Personal Loans: Interest Rates & How To Find The Best Offer

Table of Contents

Understanding Personal Loan Interest Rates

Interest rates are the cost of borrowing money. Lower interest rates translate to lower monthly payments and less overall interest paid over the life of the loan. Conversely, higher interest rates mean higher monthly payments and a significantly increased total cost. Several factors influence the interest rate you'll receive.

Factors Affecting Interest Rates

-

Credit score: Your credit score is a major determinant of your interest rate. Lenders use this score to assess your creditworthiness and risk. A higher credit score (generally above 700) typically qualifies you for lower interest rates on personal loans and other forms of credit. Conversely, a lower credit score indicates higher risk, leading to higher interest rates or even loan rejection.

-

Debt-to-income ratio (DTI): Your DTI is the percentage of your gross monthly income that goes towards debt payments. A lower DTI signifies you have more disposable income available to repay a loan, making you a less risky borrower and improving your chances of securing a low interest personal loan. For example, a DTI of 35% is generally considered manageable, while a DTI exceeding 43% might make lenders hesitant to offer favorable interest rates.

-

Loan amount and term: The amount you borrow and the repayment period both influence your interest rate. Generally, larger loan amounts come with slightly higher interest rates due to the increased risk for the lender. Similarly, longer loan terms (e.g., 60 months vs. 36 months) typically result in higher total interest paid, although your monthly payments will be lower.

-

Lender type: Different lenders offer varying interest rates. Banks often have more stringent requirements but may offer competitive rates. Credit unions frequently offer lower interest rates to their members. Online lenders provide convenience but might have higher rates or fees. Comparing offers from various lenders is essential to secure the best personal loan interest.

Types of Interest Rates

-

Fixed vs. variable interest rates: With a fixed interest rate, your monthly payment remains consistent throughout the loan term. Variable interest rates fluctuate based on market conditions, leading to potentially changing monthly payments. Fixed rates offer predictability, while variable rates might offer lower initial rates but carry greater uncertainty.

-

APR (Annual Percentage Rate): The APR represents the annual cost of borrowing, including interest and other fees. It's a crucial factor when comparing loan offers, providing a comprehensive view of the total cost. Always compare APRs to get a true understanding of the most affordable option.

-

Fees and charges: Be aware of associated fees such as origination fees (charged for processing the loan), prepayment penalties (for paying off the loan early), and late payment fees. These fees can add significantly to the overall cost of your personal loan, so be sure to factor them into your comparisons.

How to Find the Best Personal Loan Offer

Finding the best personal loan requires careful research and comparison. Don't settle for the first offer you receive.

Comparing Loan Offers

-

Use online comparison tools: Several reputable websites and tools allow you to compare loan rates from multiple lenders simultaneously. These tools save you time and effort in your search for affordable personal loans.

-

Check lender reviews and ratings: Before applying for a loan, research the lender's reputation and customer reviews. This helps you avoid lenders with poor customer service or hidden fees. Look for ratings from independent sources, such as the Better Business Bureau.

-

Consider pre-qualification: Many lenders offer pre-qualification, which allows you to see your potential interest rate without impacting your credit score. This helps you understand your eligibility and shop for the most suitable loan offer before submitting a full application.

Improving Your Chances of Getting a Low Interest Rate

-

Improve your credit score: A higher credit score significantly boosts your chances of obtaining a lower interest rate. Pay your bills on time, reduce your debt-to-income ratio, and monitor your credit report for errors.

-

Shop around for the best rates: Compare offers from several lenders to find the most competitive interest rates. Don't limit your search to one lender – taking advantage of online comparison tools can expedite this process.

-

Negotiate with lenders: Once you find a potentially suitable loan offer, consider negotiating for a lower interest rate. Lenders are often willing to negotiate, especially if you have a strong credit history and a low DTI.

-

Secure a co-signer: Having a co-signer with excellent credit can improve your chances of approval and securing a lower interest rate. However, be mindful that your co-signer will be held responsible for repayment if you default on the loan.

The Application Process for a Personal Loan

Applying for a personal loan involves several steps. Be prepared and organized to streamline the process.

Gather Necessary Documents

Before you begin the application, gather essential documents such as proof of income (pay stubs, tax returns), a valid government-issued ID, and information about your existing debts. Having these readily available will make the application process smoother.

Complete the Application

Complete the loan application accurately and thoroughly. Inaccuracies can delay the process or lead to rejection. Double-check all information before submitting your application.

Review Loan Terms Carefully

Before signing any loan agreement, carefully review all terms and conditions. Ensure you fully understand the interest rate, repayment schedule, fees, and any other stipulations. Don't hesitate to ask questions if anything is unclear.

Conclusion

Securing a personal loan with favorable interest rates requires careful planning and comparison. By understanding the factors that influence interest rates, actively comparing loan offers, and improving your creditworthiness, you can significantly increase your chances of obtaining a low-interest, affordable loan. Remember to check lender reviews, utilize online comparison tools, and negotiate for the best terms. Start your search for the best personal loan interest rates now! Find your ideal personal loan today! Don't overpay – compare personal loan offers and secure the best deal!

Featured Posts

-

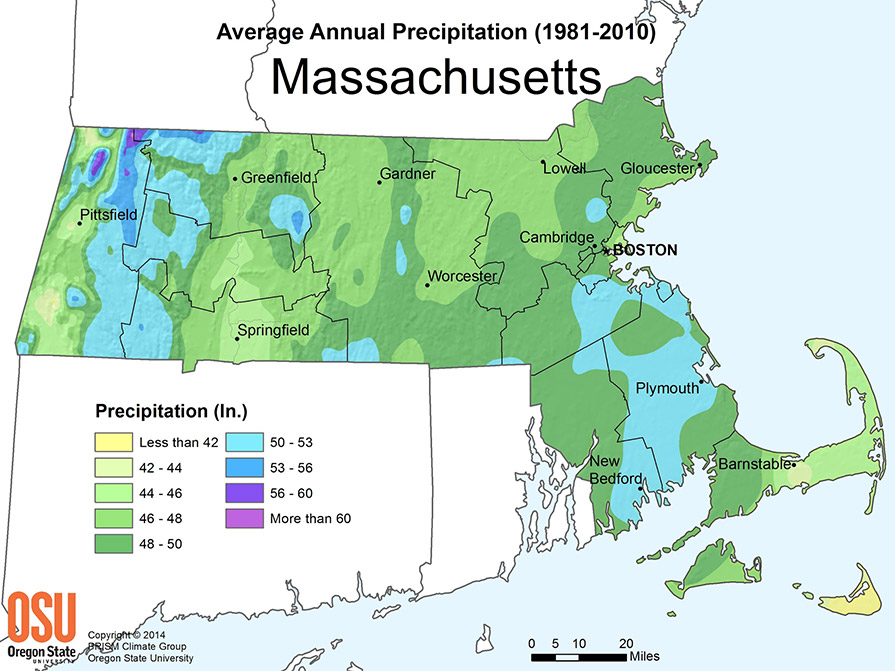

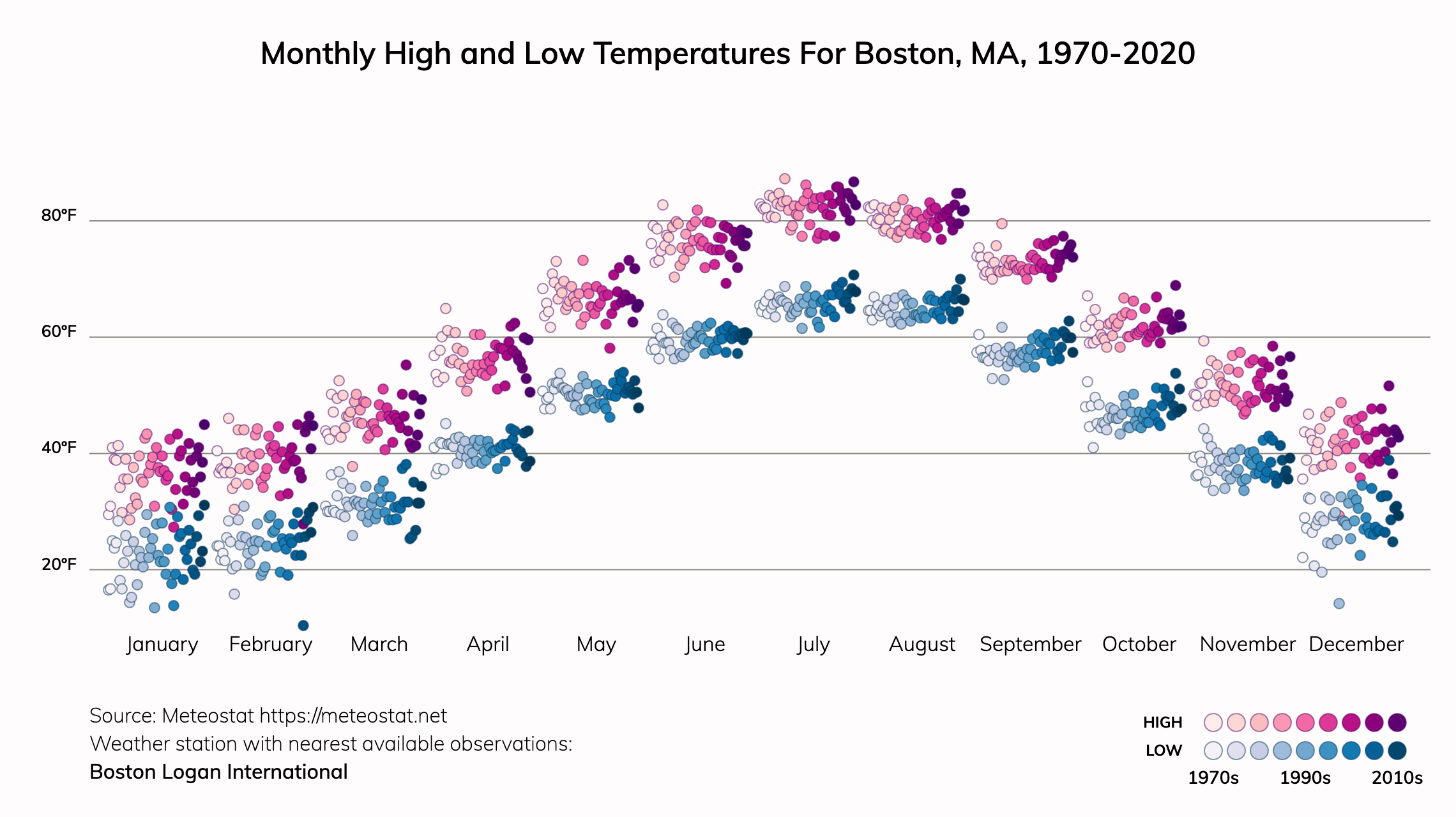

Western Massachusetts Rainfall The Impact Of Climate Change

May 28, 2025

Western Massachusetts Rainfall The Impact Of Climate Change

May 28, 2025 -

Padres Vs Astros Predicting The Winner Of This Series

May 28, 2025

Padres Vs Astros Predicting The Winner Of This Series

May 28, 2025 -

Eugenio Suarezs 4 Homer Game Highlights Nl West Update Giants On Top Rockies At Bottom

May 28, 2025

Eugenio Suarezs 4 Homer Game Highlights Nl West Update Giants On Top Rockies At Bottom

May 28, 2025 -

The Effects Of Climate Change On Rainfall In Western Massachusetts

May 28, 2025

The Effects Of Climate Change On Rainfall In Western Massachusetts

May 28, 2025 -

Exploring Wes Andersons Cinematic World A New Exhibition

May 28, 2025

Exploring Wes Andersons Cinematic World A New Exhibition

May 28, 2025

Latest Posts

-

Le Mandat De Laurent Jacobelli Depute De La Moselle Et Vice President Du Groupe Rn

May 30, 2025

Le Mandat De Laurent Jacobelli Depute De La Moselle Et Vice President Du Groupe Rn

May 30, 2025 -

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025

Biographie De Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025 -

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Rn Son Role De Vice President A L Assemblee Nationale

May 30, 2025 -

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Depute Rn Vice President Du Groupe A L Assemblee Nationale

May 30, 2025 -

Andre Agassi Cambio De Cancha Misma Pasion

May 30, 2025

Andre Agassi Cambio De Cancha Misma Pasion

May 30, 2025