PBOC's Yuan Support: A Below-Estimate Performance

Table of Contents

Insufficient Intervention Measures

The PBOC employs various tools to manage the Yuan's exchange rate. These include setting the daily fixing – the central parity rate against the US dollar – manipulating reserve requirements for banks, and conducting open market operations to influence liquidity. However, recent interventions have been comparatively less forceful than in previous periods of Yuan weakness.

The scale and frequency of these interventions haven't matched the pressure on the Yuan. For example, while the PBOC did increase its dollar-selling activities in late 2022 and early 2023, the impact was relatively muted compared to the significant interventions seen during previous periods of currency volatility.

- Specific examples: In October 2022, the PBOC intervened to stem the Yuan's decline, but the currency continued to weaken throughout the remainder of the year. Similarly, early 2023 saw limited impact from PBOC actions despite heightened uncertainty in global markets.

- Comparison to previous interventions: A comparison with the 2015-2016 period reveals a more aggressive approach by the PBOC then, leading to a greater impact on the Yuan's exchange rate.

- Market reaction: The market's muted response suggests a loss of confidence in the PBOC's ability to effectively manage the Yuan's value, possibly due to perceived limitations in the available policy tools.

External Factors Impacting Yuan Performance

Global economic factors significantly influence the Yuan's performance, often overshadowing the PBOC's efforts. The strength of the US dollar, global trade tensions (particularly the US-China trade war), and interest rate differentials between China and other major economies all play a crucial role.

The ongoing strength of the US dollar, driven by aggressive interest rate hikes by the Federal Reserve, has created significant downward pressure on the Yuan. Simultaneously, persistent global trade uncertainties and slowing global growth have dampened demand for Chinese exports, further weakening the Yuan.

- Specific examples: The rise in US interest rates in 2022 and 2023 directly impacted the Yuan's value, drawing investment away from China. The ongoing geopolitical tensions also contributed to market uncertainty.

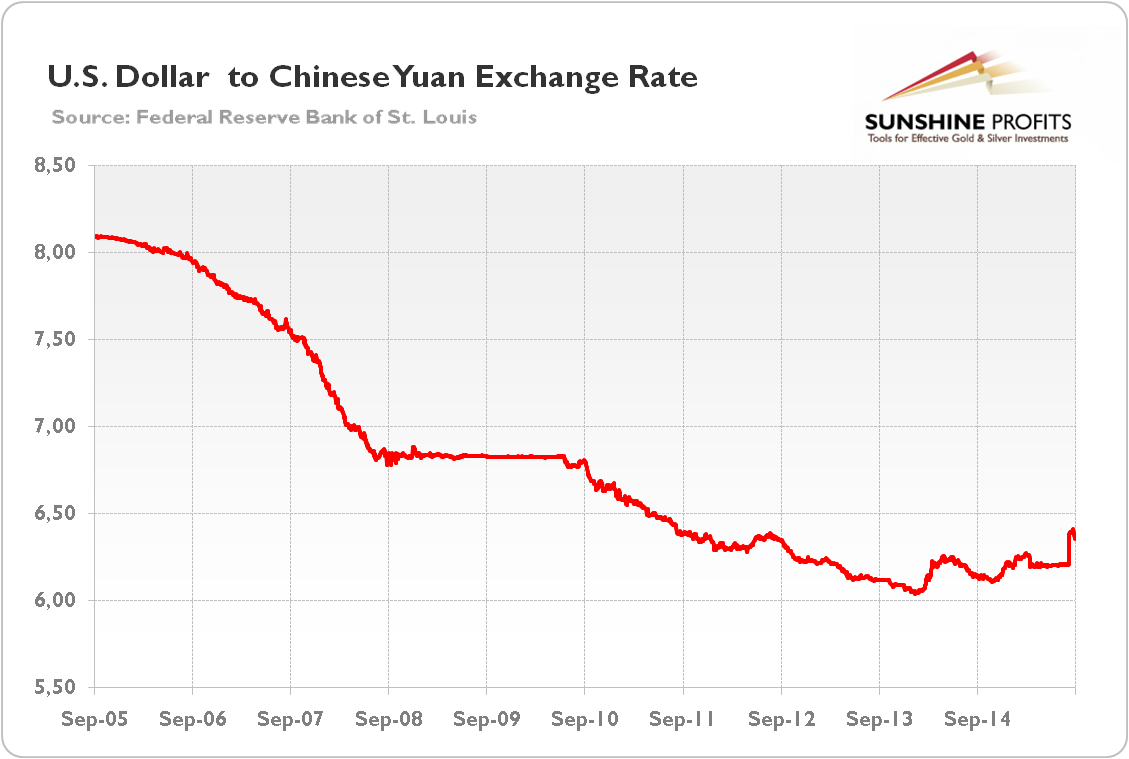

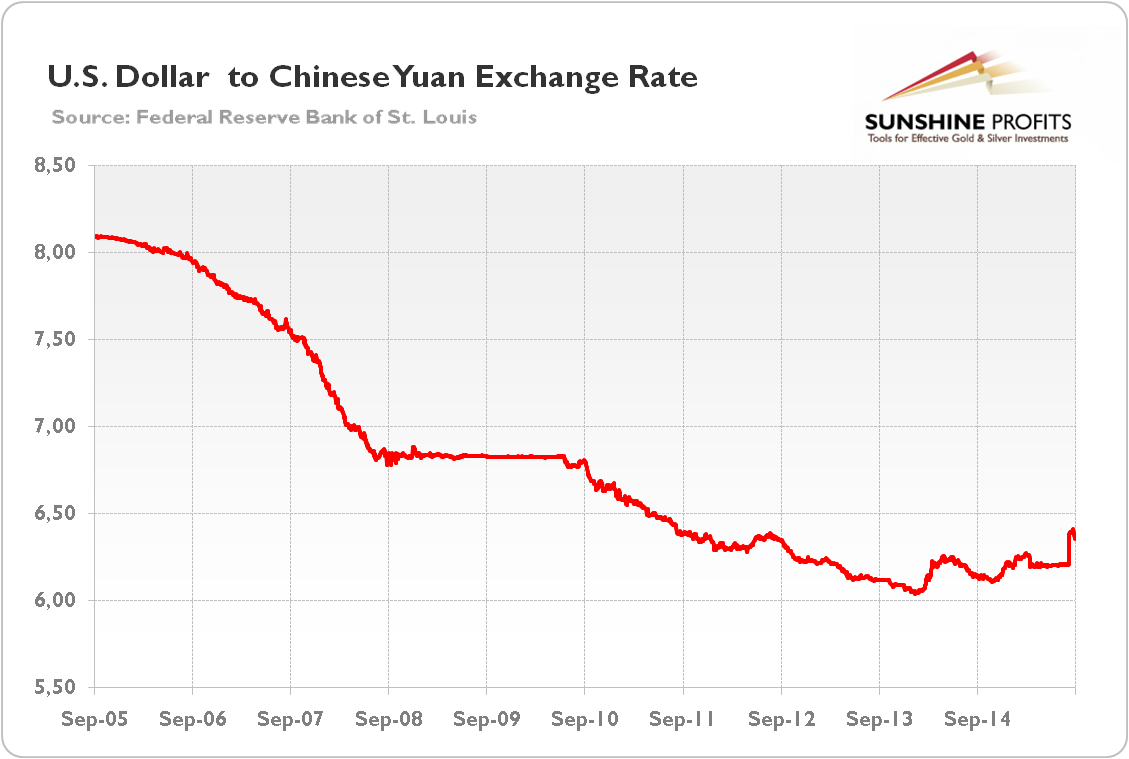

- Data illustrating correlation: Charts showing the correlation between US interest rates, the US Dollar Index (DXY), and the Yuan's exchange rate clearly illustrate the dominant influence of external factors.

- Expert opinions: Many economists believe that the external pressures currently facing the Yuan are exceptionally strong and difficult to counter solely through domestic policy interventions.

Market Sentiment and Speculation

Negative market sentiment and speculation significantly impact the Yuan's value, potentially neutralizing the effects of PBOC interventions. A loss of confidence in the Chinese economy, driven by factors like slowing growth, regulatory uncertainties, and geopolitical risks, can lead to capital flight and downward pressure on the Yuan. Speculative attacks can further exacerbate these trends.

- Examples of negative news: Concerns about China's property market, regulatory crackdowns on tech companies, and the ongoing COVID-19 situation have all contributed to negative market sentiment.

- Analysis of capital flows: Data on capital flows indicates a net outflow of funds from China in recent periods, suggesting a lack of confidence in the Yuan's stability.

- Speculative attacks: While difficult to definitively prove, there is evidence suggesting that speculative activity has amplified downward pressure on the Yuan.

Implications for the Chinese Economy

A weaker Yuan has several implications for the Chinese economy. It can contribute to inflation by increasing the cost of imported goods, potentially impacting consumer purchasing power. While it might boost exports in the short term by making them cheaper, this benefit can be offset by the increased costs of imports. Furthermore, a persistently weak Yuan could deter foreign investment, impacting economic growth.

- Potential economic risks: Inflationary pressures, reduced foreign investment, and increased uncertainty are major risks associated with a weaker Yuan.

- Impact on businesses and consumers: Chinese businesses relying on imports face higher costs, while consumers may see a rise in prices for various goods.

- Possible future actions by the PBOC: The PBOC may consider further interventions, potentially including adjustments to interest rates or reserve requirements, to stabilize the Yuan. However, the effectiveness of such measures remains uncertain given the current external pressures.

Conclusion: Assessing the Future of PBOC's Yuan Support

In conclusion, the PBOC's Yuan support measures have been less effective than anticipated due to a confluence of factors: insufficient intervention scale, strong external headwinds, and prevalent negative market sentiment. The implications for the Chinese economy include potential inflationary pressures, reduced foreign investment, and uncertainty. The effectiveness of future PBOC interventions will depend on the interplay between domestic policy adjustments and the evolution of global economic conditions. The PBOC's continued efforts to manage the Yuan's exchange rate will require close monitoring and analysis. Stay informed about the ongoing developments regarding PBOC's Yuan support and its impact on the global economy. Continue to monitor our site for further analysis of PBOC's Yuan strategies and their efficacy.

Featured Posts

-

Freeman And Ohtanis Homers Lead Dodgers To Another Win Against Marlins

May 16, 2025

Freeman And Ohtanis Homers Lead Dodgers To Another Win Against Marlins

May 16, 2025 -

Lane Hutson Peut Il Devenir Un Defenseur Etoile Dans La Lnh

May 16, 2025

Lane Hutson Peut Il Devenir Un Defenseur Etoile Dans La Lnh

May 16, 2025 -

Assessing Bidens Mental State Warrens Response Analyzed

May 16, 2025

Assessing Bidens Mental State Warrens Response Analyzed

May 16, 2025 -

Loss To Rapids Exposes Earthquakes Weaknesses Steffens Included

May 16, 2025

Loss To Rapids Exposes Earthquakes Weaknesses Steffens Included

May 16, 2025 -

Dodgers Freeman And Ohtani Hit Home Runs In Victory Over Marlins

May 16, 2025

Dodgers Freeman And Ohtani Hit Home Runs In Victory Over Marlins

May 16, 2025

Latest Posts

-

Auction Results Kid Cudis Personal Items Command High Prices

May 16, 2025

Auction Results Kid Cudis Personal Items Command High Prices

May 16, 2025 -

Kid Cudis Joopiter Auction Everything You Need To Know

May 16, 2025

Kid Cudis Joopiter Auction Everything You Need To Know

May 16, 2025 -

Kid Cudi Joopiter Auction Date Items And Bidding Information Revealed

May 16, 2025

Kid Cudi Joopiter Auction Date Items And Bidding Information Revealed

May 16, 2025 -

Kid Cudis Jewelry And Sneakers Record Breaking Auction Results

May 16, 2025

Kid Cudis Jewelry And Sneakers Record Breaking Auction Results

May 16, 2025 -

Joopiter Auction Features Exclusive Kid Cudi Pieces Official Announcement

May 16, 2025

Joopiter Auction Features Exclusive Kid Cudi Pieces Official Announcement

May 16, 2025