live

May 08, 2025

The Night That Changed Everything Counting Crows And Saturday Night Live

May 08, 2025