Payday Loans For Bad Credit: Guaranteed Approval Direct & Online

Table of Contents

Understanding Payday Loans for Bad Credit

Payday loans are short-term, small-dollar loans designed to help borrowers cover unexpected expenses until their next payday. For those with bad credit, these loans can offer a lifeline when traditional lenders say no. However, it's crucial to understand the terms before applying.

- High-interest rates and short repayment terms: Payday loans typically have higher interest rates than other loan types and are due within a short period, usually two to four weeks.

- Designed for short-term financial relief: These loans are intended for temporary emergencies, not long-term financial solutions.

- Accessibility despite poor credit history: While your credit score matters, lenders often prioritize your ability to repay the loan based on your income and employment.

- Focus on repayment ability, not solely credit score: Lenders will assess your income and employment stability as key factors in determining your eligibility.

Why Bad Credit Impacts Loan Approval

Your credit score is a significant factor in loan applications. Lenders use it to assess the risk of lending you money.

- Lenders assess risk based on credit reports: A low credit score suggests a higher probability of default, making lenders hesitant to approve your application.

- Low credit scores indicate higher risk of default: A history of missed payments or bankruptcies negatively impacts your credit score and increases perceived risk.

- Impact on interest rates and loan terms: A bad credit score can lead to higher interest rates and less favorable loan terms.

- Importance of responsible borrowing: Building and maintaining a good credit score is crucial for accessing better loan options in the future.

Finding Direct Lenders for Payday Loans

Applying directly to a lender offers several advantages over using a broker or third-party service.

- Avoid third-party fees and brokers: Direct lenders eliminate the extra fees charged by intermediaries.

- Faster processing times: Applications are processed directly, leading to quicker approvals.

- More transparent terms and conditions: You'll have direct access to the lender's terms and conditions without any hidden fees.

- Increased chances of approval: While not guaranteed, applying directly may increase your chances of approval, especially for payday loans for bad credit.

The Online Application Process: Quick & Easy

Applying for payday loans online is typically quick and straightforward.

- Simple application forms with minimal paperwork: Online applications usually require basic personal and financial information.

- Fast approval times (often within minutes): Many lenders provide near-instantaneous approval decisions.

- Secure online platforms protecting personal information: Reputable lenders utilize secure encryption to protect your data.

- Direct deposit into bank accounts: Once approved, funds are often deposited directly into your bank account within one business day.

Documents Required for Application

To apply, you'll typically need:

- Proof of income (pay stubs, bank statements): Demonstrates your ability to repay the loan.

- Government-issued ID: Verifies your identity.

- Bank account details: For direct deposit of funds.

- Contact information: For communication regarding your application and loan.

Risks and Responsibilities of Payday Loans

While convenient, payday loans come with significant risks.

- High interest rates and fees: These loans can be incredibly expensive if not repaid on time.

- Debt cycle risk if not repaid promptly: Rolling over loans can lead to a cycle of debt that's difficult to escape.

- Importance of budgeting and responsible borrowing: Carefully assess your ability to repay the loan before applying.

- Exploring alternative financial solutions: Consider other options before resorting to payday loans.

Alternatives to Payday Loans for Bad Credit

If possible, explore these alternatives:

- Credit unions: Often offer more affordable loan options with better terms.

- Personal loans from banks or online lenders: While potentially harder to obtain with bad credit, they may offer lower interest rates than payday loans.

- Borrowing from friends or family: A less formal option, but crucial to maintain clear repayment terms.

Conclusion

Securing payday loans for bad credit requires careful consideration and a clear understanding of the terms involved. While online direct lenders offer convenience and potentially faster approval, it’s crucial to assess your ability to repay the loan promptly and avoid the high-interest rates and fees associated with these types of loans. Explore all available options, weigh the risks, and prioritize responsible borrowing. If you need immediate financial assistance and meet the lender's requirements, applying for payday loans for bad credit online directly could be a solution, but only proceed if you're confident in your ability to manage the repayment schedule. Remember to always compare offers from multiple lenders before making a decision. Find the best payday loan for bad credit that suits your needs today.

Featured Posts

-

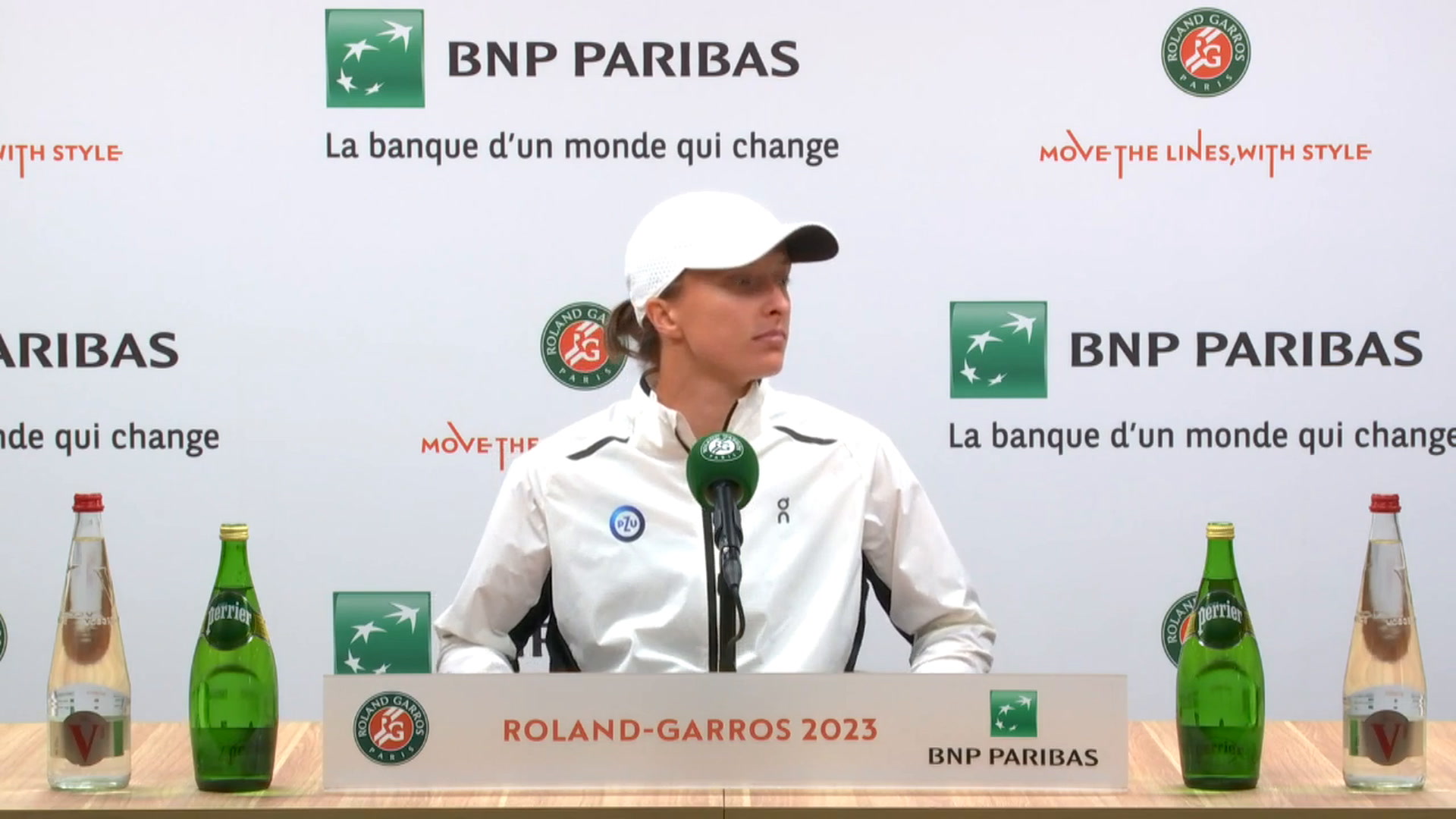

Swiatek And Alcaraz Win Opening Matches At Roland Garros

May 28, 2025

Swiatek And Alcaraz Win Opening Matches At Roland Garros

May 28, 2025 -

Bon Plan Samsung Galaxy S25 Ultra 1 To 1294 90 E 13

May 28, 2025

Bon Plan Samsung Galaxy S25 Ultra 1 To 1294 90 E 13

May 28, 2025 -

Ramalan Cuaca Jawa Tengah 24 April 2024 Siap Siaga Hujan

May 28, 2025

Ramalan Cuaca Jawa Tengah 24 April 2024 Siap Siaga Hujan

May 28, 2025 -

Analisis Del Partido Real Madrid 3 2 Celta Vigo Tres Preguntas Y Respuestas

May 28, 2025

Analisis Del Partido Real Madrid 3 2 Celta Vigo Tres Preguntas Y Respuestas

May 28, 2025 -

Persemian Gerakan Bali Bersih Sampah Peran Masyarakat Dalam Mewujudkan Bali Yang Bersih

May 28, 2025

Persemian Gerakan Bali Bersih Sampah Peran Masyarakat Dalam Mewujudkan Bali Yang Bersih

May 28, 2025

Latest Posts

-

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rn Proteste

May 30, 2025

Subventions Regionales Pour Le Concert De Medine En Grand Est Le Rn Proteste

May 30, 2025 -

Le Jugement De Marine Le Pen 5 Ans D Ineligibilite Et Ses Implications Politiques

May 30, 2025

Le Jugement De Marine Le Pen 5 Ans D Ineligibilite Et Ses Implications Politiques

May 30, 2025 -

Ineligibilite De Marine Le Pen Reactions Et Consequences De La Sentence

May 30, 2025

Ineligibilite De Marine Le Pen Reactions Et Consequences De La Sentence

May 30, 2025 -

La Condamnation De Marine Le Pen Analyse D Une Decision Judiciaire Divisee

May 30, 2025

La Condamnation De Marine Le Pen Analyse D Une Decision Judiciaire Divisee

May 30, 2025 -

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Controversee

May 30, 2025

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Controversee

May 30, 2025