Podcast: Riding The Wave Of Low Inflation

Table of Contents

Understanding Low Inflation and its Causes

Low inflation, generally defined as a sustained annual increase in the Consumer Price Index (CPI) of below 2%, significantly impacts economic activity. While seemingly positive, understanding its causes is crucial. This current period of low inflation is a complex interplay of several factors.

- Decreased demand for goods and services: A slowdown in economic growth can lead to reduced consumer spending, dampening inflationary pressures.

- Increased productivity and efficiency: Technological advancements and improvements in manufacturing processes can lower production costs, contributing to lower prices.

- Technological innovation lowering production costs: Automation and technological innovation have dramatically increased efficiency in many sectors, reducing the cost of goods and services.

- Geopolitical factors impacting global prices: International trade tensions and geopolitical instability can influence supply chains and commodity prices, affecting overall inflation rates. For example, fluctuating oil prices significantly impact transportation and manufacturing costs.

The Benefits of a Low Inflation Economy

A low-inflation environment presents several advantages. For consumers, it means increased purchasing power, stretching budgets further. Businesses benefit from lower borrowing costs, allowing for increased investment and expansion.

- Lower interest rates on loans and mortgages: Lower inflation typically translates to lower interest rates, making borrowing more attractive for both individuals and businesses. This can stimulate investment and consumer spending.

- Greater affordability of goods and services: Stable prices mean greater predictability and affordability for consumers, improving their standard of living.

- Increased investment and economic expansion: Lower inflation encourages investment as businesses feel more confident about future returns. This leads to economic growth and job creation.

- Reduced risk of hyperinflation or deflation: A stable, low inflation rate protects against the extreme economic volatility associated with hyperinflation or deflation.

Challenges Posed by Low Inflation

While seemingly beneficial, low inflation can also present significant hurdles. The risk of deflation, a sustained decrease in the general price level, is a major concern. This can lead to a downward spiral of reduced spending, investment, and economic stagnation.

- Difficulty in raising prices to cover costs: Businesses may struggle to raise prices to cover increased production costs, impacting profitability and potentially leading to job losses.

- Reduced investment due to low returns: Low inflation can reduce the return on investment, discouraging businesses from investing in expansion or new projects.

- Risk of wage stagnation: In a low-inflation environment, wages may stagnate, impacting consumer spending and overall economic growth.

- Potential for deflationary pressure on asset prices: Deflation can lead to a decline in asset values, such as real estate and stocks, impacting wealth and investment confidence.

Strategies for Navigating a Low-Inflation Environment

Successfully navigating a low-inflation economy requires careful planning and strategic decision-making for both individuals and businesses.

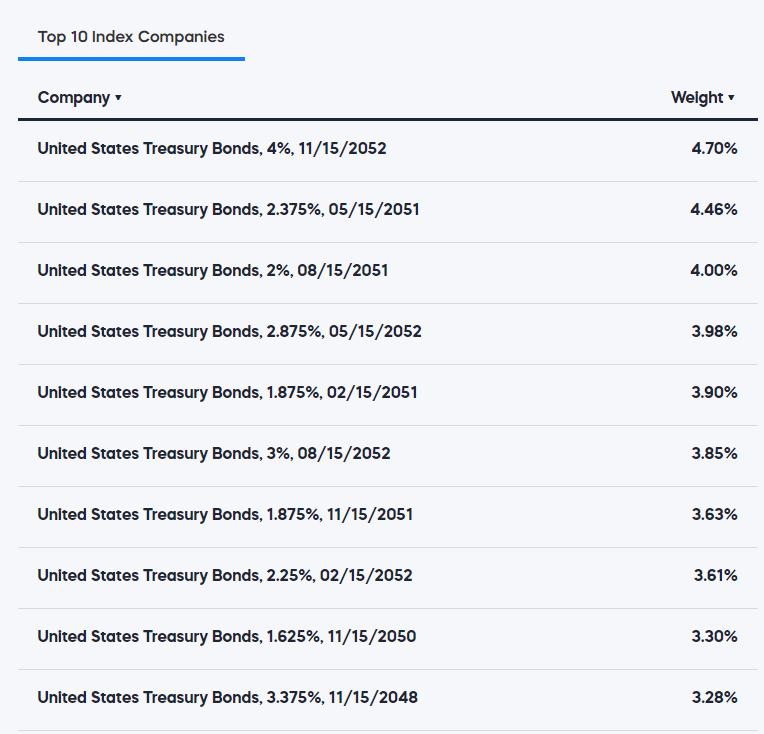

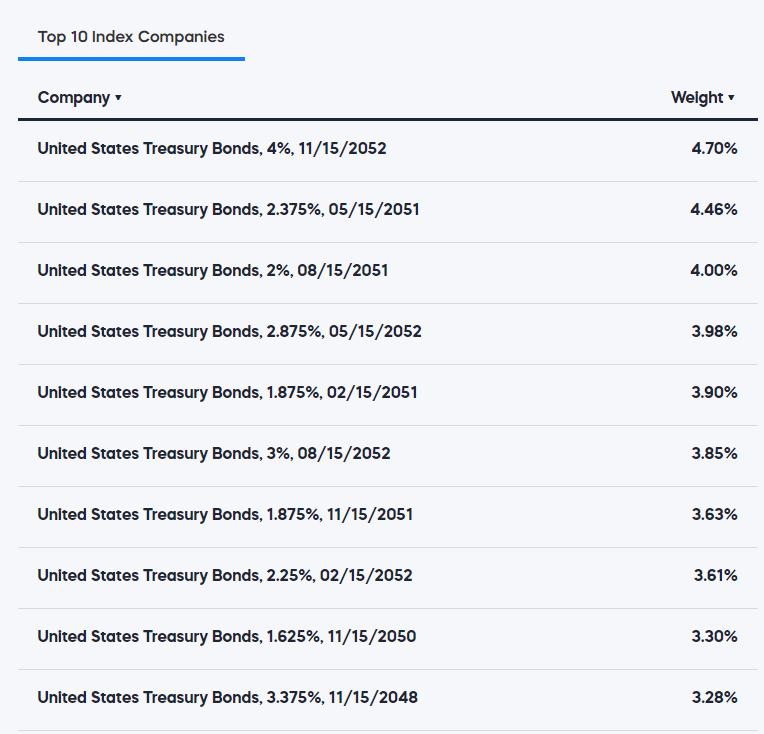

- Diversifying investment portfolio: Spread investments across different asset classes (stocks, bonds, real estate) to mitigate risk and potentially achieve higher returns.

- Focusing on value investing: Look for undervalued companies with strong fundamentals, offering the potential for long-term growth.

- Seeking higher-yielding investments: Explore investment options that offer higher returns than traditional low-yield savings accounts, such as dividend-paying stocks or high-yield bonds.

- Implementing cost-cutting measures for businesses: Identify and eliminate inefficiencies to maintain profitability in a low-margin environment. This could involve streamlining operations, negotiating better supplier contracts, or improving productivity.

Podcast: Riding the Wave of Low Inflation – Key Takeaways and Call to Action

Low inflation presents a complex economic landscape with both benefits and challenges. Understanding its causes and potential impact is crucial for making informed financial decisions and navigating this environment successfully. From understanding the implications of low interest rates to strategizing for investment in a low-return environment, navigating this period requires careful planning and adaptation.

Don't miss our in-depth analysis on how to successfully navigate this period of low inflation! Listen to our podcast, "Podcast: Riding the Wave of Low Inflation," now for a comprehensive understanding of the topic and actionable strategies. [Link to Podcast Episode] Learn more about effectively riding the wave of low inflation by listening to our podcast today!

Featured Posts

-

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

May 27, 2025

Betting On Natural Disasters The Los Angeles Wildfires And The Changing Landscape Of Gambling

May 27, 2025 -

Moriarty Returns A Sneak Peek At Watson Season 1 Episode 5

May 27, 2025

Moriarty Returns A Sneak Peek At Watson Season 1 Episode 5

May 27, 2025 -

Is Matlock On Tonight New Episodes And Where To Watch

May 27, 2025

Is Matlock On Tonight New Episodes And Where To Watch

May 27, 2025 -

Epikindyni Klopi Drastes Stoxopoioyn Kalodia Ilektrikon Oximaton Vinteo

May 27, 2025

Epikindyni Klopi Drastes Stoxopoioyn Kalodia Ilektrikon Oximaton Vinteo

May 27, 2025 -

Robert F Kennedy Assassination Files 10 000 Pages Released To The Public

May 27, 2025

Robert F Kennedy Assassination Files 10 000 Pages Released To The Public

May 27, 2025

Latest Posts

-

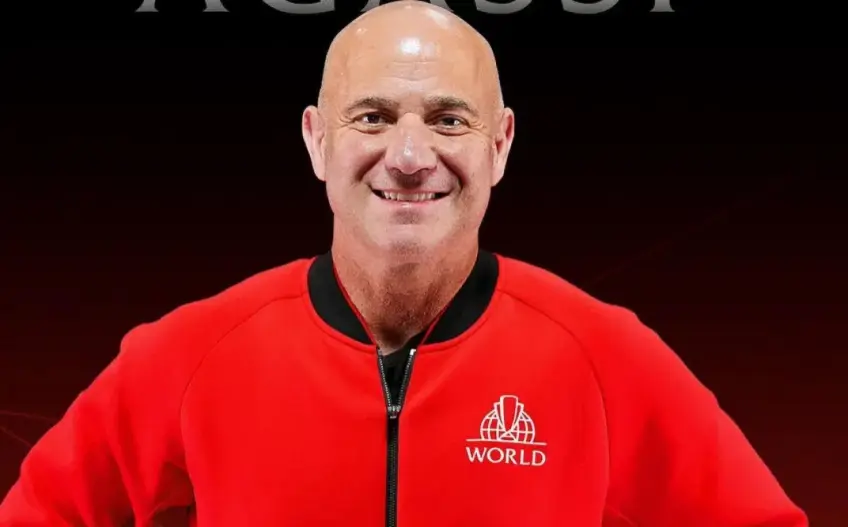

Andre Agassis Pro Pickleball Debut Tournament Details Revealed

May 30, 2025

Andre Agassis Pro Pickleball Debut Tournament Details Revealed

May 30, 2025 -

Andre Agassi Meeting Leaves Ira Khan With A Stunning Revelation

May 30, 2025

Andre Agassi Meeting Leaves Ira Khan With A Stunning Revelation

May 30, 2025 -

Aamir Khans Daughter Ira Shares Surprise Post Agassi Encounter

May 30, 2025

Aamir Khans Daughter Ira Shares Surprise Post Agassi Encounter

May 30, 2025 -

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025

Ira Khans Shocking Revelation After Meeting Andre Agassi

May 30, 2025 -

Dezvaluiri Andre Agassi Frica De Esec Si Presiunea Meciurilor Importante

May 30, 2025

Dezvaluiri Andre Agassi Frica De Esec Si Presiunea Meciurilor Importante

May 30, 2025