PBOC Yuan Intervention Falls Short Of Expectations

Table of Contents

Market Expectations vs. Actual PBOC Intervention

Leading up to the intervention (specify timeframe, e.g., the week of October 23rd, 2023), market sentiment pointed towards a significant weakening of the Yuan (RMB exchange rate), fueled by persistent Yuan depreciation and the strengthening US dollar. Analysts widely predicted the PBOC would take robust measures to stem the decline, with some forecasting a substantial increase in the daily fix and aggressive open market operations. Forecasts varied, but a consensus emerged suggesting a more decisive intervention than what ultimately transpired.

- Market Forecasts: Many analysts predicted a Yuan depreciation exceeding 7.3 against the US dollar, leading to expectations of forceful PBOC countermeasures. Some even predicted interventions exceeding $100 billion.

- PBOC Actions: In reality, the PBOC's actions were more subtle and less impactful than anticipated. While they did adjust the daily fix and engaged in some open market operations, the scale of intervention was significantly smaller than widely predicted. Verbal guidance was also provided, but it lacked the strong assertive tone expected by the market.

- Comparison: The disparity between the anticipated "heavy-handed" intervention and the relatively measured response left the market disappointed, contributing to further Yuan volatility. The actual intervention proved insufficient to counteract the prevailing market forces.

Reasons for the Ineffectiveness of PBOC Intervention

The PBOC's intervention failed to meet expectations due to a confluence of factors, highlighting the limitations of monetary policy in the face of powerful global headwinds.

-

Global Economic Headwinds: The persistent strength of the US dollar, driven by aggressive US interest rate hikes and concerns about a global recession, significantly undermined the PBOC's efforts. Global economic uncertainty created a bearish sentiment towards emerging market currencies, including the Yuan.

-

Strength of the US Dollar: The US dollar's strength acted as a powerful counterforce, attracting capital away from emerging markets and putting downward pressure on the Yuan, regardless of the PBOC's actions. This made it considerably more difficult for the PBOC to stabilize the exchange rate.

-

Speculative Attacks: The potential for further Yuan depreciation attracted speculative attacks, exacerbating the downward pressure on the currency and further reducing the effectiveness of the PBOC's intervention.

-

Limited Ammunition: The PBOC's foreign exchange reserves, while still substantial, are not unlimited. The scale of intervention required to meaningfully counter the prevailing market forces might have exceeded the PBOC's willingness or ability to deploy its reserves.

-

Detailed Explanation: Each of these factors played a significant role in limiting the success of the PBOC’s intervention. The global economic environment was simply too challenging for the PBOC to counteract single-handedly.

-

Statistical Data: (Insert relevant statistical data supporting the above points – e.g., data on US interest rates, US dollar index, Yuan exchange rate, PBOC foreign exchange reserves).

-

Expert Opinions: (Include quotes from relevant financial analysts and economists supporting the analysis).

Impact of the Underwhelming Intervention on the Yuan and the Chinese Economy

The ineffective intervention has resulted in continued Yuan volatility, with potentially significant consequences for the Chinese economy.

-

Impact on the Yuan's Exchange Rate: The Yuan continued its depreciation against the US dollar following the intervention, albeit at a slower pace than anticipated.

-

Impact on Chinese Exports and Imports: A weaker Yuan makes Chinese exports more competitive but also increases the cost of imports, potentially fueling inflationary pressures.

-

Impact on Inflation: Increased import costs contribute to inflationary pressure within China, potentially requiring further policy adjustments from the PBOC.

-

Impact on Foreign Investment: Yuan volatility can deter foreign direct investment (FDI), impacting economic growth.

-

Impact on Overall Economic Growth: The combined effects of currency fluctuations, inflation, and reduced FDI pose challenges to China's overall economic growth trajectory.

-

Statistical Data and Charts: (Insert charts and graphs illustrating the Yuan's performance and its impact on key economic indicators).

-

Expert Predictions: (Include expert opinions on the future trajectory of the Yuan and its impact on the Chinese economy).

-

Sectoral Analysis: (Discuss the specific impact on different sectors of the Chinese economy, such as manufacturing, technology, and tourism).

Future Outlook: What's Next for PBOC Yuan Intervention?

The PBOC will likely need to adopt a more nuanced and potentially multi-pronged approach to managing the Yuan's exchange rate going forward.

- Potential Policy Options: These might include further adjustments to the daily fix, more targeted open market operations, potentially adjusting interest rates, and implementing capital controls.

- Feasibility and Effectiveness: The effectiveness of each option will depend on the evolving global economic landscape and the interplay of domestic and international forces.

- Predictions for the Yuan's Future Movement: Predicting the Yuan's future movement remains challenging, given the multitude of factors at play. However, continued volatility seems likely in the short to medium term.

Conclusion: Analyzing the PBOC Yuan Intervention and Looking Ahead

The PBOC's recent Yuan intervention fell short of market expectations due to a combination of global economic headwinds, the strength of the US dollar, speculative attacks, and potentially limited reserves. This has resulted in continued Yuan volatility and poses challenges for the Chinese economy. The underwhelming intervention underscores the complexity of managing a currency in a turbulent global environment. To stay updated on PBOC Yuan interventions and their implications for the Chinese and global economies, follow the latest developments in the Yuan exchange rate and learn more about PBOC monetary policy through reputable financial news sources. Stay informed about future developments in PBOC Yuan interventions and their impact on global markets.

Featured Posts

-

May 8th Mlb Dfs Top Sleeper Picks And Hitter To Fade

May 16, 2025

May 8th Mlb Dfs Top Sleeper Picks And Hitter To Fade

May 16, 2025 -

Venezia Vs Napoles Transmision En Directo

May 16, 2025

Venezia Vs Napoles Transmision En Directo

May 16, 2025 -

San Diego Padres Defying The Los Angeles Dodgers Dominance

May 16, 2025

San Diego Padres Defying The Los Angeles Dodgers Dominance

May 16, 2025 -

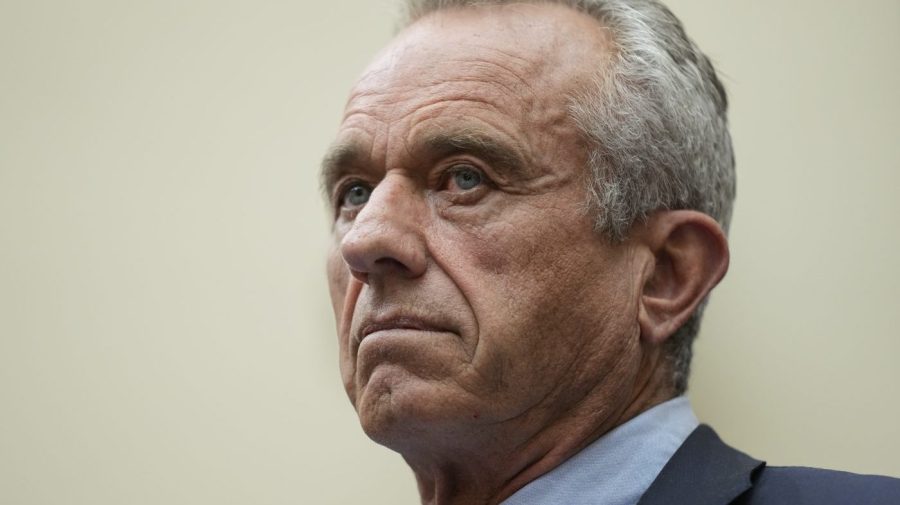

Rfk Jr Family Swim In Bacteria Contaminated Rock Creek

May 16, 2025

Rfk Jr Family Swim In Bacteria Contaminated Rock Creek

May 16, 2025 -

Senator Vance Questions Bidens Stance On Trumps Russia Ukraine Actions

May 16, 2025

Senator Vance Questions Bidens Stance On Trumps Russia Ukraine Actions

May 16, 2025

Latest Posts

-

Auction Of Kid Cudis Personal Items Surpasses Expectations

May 16, 2025

Auction Of Kid Cudis Personal Items Surpasses Expectations

May 16, 2025 -

Kid Cudi Memorabilia Sells For Staggering Amounts At Auction

May 16, 2025

Kid Cudi Memorabilia Sells For Staggering Amounts At Auction

May 16, 2025 -

Kid Cudi Auction Unexpectedly High Sales Figures For Personal Items

May 16, 2025

Kid Cudi Auction Unexpectedly High Sales Figures For Personal Items

May 16, 2025 -

Rare Kid Cudi Items Command High Prices At Recent Auction

May 16, 2025

Rare Kid Cudi Items Command High Prices At Recent Auction

May 16, 2025 -

Auction Results Reveal High Demand For Kid Cudis Personal Effects

May 16, 2025

Auction Results Reveal High Demand For Kid Cudis Personal Effects

May 16, 2025