Palantir Technologies Stock: Buy, Sell, Or Hold? An Investor's Guide

Table of Contents

Palantir Technologies: Company Overview and Business Model

Palantir Technologies is a prominent data analytics company specializing in providing software platforms for complex data integration and analysis. Its business model centers around two core platforms: Gotham and Foundry. Gotham caters primarily to government clients, assisting in national security and intelligence operations, while Foundry serves commercial clients across various sectors. Both platforms leverage Palantir's proprietary technology to help organizations make sense of massive datasets, uncover hidden insights, and improve operational efficiency.

Palantir's software solutions are known for their ability to handle highly sensitive and structured data, making them invaluable for clients in sectors like finance, healthcare, and aerospace. Key clients and partnerships showcase Palantir's broad market reach, demonstrating its ability to secure significant contracts across various industries.

- Government contracts and their significance: These contracts represent a substantial portion of Palantir's revenue and provide a stable revenue stream. However, their dependence on government contracts is also a risk factor (discussed later).

- Commercial market expansion and key industry sectors: Palantir is actively expanding its commercial client base, targeting sectors like finance, healthcare, and energy. Success in this area will be vital for long-term growth and diversification.

- Competitive advantages and technological innovation: Palantir's proprietary technology, particularly its ability to handle complex and sensitive data, provides a significant competitive advantage. Continuous innovation in data analytics is crucial for maintaining this edge.

Analyzing Palantir's Financial Performance

Analyzing Palantir's financial performance requires a thorough examination of key metrics. While Palantir has demonstrated significant revenue growth, profitability remains a key area of focus for investors. Careful assessment of revenue growth, operating margin, net income, and cash flow are essential for understanding the company's financial health and future prospects. Comparing Palantir's performance to competitors like Snowflake and Databricks provides valuable context within the broader data analytics market.

- Year-over-year revenue growth analysis: Examining historical revenue growth trends reveals the company's ability to expand its market share and attract new clients.

- Profitability trends and future projections: Analyzing profitability metrics (operating margin, net income) and projections is critical for assessing the company's long-term financial sustainability.

- Debt levels and financial stability: Assessing Palantir's debt levels and overall financial stability helps investors gauge its risk profile.

- Comparison with competitors' financial performance: Comparing Palantir's financial performance against industry peers like Snowflake and Databricks helps contextualize its growth and profitability within the broader competitive landscape.

Market Factors Influencing Palantir Stock Price

Several factors influence Palantir's stock price, including macroeconomic conditions, industry trends, and investor sentiment. Geopolitical events can significantly impact government contracts, while technological advancements and innovation drive competition and influence market perception. Analyst ratings and price targets play a role, alongside news and events affecting investor confidence.

- Impact of geopolitical events on Palantir's government contracts: Global instability or changes in government priorities can affect the demand for Palantir's services.

- The role of technological advancements and innovation: The rapid pace of technological change in the data analytics sector necessitates continuous innovation for Palantir to remain competitive.

- Analysis of analyst ratings and price targets: Understanding the consensus view among financial analysts provides valuable insight into market sentiment.

- Influence of news and events on Palantir stock price: Positive or negative news about the company, its clients, or the broader market can cause significant stock price fluctuations.

Risks and Potential Downsides of Investing in Palantir Stock

Investing in Palantir Technologies stock carries inherent risks. These include competition from established and emerging technology companies, reliance on large government contracts, potential regulatory changes, and a high stock valuation relative to current earnings. The volatility of the stock price is another significant consideration for investors.

- Competition from established and emerging tech companies: The data analytics market is highly competitive, with both established and emerging players vying for market share.

- Reliance on large government contracts: Palantir's dependence on government contracts creates vulnerability to changes in government spending or priorities.

- Potential for regulatory changes impacting the business: New regulations could significantly impact Palantir's operations and profitability.

- High stock valuation relative to earnings: A high price-to-earnings ratio suggests that the market is placing a premium on Palantir's future growth potential, making it vulnerable to disappointments.

Should You Buy, Sell, or Hold Palantir Technologies Stock?

The decision to buy, sell, or hold Palantir Technologies stock depends on your individual investment goals, risk tolerance, and assessment of the factors discussed above. A balanced assessment is crucial.

- Buy recommendation: A buy recommendation might be suitable for long-term investors with a high-risk tolerance who believe in Palantir's growth potential and its ability to successfully navigate the competitive landscape.

- Sell recommendation: A sell recommendation might be appropriate for investors concerned about the risks outlined above, particularly the high valuation and dependence on government contracts.

- Hold recommendation: A hold recommendation might be suitable for investors who are currently invested in Palantir and are willing to wait for further developments before making a decision.

- Diversification strategies for Palantir investment: It's essential to diversify your investment portfolio to minimize risk, rather than concentrating heavily in any single stock, including Palantir.

Conclusion

Palantir Technologies stock presents a complex investment opportunity. Its growth potential is significant, fueled by its innovative data analytics platforms and expanding market reach. However, the company faces risks related to competition, reliance on government contracts, and its current valuation. Before making a decision on whether to buy, sell, or hold Palantir Technologies stock, conduct your own thorough due diligence and consult with a financial advisor. Remember that investing in Palantir stock or any stock involves risk, and past performance is not indicative of future results. Use this guide as a starting point for your Palantir Technologies stock analysis.

Featured Posts

-

What The Williams Team Boss Said About Logan Sargeant And The Driver Lineup

May 09, 2025

What The Williams Team Boss Said About Logan Sargeant And The Driver Lineup

May 09, 2025 -

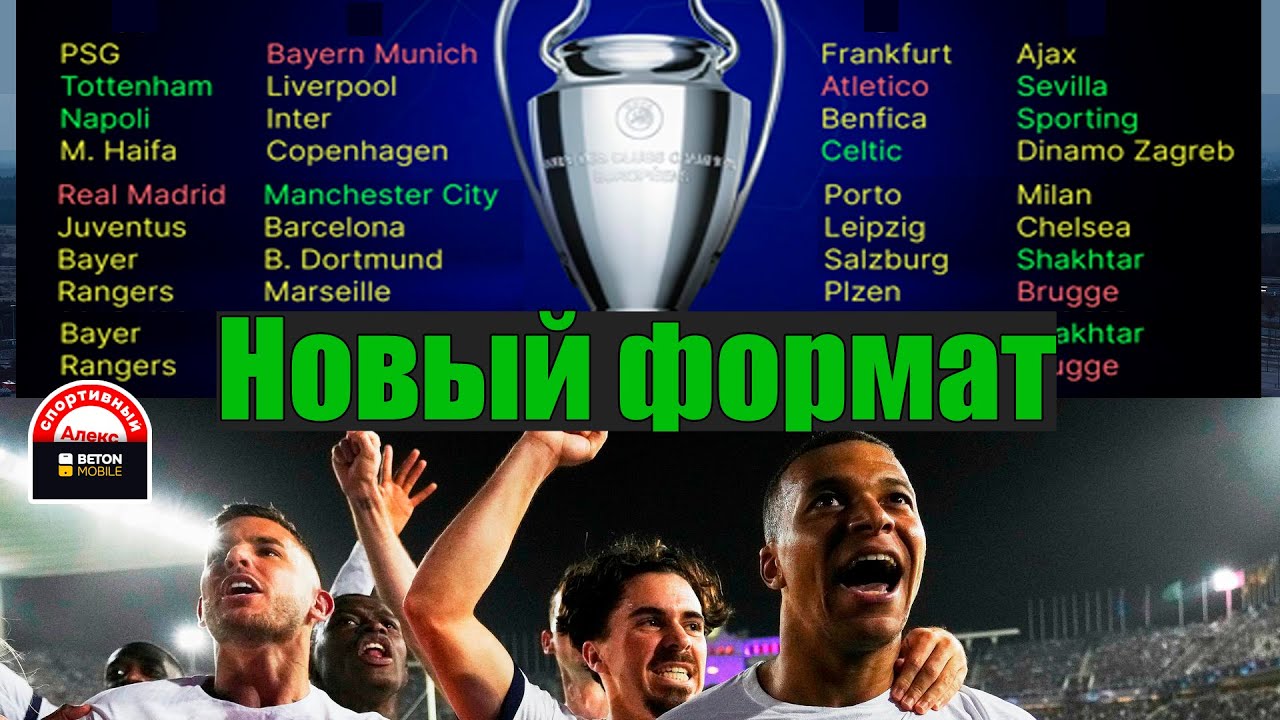

Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy Daty Matchey I Gde Smotret

May 09, 2025

Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy Daty Matchey I Gde Smotret

May 09, 2025 -

Putins Victory Day Ceasefire Implications And Reactions

May 09, 2025

Putins Victory Day Ceasefire Implications And Reactions

May 09, 2025 -

Sensex And Niftys Impressive Gains Understanding The 5 Drivers Behind Todays Market Jump

May 09, 2025

Sensex And Niftys Impressive Gains Understanding The 5 Drivers Behind Todays Market Jump

May 09, 2025 -

Imalaia 23etis Rekor Xamilon Xionoptoseon

May 09, 2025

Imalaia 23etis Rekor Xamilon Xionoptoseon

May 09, 2025