Post-Trump Endorsement: A Look At Institutional XRP Holdings

Table of Contents

Pre-Endorsement Institutional XRP Sentiment

Before any significant endorsements, the institutional investment landscape for XRP was characterized by a mix of cautious optimism and regulatory uncertainty. While some institutional investors saw potential in XRP's technology and its use within Ripple's payment network, others remained hesitant due to ongoing legal battles and the overall regulatory ambiguity surrounding cryptocurrencies.

Key Players

Identifying specific prominent institutional investors holding XRP pre-endorsement is difficult due to the lack of transparency in cryptocurrency investments. Many institutions prefer to keep their holdings private, especially in a relatively nascent asset class like XRP. However, anecdotal evidence and market analysis suggest some hedge funds and potentially some larger financial institutions had exposure to XRP, albeit often indirectly through various investment vehicles. Determining the precise strategies and public statements of these entities remains a challenge.

Market Performance Before Endorsement

XRP's price action leading up to any potential endorsement would have likely reflected the broader cryptocurrency market trends and specific news impacting Ripple and XRP. Analyzing historical price charts and market capitalization data would reveal periods of growth, consolidation, and volatility. (Note: Ideally, this section would include actual charts and graphs showing XRP's performance.)

- Regulatory Hurdles: The SEC lawsuit against Ripple significantly impacted investor sentiment and created uncertainty regarding XRP's legal status in the US.

- Positive News: Announcements of partnerships integrating XRP into payment systems could have generated positive market sentiment and potentially attracted institutional investment.

- Negative News: Conversely, any negative news regarding Ripple's operations or the broader cryptocurrency market could have negatively impacted institutional confidence.

Impact of the Trump Endorsement (if applicable)

Analyzing the impact of a hypothetical Trump endorsement on institutional XRP holdings requires careful consideration of various factors. The immediate market reaction would likely depend on the nature of the endorsement, the timing, and the overall market context.

Short-Term Effects

A positive endorsement could trigger a short-term surge in trading volume and price increases. Conversely, a negative endorsement, or even a neutral statement interpreted negatively by the market, might lead to a price drop and decreased trading activity. The speed and magnitude of these changes would be determined by market liquidity and investor sentiment.

Long-Term Implications

The long-term implications are harder to predict. A positive endorsement might attract new institutional investors seeking exposure to XRP, particularly if it lends credibility to the cryptocurrency and mitigates some of the regulatory uncertainties. However, the long-term impact could also be minimal if the endorsement is perceived as a temporary phenomenon or if other factors outweigh its influence.

- News Analysis: Analyzing news coverage and expert opinions surrounding the endorsement would reveal the prevailing sentiment and its impact on investor confidence.

- Legal Ramifications: Any legal or regulatory consequences stemming from the endorsement need to be evaluated, as this could impact institutional investment decisions.

- Future Investment: The endorsement might influence future institutional investment decisions by signaling either increased risk or increased potential.

Current Institutional XRP Holdings (Post-Endorsement)

Accurately determining current institutional XRP holdings post-endorsement remains a significant challenge. The opaque nature of cryptocurrency investments makes it difficult to obtain precise data.

Data Challenges and Transparency

Tracking institutional cryptocurrency holdings is hindered by the lack of standardized reporting requirements and the absence of a central, publicly accessible database. Many institutions do not publicly disclose their cryptocurrency holdings due to competitive reasons or concerns about market manipulation.

Proxy Indicators

While direct data is scarce, we can use indirect indicators to infer institutional interest. On-chain analysis, which involves examining transaction data on the XRP ledger, can sometimes reveal patterns suggestive of large institutional trades. Tracking large transaction volumes exceeding typical retail investor activity can also provide clues.

- Public Information: While unlikely, some limited information might be gleaned from SEC filings or other public disclosures if an institution is required to report its XRP holdings.

- Data Providers: Specialized data providers that aggregate information from various sources might offer insights, though their data might still be incomplete or require careful interpretation.

- Data Limitations: It is critical to acknowledge that any inferred data based on proxy indicators might not be entirely accurate.

Conclusion

Determining the precise impact of a potential Trump endorsement on institutional XRP holdings remains difficult due to inherent limitations in data availability. While a positive endorsement could potentially boost investor confidence and attract new institutional investment, the long-term effects are uncertain. The opaque nature of cryptocurrency investments highlights the challenges in obtaining precise and reliable data on institutional holdings. It's crucial to remember that external factors such as endorsements can influence the cryptocurrency market significantly but should be considered in conjunction with other fundamental and technical analyses.

Call to Action: Stay informed about the evolving landscape of institutional XRP holdings. Continue to research and analyze the market to make informed investment decisions related to institutional XRP holdings, and remember to diversify your portfolio accordingly.

Featured Posts

-

Ai Development Mideasts Diminishing Role Compared To Us And China

May 07, 2025

Ai Development Mideasts Diminishing Role Compared To Us And China

May 07, 2025 -

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025

Papal Conclave Explained How The Next Pope Is Chosen

May 07, 2025 -

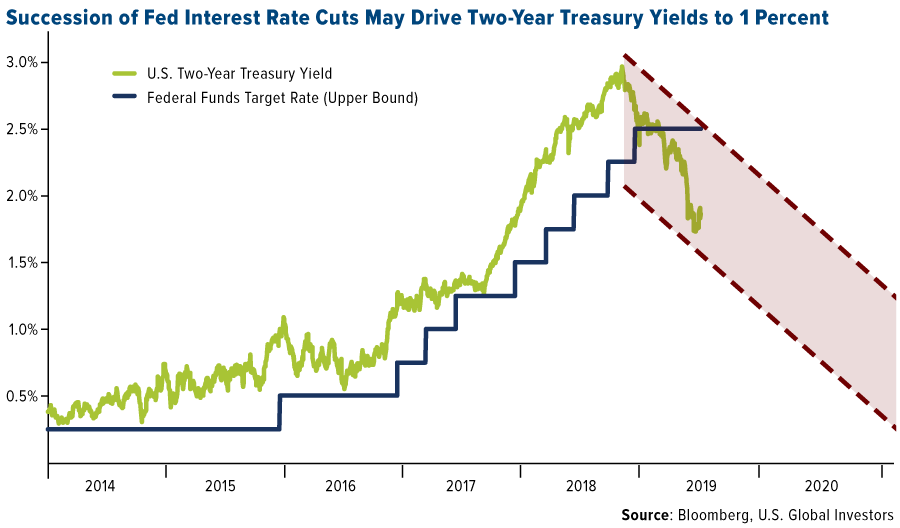

Powells Risk Tolerance A Deep Dive Into The Feds Delayed Interest Rate Cuts

May 07, 2025

Powells Risk Tolerance A Deep Dive Into The Feds Delayed Interest Rate Cuts

May 07, 2025 -

Daily Lotto Results Thursday April 17 2025

May 07, 2025

Daily Lotto Results Thursday April 17 2025

May 07, 2025 -

Y And R Spoilers Summers Five Words Threaten Claire And Kyles New Apartment

May 07, 2025

Y And R Spoilers Summers Five Words Threaten Claire And Kyles New Apartment

May 07, 2025

Latest Posts

-

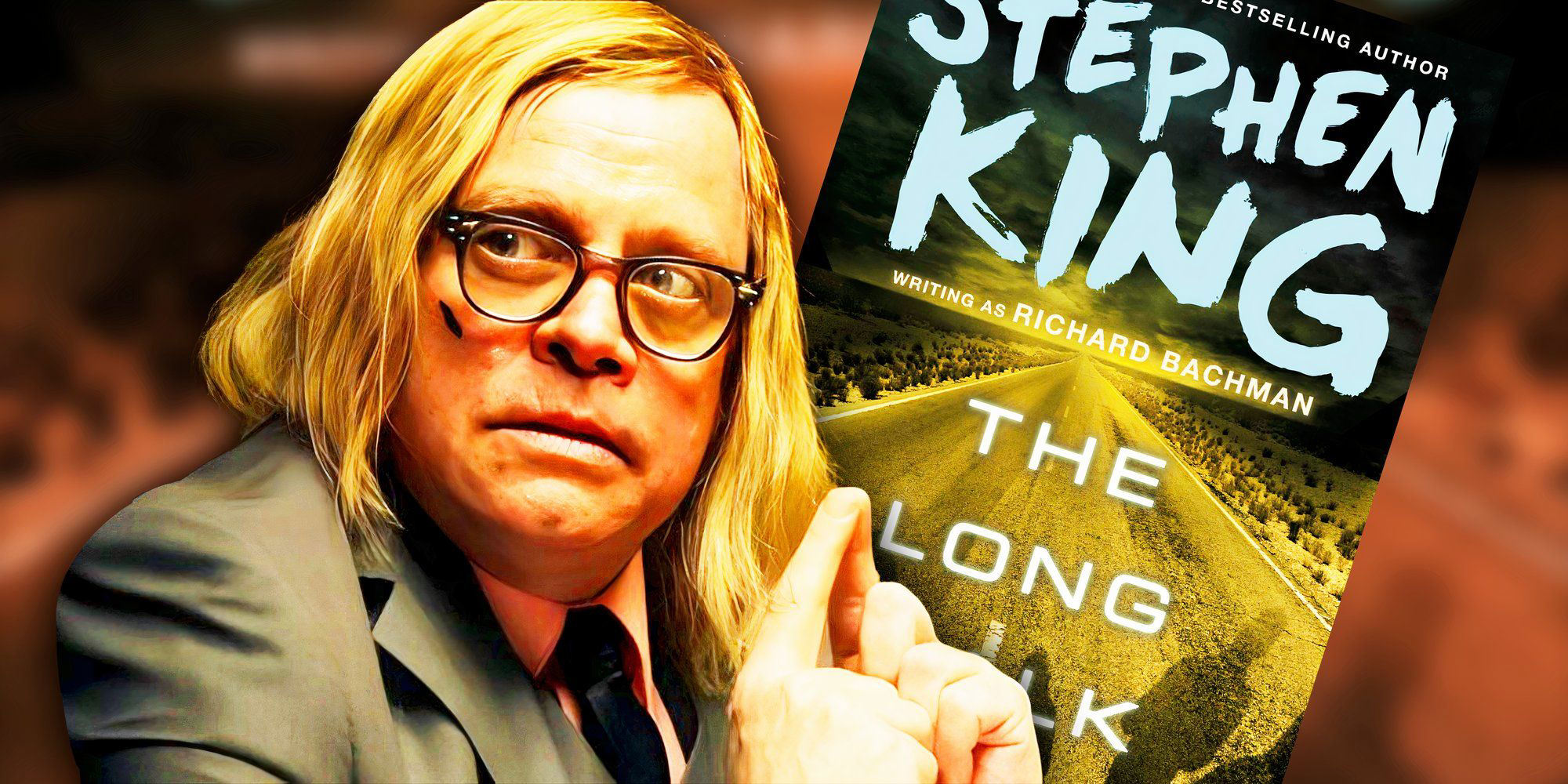

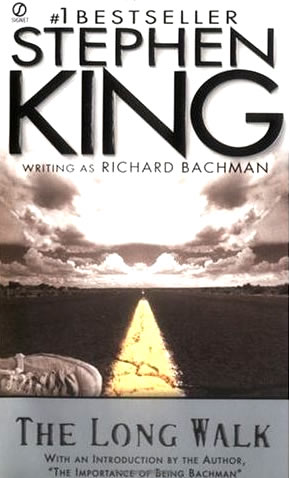

Stephen Kings The Long Walk The Movie Is Real And Heres Why It Matters

May 08, 2025

Stephen Kings The Long Walk The Movie Is Real And Heres Why It Matters

May 08, 2025 -

A New Look At Stephen Kings The Long Walk Movie

May 08, 2025

A New Look At Stephen Kings The Long Walk Movie

May 08, 2025 -

First Look At The Stephen Kings The Long Walk Movie Adaptation

May 08, 2025

First Look At The Stephen Kings The Long Walk Movie Adaptation

May 08, 2025 -

Stephen Kings The Long Walk From Book To Big Screen

May 08, 2025

Stephen Kings The Long Walk From Book To Big Screen

May 08, 2025 -

The Long Walk Movie Trailer Analysis And Reaction

May 08, 2025

The Long Walk Movie Trailer Analysis And Reaction

May 08, 2025