Paytm Payments Bank Faces ₹5.45 Crore Fine From FIU-IND Over Money Laundering

Table of Contents

Details of the FIU-IND Fine and its Implications

Paytm Payments Bank was slapped with a ₹5.45 crore fine by the FIU-IND for failing to adhere to stringent anti-money laundering (AML) and Know Your Customer (KYC) regulations. The fine follows a thorough investigation by the FIU-IND, which uncovered significant deficiencies in Paytm Payments Bank's compliance measures. The investigation likely involved analyzing transaction data, identifying suspicious activities, and assessing the bank's internal controls. The specific money laundering violations are yet to be fully disclosed publicly but are likely related to inadequate KYC processes, allowing potentially illicit transactions to slip through the cracks. This lapse in regulatory compliance carries significant implications, potentially affecting customer trust, investor confidence, and the overall reputation of Paytm Payments Bank.

- Date of Fine Imposition: [Insert Date if available]

- Breakdown of the Fine: [Insert details if available]

- Official Statement: [Insert quotes from official statements if available]

- Severity Analysis: The severity of the violation suggests a significant failure in implementing adequate KYC/AML measures, potentially impacting the bank's ability to operate effectively and maintain a strong reputation.

Paytm Payments Bank's Response to the Allegations

Paytm Payments Bank's official response to the FIU-IND fine is crucial in understanding their position and future actions. [Insert details of their official statement here, if available]. Their response will likely indicate whether they accept full responsibility, plan to appeal the decision, or intend to implement more robust compliance measures. Any previous regulatory actions against Paytm Payments Bank should also be considered to assess the pattern of compliance issues. A strong and transparent response is vital to regain customer and investor trust.

- Key Points from Paytm's Statement: [List key points from any press releases or public statements]

- Communication Strategy Analysis: [Analyze their communication, highlighting strengths and weaknesses]

- Timeline of Events: [Outline the key events leading up to the imposition of the fine]

The Broader Context of Money Laundering Regulations in India

The significance of this fine extends beyond Paytm Payments Bank, highlighting the critical role of anti-money laundering (AML) regulations in India. The FIU-IND, as the central agency responsible for receiving, processing, and disseminating intelligence related to financial crimes, plays a vital role in preventing money laundering and terrorist financing. The Prevention of Money Laundering Act, 2002 (PMLA), is the primary legislation governing AML compliance in India, mandating stringent KYC and transaction monitoring procedures for financial institutions. The fine imposed on Paytm Payments Bank serves as a stark reminder of the potential consequences of non-compliance.

- Key AML Legislation: Prevention of Money Laundering Act, 2002 (PMLA), and other relevant regulations.

- Similar Cases: Mention other instances of Indian companies facing penalties for money laundering violations.

- Economic Impact: Discuss the detrimental effect of money laundering on the Indian economy.

Future Implications for Paytm Payments Bank and the Fintech Industry

The ₹5.45 crore fine will undoubtedly have long-term implications for Paytm Payments Bank. It could lead to changes in their business strategies, potentially impacting their growth and market share. The incident could also erode customer trust and loyalty, affecting their user base. Furthermore, this case sets a precedent for other fintech companies in India, underscoring the need for robust KYC/AML compliance programs. Regulatory scrutiny of the fintech sector is likely to increase, leading to stricter oversight and potentially higher compliance costs.

- Strategic Changes: Potential changes to Paytm Payments Bank's operational procedures and risk management strategies.

- Customer Impact: Analyze the potential effects on customer trust and loyalty.

- Industry-Wide Changes: Discuss the broader implications for KYC and AML procedures across the fintech sector.

Conclusion: Understanding the Paytm Payments Bank Fine and its Implications for Financial Compliance

The ₹5.45 crore fine imposed on Paytm Payments Bank for money laundering violations underscores the critical importance of stringent KYC/AML compliance for all financial institutions in India. This case highlights the potential consequences of neglecting regulatory obligations and the significant role of the FIU-IND in maintaining the integrity of the financial system. The incident has far-reaching implications for the Indian fintech industry, prompting a renewed focus on compliance and potentially leading to stricter regulatory oversight. Staying informed about financial regulations and compliance measures related to Paytm Payments Bank and other financial institutions is crucial to mitigating the risks of similar violations. Research and understand the implications of money laundering and the importance of KYC compliance to protect yourself and the financial ecosystem.

Featured Posts

-

Decoding The Us China Trade Deal Who Compromised

May 15, 2025

Decoding The Us China Trade Deal Who Compromised

May 15, 2025 -

Late Game Heroics Gurriels Rbi Single Lifts Padres Past Braves

May 15, 2025

Late Game Heroics Gurriels Rbi Single Lifts Padres Past Braves

May 15, 2025 -

Cubs Strong Pitching Stifles Dodgers Offense

May 15, 2025

Cubs Strong Pitching Stifles Dodgers Offense

May 15, 2025 -

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025 -

Analyzing The San Diego Padres Winning Strategies And Challenges

May 15, 2025

Analyzing The San Diego Padres Winning Strategies And Challenges

May 15, 2025

Latest Posts

-

Ayesha Howards Daughter And Anthony Edwards Son A Unique Co Parenting Arrangement

May 15, 2025

Ayesha Howards Daughter And Anthony Edwards Son A Unique Co Parenting Arrangement

May 15, 2025 -

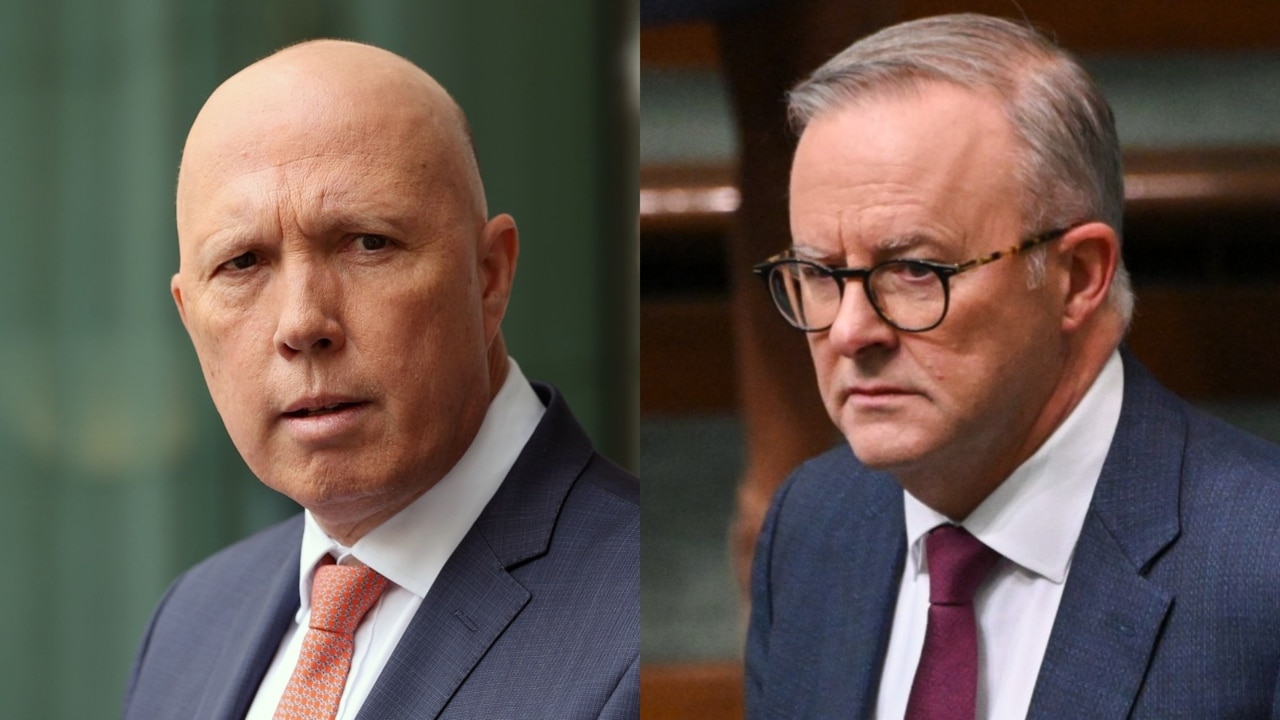

Albanese Vs Dutton A Critical Analysis Of Their Policy Pitches

May 15, 2025

Albanese Vs Dutton A Critical Analysis Of Their Policy Pitches

May 15, 2025 -

Ayesha Howard And Anthony Edwards Shared Custody Agreement Raising Their Children Together

May 15, 2025

Ayesha Howard And Anthony Edwards Shared Custody Agreement Raising Their Children Together

May 15, 2025 -

Ayesha Howard And Anthony Edwards Co Parenting Under One Roof

May 15, 2025

Ayesha Howard And Anthony Edwards Co Parenting Under One Roof

May 15, 2025 -

Warner Robins Man Convicted In 2023 Killing Of Estranged Wifes Friend

May 15, 2025

Warner Robins Man Convicted In 2023 Killing Of Estranged Wifes Friend

May 15, 2025