Personal Loan Interest Rates Today: Find Your Lowest Rate

Table of Contents

Factors Affecting Your Personal Loan Interest Rate

Several key factors determine the personal loan interest rate you'll qualify for. Understanding these factors empowers you to improve your chances of securing a lower rate.

Your Credit Score

Your credit score is arguably the most significant factor influencing your personal loan interest rates. Lenders use your credit score, derived from reports provided by agencies like Experian, Equifax, and TransUnion (resulting in scores like FICO and VantageScore), to assess your creditworthiness. A higher credit score indicates a lower risk to the lender, resulting in a lower interest rate. A lower credit score, conversely, signifies a higher risk, leading to higher interest rates or even loan rejection.

- Improve your credit score by:

- Paying all bills on time.

- Keeping your credit utilization ratio (the amount of credit you use compared to your total available credit) low (ideally under 30%).

- Maintaining a diverse mix of credit accounts.

- Avoiding opening multiple new credit accounts in a short period.

- Regularly checking your credit reports for errors.

- (example link - replace with actual relevant links).

Loan Amount and Term

The amount of money you borrow and the length of the repayment period (loan term) directly impact your personal loan interest rates. Generally, larger loan amounts and longer loan terms come with higher interest rates because they represent a greater risk to the lender.

- Examples:

- A $5,000 loan over 12 months might have a lower interest rate than a $20,000 loan over 60 months.

- A shorter loan term demonstrates a quicker repayment commitment, often leading to a lower interest rate.

Lender Type

Different lenders offer varying personal loan interest rates. Banks, credit unions, and online lenders each have their own lending criteria and pricing structures.

- Lender Types:

- Banks: Often offer competitive rates, especially for borrowers with excellent credit.

- Credit Unions: May provide lower rates and more personalized service, but membership requirements might apply.

- Online Lenders: Offer convenience and often a wider range of loan options, but may have higher fees.

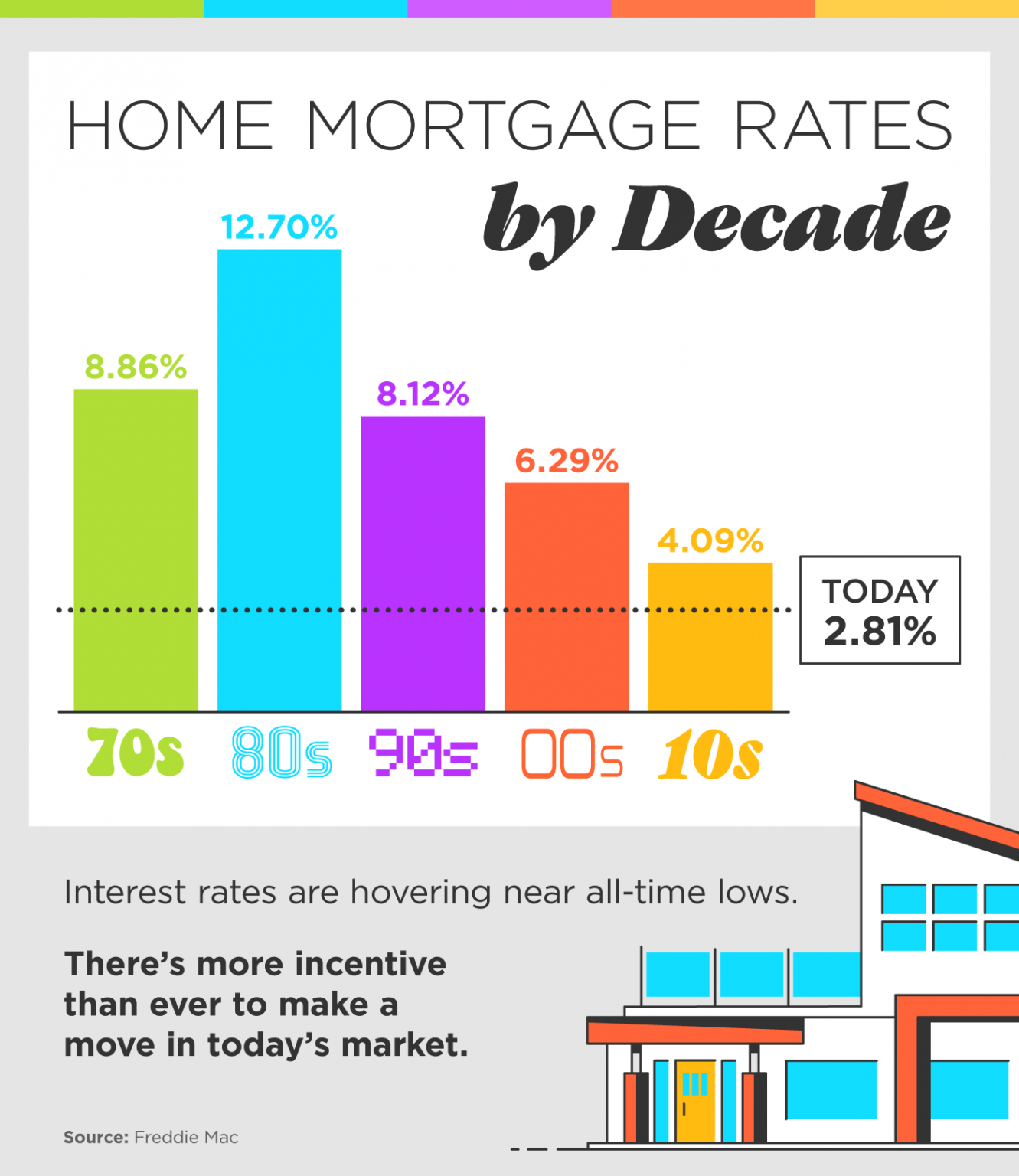

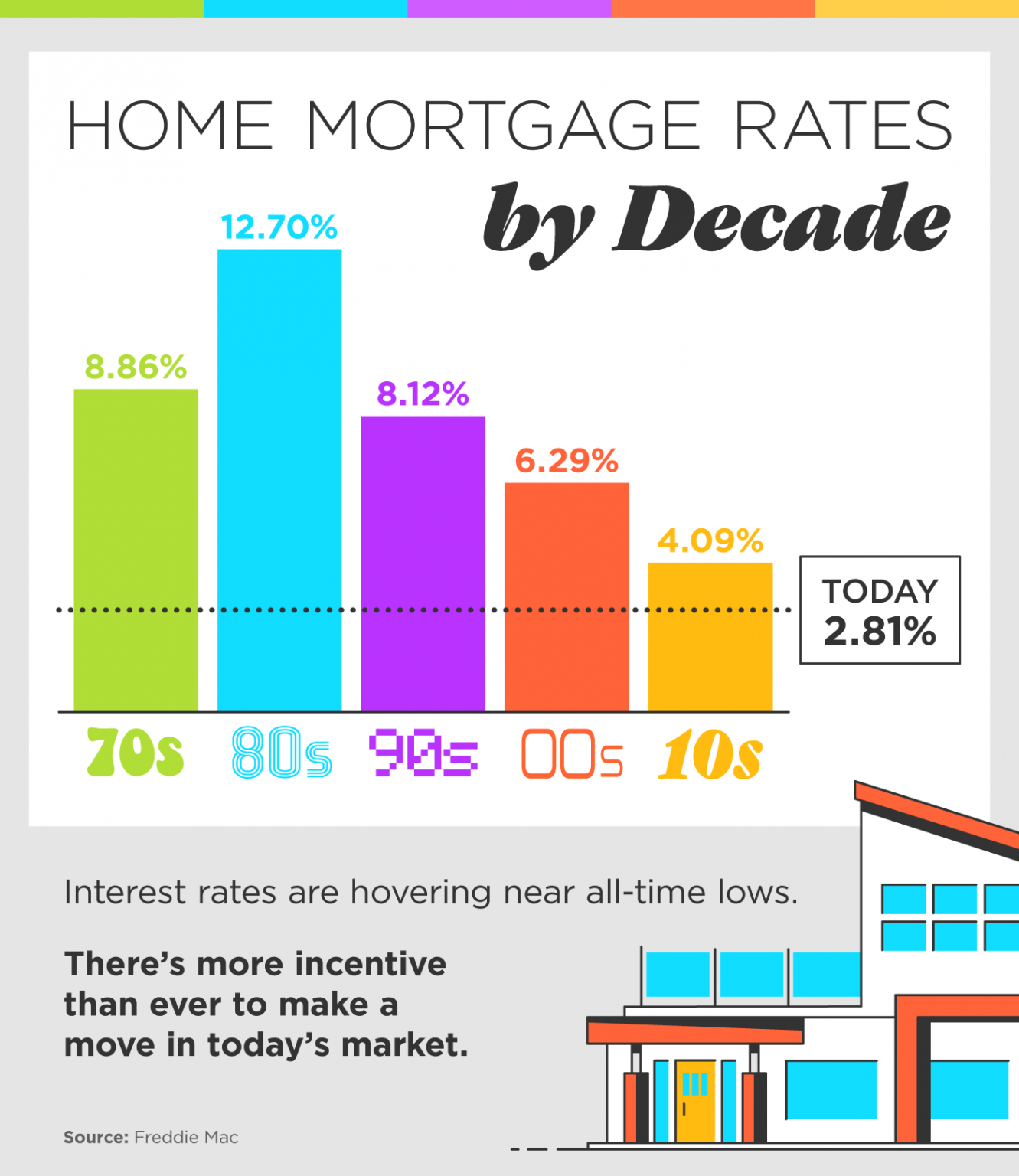

Current Economic Conditions

Prevailing interest rates, heavily influenced by the central bank's monetary policy, significantly impact personal loan interest rates. Inflation and economic growth directly affect borrowing costs. Higher inflation typically leads to higher interest rates, while slower economic growth can sometimes result in lower rates.

- Influencing Factors:

- Inflation: High inflation usually translates to higher interest rates across the board.

- Economic Growth: Strong economic growth might lead to slightly higher rates as lenders adjust for increased demand.

- (example link - replace with actual relevant links).

How to Find the Lowest Personal Loan Interest Rates

Finding the lowest personal loan interest rate requires a proactive and informed approach. Don't settle for the first offer you receive.

Shop Around and Compare

Comparing offers from multiple lenders is paramount. Don't just focus on the advertised interest rate; consider the Annual Percentage Rate (APR), which includes all fees and interest charges.

- Comparison Tips:

- Use online comparison tools to quickly see rates from various lenders.

- Pay close attention to the APR, fees (origination fees, prepayment penalties), and repayment terms.

Improve Your Credit Score (Again!)

Improving your credit score is the single most effective way to secure lower personal loan interest rates. Refer to the tips in the previous section to improve your creditworthiness.

Negotiate with Lenders

Don't be afraid to negotiate with lenders. Having multiple offers in hand strengthens your negotiating position. Highlight your strong financial history and responsible credit management.

- Negotiation Strategies:

- Present competing offers from other lenders.

- Emphasize your stable employment and consistent income.

- Discuss the possibility of a shorter loan term to mitigate lender risk.

Consider Secured Loans

Secured loans, which require collateral (like a car or savings account), often come with lower interest rates than unsecured loans. However, remember that you risk losing your collateral if you default on the loan.

- Secured Loan Considerations:

- Lower interest rates are a significant benefit.

- The risk of losing collateral is a considerable drawback.

Understanding Personal Loan Interest Rate Terminology

Understanding key terminology helps you compare loan offers effectively.

APR (Annual Percentage Rate)

The APR is the annual cost of borrowing, including interest and fees. It's a crucial factor when comparing personal loan offers. A lower APR indicates a lower overall cost.

Fixed vs. Variable Interest Rates

- Fixed Interest Rates: Remain consistent throughout the loan term, providing predictability in monthly payments.

- Variable Interest Rates: Fluctuate based on market conditions, potentially leading to changing monthly payments.

Other Fees

Beyond interest, be aware of potential fees such as origination fees (charged for processing the loan) and prepayment penalties (charged for paying off the loan early).

Conclusion

Securing the best personal loan interest rates requires careful planning and research. By understanding the factors influencing rates—your credit score, the loan amount and term, the lender type, and current economic conditions—you can significantly improve your chances of obtaining a favorable interest rate. Remember to shop around, compare offers thoroughly, and don't hesitate to negotiate. Start comparing personal loan interest rates today to find the best personal loan rates and secure the best possible deal on your personal loan! Find the lowest personal loan rates and apply for the best personal loan today!

Featured Posts

-

January 6th Hearings Cassidy Hutchinson To Publish Memoir This Fall

May 28, 2025

January 6th Hearings Cassidy Hutchinson To Publish Memoir This Fall

May 28, 2025 -

No Credit Check Loans Guaranteed Approval From Direct Lenders

May 28, 2025

No Credit Check Loans Guaranteed Approval From Direct Lenders

May 28, 2025 -

The Phoenician Scheme Trailer Pure Wes Anderson Style

May 28, 2025

The Phoenician Scheme Trailer Pure Wes Anderson Style

May 28, 2025 -

Analyse Van Bert Natters Concentratiekamproman Grootse Schaal Zware Impact

May 28, 2025

Analyse Van Bert Natters Concentratiekamproman Grootse Schaal Zware Impact

May 28, 2025 -

Viktor Gyoekeres Istatistikleri Ve Kariyer Performansi

May 28, 2025

Viktor Gyoekeres Istatistikleri Ve Kariyer Performansi

May 28, 2025

Latest Posts

-

Integrale Europe 1 Soir 19 03 2025 Replay Et Podcast

May 30, 2025

Integrale Europe 1 Soir 19 03 2025 Replay Et Podcast

May 30, 2025 -

19 Mars 2025 Ecouter L Integrale Europe 1 Soir

May 30, 2025

19 Mars 2025 Ecouter L Integrale Europe 1 Soir

May 30, 2025 -

Cyril Hanouna Et Le Debat Sur L Eventuelle Exclusion De Marine Le Pen Pour 2027

May 30, 2025

Cyril Hanouna Et Le Debat Sur L Eventuelle Exclusion De Marine Le Pen Pour 2027

May 30, 2025 -

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

2027 Marine Le Pen Menacee D Exclusion La Reaction Vehemente De Laurent Jacobelli

May 30, 2025

2027 Marine Le Pen Menacee D Exclusion La Reaction Vehemente De Laurent Jacobelli

May 30, 2025