PBOC Daily Yuan Support Below Estimates: First Time In 2024

Table of Contents

Analysis of the PBOC's Reduced Yuan Intervention

The PBOC's decision to lower its daily yuan support is a notable departure from previous practices. Several factors could be contributing to this change in policy:

-

Shifting economic priorities: The Chinese government might be prioritizing other economic goals, such as stimulating domestic demand or managing inflation, over maintaining a specific yuan exchange rate. A more flexible exchange rate could help the Chinese economy adapt more easily to global economic changes. This strategy is often referred to as managed floating.

-

Impact of global economic uncertainty: The current global economic climate, marked by high inflation and geopolitical instability, may have prompted the PBOC to adopt a more cautious approach to currency intervention. Reducing direct support allows the market to absorb some of the pressure, rather than shouldering the entire burden.

-

Potential for increased market flexibility: By reducing its daily support, the PBOC could be aiming to increase the market's role in determining the yuan's value. This increased flexibility could, in the long run, lead to a more efficient and resilient currency market. This is a key element of PBOC policy and its currency management strategy.

-

Assessment of the effectiveness of previous interventions: The PBOC may have reassessed the effectiveness of its previous interventions and concluded that a less interventionist approach is more appropriate in the current economic environment. This involves a careful review of past yuan intervention techniques and their impact on the monetary policy goals.

Impact on the Yuan Exchange Rate and Market Volatility

The reduced PBOC support has already led to noticeable changes in the CNY exchange rate and increased market volatility.

-

Short-term fluctuations and market reactions: The immediate response has been increased volatility in the foreign exchange market. The RMB value has experienced fluctuations as market forces play a larger role in determining its price.

-

Potential for increased volatility in the foreign exchange market: The decreased intervention means the CNY exchange rate is more susceptible to global market swings. This can lead to unpredictable swings for businesses and investors.

-

Impact on Chinese exports and imports: A weaker yuan can boost Chinese exports by making them cheaper for foreign buyers, but it can also make imports more expensive, potentially fueling inflation.

-

Implications for foreign investors in China: The increased volatility creates both opportunities and risks for foreign investors, necessitating a careful reassessment of investment strategies in relation to Chinese exports and the overall economy.

Implications for the Chinese Economy and Global Markets

The PBOC's policy shift carries significant implications for both the Chinese economy and the global landscape.

-

Impact on inflation and economic growth in China: A weaker yuan can boost exports and potentially stimulate economic growth, but it also carries the risk of higher inflation due to more expensive imports. This carefully balanced approach is a significant aspect of the Chinese economy.

-

Potential ripple effects on global trade and investment: Changes in the yuan's value influence global trade patterns and investment flows, affecting other economies linked to China.

-

Reactions from other central banks and international organizations: The PBOC's move will be closely watched by other central banks and international organizations, potentially leading to adjustments in their own monetary policies.

-

Long-term outlook for the yuan and the Chinese economy: The long-term impact will depend on several factors, including global economic conditions and the effectiveness of the PBOC's broader monetary policy strategy.

Future Outlook and Predictions for PBOC Yuan Support

Predicting the PBOC's future actions is challenging, but several factors will likely influence its decisions:

-

Potential scenarios for future yuan support levels: The PBOC might continue to reduce its intervention gradually or increase it if significant currency volatility threatens stability.

-

Factors that may influence future PBOC decisions: Global economic conditions, inflation rates, and capital flows will play a crucial role in shaping the PBOC's future interventions. Expert analysis will continue to examine these aspects.

-

Expert opinions and market analysis: Market analysts and economists will closely monitor the situation and offer predictions about future PBOC forecasts, providing crucial insights for investors.

-

Recommendations for investors and businesses: Businesses engaged in international trade and investors with exposure to the Chinese market need to closely monitor these developments and adjust their strategies accordingly based on the yuan outlook. This includes strategies to mitigate risks related to currency predictions and overall investment strategy.

Conclusion: Understanding the Implications of Reduced PBOC Daily Yuan Support

The recent decrease in PBOC daily yuan support marks a potentially significant shift in Chinese monetary policy. The reduced intervention signifies a move toward a more market-driven exchange rate, with both potential benefits and risks for the Chinese economy and the global financial system. This change necessitates a careful review of the PBOC daily yuan support mechanism and its ongoing impact. Understanding these implications is critical for businesses, investors, and policymakers alike. To stay updated on future developments and gain a deeper understanding of yuan exchange rate dynamics and Chinese monetary policy, continue to follow reputable financial news sources and economic analysis reports.

Featured Posts

-

Nba Playoffs Jimmy Butlers Game 6 Predictions For Rockets Vs Warriors

May 16, 2025

Nba Playoffs Jimmy Butlers Game 6 Predictions For Rockets Vs Warriors

May 16, 2025 -

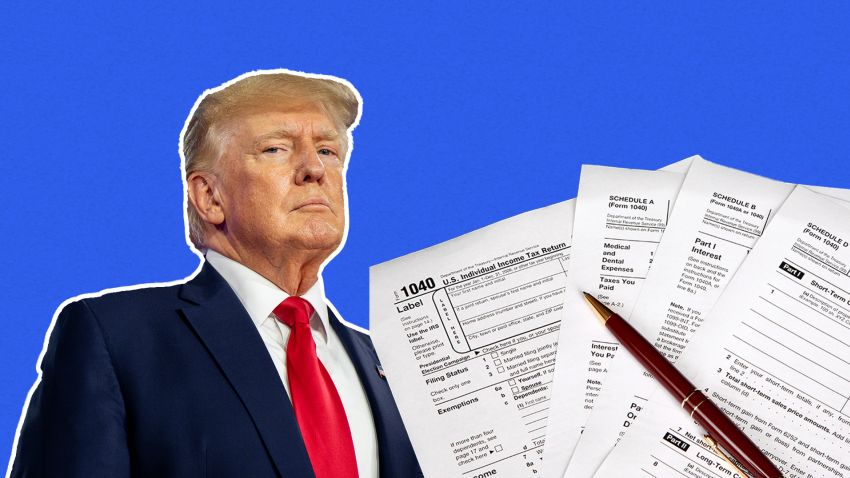

The Trump Tax Plan A Closer Look At The House Gops Proposal

May 16, 2025

The Trump Tax Plan A Closer Look At The House Gops Proposal

May 16, 2025 -

Complete Series Sweep For Rays Against Padres Real Radio 104 1 Coverage

May 16, 2025

Complete Series Sweep For Rays Against Padres Real Radio 104 1 Coverage

May 16, 2025 -

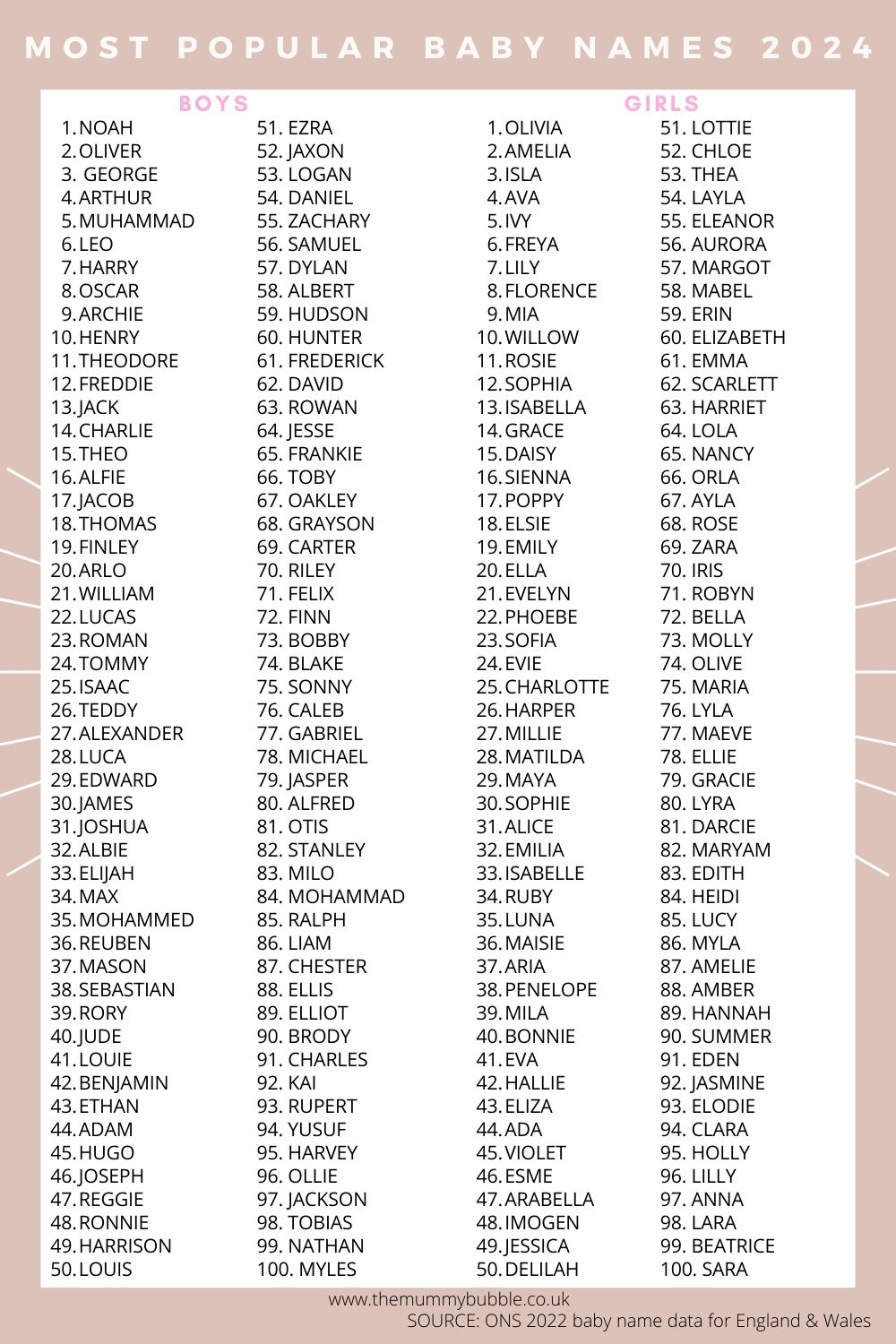

Top Baby Names Of 2024 Familiar Favorites And Fresh Picks

May 16, 2025

Top Baby Names Of 2024 Familiar Favorites And Fresh Picks

May 16, 2025 -

Ohtanis Selfless Act Why He Saved His Biggest Home Run Celebration For A Teammate

May 16, 2025

Ohtanis Selfless Act Why He Saved His Biggest Home Run Celebration For A Teammate

May 16, 2025

Latest Posts

-

Hyeseong Kims Breakout Performance Dodgers Okc Affiliate Sweeps Doubleheader

May 16, 2025

Hyeseong Kims Breakout Performance Dodgers Okc Affiliate Sweeps Doubleheader

May 16, 2025 -

The Reason Behind Shohei Ohtanis Emotional Home Run Celebration

May 16, 2025

The Reason Behind Shohei Ohtanis Emotional Home Run Celebration

May 16, 2025 -

Hyeseong Kim Zyhir Hope Evan Phillips Bobby Miller The Next Generation Of Dodgers

May 16, 2025

Hyeseong Kim Zyhir Hope Evan Phillips Bobby Miller The Next Generation Of Dodgers

May 16, 2025 -

Shohei Ohtani Celebrates Teammates Success The Story Behind The Gesture

May 16, 2025

Shohei Ohtani Celebrates Teammates Success The Story Behind The Gesture

May 16, 2025 -

Dodgers Future Stars A Look At Kim Hope Miller And Phillips In The Minors

May 16, 2025

Dodgers Future Stars A Look At Kim Hope Miller And Phillips In The Minors

May 16, 2025