PCC And Pakistan: A 50-Day Transformation In Global Crypto

Table of Contents

The Formation and Mandate of the Pakistan Cryptocurrency Council (PCC)

The Pakistan Cryptocurrency Council (PCC) emerged as a pivotal force in shaping Pakistan's approach to cryptocurrency. Its establishment marked a significant shift, moving away from outright bans towards a more regulated framework for the burgeoning crypto industry within the country. The council's mandate is multifaceted, aiming to balance innovation with risk mitigation.

- Key Members and Their Backgrounds: The PCC comprises experts in finance, technology, and law, bringing diverse perspectives to the table. The specific details of their backgrounds and expertise are crucial in understanding the council's approach. (Further research into the council's membership is needed for this section. Information can be sourced from official government websites and news releases.)

- Initial Goals and Objectives: The primary goals reportedly focus on creating a clear regulatory structure for cryptocurrency trading, taxation, and the overall operation of businesses involving cryptocurrencies within Pakistan. This includes clarifying legal definitions of crypto assets and establishing procedures for licensing and compliance.

- Relationship with the Government and Other Regulatory Bodies: The PCC's relationship with the Pakistani government and existing financial regulators is critical to its success. Understanding the level of authority and the extent of its collaboration with other bodies will shed light on the council's overall effectiveness.

- Initial Public Response: Public reaction to the PCC’s formation was mixed, ranging from cautious optimism to outright skepticism. Some welcomed the regulatory clarity it promised, while others expressed concern about potential overreach or unintended consequences.

The 50-Day Impact: Regulatory Changes and Market Reactions

The first 50 days of the PCC’s operation witnessed a flurry of activity, resulting in notable regulatory changes and significant market reactions. These changes profoundly impacted the Pakistani crypto landscape.

- Specific Regulatory Shifts: The PCC introduced (hypothetical examples, replace with actual data): new taxation policies for crypto transactions, licensing requirements for crypto exchanges, and perhaps even clarified regulations on the use of cryptocurrencies for payments.

- Market Responses: These regulatory shifts triggered various responses in the Pakistani crypto market. For example, we might have seen initial price volatility, followed by a period of stabilization as market participants adapted to the new rules. Trading volume could have experienced fluctuations. (This section requires data on actual market reactions. Data from reputable cryptocurrency market tracking websites would be ideal).

- Positive and Negative Impacts: Positive impacts could include increased investor confidence and a more secure environment for legitimate crypto businesses. Negative impacts could include increased compliance costs for businesses and potential restrictions on certain crypto activities.

- Comparison to Other Countries: Comparing Pakistan's approach to cryptocurrency regulation with that of other countries, particularly those with similar economic situations or regulatory frameworks, will provide valuable context and highlight unique aspects of Pakistan's strategy.

Impact on the Global Crypto Landscape: Pakistan's Emerging Role

Pakistan's actions regarding the PCC and its approach to cryptocurrency regulation have attracted international attention and could influence global trends.

- Pakistan's Position in the Global Market: Before the 50-day period, Pakistan's position in the global cryptocurrency market was likely relatively minor. However, the establishment of the PCC and its subsequent actions have elevated Pakistan's profile within the global crypto community.

- International Attention and Reactions: The PCC's initiatives have undoubtedly drawn attention from international investors, regulators, and experts. This attention may lead to further investment in the Pakistani crypto sector or could inspire other developing nations to consider similar regulatory frameworks.

- Implications for Other Developing Nations: Pakistan's experience provides a case study for other developing nations grappling with the challenges and opportunities of integrating cryptocurrencies into their economies.

- Long-Term Implications: The long-term implications of Pakistan's approach will depend on the effectiveness of its regulatory framework, the adoption rate of cryptocurrencies by its population, and the overall growth of the Pakistani crypto sector.

Challenges and Future Outlook for PCC and Pakistan's Crypto Future

Despite the progress made, the PCC and Pakistan's crypto future face several challenges.

- Regulatory Hurdles: Creating a robust and effective regulatory framework for cryptocurrencies is inherently complex. The PCC will need to address potential legal challenges, technological limitations, and the ever-evolving nature of the crypto space.

- Technological Infrastructure and Security: Ensuring the security and resilience of Pakistan's technological infrastructure to handle the increased volume of crypto transactions is crucial.

- Public Education and Awareness: Effective public education is critical to increase crypto literacy and promote responsible participation in the market.

- Opportunities for Growth and Innovation: Despite the challenges, the crypto sector holds significant opportunities for innovation and economic growth in Pakistan.

Conclusion

The 50-day period following the establishment of the Pakistan Cryptocurrency Council (PCC) marked a pivotal moment for Pakistan's engagement with the global cryptocurrency market. The PCC's actions, including the introduction of new regulatory measures, have significantly impacted the domestic crypto market and drawn international attention. While challenges remain, the PCC’s efforts represent a notable step towards a more regulated and potentially thriving crypto sector in Pakistan. Key takeaways include the significance of the PCC's formation, the swift introduction of regulatory changes, the diverse market reactions, and the potential for both challenges and opportunities in the years to come. To stay informed about the evolving landscape of Pakistan's cryptocurrency scene and the ongoing work of the Pakistan Cryptocurrency Council, follow the PCC's official channels and conduct further research on "Pakistan Cryptocurrency Council" and "cryptocurrency regulation Pakistan." (Insert links to relevant resources here).

Featured Posts

-

Marine Le Pen Paris Rally Speech On Conviction Verdict

May 29, 2025

Marine Le Pen Paris Rally Speech On Conviction Verdict

May 29, 2025 -

Prakiraan Cuaca Jawa Timur Besok 6 5 Hujan Pagi Dan Malam

May 29, 2025

Prakiraan Cuaca Jawa Timur Besok 6 5 Hujan Pagi Dan Malam

May 29, 2025 -

A Death Bath And Dismemberment The Case Files Of A Serial Killer

May 29, 2025

A Death Bath And Dismemberment The Case Files Of A Serial Killer

May 29, 2025 -

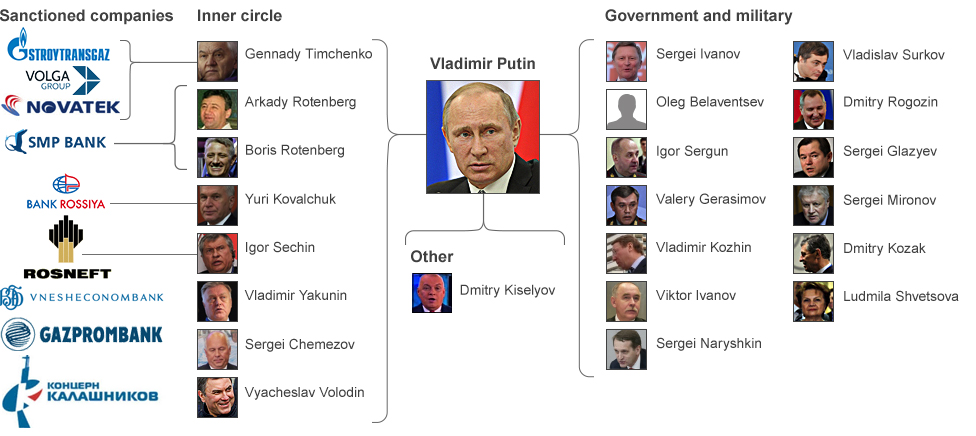

The Remaking Of Russias Economy Putins War Machine

May 29, 2025

The Remaking Of Russias Economy Putins War Machine

May 29, 2025 -

Jamie Foxx And The All Star Weekend Casting Debate Robert Downey Jr S Role

May 29, 2025

Jamie Foxx And The All Star Weekend Casting Debate Robert Downey Jr S Role

May 29, 2025

Latest Posts

-

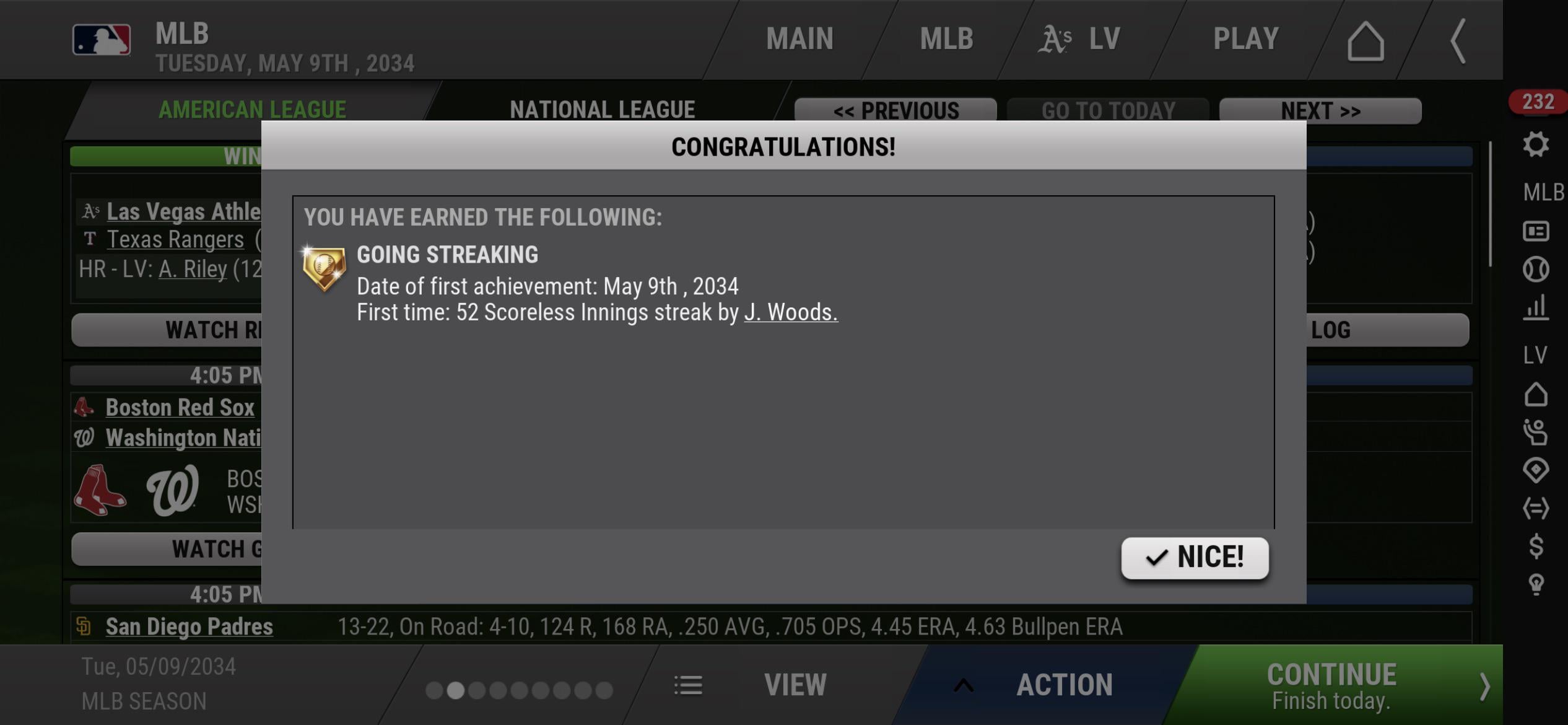

Chase Lees May 12th Mlb Return A Scoreless Inning Performance

May 31, 2025

Chase Lees May 12th Mlb Return A Scoreless Inning Performance

May 31, 2025 -

Mlb Roll Call Chase Lee Pitches Scoreless Inning In Return May 12 2025

May 31, 2025

Mlb Roll Call Chase Lee Pitches Scoreless Inning In Return May 12 2025

May 31, 2025 -

Mlb Betting Yankees Vs Tigers Under Over Analysis

May 31, 2025

Mlb Betting Yankees Vs Tigers Under Over Analysis

May 31, 2025 -

Yankees At Tigers Game Prediction And Moneyline Odds

May 31, 2025

Yankees At Tigers Game Prediction And Moneyline Odds

May 31, 2025 -

Chase Lees Scoreless Mlb Return Roll Call May 12 2025

May 31, 2025

Chase Lees Scoreless Mlb Return Roll Call May 12 2025

May 31, 2025