Personal Loan Rates Today: How To Get The Lowest Interest Rate

Table of Contents

<p>Securing a personal loan can be a smart financial move, but navigating the world of interest rates can be tricky. Understanding personal loan rates today is crucial to getting the best deal. This guide breaks down how to find and secure the lowest possible interest rate on your personal loan.</p>

<h2>Understanding Personal Loan Interest Rates</h2>

<p>Before diving into strategies for securing a low interest rate, it's vital to understand the basics. The key term you'll encounter frequently is APR, or Annual Percentage Rate. The APR represents the annual cost of borrowing, including the interest rate and any fees associated with the loan. A lower APR means you'll pay less overall for your loan. Several factors influence the interest rate you'll receive.</p>

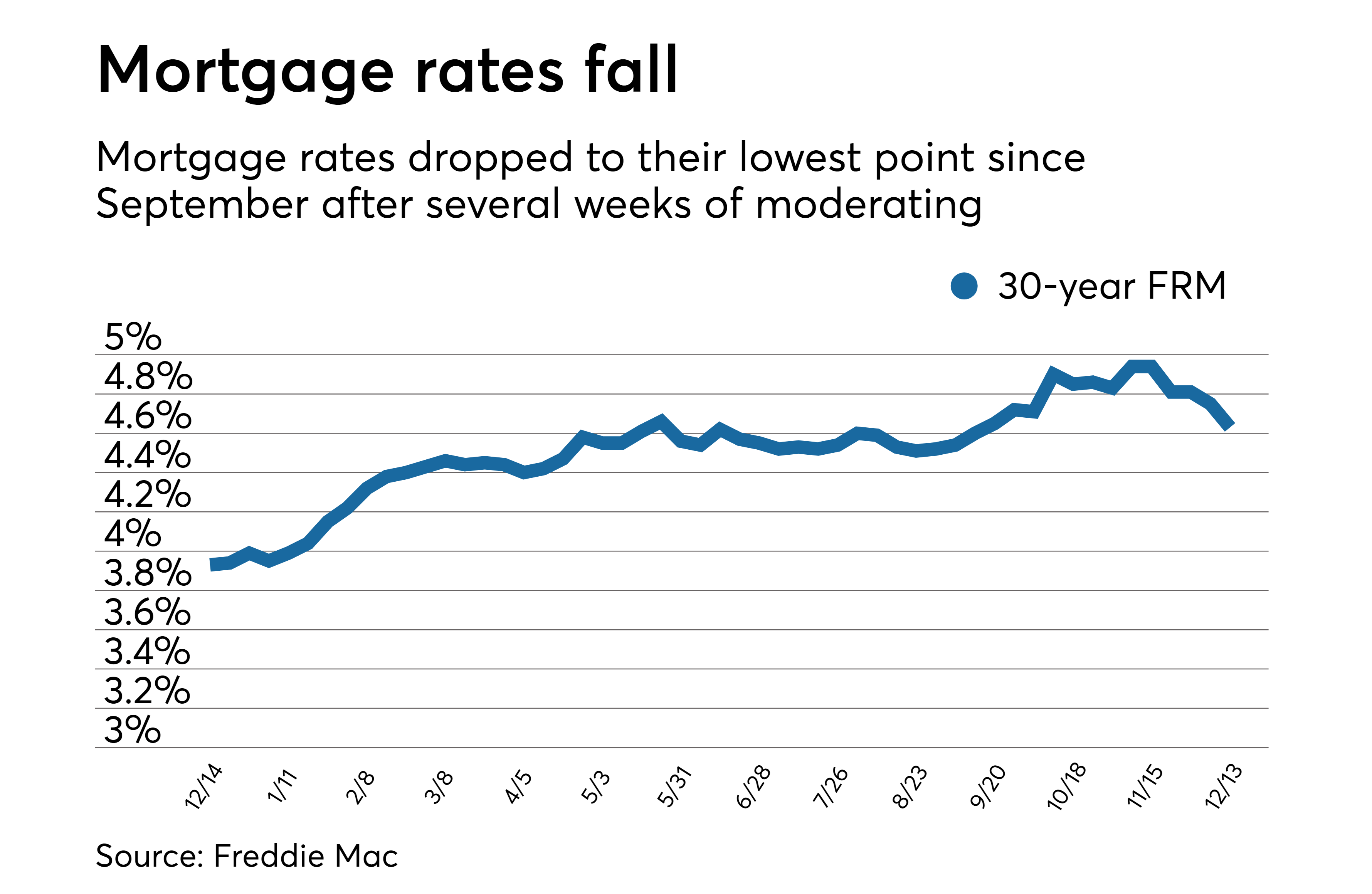

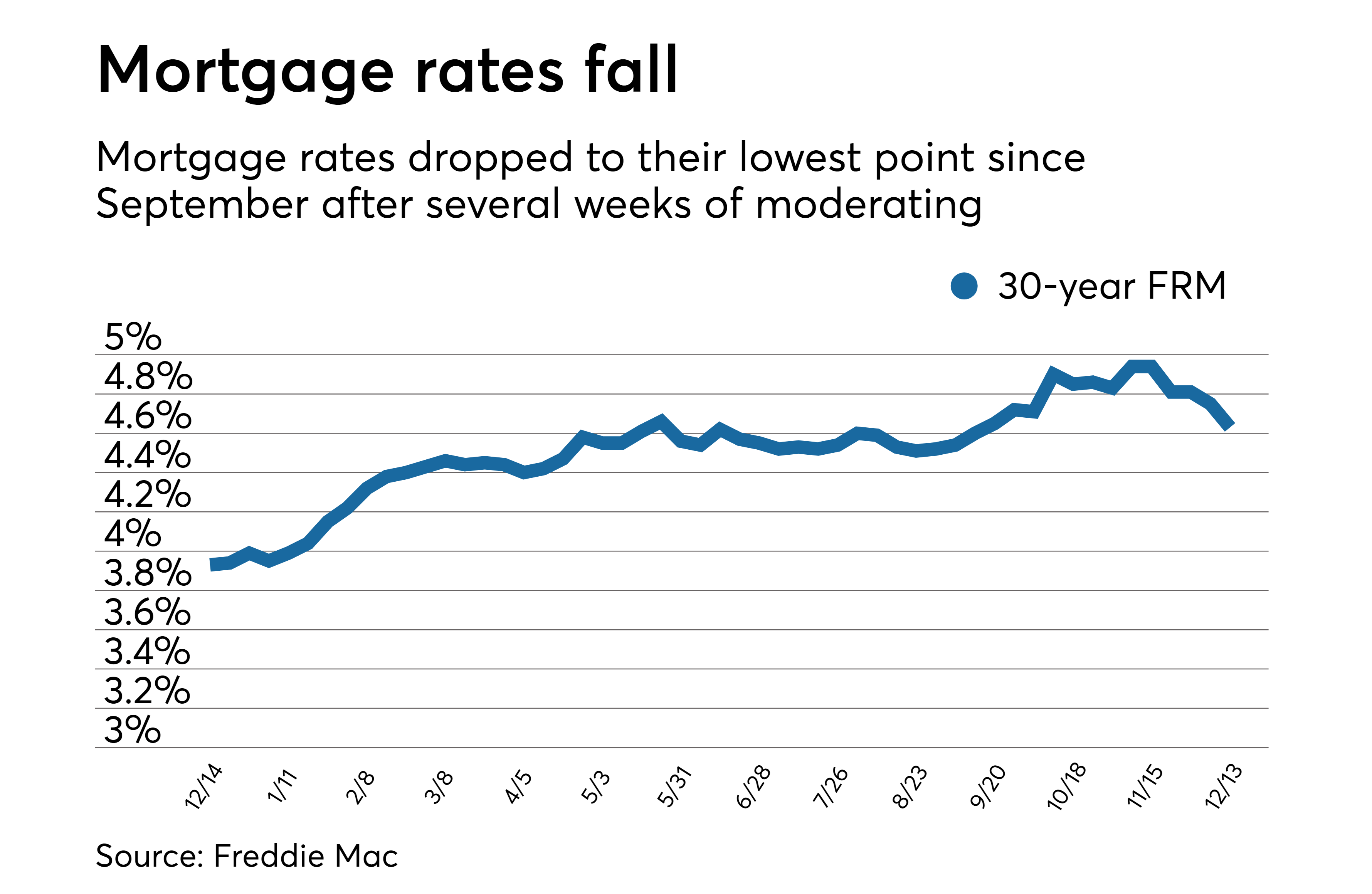

<p>Your credit score plays a significant role. Lenders use your credit history to assess your risk. A higher credit score indicates lower risk, leading to more favorable interest rates. The amount you borrow also influences the rate. Generally, larger loan amounts might come with slightly higher rates due to increased risk for the lender. Finally, the loan term affects your monthly payments and the total interest paid. Shorter loan terms usually mean higher monthly payments but lower overall interest. It's important to remember that interest rates constantly fluctuate based on market conditions, meaning today's rates might differ slightly from tomorrow's.</p>

<ul> <li>Higher credit score = lower interest rates</li> <li>Shorter loan terms usually mean higher monthly payments but lower overall interest</li> <li>Larger loan amounts might come with slightly higher rates</li> <li>Interest rates fluctuate daily based on market conditions.</li> </ul>

<h2>Improving Your Credit Score for Better Rates</h2>

<p>A good credit score is paramount when applying for a personal loan. A higher score significantly increases your chances of securing a lower interest rate. Improving your credit score takes time and consistent effort, but the payoff is well worth it. Here's how to enhance your creditworthiness:</p>

<ul> <li><b>Pay bills on time:</b> This is the single most important factor influencing your credit score. Consistent on-time payments demonstrate responsible financial behavior.</li> <li><b>Keep credit utilization low:</b> Aim to keep your credit card balances below 30% of your total credit limit. High utilization suggests you're heavily reliant on credit, increasing perceived risk.</li> <li><b>Monitor your credit report regularly:</b> Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) annually for errors. Dispute any inaccuracies promptly.</li> <li><b>Consider a secured credit card:</b> If you have limited or poor credit history, a secured credit card can help build your credit responsibly. You'll need to put down a security deposit, which serves as your credit limit.</li> </ul>

<p>Improving your credit score takes time – typically several months to a year to see significant changes. However, even small improvements can lead to noticeable differences in the interest rates you qualify for.</p>

<h2>Comparing Personal Loan Offers from Different Lenders</h2>

<p>Once you've taken steps to improve your credit, it's crucial to shop around and compare offers from various lenders. Don't settle for the first loan offer you receive. Banks, credit unions, and online lenders all offer personal loans, each with varying terms and interest rates. Using online comparison tools can streamline this process, allowing you to quickly see rates from multiple lenders simultaneously. These tools often allow you to filter by loan amount, term, and credit score, making it easy to find the best match for your situation.</p>

<ul> <li>Check interest rates, fees, and terms.</li> <li>Compare APR, not just the interest rate.</li> <li>Be wary of hidden fees.</li> <li>Read reviews of different lenders.</li> </ul>

<h2>Negotiating a Lower Interest Rate</h2>

<p>While comparison shopping is essential, you might still be able to negotiate a lower interest rate. Don't be afraid to politely discuss your options with lenders. Highlighting your strong credit score, providing evidence of a consistent financial history, and presenting competitive offers from other lenders can strengthen your negotiating position. Inquiring about any discounts or promotions available can also yield positive results.</p>

<ul> <li>Highlighting a strong credit score.</li> <li>Presenting a solid financial history.</li> <li>Comparing offers from competitors.</li> <li>Inquiring about discounts or promotions.</li> </ul>

<p>Remember to maintain a professional and polite demeanor throughout the negotiation process. A respectful approach is more likely to lead to a successful outcome.</p>

<h3>Alternatives to Traditional Personal Loans</h3>

<p>Besides traditional personal loans from banks and credit unions, alternative financing options exist. Peer-to-peer lending connects borrowers directly with investors, potentially offering competitive interest rates. However, eligibility criteria might be stricter. Balance transfer credit cards can also be considered, especially if you can secure a card with a 0% introductory APR period. However, be aware of balance transfer fees and the interest rate that applies after the introductory period ends. Carefully weigh the pros and cons of each option before making a decision.</p>

<h2>Conclusion</h2>

<p>Finding the best personal loan rates today requires careful planning and research. By understanding the factors influencing interest rates, improving your credit score, comparing offers, and potentially negotiating, you can significantly reduce the cost of borrowing. Remember, a lower interest rate translates to significant savings over the life of your loan.</p>

<p>Start your search for the lowest personal loan rates today! Use our tips to secure the best financing options for your needs. Don't delay – find the perfect personal loan rate now!</p>

Featured Posts

-

French Open 2025 Top Seed Sinners Commanding Performance Against Rinderknech

May 28, 2025

French Open 2025 Top Seed Sinners Commanding Performance Against Rinderknech

May 28, 2025 -

Ipswich Town Injury Update On Muric And The Future Of Tuanzebe Phillips Chaplin

May 28, 2025

Ipswich Town Injury Update On Muric And The Future Of Tuanzebe Phillips Chaplin

May 28, 2025 -

Miami Marlins Predicting The 2025 Opening Day Lineup Battles

May 28, 2025

Miami Marlins Predicting The 2025 Opening Day Lineup Battles

May 28, 2025 -

Leeds United Transfer News Verbal Agreement Reached For England Star

May 28, 2025

Leeds United Transfer News Verbal Agreement Reached For England Star

May 28, 2025 -

Rebecca Blacks Vegas Amas Look A Shotgun Wedding Interpretation

May 28, 2025

Rebecca Blacks Vegas Amas Look A Shotgun Wedding Interpretation

May 28, 2025

Latest Posts

-

Le Mandat De Laurent Jacobelli Depute De La Moselle Et Vice President Du Groupe Rn

May 30, 2025

Le Mandat De Laurent Jacobelli Depute De La Moselle Et Vice President Du Groupe Rn

May 30, 2025 -

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025 -

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025 -

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025 -

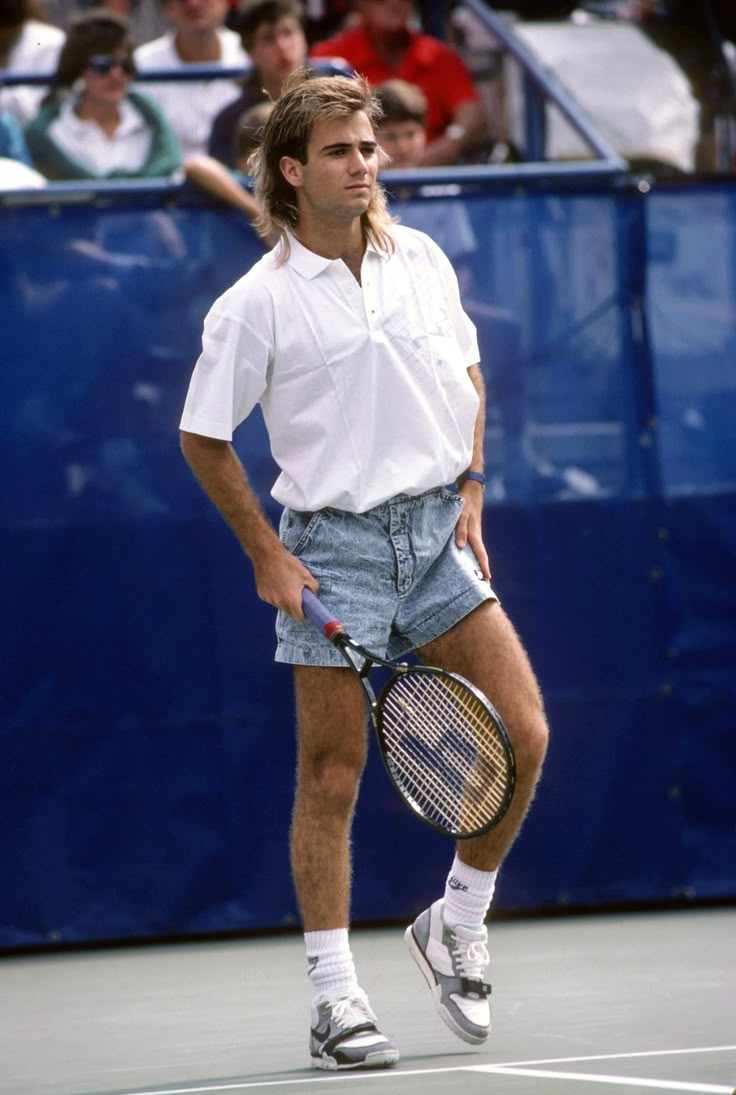

Andre Agassi Cambio De Cancha Misma Pasion

May 30, 2025

Andre Agassi Cambio De Cancha Misma Pasion

May 30, 2025