Paytm Payments Bank Penalized ₹5.45 Crore By FIU-IND For Money Laundering

Table of Contents

The FIU-IND's Findings and the Penalty

The FIU-IND's investigation into Paytm Payments Bank uncovered several deficiencies in its anti-money laundering (AML) compliance program. The investigation, spanning several months, focused on Paytm Payments Bank's adherence to KYC (Know Your Customer) norms and its transaction monitoring systems. The regulatory action underscores the seriousness with which the FIU-IND views AML violations.

-

Specific Violations: The FIU-IND report detailed several alleged violations, including inadequate KYC checks, insufficient transaction monitoring, and a lack of robust systems for identifying suspicious activity. These failings allowed potentially illicit transactions to slip through the cracks, raising concerns about money laundering vulnerabilities within the system. While specifics remain partially undisclosed, the severity of the penalty indicates significant breaches.

-

Penalty Breakdown: The ₹5.45 crore penalty represents a substantial financial blow to Paytm Payments Bank. This financial penalty aims to serve as a deterrent against future AML compliance failures and reinforces the importance of adhering to stringent regulations. The amount reflects the seriousness of the identified shortcomings and the potential for wider systemic risk.

-

Paytm's Response: Paytm Payments Bank has yet to officially comment publicly on the specifics of the FIU-IND's findings or announce any planned legal challenges. However, it's anticipated that the bank will review its AML procedures and strengthen its compliance framework.

-

Severity of the Penalty: Compared to penalties imposed on other financial institutions in India for similar AML violations, the ₹5.45 crore fine falls within a range reflecting the scale of the reported infractions. The financial penalty signals a clear message from the regulator emphasizing the importance of robust AML compliance for all financial institutions.

Implications for the Fintech Industry in India

The FIU-IND's action against Paytm Payments Bank sends a strong message to the entire fintech industry in India. It signals a heightened focus on regulatory compliance and the increasing expectation of robust AML measures. The implications are far-reaching.

-

Increased Regulatory Scrutiny: This case highlights the increasing regulatory scrutiny facing the burgeoning fintech sector in India. The government is actively working to strengthen AML regulations and enhance oversight mechanisms to safeguard the financial system.

-

Enhanced AML Measures: Fintech companies need to proactively review and enhance their AML compliance programs. This includes strengthening KYC processes, implementing sophisticated transaction monitoring systems, and regularly conducting risk assessments.

-

Importance of KYC and Customer Due Diligence: Robust KYC (Know Your Customer) and customer due diligence processes are no longer optional; they are critical for compliance and mitigating financial crime risks. Effective KYC involves verifying customer identities and understanding their business activities to identify and prevent potential money laundering.

-

Impact on Customer Trust: AML failures can significantly damage customer trust and the overall reputation of the fintech industry. Maintaining customer trust is paramount, and robust AML compliance is a crucial element in building that trust.

Strengthening AML Compliance: Best Practices for Fintechs

Given the Paytm Payments Bank case, fintech companies must prioritize and strengthen their AML compliance strategies.

-

Effective AML Compliance Strategies: Implementing a comprehensive AML compliance program requires a multi-pronged approach, including robust KYC procedures, advanced transaction monitoring systems, and regular internal audits.

-

Best Practices for KYC and Customer Due Diligence: This includes verifying customer identities using multiple sources, conducting thorough background checks, and maintaining accurate customer records.

-

Robust Transaction Monitoring Systems: Sophisticated transaction monitoring systems can help identify suspicious activity patterns, flagging potentially illicit transactions for further investigation.

-

Regulatory Technology (RegTech): Leveraging RegTech solutions can significantly enhance AML compliance efforts by automating tasks, improving accuracy, and providing valuable data analytics.

-

Risk Assessment and Mitigation: Regular risk assessments are essential to identify vulnerabilities and develop appropriate mitigation strategies. These assessments should consider both internal and external factors that could expose the business to AML risks.

Customer Impact and Data Security Concerns

The FIU-IND's penalty against Paytm Payments Bank also raises concerns about customer data security and privacy.

-

Potential Impact on Customers: While the direct impact on individual customers may be limited, the penalty underscores the importance of choosing financial institutions with robust security measures and strong AML compliance.

-

Data Security and Privacy: The incident highlights the importance of data security and privacy, particularly in the context of financial transactions. Protecting customer data is critical, and strong security measures are essential to prevent data breaches and misuse.

-

Protecting Financial Information: Customers should remain vigilant in protecting their financial information by using strong passwords, being wary of phishing scams, and regularly reviewing their account statements.

Conclusion

The ₹5.45 crore penalty imposed on Paytm Payments Bank by the FIU-IND serves as a stark reminder of the critical importance of stringent anti-money laundering compliance within the Indian fintech sector. The case highlights the need for enhanced KYC procedures, sophisticated transaction monitoring, and the adoption of best practices to prevent financial crimes. The increased regulatory scrutiny demands a proactive approach to AML compliance from all financial institutions.

Call to Action: Understanding the implications of this Paytm Payments Bank penalty is crucial for all stakeholders in the Indian fintech ecosystem. Stay informed about evolving AML regulations and ensure your financial institution maintains robust anti-money laundering compliance to avoid similar penalties and protect your business and customers. Proactive implementation of best practices in anti-money laundering is not just a regulatory requirement; it's a fundamental aspect of responsible financial operations.

Featured Posts

-

Fentanyl And China The Price Of Inaction Says Former Us Envoy

May 15, 2025

Fentanyl And China The Price Of Inaction Says Former Us Envoy

May 15, 2025 -

Npos Strijd Tegen Grensoverschrijdend Gedrag Een Kritische Blik

May 15, 2025

Npos Strijd Tegen Grensoverschrijdend Gedrag Een Kritische Blik

May 15, 2025 -

Stefanos Stefanu Ve Kibris Sorunu Yeni Bir Yaklasim

May 15, 2025

Stefanos Stefanu Ve Kibris Sorunu Yeni Bir Yaklasim

May 15, 2025 -

Analyzing The Gop Mega Bill Key Provisions And Expected Opposition

May 15, 2025

Analyzing The Gop Mega Bill Key Provisions And Expected Opposition

May 15, 2025 -

Rising Alcohol Consumption Among Women Doctors Sound The Alarm

May 15, 2025

Rising Alcohol Consumption Among Women Doctors Sound The Alarm

May 15, 2025

Latest Posts

-

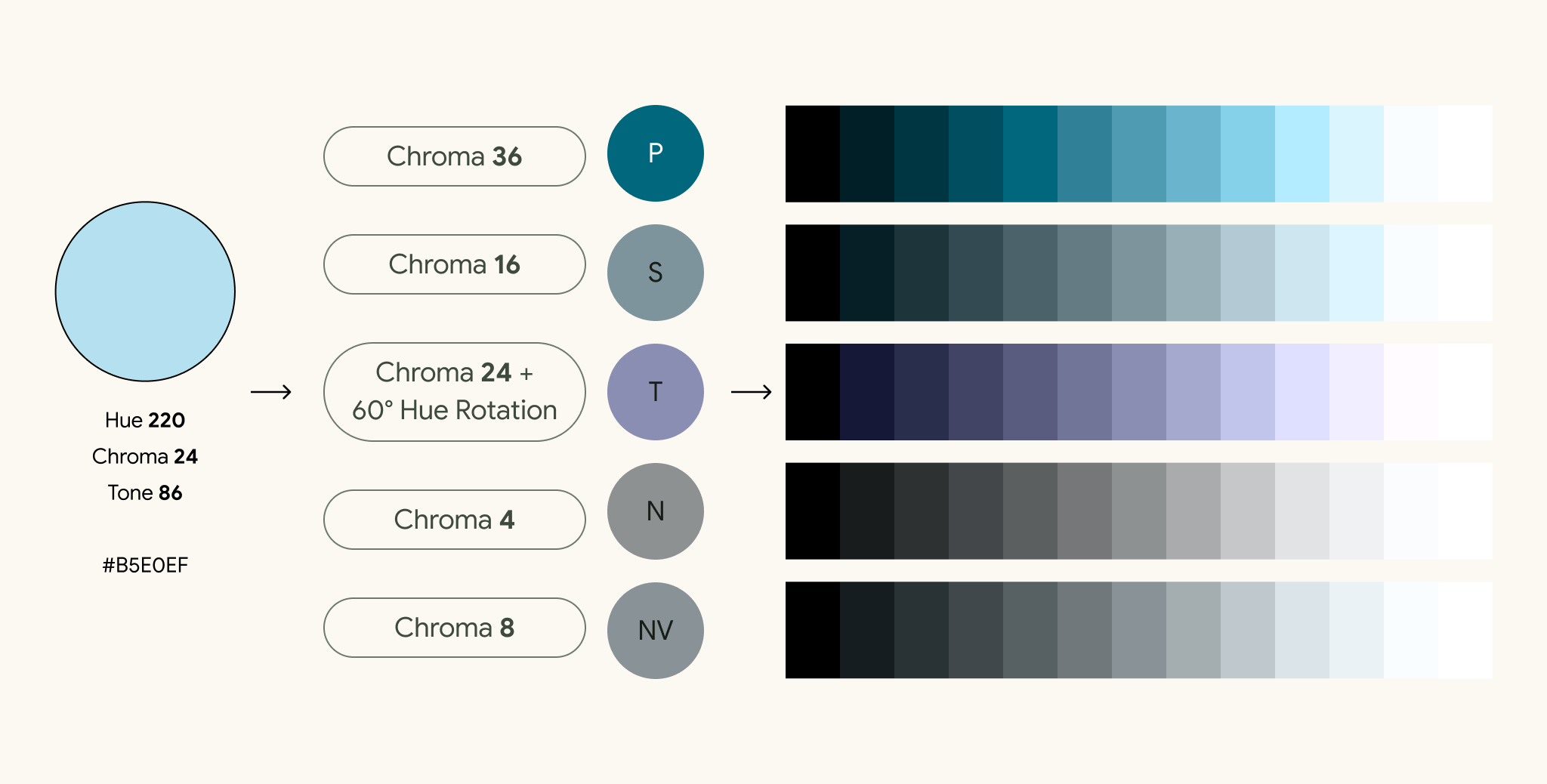

Introducing Androids Evolved Design Language

May 15, 2025

Introducing Androids Evolved Design Language

May 15, 2025 -

The New Android Design A Deep Dive

May 15, 2025

The New Android Design A Deep Dive

May 15, 2025 -

Android Design Overhaul Key Features And Updates

May 15, 2025

Android Design Overhaul Key Features And Updates

May 15, 2025 -

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025

The 2026 Bmw I X Best Case Electric Vehicle Or Overhyped

May 15, 2025 -

Exploring Androids Updated Design Language

May 15, 2025

Exploring Androids Updated Design Language

May 15, 2025