Palantir Technologies Stock: Is It A Good Investment Right Now?

Table of Contents

Palantir's Business Model and Growth Prospects

Palantir Technologies operates in the lucrative big data analytics market, providing sophisticated software platforms to government and commercial clients. Understanding its dual-revenue streams is crucial for assessing its investment potential.

Government Contracts and Revenue Streams

Palantir's substantial revenue historically stemmed from lucrative government contracts, primarily with US intelligence agencies. This reliance offers a degree of stability, but also presents risks. Changes in government priorities or budget cuts could significantly impact revenue. However, Palantir is actively expanding its commercial client base, a crucial element for long-term growth.

- Significant Government Contracts: Palantir has secured major contracts with various government agencies, including the CIA and other defense departments. The value and duration of these contracts significantly influence Palantir's short-term financial performance.

- Revenue Growth Analysis: While government contracts provide a steady baseline, Palantir's success hinges on its ability to secure and maintain significant commercial clients. Analyzing the year-over-year growth in both sectors reveals the trajectory of its overall revenue.

- Contract Renewal Rates: The success rate of contract renewals is a key indicator of client satisfaction and long-term sustainability of the government revenue stream.

Technological Innovation and Competitive Advantage

Palantir's core offering, the Foundry platform, is a sophisticated data integration and analytics tool. This technology provides a crucial competitive advantage, allowing clients to integrate and analyze vast amounts of data from disparate sources.

- Key Technologies: Palantir's proprietary technologies, including Foundry and Gotham, represent significant barriers to entry for competitors. Continuous innovation is essential for maintaining this edge.

- Competition Analysis: While Palantir faces competition from established players like Databricks and Snowflake, its unique approach and focus on complex data integration differentiate it.

- R&D Spending: Palantir's investment in research and development indicates its commitment to technological innovation, a crucial factor in sustaining its competitive advantage in the ever-evolving big data landscape.

Financial Performance and Valuation

Analyzing Palantir's financials is crucial to understanding its investment viability. While revenue growth is encouraging, profitability remains a key concern for many investors.

Recent Financial Results and Key Metrics

Scrutinizing Palantir's recent financial reports (10-Ks and 10-Qs) provides a clear picture of its performance. Key metrics include:

- Revenue Growth: Tracking year-over-year revenue growth provides insights into the company's ability to expand its market reach and secure new contracts.

- Profitability: Examining profit margins, operating income, and net income reveals whether Palantir is generating sustainable profits.

- Debt Levels and Cash Reserves: Analyzing debt-to-equity ratios and cash on hand gives a clear picture of the company's financial health and resilience.

Stock Price Analysis and Future Projections

The current PLTR stock price reflects investor sentiment. Examining historical performance, along with analyst forecasts, can help in assessing its future potential.

- Stock Price Trends: Charting the historical stock price helps illustrate the volatility and potential for both substantial gains and losses.

- Analyst Ratings and Price Targets: Consulting various financial analysts' reports provides a range of predictions and potential outcomes for the stock price.

- Factors Affecting Stock Price: External factors, including macroeconomic conditions, geopolitical events, and technological advancements, can all greatly influence PLTR's stock price.

Risks and Considerations for Investors

Investing in Palantir Technologies stock comes with considerable risks. It's crucial to understand these before making any investment decisions.

Geopolitical Risks and Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to geopolitical risks. Changes in government policy, budget cuts, or international relations could negatively impact its revenue.

- Specific Geopolitical Risks: Analyzing the potential impact of political instability in key regions where Palantir operates is vital.

- Revenue Stream Diversification: Assessing Palantir's strategies to diversify its revenue streams away from government contracts is essential for long-term stability.

Competition and Market Saturation

The big data analytics market is becoming increasingly competitive. The potential for market saturation poses a threat to Palantir's growth.

- Major Competitors: Identifying and analyzing the strengths and weaknesses of key competitors, including their market share and growth strategies, is critical.

- Market Share Analysis: Examining Palantir's market share and its ability to maintain or expand it in a competitive environment is crucial for evaluating its future prospects.

Conclusion

Palantir Technologies presents a compelling investment opportunity, fueled by its innovative technology and expanding market reach. However, its reliance on government contracts and intense competition present considerable risks. While its revenue growth is encouraging, its profitability needs further improvement. The volatility of PLTR stock requires careful consideration. Based on the current analysis, whether Palantir Technologies stock is a good investment right now depends heavily on your risk tolerance and investment horizon. Consider your investment goals before deciding whether Palantir Technologies stock is right for you. Do your own due diligence before investing in Palantir Technologies stock.

Featured Posts

-

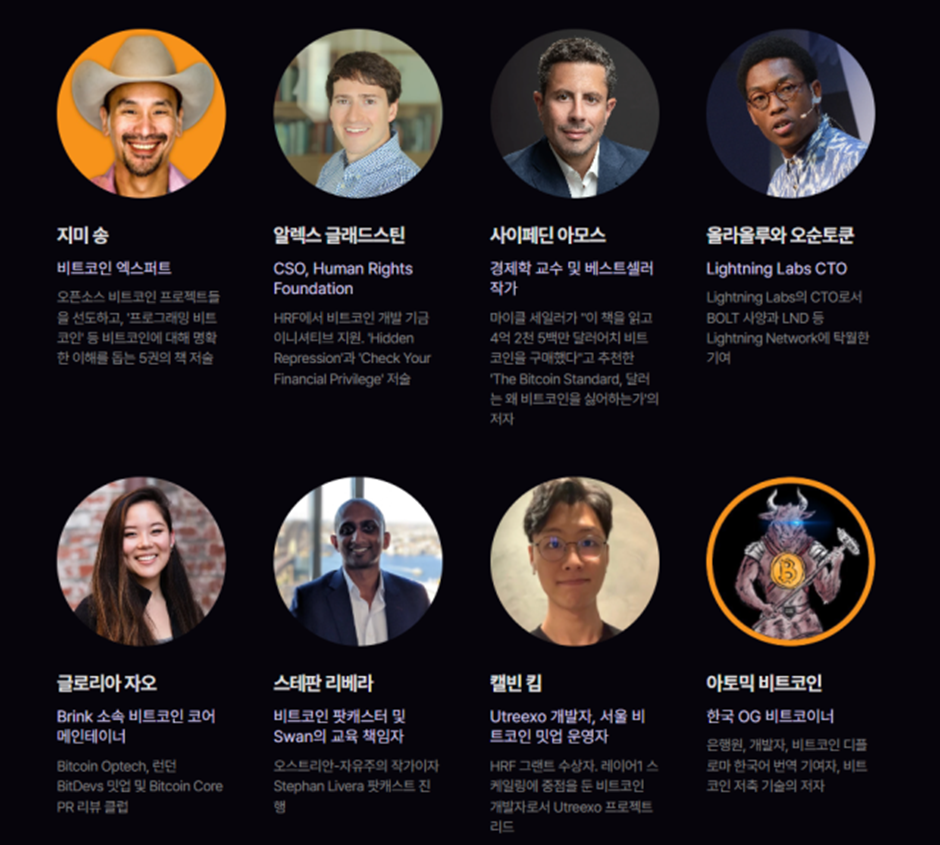

Attending Bitcoin Seoul 2025 A Guide For Attendees

May 09, 2025

Attending Bitcoin Seoul 2025 A Guide For Attendees

May 09, 2025 -

Polish Woman And Accomplice Deny Charges In Mc Cann Home Incident

May 09, 2025

Polish Woman And Accomplice Deny Charges In Mc Cann Home Incident

May 09, 2025 -

Changes To Uk Student Visas Implications For Asylum Claims

May 09, 2025

Changes To Uk Student Visas Implications For Asylum Claims

May 09, 2025 -

Mans 3 000 Babysitting Complaint Leads To 3 600 Daycare Bill

May 09, 2025

Mans 3 000 Babysitting Complaint Leads To 3 600 Daycare Bill

May 09, 2025 -

Mestarien Liiga Bayern Muenchen Inter Ja Psg Etenevaet Puolivaelieriin

May 09, 2025

Mestarien Liiga Bayern Muenchen Inter Ja Psg Etenevaet Puolivaelieriin

May 09, 2025